Let’s start with a wealth warning:

- This article covers bitcoin miner Argo Blockchain;

- I am not a bitcoin expert;

- The bitcoin price is highly unpredictable;

- Argo’s share price is highly unpredictable, and;

- Argo issues frequent updates.

The upshot is my logic and calculations may be completely wrong or out-of-date by the time you read what follows.

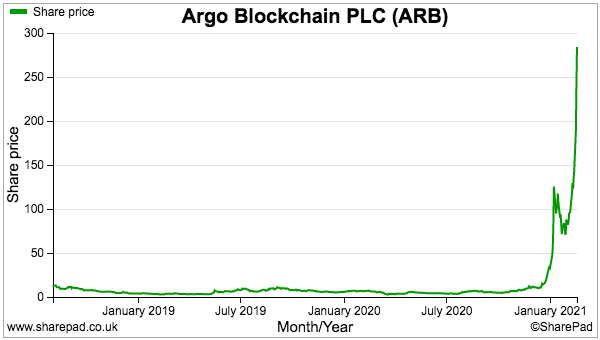

Still, Argo is a company worth studying. The shares have soared 25-fold in just two months…

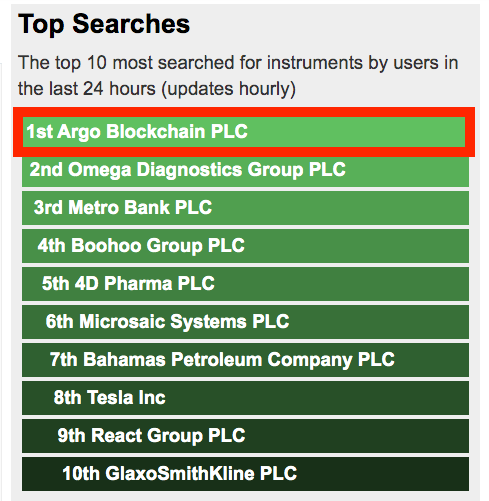

…and the price action has naturally caught the attention of SharePad subscribers:

Headlines such as these may have helped fuel the buying spree:

- “Why Bitcoin fans hope Tesla’s $1.5bn bet will unlock a cryptocurrency revolution”

- “Man offers Newport Council £50m to help him find his Bitcoin bounty in a landfill”

- “How to spend your Bitcoin profits on big-ticket luxuries, from fine art to supercars”

Let’s find out what is happening at Argo.

Mining 93 bitcoins a month

I will not confuse you with a comprehensive explanation of bitcoin mining.

All you need to know is companies such as Argo have thousands of computers performing billions of calculations in the hope of receiving bitcoins for verifying transactions within the bitcoin network.

A statement the other week from Argo outlined eye-catching progress:

“During the month of January, Argo mined 93 Bitcoin or Bitcoin Equivalent (BTC) compared to 96 Bitcoin Equivalent in December.

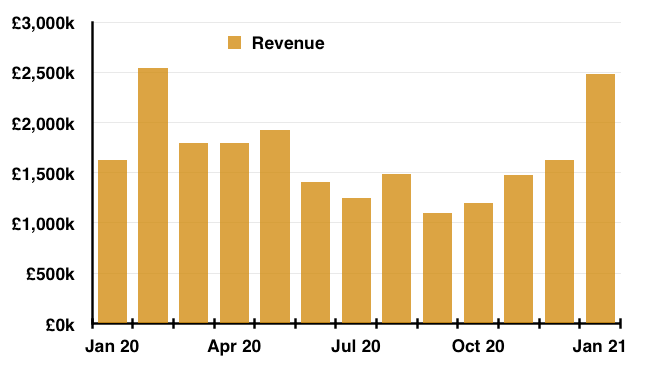

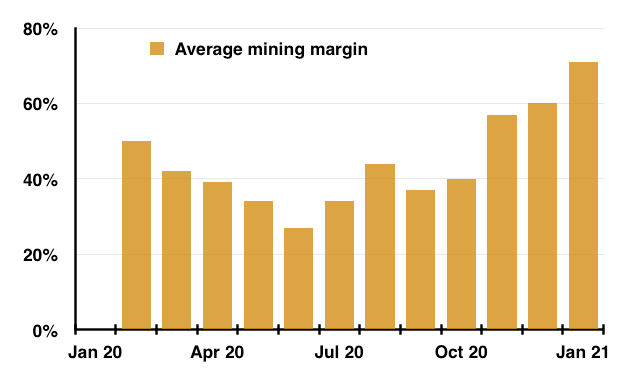

Based on daily foreign exchange rates and cryptocurrency prices during the month, mining revenue in January amounted to £2.48 million (December 2020: £1.63 million). Argo generated this income at an average monthly mining margin of approximately 71% for the month of January (December 2020: 60%).

At the end of January, the company held 501 BTC in Bitcoin and BTC equivalents. In the second half of January, the Company purchased a total of 172.5 BTC as part of its asset management strategy. Argo’s total mining capacity is currently 787 petahash (SHA-256) in addition to 280 Megasols of equihash mining capacity.”

January revenue surging 52% on the preceding month and a 71% mining margin certainly seem impressive.

Argo has issued monthly updates since January 2020, when the business began mining bitcoin for itself rather than on behalf of customers. My charts below show Argo’s progress.

Revenue during January was indeed much higher than usual…

…while the mining margin was the best ever:

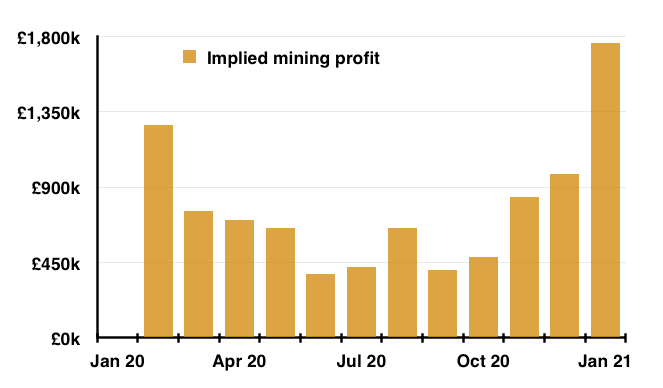

The implied mining profit for January therefore set a new high:

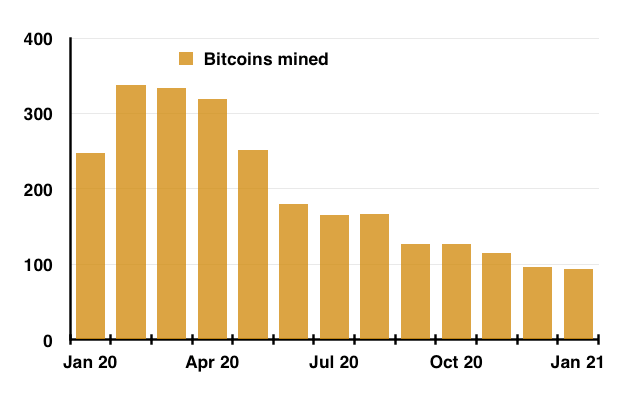

Note that the number of bitcoins mined by Argo has dropped by two-thirds during the last twelve months…

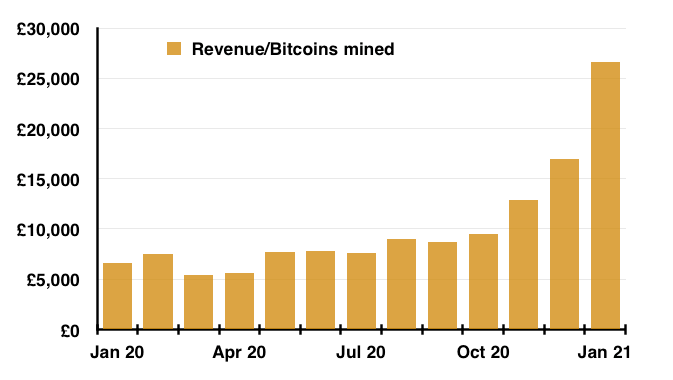

…but the value of each bitcoin collected has surged:

Argo’s bumper revenue for January was supported by a much stronger bitcoin price.

Note that a correlation exists between the bitcoin price and the number of bitcoins the likes of Argo can earn. Simply put, a higher bitcoin price leads to increased mining activity and the less chance any particular miner receives a bitcoin.

A £13 million profit?

You could be forgiven for thinking Argo’s 25-fold share-price surge is a manic bubble just waiting to burst.

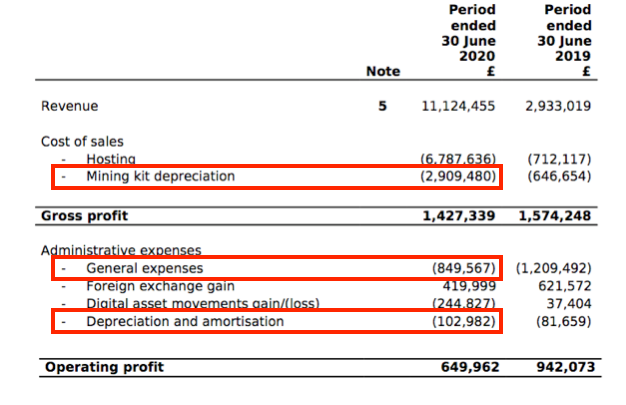

But the soaring price seems understandable when you extrapolate January’s performance and plug in some figures from the latest (half-year) results:

I see the sums like this.

Annualising January’s revenue of £2.48 million gives £29.8 million.

A mining margin of 71% then implies computer-hosting costs of £8.6 million (i.e. £29.8 million * 29%).

We can also double up the first-half mining-kit depreciation to £5.8 million, general expenses to £1.7 million and other depreciation to £0.2 million to arrive at total other costs of £7.7 million.

So:

- Revenue of £29.8 million;

- Less hosting costs of £8.6 million;

- Less other costs of £7.7 million……gives a possible yearly operating profit of £13.5 million.

All of a sudden that rocketing share price starts to make sense – the market cap at 5p last October was just £15 million.

£22 million placement and extra mining capacity

Argo is not content receiving only 93 bitcoins a month. The company recently raised £22 million to expand its operations:

“The net proceeds of the Private Placement will be used by the Company for working capital and general corporate purposes, including the expansion of the Company’s mining capacity in Q1 and Q2 of 2021 through a purchase from two leading manufacturers.

This new mining hardware expansion is expected to be installed in batches at Core Scientific’s facilities in the United States between February to June, and is scheduled to be fully operational by June 2021. This expansion will add approximately 610 petahash to the Company’s installed computing power, bringing it to a total of 1,685 petahash or 1,68 Exahash by the end of Q2 2021.”

Petahash is a measure of bitcoin mining power, and essentially Argo plans to spend the £22 million to increase its mining capability by 57%.

This investment allows us to refine our profit estimate further.

Assuming mining success rates and bitcoin prices remain unchanged, a 57% lift to computing capacity ought to lead to January’s monthly revenue rising from £2.5 million to £3.9 million — equivalent to £46.6 million a year.

Then assuming the mining margin stays at 71%, computer-hosting costs would come in at £13.5 million (i.e. £46.6 million * 29%).

The £22 million spent on an extra 610 petahash tells us Argo’s entire 1,685 petahash system would cost £61.9 million to replace.

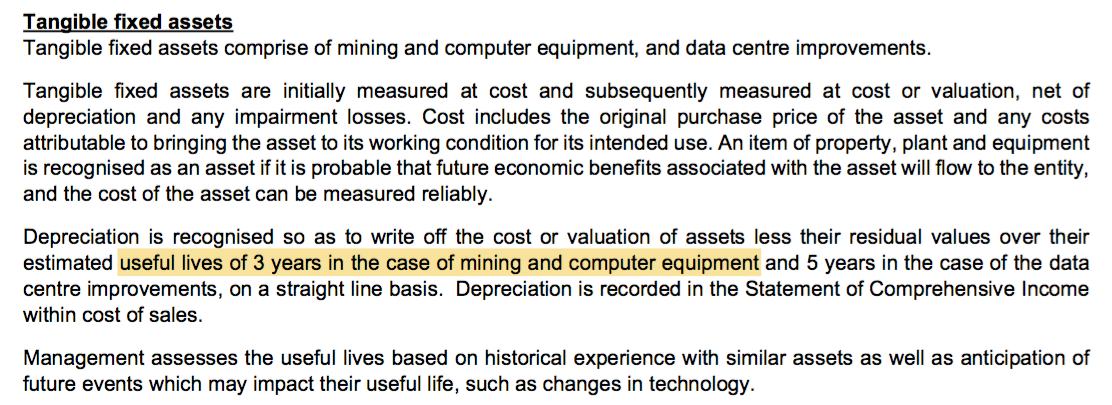

The 2019 annual report reveals the useful life of a bitcoin mining computer to be three years…

… and therefore Argo could be expected to invest £20.6 million a year (i.e. £61.9 million every three years) to keep its computers up to date — and therefore sustain its present level of mining success.

Let’s also assume general expenses and other costs remain at £1.7 million and £0.2 million respectively.

So:

- Revenue of £46.6 million;

- Less hosting costs of £13.5 million;

- Less replacement computer costs of £20.6 million;

- Less general and other expenses of £1.9 million…

…gives an annual profit of £10.6 million.

Hmmm. £10.6 million is less than the earlier £13.5 million profit – even though revenue is 57% greater.

The lower profit estimate is due to greater expenditure on mining computers.

Argo’s results for the half-year to June 2020 showed its computers were purchased for £19 million and offered 730 petahash of mining capacity. The historic cost was therefore £26k per petahash.

However, the recent £22 million deal to acquire an extra 610 petahash valued each petahash at £37k — up 42%.

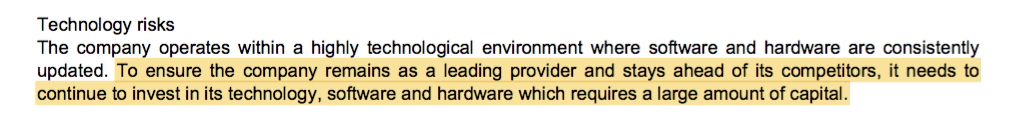

I am not sure whether Argo will mine as efficiently if its older machines are not replaced. If it can in fact mine as efficiently, then annual computer expenditure should be lower than my estimated £20.6 million. But the risk section of the 2019 annual report suggests significant IT reinvestment is required:

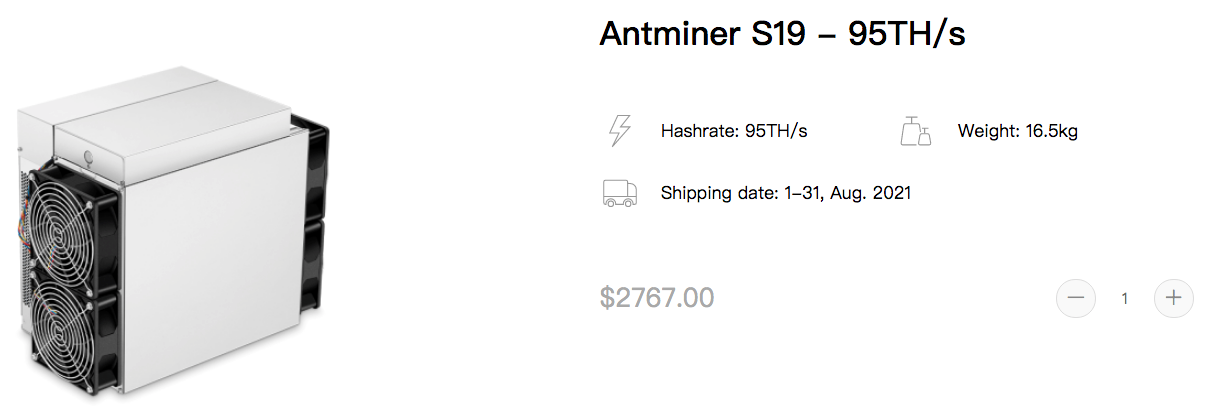

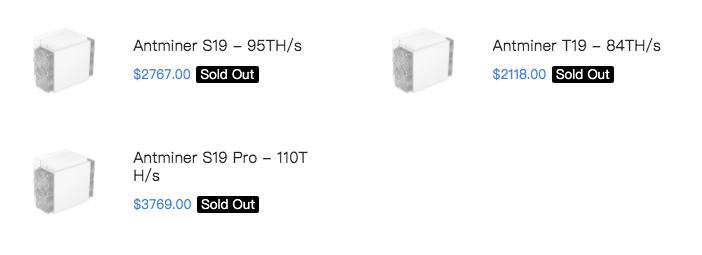

Underlining the notion of higher computer costs, the website for Bitmain – one of Argo’s computer suppliers – presently shows every product has sold out:

Order your Antminer S19 mining rig today and you should receive it during August.

A further $100+ million expansion

Whether Argo’s operating profit is running at £13.5 million or £10.6 million could be academic given this development:

“Argo Blockchain, the leading cryptocurrency miner based in the UK (LSE: ARB), is pleased to announce it has entered into a non-binding Letter of Intent (LOI) with DPN LLC of New York, setting out the terms for Argo to acquire 320 acres of land in West Texas, USA, with access of up to 800-megawatts of electrical power where Argo intends to build a new 200mw mining facility in the next 12 months.”.

Argo will pay $17.5 million for the land, and then take on a $100 million loan to construct the data centre:

“As part of this project, Argo will also gain access to a pre-negotiated US$100 million credit facility at competitive rates. This will provide Argo with sufficient debt capital to build out the facility and further expand its mining fleet to upscale the Company’s operations and capacity.”

This project costing approximately £86 million certainly feels bold.

To put the new 200-megawatt facility into perspective, Argo said in November that computers with 430 petahash of power consumed 15 megawatts of electricity.

On that basis, the 200 megawatt Texas facility could add an extra 5,733 petahash of mining capacity — equivalent to more than three times the 1,685 petahash capability expected following the aforementioned £22 million investment.

Does that mean profits could also be three times higher than my £10.6 million or £13.5 million estimates? Your guess is as good as mine.

Note that Argo will issue an as-yet-unspecified number of new shares to fund a deposit to secure the $100 million loan:

“In connection with the proposed acquisition, a circular will be sent out to shareholders shortly to convene a general meeting at which shareholders will be asked to approve the allotment and issue of (a) the new shares to be issued to DPN LLC and (b) the issue of further new shares to raise equity to fund the down payment (or deposit) on the credit facility.”

My reading of the acquisition circular implies Argo is seeking permission to issue up to 17 million extra shares – representing almost 5% of the present share count – for the Texas facility.

Presumably the lender did not feel Argo’s present hodl of 501 bitcoins, which at recent prices is valued at a total £18 million, was a suitable alternative for the deposit.

Summary

Trying to make sense of Argo’s profit and investment potential is not straightforward.

When I began studying the company the shares were 130p. A few days later they briefly topped 300p to support a £1 billion market cap. Helping the valuation higher has been the bitcoin price – up 40% on the average level seen during January.

The market gyrations are just part of the valuation puzzle. Other considerations include:

- How will Argo’s rate of mining success change if the bitcoin price keeps rising?

- How much must Argo spend on new computers to maintain mining efficiency?

- How long is the replacement cycle for mining computers?

- How many shares will Argo issue to complete the Texas deal?

- How much additional mining capacity will the Texas facility provide?

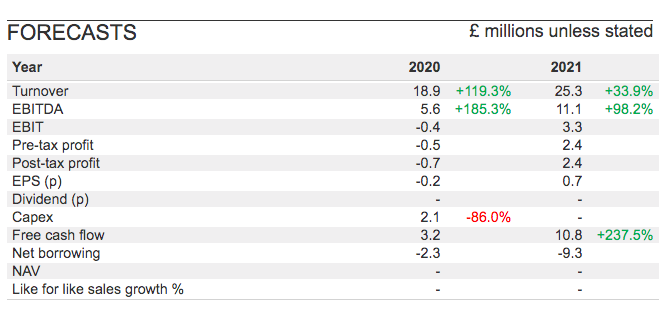

Find answers to those questions and you will undoubtedly be miles ahead of the wider investment community. SharePad’s forecasts reveal City brokers have fallen way behind Argo’s newsflow:

Bitcoin is not for everyone, and whether Argo is worth further investigation is something only you can decide.

But you never know; the successful completion of the Texas facility plus a soaring bitcoin price might actually justify a £1 billion market cap. All I can say is judging Argo’s potential before the shares surged 25-fold would have been a lot easier.

Until next time, I wish you safe and healthy investing with SharePad.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com and hosts an investment discussion forum at quidisq.com.

He does not own shares in Argo Blockchain.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.