The Bubble has burst

Sometimes we spend so long waiting for something to happen we don’t realise it has started. But I think it has already started. No one rings a bell at market changing points. There are the 1987 and 1929 crashes that are obvious but the top of the technology bubble in 200 had to be worked out.

Everyone has their own story but the time I realised the world had changed was when a fund manager told me he was selling his technology stocks to buy mining stocks in May 2000. Having filled his fund with speculative technology stocks this was short-term very good news to a broker as they all had to come out again, but as I had no clue about mining stocks and if this fund managers call was right I was going to have to rethink my future career. He turned out to be correct and we had an oil and gas boom alongside a mining boom over the ensuing years after which he retired, and I didn’t.

Last week was one of those moments for me. When Funding Circle fell 40%, I found myself unable to make a convincing case for buying the stock. It’s one of those binary stocks when if it doesn’t work the fair value can be zero ultimately. And so are most of the unicorns that growth seeking money has been crowding into. Beyond Meat, the $10bn unicorn plant burger company fell 7% last week while Uber, another lossmaker fell 4% and Lyft 7% while the proven profitable companies Facebook, Apple and Alphabet all rose. Could it be that the market is closing the door on speculative companies?

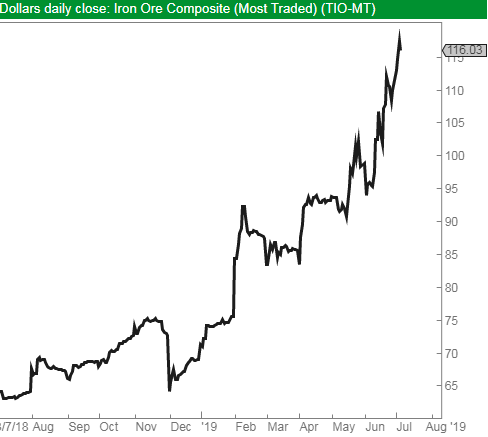

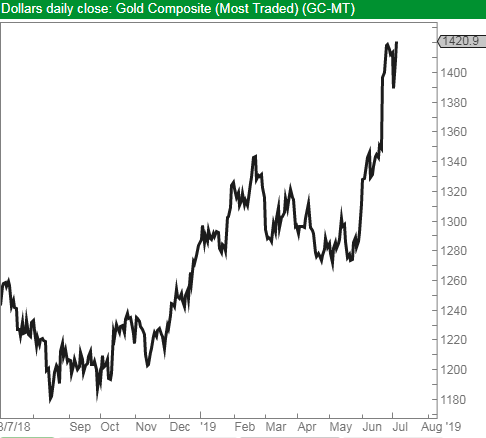

The other indicators I notice are the gold price and the iron ore price which have both been moving up for a year now.

Neither of these indicators are usually good for markets. The gold price indicates safe havens are in demand while the rising iron ore price is a result of growing demand while there are supply constraints. This will of course benefit China as the largest producer in the world, which could possibly make Mr Trump a little more cross than he already seems to be.

In 2000 there were other soft indicators that the market had changed such as the famous proponent of value stocks Tony Dye being fired 6 weeks before the market peaked. Woodford seems to be experiencing potentially fatal problems at the moment. He is a fund manager who built his track record buying out of favour large cap stocks.

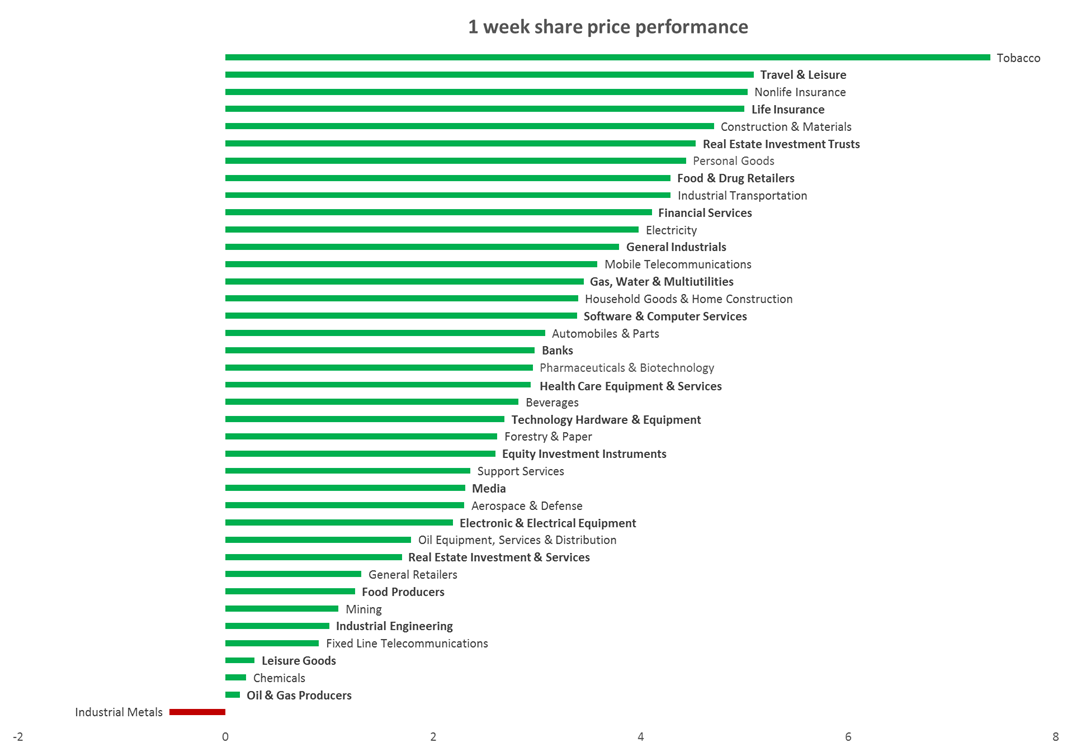

Sectors

To see what the markets are thinking about these changes it is sometimes useful to look at which sectors are performing. In the last week it seems that the market has had a strong week with only one sector producing a negative performance. The negative sector is industrial metals where we can envisage an input cost squeeze if this iron ore price is sustained. All the others were positive.

What is immediately clear is the defensive sectors represented most of the strong performances. Tobacco was the best sector, with Life insurance, non-life insurance in the top 5. Granted construction and travel & leisure are cyclical but then comes Real estate which is a value sector as outlined 6 weeks ago in my weekly commentary. Having underperformed strongly over the past 1,3 and 5 years this value sector seems to be coming to life. This is beginning to feel like a change in the market.

Reasons

Before we head out and sell everything shouting “it’s all over” it may be worth contemplating why we are where we are. We have more debt globally than we have ever had and therefore interest rates are lower than they have ever been.

Austria’s 100-year bond yields 1.06%. Just thinking about that. If I can borrow money for 100 years at 1% and invest it in a project, where it be a house or shares as a proxy for a project it should be highly likely I would make money. While in Germany as I write the 10-year bond is -0.4%. So, with negative rates you don’t even need growth to use this cheap money to invest. In fact, you could put it in a bank account.

To perhaps simplify this further, today it is possible to get a fixed rate 5-year mortgage at 1.3%. I can then put it in a 5-year fixed rate deposit account with a licensed bank at 2.6%. So, to make this trade completely risk free I would take the amount the Bank of England guarantees in the event of a bank insolvency, which is £85,000 out as a mortgage and place it with another bank. And I get £1,105 more back than the zero money that I put in. This is a very strange world.

Which may explain why bond markets are rising and equity markets are rising together. Usually rising bond markets indicate expectations of interest rate cuts due to a coming downturn which harms equities but this time both are rising together suggesting that the flow of cheap money is driving the buying of equities. The implication of this is that while the bubble may be over, we need to be very careful of holding cash. Assets that will hold or increase their value are a better place – such as Gold, Property or shares. High levels of government debt mean that interest rates will have to stay low and the only way to reduce the debt burden is to devalue money faster than assets until eventually the balance sheet comes back into reasonable shape gain.

Portfolio

I think this is a point of change in markets for reasons outlined above which means that I need to review my holdings. The question I like to ask each share is “If the market fell sharply and I lost money would I still be pleased I own this share”. And for those that fail that test they must go. Effectively this is getting rid of the momentum stocks that I have lazily been holding and results in a portfolio of high conviction stocks and, as fund managers like to call them “special situations”.

Next, I have to consider which sectors are likely to fare best. I fear it could again be mining as I see the iron ore price rising but I am not sure as copper isn’t following yet. And to me investing in mining and oil exploration and production companies always seems like using a roulette wheel. But I want things with assets and reasonable valuations. I certainly like the property sector and the insurance sector, the pawnbrokers I have previously covered and I want that undiscovered special situation. I can think of one special situation in the insurance sector and there is another cheap stock where a play on the increasing international disruption could well exist.

Companies

Both companies are small and cheap with useful yields. They operate in niche markets and the combination of being small and needing a lot of work to understand them means that many institutions simply “wait until they are larger” thereby ensuring that as the company grows there is a ready audience of buyers ready to acquire the shares at a more expensive valuation when the earnings are larger. I think of these as “diamonds in the undergrowth”. As markets change their tune, I find myself very happy with obscure companies in niche sectors that aren’t economically sensitive.

Firstly, the insurance play.

Randall & Quilter

Share Price 182p

Market Cap £360m

History

This is a long-established insurance services business founded by Alan Quilter and Ken Randall. Ken Randall has now moved to Executive Chairman and holds 9% of the company while Alan Quilter is the joint CEO and owns 2.7% of the company. Having run a myriad of Lloyds insurance related business in 2016 the company decided to sell off lots of cash generative but ex growth businesses in order to focus on two divisions which grow. This took c 18 months to complete the sales and for the past 12 months the company has been focussed on growing the remaining two divisions.

Business

The insurance run-off business manages legacy insurance books which it takes from large insurers. It sources deals through industry connections, lawyers accountants etc and as long as there is M&A going on there will be deals to do. With Brexit and changing regulation, they are confident they have visibility on a pipeline of deals where they re-insure (rather than acquire) insurance books. This is hugely profitable, and they are the market leader where they have done c.65 deals against their nearest rival having done c.20. Market leadership is key. The second business is “fronting” which is essentially providing the regulatory umbrella for insurance fintech. When I used to audit Lloyds syndicates there were 350. Now there are 60 big ones and the old specialist syndicates now simply have authority to write business for a portion of the separately owned syndicate and are effectively a broker who has authority to underwrite. Which means these are effectively “brokers” (but they prefer to call themselves “managing general agents”) who can sell Randall & Quilters tailored product where you can insure for 3 hours on an app through a fintech company such as Cuvva. They provide the regulatory cover while the risk is passed over to say MunichRe; So, they get a 5% commission for no risk with fast Fintech type growth. Their Malta registration will also enable to provide this throughout Europe post Brexit which gives them an edge.

Estimates

The company delivered £14.3m pre tax profit in the year to December 2018. The forecast for the current year is £41.5m PBT (Profit before tax) following a string of recently announced deals for the legacy business. This is set to fall a little in 2020 as the legacy business may not repeat the strong deal flow before the programme business starts to drive the growth in 2021 when the profits are expected to grow 20% to £47m. I note that forecasts haven’t been changed this week for the two deals announced pending completion of the deals.

Valuation

The market struggles to value this company as the legacy business is less predictable while the fronting business is repeat revenues from commission which builds over time in a predictable way. Consequently, as the fronting business becomes a larger driver of profits it would be logical to expect a rating uplift. On today’s forecasts the PE is 10X and the yield is 5.1%. It is important to note there is a strange dividend policy whereby “B” shares are issued and then bought back by the company, so the company distributes capital rather than paying a dividend. This is because the founders prefer capital gains to income.

Conclusion

This is a non-economically sensitive business which is in fact benefiting from global disruption now. The complexity of the niche it inhabits ensures it is under owned and cheap given the strong growth prospects. I personally think it could be one of those diamonds in the undergrowth. With a ROE this year of 14% it is a high return business and may be just the sort of thing that gets more popular now the bubble has burst.

Another possible gem in the undergrowth that benefits from global disruption is RA International.

RA International

Share Price 53p

Market Cap £95m

History

This remote site services provider was founded by the CEO Soraya Narfeldt in 2004 who at the time was working for a relief agency and tired of the wrong supplies being delivered to the wrong place in the wrong way at the wrong time. She is married to the COO Lars Narfeldt. The IPO came in 2018 and towards the end of the year an expected contract slipped to the other side of the year end and in its first year it failed to meet its forecasts resulting in a calamitous share price performance. The IPO price was 56p and the shares haven’t yet reclaimed that level.

Business

The company is typically hired by humanitarian, government or commercial organisations to execute projects in remote locations such as Afghanistan, Cameroon, Sudan, Malawi etc. Typically, the company will submit a tender which is complex and may take 6 months to prepare. The service is comprehensive and may range from buying a site to erect a cap, providing vehicles and catering facilities as well as the infrastructure and security. The company has never made a loss on a contract save two small ones which were priced low in order to gain a larger contract. There is a strong pipeline of contracts and the company aims to challenge the large outsourcers. The reason for coming to market was to bolster the balance sheet to provide credibility with the larger customers.

The customer list is particularly credible and includes UNICEF, the Ministry of defence, NATO, Interpol, The World Bank, the US department of State and the EU.

Estimates

Forecasts indicate 10% revenue growth in 2019 to $60m which drives 22% profit growth to $13.9m. Note the company reports in dollars as all the contracts are priced in dollars. At this stage the dividend pay-out ratio is only 18%.

Valuation

The shares trade on a 12-month forward PE of 8.2X and yield 2.85%

Conclusion

I suspect this company is deemed too risky for many investors as it disappointed in its first-year post IPO. Which is why the valuation is low. If it can land some of these larger contracts the market cap will increase above £100m when it becomes more investable for institutions. So, there is earnings upside as well as a valuation upside. And if the current trend of global disruption continues, they are well positioned. It could just be that this turns out to be a good place to hide while the bubble bursts.

Summary

The bubble has now burst. It’s never clear what the next flavour will be for the market but at times like this we need to be in safety stocks. Property stocks, as previously written on are deep value and backed by assets, while the pawnbrokers make a good play on the gold price which continues to appreciate. This week I suggest a couple of special situations that are also value situations but could possibly turn out to be tomorrow’s growth stocks. Tomorrow’s growth stocks are inevitably todays overlooked stocks and I believe these are certainly overlooked.

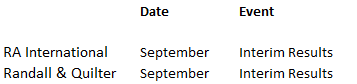

Upcoming Events

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 08/07/19

The Bubble has burst

Sometimes we spend so long waiting for something to happen we don’t realise it has started. But I think it has already started. No one rings a bell at market changing points. There are the 1987 and 1929 crashes that are obvious but the top of the technology bubble in 200 had to be worked out.

Everyone has their own story but the time I realised the world had changed was when a fund manager told me he was selling his technology stocks to buy mining stocks in May 2000. Having filled his fund with speculative technology stocks this was short-term very good news to a broker as they all had to come out again, but as I had no clue about mining stocks and if this fund managers call was right I was going to have to rethink my future career. He turned out to be correct and we had an oil and gas boom alongside a mining boom over the ensuing years after which he retired, and I didn’t.

Last week was one of those moments for me. When Funding Circle fell 40%, I found myself unable to make a convincing case for buying the stock. It’s one of those binary stocks when if it doesn’t work the fair value can be zero ultimately. And so are most of the unicorns that growth seeking money has been crowding into. Beyond Meat, the $10bn unicorn plant burger company fell 7% last week while Uber, another lossmaker fell 4% and Lyft 7% while the proven profitable companies Facebook, Apple and Alphabet all rose. Could it be that the market is closing the door on speculative companies?

The other indicators I notice are the gold price and the iron ore price which have both been moving up for a year now.

Neither of these indicators are usually good for markets. The gold price indicates safe havens are in demand while the rising iron ore price is a result of growing demand while there are supply constraints. This will of course benefit China as the largest producer in the world, which could possibly make Mr Trump a little more cross than he already seems to be.

In 2000 there were other soft indicators that the market had changed such as the famous proponent of value stocks Tony Dye being fired 6 weeks before the market peaked. Woodford seems to be experiencing potentially fatal problems at the moment. He is a fund manager who built his track record buying out of favour large cap stocks.

Sectors

To see what the markets are thinking about these changes it is sometimes useful to look at which sectors are performing. In the last week it seems that the market has had a strong week with only one sector producing a negative performance. The negative sector is industrial metals where we can envisage an input cost squeeze if this iron ore price is sustained. All the others were positive.

What is immediately clear is the defensive sectors represented most of the strong performances. Tobacco was the best sector, with Life insurance, non-life insurance in the top 5. Granted construction and travel & leisure are cyclical but then comes Real estate which is a value sector as outlined 6 weeks ago in my weekly commentary. Having underperformed strongly over the past 1,3 and 5 years this value sector seems to be coming to life. This is beginning to feel like a change in the market.

Reasons

Before we head out and sell everything shouting “it’s all over” it may be worth contemplating why we are where we are. We have more debt globally than we have ever had and therefore interest rates are lower than they have ever been.

Austria’s 100-year bond yields 1.06%. Just thinking about that. If I can borrow money for 100 years at 1% and invest it in a project, where it be a house or shares as a proxy for a project it should be highly likely I would make money. While in Germany as I write the 10-year bond is -0.4%. So, with negative rates you don’t even need growth to use this cheap money to invest. In fact, you could put it in a bank account.

To perhaps simplify this further, today it is possible to get a fixed rate 5-year mortgage at 1.3%. I can then put it in a 5-year fixed rate deposit account with a licensed bank at 2.6%. So, to make this trade completely risk free I would take the amount the Bank of England guarantees in the event of a bank insolvency, which is £85,000 out as a mortgage and place it with another bank. And I get £1,105 more back than the zero money that I put in. This is a very strange world.

Which may explain why bond markets are rising and equity markets are rising together. Usually rising bond markets indicate expectations of interest rate cuts due to a coming downturn which harms equities but this time both are rising together suggesting that the flow of cheap money is driving the buying of equities. The implication of this is that while the bubble may be over, we need to be very careful of holding cash. Assets that will hold or increase their value are a better place – such as Gold, Property or shares. High levels of government debt mean that interest rates will have to stay low and the only way to reduce the debt burden is to devalue money faster than assets until eventually the balance sheet comes back into reasonable shape gain.

Portfolio

I think this is a point of change in markets for reasons outlined above which means that I need to review my holdings. The question I like to ask each share is “If the market fell sharply and I lost money would I still be pleased I own this share”. And for those that fail that test they must go. Effectively this is getting rid of the momentum stocks that I have lazily been holding and results in a portfolio of high conviction stocks and, as fund managers like to call them “special situations”.

Next, I have to consider which sectors are likely to fare best. I fear it could again be mining as I see the iron ore price rising but I am not sure as copper isn’t following yet. And to me investing in mining and oil exploration and production companies always seems like using a roulette wheel. But I want things with assets and reasonable valuations. I certainly like the property sector and the insurance sector, the pawnbrokers I have previously covered and I want that undiscovered special situation. I can think of one special situation in the insurance sector and there is another cheap stock where a play on the increasing international disruption could well exist.

Companies

Both companies are small and cheap with useful yields. They operate in niche markets and the combination of being small and needing a lot of work to understand them means that many institutions simply “wait until they are larger” thereby ensuring that as the company grows there is a ready audience of buyers ready to acquire the shares at a more expensive valuation when the earnings are larger. I think of these as “diamonds in the undergrowth”. As markets change their tune, I find myself very happy with obscure companies in niche sectors that aren’t economically sensitive.

Firstly, the insurance play.

Randall & Quilter

Share Price 182p

Market Cap £360m

History

This is a long-established insurance services business founded by Alan Quilter and Ken Randall. Ken Randall has now moved to Executive Chairman and holds 9% of the company while Alan Quilter is the joint CEO and owns 2.7% of the company. Having run a myriad of Lloyds insurance related business in 2016 the company decided to sell off lots of cash generative but ex growth businesses in order to focus on two divisions which grow. This took c 18 months to complete the sales and for the past 12 months the company has been focussed on growing the remaining two divisions.

Business

The insurance run-off business manages legacy insurance books which it takes from large insurers. It sources deals through industry connections, lawyers accountants etc and as long as there is M&A going on there will be deals to do. With Brexit and changing regulation, they are confident they have visibility on a pipeline of deals where they re-insure (rather than acquire) insurance books. This is hugely profitable, and they are the market leader where they have done c.65 deals against their nearest rival having done c.20. Market leadership is key. The second business is “fronting” which is essentially providing the regulatory umbrella for insurance fintech. When I used to audit Lloyds syndicates there were 350. Now there are 60 big ones and the old specialist syndicates now simply have authority to write business for a portion of the separately owned syndicate and are effectively a broker who has authority to underwrite. Which means these are effectively “brokers” (but they prefer to call themselves “managing general agents”) who can sell Randall & Quilters tailored product where you can insure for 3 hours on an app through a fintech company such as Cuvva. They provide the regulatory cover while the risk is passed over to say MunichRe; So, they get a 5% commission for no risk with fast Fintech type growth. Their Malta registration will also enable to provide this throughout Europe post Brexit which gives them an edge.

Estimates

The company delivered £14.3m pre tax profit in the year to December 2018. The forecast for the current year is £41.5m PBT (Profit before tax) following a string of recently announced deals for the legacy business. This is set to fall a little in 2020 as the legacy business may not repeat the strong deal flow before the programme business starts to drive the growth in 2021 when the profits are expected to grow 20% to £47m. I note that forecasts haven’t been changed this week for the two deals announced pending completion of the deals.

Valuation

The market struggles to value this company as the legacy business is less predictable while the fronting business is repeat revenues from commission which builds over time in a predictable way. Consequently, as the fronting business becomes a larger driver of profits it would be logical to expect a rating uplift. On today’s forecasts the PE is 10X and the yield is 5.1%. It is important to note there is a strange dividend policy whereby “B” shares are issued and then bought back by the company, so the company distributes capital rather than paying a dividend. This is because the founders prefer capital gains to income.

Conclusion

This is a non-economically sensitive business which is in fact benefiting from global disruption now. The complexity of the niche it inhabits ensures it is under owned and cheap given the strong growth prospects. I personally think it could be one of those diamonds in the undergrowth. With a ROE this year of 14% it is a high return business and may be just the sort of thing that gets more popular now the bubble has burst.

Another possible gem in the undergrowth that benefits from global disruption is RA International.

RA International

Share Price 53p

Market Cap £95m

History

This remote site services provider was founded by the CEO Soraya Narfeldt in 2004 who at the time was working for a relief agency and tired of the wrong supplies being delivered to the wrong place in the wrong way at the wrong time. She is married to the COO Lars Narfeldt. The IPO came in 2018 and towards the end of the year an expected contract slipped to the other side of the year end and in its first year it failed to meet its forecasts resulting in a calamitous share price performance. The IPO price was 56p and the shares haven’t yet reclaimed that level.

Business

The company is typically hired by humanitarian, government or commercial organisations to execute projects in remote locations such as Afghanistan, Cameroon, Sudan, Malawi etc. Typically, the company will submit a tender which is complex and may take 6 months to prepare. The service is comprehensive and may range from buying a site to erect a cap, providing vehicles and catering facilities as well as the infrastructure and security. The company has never made a loss on a contract save two small ones which were priced low in order to gain a larger contract. There is a strong pipeline of contracts and the company aims to challenge the large outsourcers. The reason for coming to market was to bolster the balance sheet to provide credibility with the larger customers.

The customer list is particularly credible and includes UNICEF, the Ministry of defence, NATO, Interpol, The World Bank, the US department of State and the EU.

Estimates

Forecasts indicate 10% revenue growth in 2019 to $60m which drives 22% profit growth to $13.9m. Note the company reports in dollars as all the contracts are priced in dollars. At this stage the dividend pay-out ratio is only 18%.

Valuation

The shares trade on a 12-month forward PE of 8.2X and yield 2.85%

Conclusion

I suspect this company is deemed too risky for many investors as it disappointed in its first-year post IPO. Which is why the valuation is low. If it can land some of these larger contracts the market cap will increase above £100m when it becomes more investable for institutions. So, there is earnings upside as well as a valuation upside. And if the current trend of global disruption continues, they are well positioned. It could just be that this turns out to be a good place to hide while the bubble bursts.

Summary

The bubble has now burst. It’s never clear what the next flavour will be for the market but at times like this we need to be in safety stocks. Property stocks, as previously written on are deep value and backed by assets, while the pawnbrokers make a good play on the gold price which continues to appreciate. This week I suggest a couple of special situations that are also value situations but could possibly turn out to be tomorrow’s growth stocks. Tomorrow’s growth stocks are inevitably todays overlooked stocks and I believe these are certainly overlooked.

Upcoming Events

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.