Richard reveals the names of all 211 shares that pass his minimum quality screen, and the Strikes he gave them in 2025. Despite striking out, AstraZeneca features.

Following my 5 Strikes explainer, I thought I would share the whole list of shares that passed my minimum quality filter in 2025. Shares that do not pass the filter do not get scrutinised at all so this is the pool I fish from.

Before I forget, though, two shares have passed the filter since my last update but they did not get past the next stage. I gave three strikes to Imperial Brands and four to Future. Shares need to score less than three strikes to get my attention:

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Imperial Brands | IMB | 11/12/25 | – Holdings – Debt – Growth | 3 |

| Future | FUTR | 12/12/25 | – Holdings ? Acquisitions – Growth – Shares | 4 |

The whole list is so long, I have put it at the end of the article or you might not notice that I had picked out a share to examine in more detail.

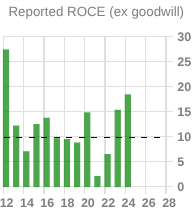

For once it is not one that scored less than three strikes, businesses with calming and uncomplicated financial track records, in fact this share struck out. Given its high profile perhaps AstraZeneca [- Holdings ? Acquisitions – Debt – Growth – ROCE – Shares] is the most noteworthy of the Xs.

I wouldn’t consider buying the shares because of its indifferent track record, but that and a corruption probe in China have not deterred other investors, judging by the share price:

To save space, I have used ShareScope’s mini charts to examine Astra Zeneca’s financial history. These go back to 2008, but mostly I am interested in the last eight years:

|

|

|

|---|

Source: ShareScope, the horizontal dotted lines show the average since 2008

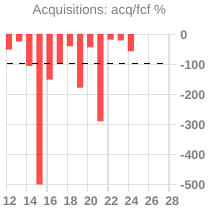

Although AstraZeneca has spent less on acquisitions than it has earned over the last eight years, twice in 2019 and 2021 it overspent.

There are two reasons I am sceptical of acquisition spending. The first is that acquisitions are risky and do not always meet buyers’ expectations.

The second is that spending more than you earn is not sustainable over the long term. To finance acquisitions persistent overspenders must borrow, or ask investors to fund the acquisitions. AstraZeneca has done both.

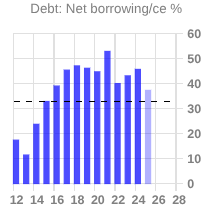

It has not persistently overspent, but debt (including leases) net of cash over the last eight years has mounted up, and it is higher than the arbitrary comfort level I set at less than 25% of capital employed (excluding goodwill). For the last eight years debt has been 40% of capital employed or more.

The company also raised money from investors in 2021 to buy Alexion, now the mainstay of AstraZeneca’s Rare Disease division. The fact that it did not finance the transaction from its own cash flow is a warning sign to me.

|

|

|

|---|

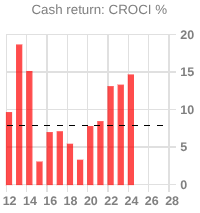

CROCI (Cash Return on Capital Invested) is positive every year, which is acceptable. When it comes to the performance of the business, though, I may have been a bit harsh in awarding strikes for growth and ROCE (Return on Capital Employed). ,

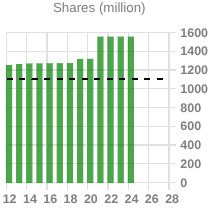

The only year of contraction in the last eight is the first, in 2018,. Acquisitions since then have boosted growth, but they will also have depressed profitability due to amortisation of acquired intangibles. This cost does not reflect on the profitability or cash flow of the business itself, which is what will generate future returns. It is an accounting convention relating to the acquisition required to balance the books.

AstraZeneca is in trouble, or heading for a fall. In fact betting against AstraZeneca has been a losing trade. It just means I think that there is much to think about even before we start looking at the business itself, which, due to its size and technical nature, is complex and difficult to understand.

Five Strikes is telling me that there are probably easier investments I could make.

All the 0s, 1s, 2s, 3s, 4s, and Xs

I am writing this article before the Christmas holiday so a handful of shares have escaped. We will round them up in the New Year.

In 2025, 211 shares passed my minimum quality filter. After briefly scrutinising their track records like I did AstraZeneca, 15 scored zero strikes, 37 scored 1 strike, 47 scored 2 strikes. These are the shares I pay attention to.

The bottom half of the list contained 64 shares on 3 strikes, 30 on 4, and 17 strike outs.

A handful of companies will report over the Christmas period and I will update you on them in the New Year.

On the subject of new years, have a good one 🙂

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| 4imprint | FOUR | 15/4/25 | ? Holdings | 0 |

| Auto Trader | AUTO | 27/6/25 | 0 | |

| Bloomsbury Publishing | BMY | 13/6/25 | 0 | |

| Cohort | CHRT | 20/8/25 | ? Acquisitions | 0 |

| Computacenter | CCC | 9/4/25 | 0 | |

| Cranswick | CWK | 27/6/25 | 0 | |

| Keystone Law | KEYS | 14/5/25 | 0 | |

| Morgan Sindall | MGNS | 24/3/25 | 0 | |

| Nichols | NICL | 24/3/25 | 0 | |

| Porvair | PRV | 14/3/25 | ? Holdings | 0 |

| Quartix | QTX | 3/3/25 | ? ROCE | 0 |

| Tatton | TAM | 10/6/25 | 0 | |

| Thorpe (F W) | TFW | 15/10/25 | ? Growth | 0 |

| Warpaint London | W7L | 20/5/25 | – Shares | 0 |

| Alfa Financial Software | ALFA | 1/4/25 | – Growth | 1 |

| Arcontech | ARC | 24/9/25 | – Growth | 1 |

| Ashmore | ASHM | 18/9/25 | – Growth | 1 |

| Barr (AG) | BAG | 28/4/25 | ? Growth | 1 |

| Bioventix | BVXP | 11/11/25 | – Growth | 1 |

| Clarkson | CKN | 2/4/25 | ? ROCE | 1 |

| Colefax | CFX | 4/8/25 | ? CROCI ? Growth | 1 |

| Dotdigital | DOTD | 4/11/25 | – Holdings ? Acquisitions | 1 |

| Dunelm | DNLM | 9/10/25 | – Debt | 1 |

| Eleco | ELCO | 12/5/25 | – Holdings ? Growth | 1 |

| FDM | FDM | 8/4/25 | – Growth | 1 |

| Fevertree Drinks | FEVR | 24/4/25 | – CROCI | 1 |

| Games Workshop | GAW | 29/7/25 | – Holdings | 1 |

| Gamma Communications | GAMA | 24/3/25 | – Holdings | 1 |

| Halma | HLMA | 20/6/25 | – Holdings | 1 |

| Hill & Smith | HILS | 11/4/25 | ? Holdings ? Acquisitions | 1 |

| Hollywood Bowl | BOWL | 3/1/25 | – Debt | 1 |

| Howden Joinery | HWDN | 18/3/25 | – Holdings | 1 |

| IMPAX | IPX | 1/12/25 | – Growth | 1 |

| Inchcape | INCH | 25/3/25 | ? Debt ? Growth | 1 |

| James Halstead | JHD | 17/10/25 | – Growth | 1 |

| Kainos | KNOS | 25/7/25 | – Growth | 1 |

| Latham (James) | LTHM | 24/7/25 | – CROCI ? Growth | 1 |

| London Security | LSC | 16/5/25 | – Holdings | 1 |

| M Winkworth | WINK | 1/5/25 | – Growth | 1 |

| Me | MEGP | 24/2/25 | – Growth | 1 |

| Mony | MONY | 3/3/25 | – Holdings ? Growth | 1 |

| Mortgage Advice Bureau | MAB1 | 4/4/25 | – Shares | 1 |

| Nexteq | NXQ | 19/3/25 | – CROCI | 1 |

| Oxford Instruments | OXIG | 25/6/25 | – Holdings ? Growth | 1 |

| Pets at Home | PETS | 18/6/25 | – Holdings | 1 |

| Polar Capital | POLR | 7/7/25 | – Growth | 1 |

| Ramsdens | RFX | 14/1/25 | – CROCI | 1 |

| Rightmove | RMV | 28/3/25 | – Holdings | 1 |

| Science | SAG | 15/4/25 | – Growth | 1 |

| Tristel | TSTL | 18/11/25 | – Holdings ? Shares | 1 |

| Volution | FAN | 22/10/25 | ? Holdings ? Acquisitions – Borrowings | 1 |

| Andrews Sykes | ASY | 15/5/25 | – Holdings – Growth | 2 |

| Anpario | ANP | 19/5/25 | ? CROCI – Growth ? ROCE | 2 |

| Aptitude Software | APTD | 26/3/25 | ? Holdings – Growth ? Shares | 2 |

| Associated British Foods | ABF | 4/11/25 | – Growth ? ROCE | 2 |

| BAE Systems | BA. | 3/3/25 | – Holdings ? Growth | 2 |

| Berkeley | BKG | 4/8/25 | ? CROCI – Growth | 2 |

| Billington | BILN | 23/4/25 | ? Holdings – CROCI ? Growth | 2 |

| Bunzl | BNZL | 20/3/25 | ? Holdings – Debt ? Growth | 2 |

| Card Factory | CARD | 19/5/25 | – Holdings – Debt | 2 |

| Churchill China | CHH | 9/5/25 | – CROCI – Growth | 2 |

| City of London Investment | CLIG | 16/9/25 | ? Holdings – Growth – Shares | 2 |

| Domino’s Pizza | DOM | 24/3/25 | ? Holdings – Debt ? Growth | 2 |

| GlobalData | DATA | 2/4/25 | ? Acquisitions ? ROCE – Shares | 2 |

| Goodwin | GDWN | 14/8/25 | – CROCI – Growth | 2 |

| Greggs | GRG | 16/4/25 | – Holdings – Debt | 2 |

| GSK | GSK | 3/3/25 | ? Holdings – Debt ? ROCE | 2 |

| Hikma Pharmaceuticals | HIK | 19/3/25 | – Debt ? Growth – Shares | 2 |

| IG | IGG | 12/8/25 | – Holdings – Growth | 2 |

| IMI | IMI | 28/3/25 | – Debt – Growth | 2 |

| InterContinental Hotels | IHG | 27/2/25 | – Holdings – Debt | 2 |

| Intertek | ITRK | 21/3/25 | ? Holdings – Debt ? Growth | 2 |

| ITV | ITV | 27/3/25 | ? Holdings – Debt – Growth | 2 |

| Jet2 | JET2 | 4/8/25 | – Holdings – CROCI | 2 |

| Johnson Service | JSG | 21/3/25 | – Holdings – Debt | 2 |

| Luceco | LUCE | 26/3/25 | ? Acquisitions ? CROCI – Debt ? Growth | 2 |

| Macfarlane | MACF | 11/4/25 | ? Holdings – Growth – Shares | 2 |

| MS International | MSI | 15/7/25 | – CROCI – ROCE | 2 |

| Netcall | NET | 18/11/25 | ? ROCE – Shares | 2 |

| Next | NXT | 9/4/25 | – Debt ? Growth | 2 |

| Page | PAGE | 14/4/25 | – Holdings – Growth | 2 |

| PHSC | PHSC | 21/8/25 | – Growth – ROCE | 2 |

| QinetiQ | QQ. | 11/6/25 | ? Holdings ? Acquisitions – ROCE | 2 |

| Record | REC | 20/6/25 | – Holdings – Growth | 2 |

| RELX | REL | 20/2/25 | – Holdings – Debt | 2 |

| Renishaw | RSW | 3/10/25 | – CROCI – Growth | 2 |

| Rotork | ROR | 26/3/25 | – Holdings – Growth | 2 |

| Sage Group | SGE | 2/12/25 | – Holdings – Debt ? Growth | 2 |

| Softcat | SCT | 5/11/25 | – Holdings ? Growth | 2 |

| Spirax | SPX | 8/4/25 | – Holdings – Debt ? Growth | 2 |

| SThree | STEM | 4/3/25 | – Holdings – Growth | 2 |

| Tracsis | TRCS | 5/12/25 | – Holdings – ROCE ? Growth | 2 |

| Unilever | ULVR | 14/3/25 | – Debt – Growth | 2 |

| Wilmington | WIL | 10/10/25 | – Holdings – Growth ? ROCE | 2 |

| XPS Pensions | XPS | 10/7/25 | – Holdings – Debt | 2 |

| Alumasc | ALU | 23/9/25 | – CROCI – Debt – Growth | 3 |

| Anglo American | AAL | 3/3/25 | – Holdings – Growth – ROCE | 3 |

| Anglo Asian Mining | AAZ | 4/6/25 | – CROCI – Growth – ROCE | 3 |

| Antofagasta | ANTO | 31/3/25 | – CROCI – Growth – ROCE | 3 |

| Ashtead | AHT | 24/7/25 | ? Holdings – Acquisitions – Debt ? Growth | 3 |

| Bakkavor | BAKK | 4/3/25 | – Debt – Growth – ROCE | 3 |

| Balfour Beatty | BBY | 3/4/25 | – Growth – CROCI – ROCE | 3 |

| Begbies Traynor | BEG | 18/8/25 | ? Acquisitions ? CROCI – ROCE – Shares | 3 |

| Bisichi | BISI | 29/4/25 | – CROCI – Growth – ROCE | 3 |

| Bodycote | BOY | 15/4/25 | – Holdings – Growth ? ROCE | 3 |

| Braemar | BMS | 29/5/25 | ? CROCI ? Debt – Growth – ROCE | 3 |

| Cardiff Property | CDFF | 1/12/25 | – Growth – ROCE – CROCI | 3 |

| Castings | CGS | 30/6/25 | – CROCI – Growth – ROCE | 3 |

| Celebrus Technologies | CLBS | 15/7/25 | – Holdings – CROCI – Growth ? ROCE | 3 |

| Centaur Media | CAU | 3/4/25 | – Holdings – Growth – ROCE | 3 |

| Central Asia Metals | CAML | 15/4/25 | – Holdings ? Acquisitions – Growth – Shares | 3 |

| Centrica | CNA | 18/3/25 | ? Holdings – Growth – ROCE | 3 |

| CMC Markets | CMCX | 5/6/25 | – CROCI – Growth – ROCE | 3 |

| Concurrent Technologies | CNC | 16/5/25 | ? Holdings – CROCI ? Growth ? ROCE – Shares | 3 |

| ConvaTec | CTEC | 19/3/25 | ? holdings – Debt ? Growth – ROCE | 3 |

| DFS Furniture | DFS | 14/10/25 | – Holdings – Growth – Debt | 3 |

| Diageo | DGE | 14/8/25 | ? Holdings – Debt – Growth | 3 |

| Drax | DRX | 28/3/25 | ? Holdings – Debt – Growth – ROCE | 3 |

| Eagle Eye | EYE | 23/10/25 | – CROCI – ROCE – Shares | 3 |

| Gattaca | GATC | 23/10/25 | – CROCI – Growth – ROCE | 3 |

| Hays | HAS | 6/10/25 | – Holdings ? CROCI – Growth – ROCE | 3 |

| Imperial Brands | IMB | 11/12/25 | – Holdings – Debt – Growth | 3 |

| Ingenta | ING | 7/5/25 | – CROCI – Growth – ROCE | 3 |

| JD Sports Fashion | JD. | 2/6/25 | – Holdings ? Acquisitions – Debt | 3 |

| Keller | KLR | 8/4/25 | – Holdings – CROCI – ROCE | 3 |

| Liontrust | LIO | 4/7/25 | – Growth – ROCE – Shares | 3 |

| London Stock Exchange | LSEG | 28/3/25 | ? Holdings – Debt – ROCE – Shares | 3 |

| LSL Property Services | LSL | 26/3/25 | – CROCI – Growth – ROCE | 3 |

| M.P. Evans | MPE | 25/3/25 | ? Acquisitions – CROCI – Growth – ROCE | 3 |

| Metals Exploration | MTL | 19/5/25 | – CROCI – ROCE – Shares | 3 |

| NAHL | NAH | 30/5/25 | – Debt – Growth – ROCE | 3 |

| Next 15 | NFG | 6/5/25 | – Debt – Growth ? ROCE – Shares | 3 |

| NWF | NWF | 8/8/25 | – Holdings ? Acquisitions – Debt – Growth | 3 |

| PayPoint | PAY | 1/7/25 | – Holdings – Debt – Growth | 3 |

| Pearson | PSON | 14/3/25 | ? Holdings – Debt – Growth – ROCE | 3 |

| Persimmon | PSN | 24/3/25 | – Holdings – CROCI – Growth | 3 |

| Property Franchise Group | TPFG | 25/4/25 | – Holdings ? Acquisitions – Shares | 3 |

| Reckitt Benckiser | RKT | 26/3/25 | – Holdings – Debt ? Growth ? ROCE | 3 |

| Rio Tinto | RIO | 20/2/25 | – Holdings – Growth ? ROCE | 3 |

| RS | RS1 | 9/6/25 | – Holdings ? Acquisitions ? Debt – Growth | 3 |

| RTC | RTC | 24/3/25 | – CROCI – Growth – ROCE | 3 |

| Savills | SVS | 7/4/25 | ? Holdings – CROCI ? Growth ? ROCE | 3 |

| Shell | SHEL | 2/7/25 | – Holdings – Growth – ROCE | 3 |

| Shoe Zone | SHOE | 10/2/25 | – CROCI – Debt – Growth | 3 |

| Smith & Nephew | SN. | 10/3/25 | – Holdings – Debt ? Growth – ROCE | 3 |

| Smiths | SMIN | 9/10/25 | – Holdings – Growth ? ROCE | 3 |

| System1 | SYS1 | 9/7/25 | – CROCI – Growth – ROCE | 3 |

| Telecom plus | TEP | 4/7/25 | – CROCI – Debt – Growth | 3 |

| Topps Tiles | TPT | 6/12/25 | – Holdings – Debt ? Growth – ROCE | 3 |

| Triad | TRD | 16/6/25 | – CROCI – Growth – ROCE | 3 |

| Ultimate Products | ULTP | 28/10/25 | ? Acquisitions – CROCI – Debt – Growth | 3 |

| Vesuvius | VSVS | 9/4/25 | ? Holdings – Debt – Growth ? ROCE | 3 |

| Victrex | VCT | 2/12/25 | – Holdings – Growth – ROCE | 3 |

| Weir | WEIR | 21/3/25 | – Holdings – Growth ? ROCE – Shares | 3 |

| Wetherspoon (JD) | JDW | 3/10/25 | ? CROCI – Debt ? Growth – ROCE | 3 |

| AEP Plantations | AEP | 30/5/25 | – Holdings – CROCI – Debt – Growth ? ROCE | 4 |

| Barratt Redrow | BTRW | 2/10/25 | – Holdings – Growth – ROCE – Shares | 4 |

| Bellway | BWY | 27/10/25 | ? Holdings – CROCI – Growth – ROCE | 4 |

| BP | BP. | 6/3/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| British American Tobacco | BATS | 14/2/25 | – Holdings – Debt – Growth – ROCE | 4 |

| Brooks Macdonald | BRK | 12/9/25 | ? Acquisitions – Holdings – Growth – ROCE ? Shares | 4 |

| Burberry | BRBY | 29/5/25 | – Holdings – Growth – Debt – ROCE | 4 |

| Chemring | CHG | 9/12/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| Christie | CTG | 16/5/25 | – CROCI – Debt – Growth – ROCE | 4 |

| EKF Diagnostics | EKF | 25/4/25 | – CROCI – Growth – ROCE ? Shares | 4 |

| Enwell Energy | ENW | 13/6/25 | – Holdings ? CROCI – Growth – ROCE | 4 |

| Eurocell | ECEL | 16/4/25 | – Holdings – Debt – Growth – ROCE | 4 |

| Ferrexpo | FXPO | 10/4/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| Future | FUTR | 12/12/25 | – Holdings ? Acquisitions – Growth – Shares | 4 |

| Gateley | GTLY | 31/8/25 | ? Holdings ? CROCI – Debt – ROCE – Shares | 4 |

| Genuit | GEN | 15/4/25 | – Holdings ? Acquisitions – Debt – Growth – Shares | 4 |

| Halfords | HFD | 29/7/25 | – Holdings – Debt ? Growth – ROCE – Shares | 4 |

| Ibstock | IBST | 11/4/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| IDOX | IDOX | 28/1/25 | ? Holdings ? Acquisitions – Growth ? ROCE – Shares | 4 |

| Intercede | IGP | 12/8/25 | – CROCI – Growth – ROCE – Shares | 4 |

| Jupiter Fund Management | JUP | 27/3/25 | – Holdings – Growth – ROCE – Shares | 4 |

| Marks & Spencer | MKS | 2/6/25 | – Holdings – Debt – Growth – ROCE | 4 |

| Marshalls | MSLH | 3/4/25 | – Holdings – Debt – Growth – Shares | 4 |

| Michelmersh Brick | MBH | 3/4/25 | – Holdings – Growth – ROCE – Shares | 4 |

| Morgan Advanced Materials | MGAM | 28/3/25 | – Holdings ? CROCI – Debt – Growth | 4 |

| PZ Cussons | PZC | 25/9/25 | – Holdings – Growth – Debt – ROCE | 4 |

| Redcentric | RCN | 25/9/25 | ? Acquisitions ? CROCI – Debt – Growth – ROCE | 4 |

| Robert Walters | RWA | 28/3/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| Serica Energy | SQZ | 23/4/25 | ? Acquisitions – CROCI – Growth – ROCE – Shares | 4 |

| Severfield | SFR | 29/7/25 | – CROCI – Debt – Growth – ROCE | 4 |

| Springfield Properties | SPR | 16/9/25 | ? Acquisitions ? CROCI – Growth – ROCE – Shares | 4 |

| Taylor Wimpey | TW. | 26/2/25 | ? Holdings – Growth – ROCE – Shares | 4 |

| Touchstar | TST | 29/5/25 | – CROCI – Growth – ROCE – Shares | 4 |

| Vistry | VTY | 14/4/25 | ? Acquisitions – CROCI ? Growth – ROCE – Shares | 4 |

| Vodafone | VOD | 6/6/25 | – Holdings – Debt – Growth – ROCE | 4 |

| Watkin Jones | WJG | 31/1/25 | – Holdings – CROCI – Growth – ROCE | 4 |

| Yu | YU. | 18/3/25 | – CROCI – ROCE | 4 |

| AstraZeneca | AZN | 18/2/25 | – Holdings ? Acquisitions – Debt – Growth – ROCE – Shares | X |

| EnQuest | ENQ | 24/4/25 | – CROCI – Debt – Growth – ROCE – Shares | X |

| Forterra | FORT | 27/3/25 | – Holdings – CROCI ? Debt – Growth – ROCE | X |

| Grainger | GRI | 20/11/25 | – Holdings – Growth – Debt – ROCE – Shares | X |

| Gulf Marine Services | GMS | 28/4/25 | – Holdings – CROCI – Debt – Growth – ROCE – Shares | X |

| Logistics Development | LDG | 22/5/25 | – Acquisitions – CROCI – Debt – ROCE – Shares – Directors holdings | X |

| M&C Saatchi | SAA | 2/4/25 | – Holdings – CROCI – Debt – Growth – ROCE – Shares | X |

| Maintel | MAI | 6/5/25 | – Acquisitions – Growth – Debt – ROCE – Holdings | X |

| Mears | MER | 28/4/25 | – Holdings – CROCI – Debt – Growth ? ROCE | X |

| Mitie | MTO | 20/6/25 | – CROCI – Growth – Debt – ROCE – Shares | X |

| Mondi | MNDI | 18/3/25 | – Holdings – CROCI – Debt – Growth – ROCE – Shares | X |

| Pebble Beach Systems | PEB | 15/7/25 | -Holdings – CROCI – Debt – Growth – ROCE | X |

| Rank Group | RNK | 16/9/25 | – CROCI – Debt – Growth – ROCE – Shares | X |

| Serco | SRP | 10/3/25 | – Holdings – Acquisitions – CROCI – Debt – Growth ? ROCE | X |

| Speedy Hire | SDY | 18/7/25 | – Holdings ? CROCI – Debt – Growth – ROCE | X |

| STV | STVG | 25/3/25 | – Holdings – CROCI – Debt – Growth – Shares | X |

| Tullow Oil | TLW | 14/4/25 | – Holdings ? CROCI – Debt – Growth – ROCE – Shares | X |

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.