Edinburgh Worldwide – a great long-term home for growth investors

Investors in funds such as Scottish Mortgage will have noticed a very peculiar phenomenon over the last few turbulent weeks. On paper many of the growth-oriented businesses sitting in its portfolio stand on huge valuations (very high price to earnings ratios) which means that they should have been the first ones to fall in value as investors hit the red button in March and sold off their risky equities.

But Scottish Mortgage, along with a small number of similar funds, have bucked the market sell off and actually risen in value. I think what we are seeing here is an absolutely fascinating trend. Even the most frightened investors seem to want to keep some exposure to equities, but they want to only back ‘quality’ businesses. In the days before Covid that meant businesses with solid balance sheets, high operating margins, understandable business models, and preferably some inkling of a strong brand (think of a typical Nick Train business). Now though many investors have turned to technology stocks as the new ‘quality’ stock, able to ride out the Covid storm with margins intact and globally scaleable platforms. That has helped push valuations for many growth oriented, tech focused businesses to even more ludicrous levels.

That has also left managers at Scottish investment firm Baillie Gifford sitting pretty. They typically like disruptive businesses with potential for global scale, led by talented entrepreneurs. It is certainly what powers the team behind Scottish Mortgage and its sibling fund Edinburgh Worldwide, the focus of this article.

On paper the funds (Edinburgh Worldwide and Scottish Mortgage) sound quite similar with their focus on businesses involved in say intelligent automation or big data, looking to build scalable platforms and boasting disruptive potential. But there are some key differences between these two Baillie Gifford funds. The first is that Edinburgh Worldwide tends to focus more on global smaller companies with a market cap under $5bn, whereas Scottish Mortgage (under James Anderson and Tom Slater) is more mega large cap based.

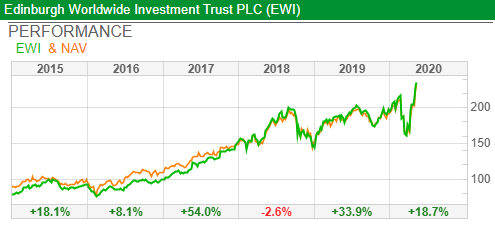

There’s also, obviously, a different manager in the shape of Douglas Brodie. His background is in academic life sciences and he’s pushed the Worldwide fund more exclusively towards tech businesses, with a decent slug of life sciences businesses. Crucially Brodie also has a great track record, so far at least. Since taking over the strategy in February 2014 the fund has delivered NAV total return of 139% (14.9% pa) versus 59% (7.7% pa) for the benchmark.

But these are all backwards looking numbers and there’s no guarantee that the fund will keep outperforming in the new world of Covid 19. But according to a report on the fund by analysts at Numis “Douglas believes that many of the structural themes in the portfolio have been accelerated by the current environment of a global Covid-19 imposed lockdown, bringing forward the investment theses for a number of the portfolio’s companies. The speed at which services are being required has meant that there is less time for potential competitors and therefore companies with the best products have been winners, regardless of size, and nimble, less bureaucratic companies are capitalising on areas of strong demand.” There’s certainly evidence that these trends have played out in some portfolio companies such as in virtual medicine specialist Teladoc and online shopping outfit Ocado.

Sitting at the core of the investment strategy is a simple idea – backing the most entrepreneurial businesses with the potential for rapid growth. In a sense this is the same radical idea behind Scottish Mortgage – back the great entrepreneurs who can scale efficiently and sit tight whilst their share price continues to climb. In effect, this is a new winner takes all world.

The Portfolio

So, what’s currently in the portfolio? The first key observation is that the vast majority of assets in the fund are in North American listed businesses – 59.8% – with UK assets next, at 15.6% of total fund holdings followed by Asia generally at 10%. That hints at another difference with Scottish Mortgage which has been taking a more aggressively bullish position on Asian assets.

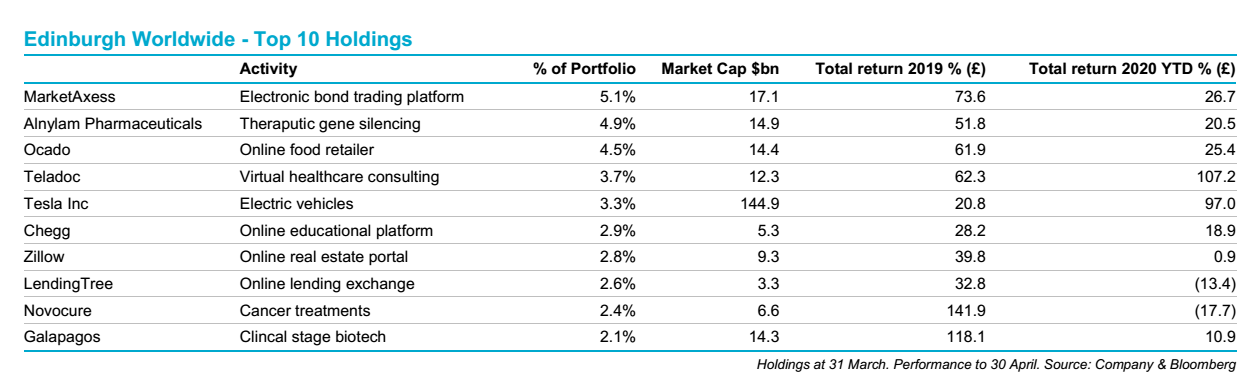

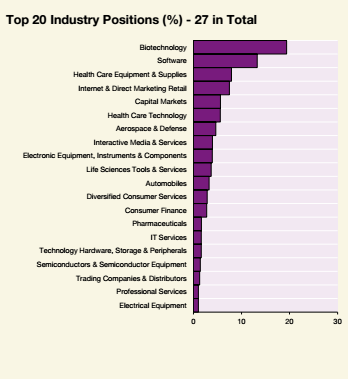

The two tables below break out this portfolio exposure. Top holdings include MarketAccess, an electronic bond trading platform, Ocado, Tesla and Teladoc. I know all four business fairly well and they strike me as a classic fits for the portfolio strategy – led by well known entrepreneurs, with global ambitions and in sectors that might avoid the worst the Covid 19 world is about to throw at us. I also structurally like the much greater focus (compared to Scottish Mortgage) on Biotech, and healthcare stocks, at more than a third of the portfolio plus software stocks.

Crucially the portfolio has little to no exposure to Energy, Utilities and Real Estate. And like its much bigger peer Scottish Mortgage, Edinburgh Worldwide also has substantial and growing exposure to private unlisted businesses. According to Numis the funds unquoted exposure is currently 6.0% of total assets across seven investments: Akili Interactive Labs; KSQ Therapeutics; Oxford Nanopore Technologies; Reaction Engines; Space Exploration Technologies; PSIQuantum; and Spire Global.

And what of new investments? According to Worldwide’s managers one of the newest positions is in a business called Liveramp, a tool for coordinating marketing campaigns, which represented 0.9% of total assets at 31 January. The marketing landscape has changed and companies are having to adapt and move online. Liveramp enables companies to onboard their customer data to use in the digital world.

In terms of returns the fund has had an extremely strong start to 2020 according to fund analysts at Numis with the NAV total returns up 9.3% ytd versus a 16.0% fall for the S&P Global Small Cap index (in Sterling).

The risks

Investors should be under no illusions about what they might be potentially buying into with this fund. This is much higher risk as its businesses are:

- Highly rated growth stocks

- Mostly small to mid cap (though still large by most measures in market cap terms)

- In the tech sector which has a reputation for springing nasty surprises. Many bets on technology are essentially binary ones. A product either works, and makes a fortune, or completely fails and investors lose everything.

All these factors speak to the need for investors to be patient and be willing to ride with market turbulence. If you are looking at your investments to produce a decent return over a 1 to 5 year time frame, I’d absolutely avoid this fund. This is only for the patient and bold.

But be aware that the academic record is clear – investing in smaller market cap businesses introduces some obvious risks but over the long term has tended (in the past) to produce much higher returns.

That said I also think there are some specific risks with investing in tech focused stocks. I sense that the regulators are starting to peer more intently into their business models and there’s also a growing lobby to more closely supervise patent protections and loosen intellectual property rights. Most of this attention is being focused on really very large businesses (such as Facebook) that aren’t in this portfolio, but the risk is real. Also be aware that the life sciences sector has had a tough few years as worries about the business model of many biotech’s for instance has led to stock level under performance.

There is also the elephant in the room – stock selection risk and what I call entrepreneur blindness! Obviously, the risk is that fund managers will pick the wrong stocks but with Baillie Gifford there is a heightened risk, namely that the managers become bedazzled by brilliant entrepreneurs and end up taking too much risk (I’m thinking here of a certain Elon Musk). This is especially the case in the private equity segment of the portfolio where data on the opaque businesses is obviously a tad sparser.

One last risk worth mentioning – currency risk. This is a portfolio consisting largely of US equities quoted in dollars. The cable rate – the sterling to dollar exchange rate – can and does fluctuate wildly, opening investors up to a valuation risk.

Bottom Line?

The fund is currently trading at a 3% premium to NAV and has been issuing shares to meet demand. That speaks to its growing popularity as a core fund holding for global growth small to mid-cap stocks. In a sense the real peer to this fund is probably something like the Smithson fund which is vastly less tech focused, and much younger having only been launched last year.

My own sense is that the share price of the fund has had a good run in recent weeks and that we might see some pullback in the markets as we head into the summer. So, at current levels I’d only be a long-term hold investor. But that said, any meaningful 10 to 20% pull back, I would argue, represent a buy opportunity.

David Stevenson

You can read more about my market views, and latest investment ideas at my daily blog – www.adventurousinvestor.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.