Softcat and Dotdigital are the only shares to pass Richard’s 5 Strikes filter. He explains why we shouldn’t worry about Softcat’s volatile turnover, but we should keep an eye on Dotdigital’s increasing capital employed.

5 Strikes

Just three shares have published annual reports and passed my minimum quality filter since my last update.

|

Name |

TIDM |

Prev AR |

Strikes |

# Strikes |

|---|---|---|---|---|

|

Softcat |

SCT |

5/11/25 |

– Holdings ? Growth |

1 |

|

Dotdigital |

DOTD |

4/11/25 |

– Holdings ? Acquisitions |

1 |

|

Ultimate Products |

ULTP |

28/10/25 |

? Acquisitions – CROCI – Debt – Growth |

3 |

|

12/11/2025 |

||||

Ultimate Products (? Acquisitions – CROCI – Debt – Growth) failed to make it past the next 5 Strikes stage, consideration of its eight year track record. The company’s record contains too many whoopsies, a not-so-technical term for blips: negative cash returns (CROCI), high financial obligations relative to capital employed, and inconsistent growth.

Ultimate Products owns a bevy of kitchen and laundry brands. It sources ironing boards, kettles, and kitchen scales, principally in China, and sells them to retailers under brand names that may be familiar to you: Beldray, Morphy Richards, and Salter for example.

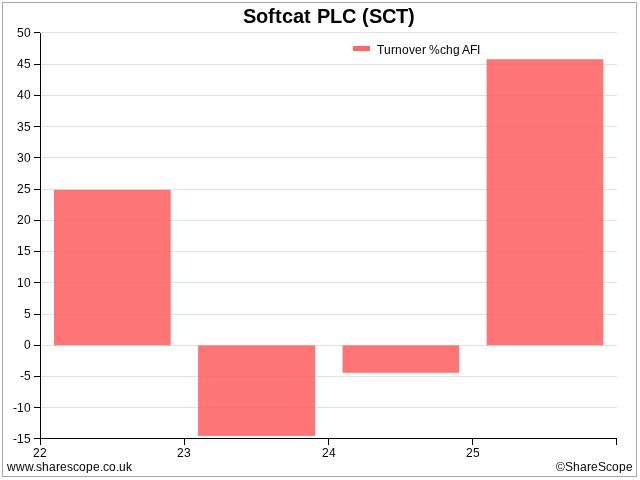

Moving swiftly on, I own Softcat (- Holdings ? Growth) shares and it is an established member of the Share Sleuth portfolio, which I run for interactive investor. I’ll provide a fuller update on my research there shortly. Here, I need to explain why its turnover growth is so volatile, because that is the only 5 Strikes financial criterion that is questionable.

Softcat is an IT reseller. It sells software and hardware products to organisations primarily in the UK. Last year I gave it a strike for growth because turnover contracted modestly in 2023 and 2024.

Turnover is an inconsistent measure because the rules determining what income Softcat could recognise as turnover changed in 2018, and the company reinterpreted them in 2021. Both times turnover fell as a result, but this did not mean the company had done less well.

Since 2021, turnover is more helpful, and penalising Softcat for its performance in 2023 and 2024 seems harsh, when you consider what happened in 2022 and 2025:

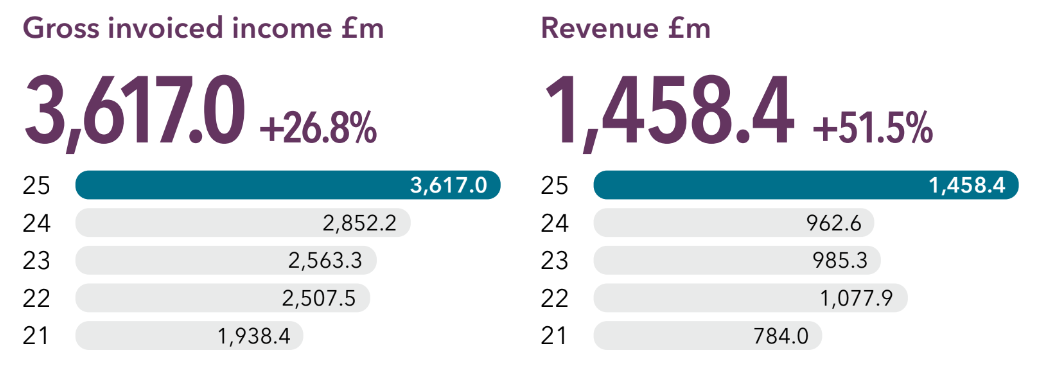

To show the long-term growth rate, Softcat uses a consistent measure it calls Gross Invoiced Income (GII). Softcat says it has grown GII every year for the last twenty years. Even over the last five years, growth has been more consistent by this measure:

Source: Softcat Annual Report 2025.

The rules, known as IFRS 15, introduced in 2018 mean that a company cannot recognise the full billable value of an invoice as turnover if it does not take control of the product. Instead, it recognises a commission on the sale.

In the old days, IT Resellers were known as box shifters, because they stocked computers and software on discs in shrink-wrapped boxes. Under this scenario the reseller took ownership of the product, stored it in a warehouse, and delivered it to the customer. If the product was damaged in storage, they bore the cost. The reseller had control.

Today software sales are mostly contracts with the supplier. The actual product is a service controlled by the software company, Adobe or Microsoft say, and delivered over the cloud. The reseller is deemed an agent and the software company has control (typically). Hardware is still sold the old way.

Since the reseller’s cut is much smaller than the total value of the software contract, reseller turnover took a hit when the rules changed.

Under IFRS 15, hardware sales, billed at their gross value, have a much bigger impact on turnover than software sales, billed net of the supplier’s cut. Yet there is much less cost associated with the software sale as the reseller doesn’t pay for it or stock it. Consequently, profit and cashflow track GII more closely than turnover.

I am as sceptical as the next investor when companies focus on alternative performance measures, but in this case I don’t think we should worry too much about dramatically fluctuating turnover. It makes Softcat look more flakey than it is.

In 2025 an eye-catching 51.5% increase in turnover exceeded a 26.8% increase in GII. The GII growth might be lower, but it is still quite impressive, a result of large contracts to supply datacenters that have continued into the new financial year.

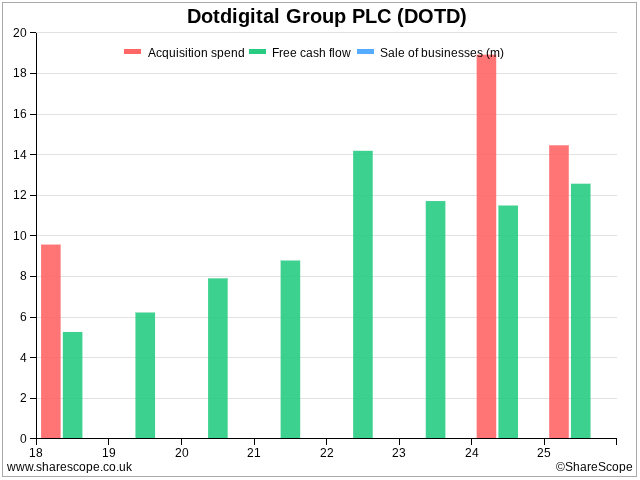

Dotdigital (- Holdings ? Acquisitions) is a marketing software platform. Judging by the key 5 Strikes financial statistics profitability, cashflow, net financial obligations and turnover growth, there is nothing to worry about.

Source: Custom Sharepad 5 Strikes table

I have added a question mark for acquisitions, though, because the company spent (a little) more than it earned in free cash flow buying other companies in both 2024 and 2025. The company also overspent in this sense, in 2018, when it acquired Comapi – which I covered.

Comapi introduced chatbots to Dotdigital’s software suite, which primarily consisted of email and text messaging at the time. The acquisition of Fresh Relevance at the beginning of the year to June 2024 brought website personalisation capabilities to the platform. Social Snowball, acquired right at the end of the financial year ending in June 2025, added influencer, affiliate and referral marketing capabilities.

The buzz-word has been “omnichannel” throughout the period, and Dotdigital is investing heavily to cover more channels.

In fact, Dotdigital has invested more heavily in acquisitions than the acquisition spend numbers in ShareScope say. It paid an additional £5.7 million in shares for Fresh Relevance. Social Snowball comes with an additional $15 million earnout, which will be paid if the business achieves certain financial targets over the next two years.

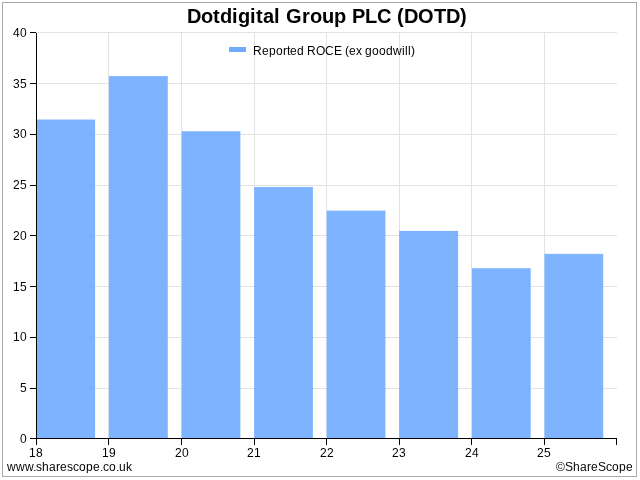

One thing to keep an eye on is return on capital, which at around 20% this decade is good, but lower than DotDigital was achieving previously.

Dotdigital has been adding capital through acquisitions, and by developing more capable software.

Capitalised Development costs are money spent on developing new features that is recorded on the balance sheet instead of being expensed in the year in which they were incurred. They are running at over 12% of turnover, indicating significant investment.

So far, the product of this investment has been slower growth in turnover and lower returns as a proportion of capital employed, which includes money spent on acquisition and capitalised development costs.

That may be the nature of investment, higher costs now in return for growth in future, or it may be that the company is having to work harder to make progress.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.