Earlier this year, Science Group bagged a 74% gain within five months following an acrimonious activist campaign. Maynard Paton studies the consultancy group’s low-profile boss, who is refreshingly prepared to instigate changes at underperforming investments.

I love activists.

The investors who roll up their sleeves and:

- Buy large stakes in underperforming companies;

- Engage with boardrooms to instigate change, and;

- Are prepared to call general meetings to eject sub-par directors.

In a small-cap market awash with tame fund managers, indifferent chief execs and docile chairmen, it seems only those stock-pickers willing to kick up a real fuss are able to generate excellent returns from UK smaller companies.

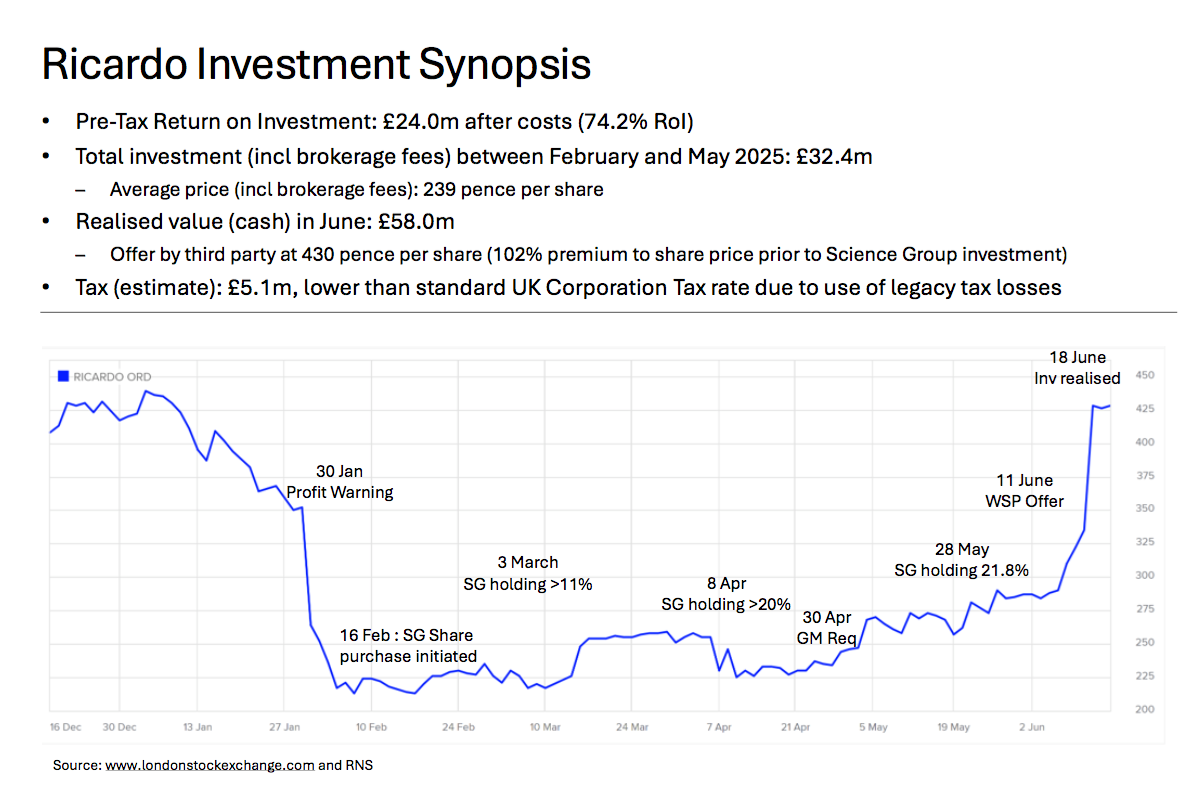

One of this year’s most high-profile activist campaigns was led by Science Group and centred on Ricardo.

Science started buying Ricardo shares during February and by April had invested £32m for a 20% stake. A series of acrimonious RNSs (notably here and here) culminated with Science requisitioning a general meeting to oust Ricardo’s chairman and trigger a recovery:

“Following poor operating performance and ineffective governance at Ricardo, resulting in a significant destruction of shareholder value, on 30 April 2025 Science Group requested the Ricardo Board to requisition a general meeting (“General Meeting”) for Ricardo shareholders to consider a single resolution to remove Mr Mark Clare as a director of the Company and Chairman of the Board.

In effect, the General Meeting is a vote of no-confidence in the leadership of the Ricardo Board and to initiate change to enable a positive, shareholder-aligned recovery to benefit all Ricardo shareholders, large and small. The date has now been set for 18 June 2025 and a shareholder circular has been posted by Ricardo.”

The general meeting did not take place because Ricardo agreed to a bid just a week before. The investment outcome for Science was very impressive:

Science’s £32 million investment led to a £24 million pre-tax profit within five months. Not a bad return for a business now capitalised at £240 million at 545p a share:

Prior to Ricardo, Science had undertaken activist positions at two other quoted companies that necessitated RNS ding-dongs and general-meeting requisitions before the targets eventually relented.

Let’s take a closer look.

Introducing Martyn Ratcliffe and Science Group

Say hello to Martyn Ratcliffe, the executive chairman of Science and the instigator of the Ricardo investment.

Public information about Mr Ratcliffe is extremely sparse — a search online for ‘Martyn Ratcliffe interview‘ yields nothing about the 64-year-old. I recall small-cap commentator Paul Scott saying earlier this year he tried to persuade Mr Ratcliffe to appear on a podcast, only to be told Mr Ratcliffe prefers to “fly under the radar“.

Mr Ratcliffe’s bio within the latest Science annual report reads as follows:

“Martyn Ratcliffe was appointed Chairman on 15 April 2010 following his investment in Sagentia Group, now Science Group. He was Chairman of Microgen plc from 1998 to 2016 and Chairman of RM plc from 2011 to 2013. He was previously Senior Vice President of Dell Computer Corporation, responsible for EMEA. He has a degree in Physics from the University of Bath and an MBA from City University, London.”

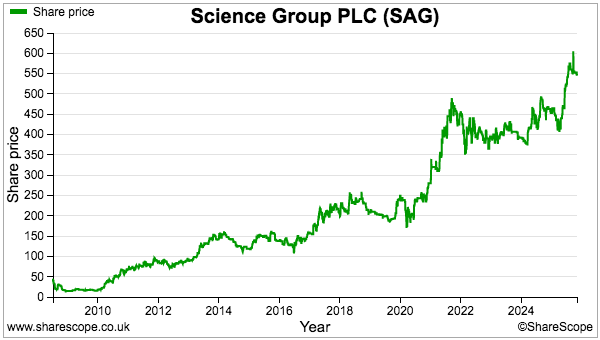

Mr Ratcliffe’s initial involvement with Science — then called Sagentia — was somewhat activist in nature. He spent £2.5 million during 2010 to acquire a 48% block of shares at 23.8p and quickly installed himself as chairman. The other non-execs exited immediately and a new finance director was soon appointed.

Mr Ratcliffe also launched an £8 million placing at 40p a share — in which he contributed a further £800k — that would give Science the “potential to accelerate growth” through acquisitions.

Subsequent acquisitions included:

- OTM Consulting (£6 million, 2013);

- Oakland Innovation (£5 million, 2015);

- Technology Sciences (£13 million, 2017);

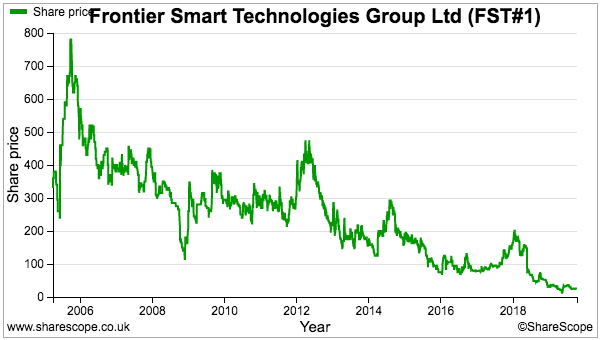

- Frontier Smart Technologies (£13 million, 2019), and;

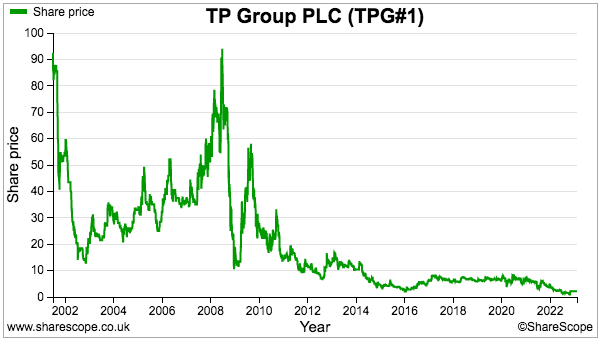

- TP Group (£30 million, 2021-2023).

Both Frontier Smart and TP were quoted on AIM, and TP in particular involved a protracted 18-month investment that witnessed Science:

- Initially buy at 5p per share;

- Launch a formal offer at 6.5p per share;

- Withdraw that 6.5p offer;

- Requisition two general meetings, and;

- Launch a conclusive offer at 2.25p per share.

Both Frontier Smart and TP had fallen on hard times well before Science appeared on their respective share registers:

Science’s acquisition strategy appears to target struggling companies that require refreshed leadership and extra funding to recover and then prosper.

Science itself was struggling when Mr Ratcliffe arrived on the scene during 2010.

But the group’s results soon talked about the “best financial performance for more than five years” after Mr Ratcliffe implemented “more robust operational and financial control processes“.

Science today describes itself as an “international science and technology consultancy and systems organisation“, and employs more than 400 scientists, engineers, technical advisers and regulatory experts who undertake specialist consultancy projects for the medical, defence, chemicals, food and aviation industries.

The group’s blog gives a flavour of the R&D consultancy work involved:

- “Optimising the formulation of agricultural biologicals“;

- “How to harness engineering biology for sustainable production of bulk chemicals“;

- “Enabling dishwashers to sense the load to optimise cycle efficiency“;

- “How can we achieve sustainable innovation in construction materials?“;

- “Modelling heat exchangers to improve efficiency in industrial equipment“;

- “Sustainable aviation fuel: navigating feedstock challenges & opportunities“;

- “How defence organisations can accelerate innovation within established frameworks“;

- “Navigating the FDA’s fast-tracking of petroleum-based food dye bans“;

- “Keeping ahead of new regulations in China“, and;

- “R&D considerations for air-fryer-friendly products“.

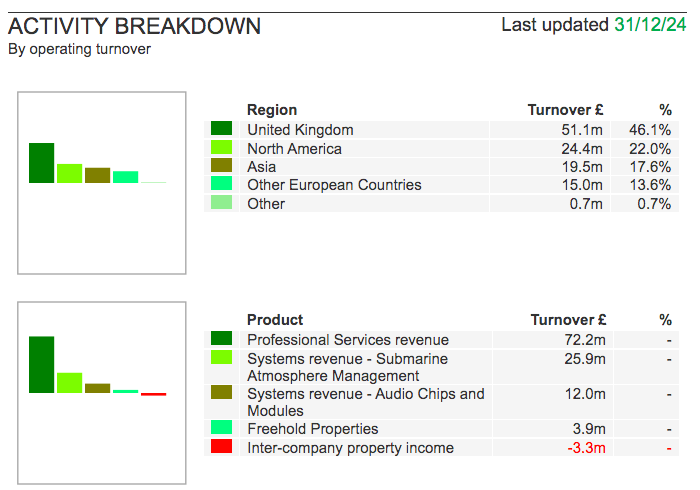

Science’s consultancy operations are complemented by a systems division, which consists of TP’s ‘submarine atmosphere management‘ equipment and Frontier Smart’s DAB radio microchips:

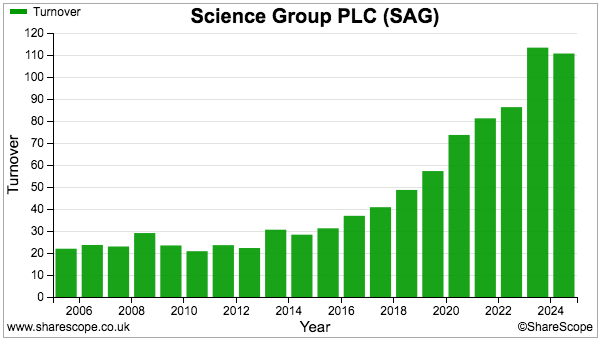

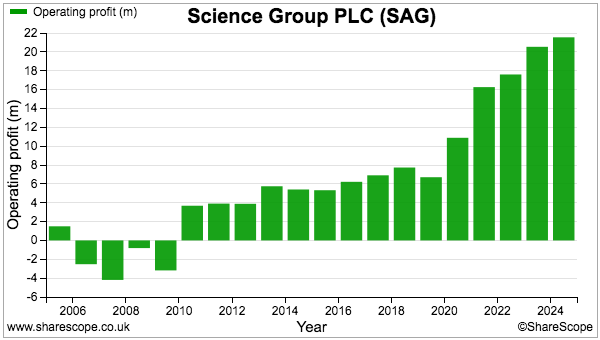

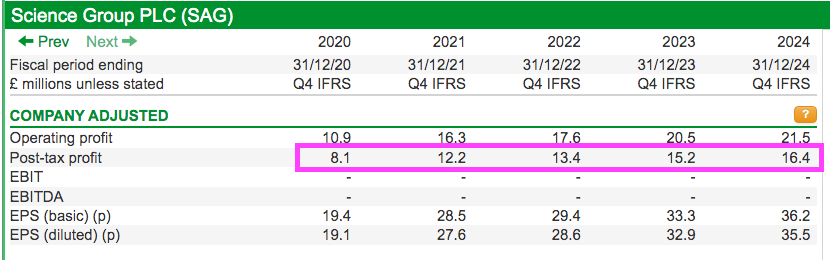

Science’s financial progress has been positive.

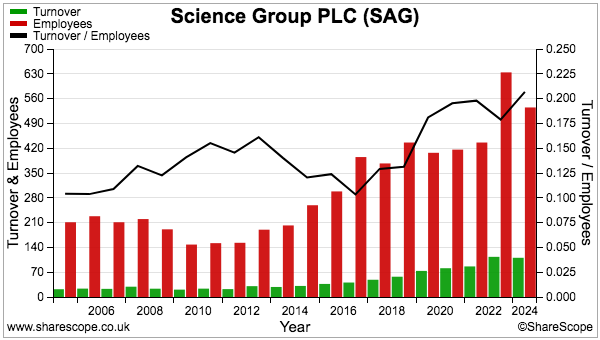

Since Mr Ratcliffe joined the board during 2010, revenue has quintupled to £110 million while adjusted operating profit has surged eight-fold to beyond £21 million:

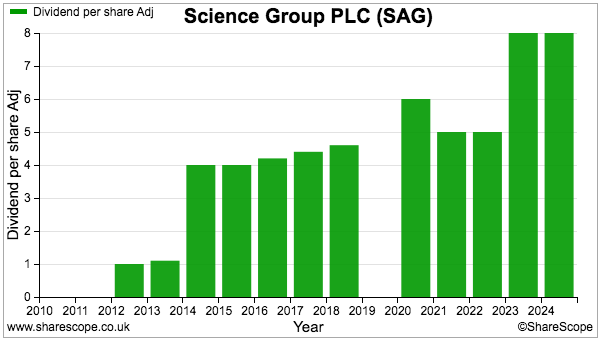

The dividend was paused during the pandemic, but has been lifted thereafter:

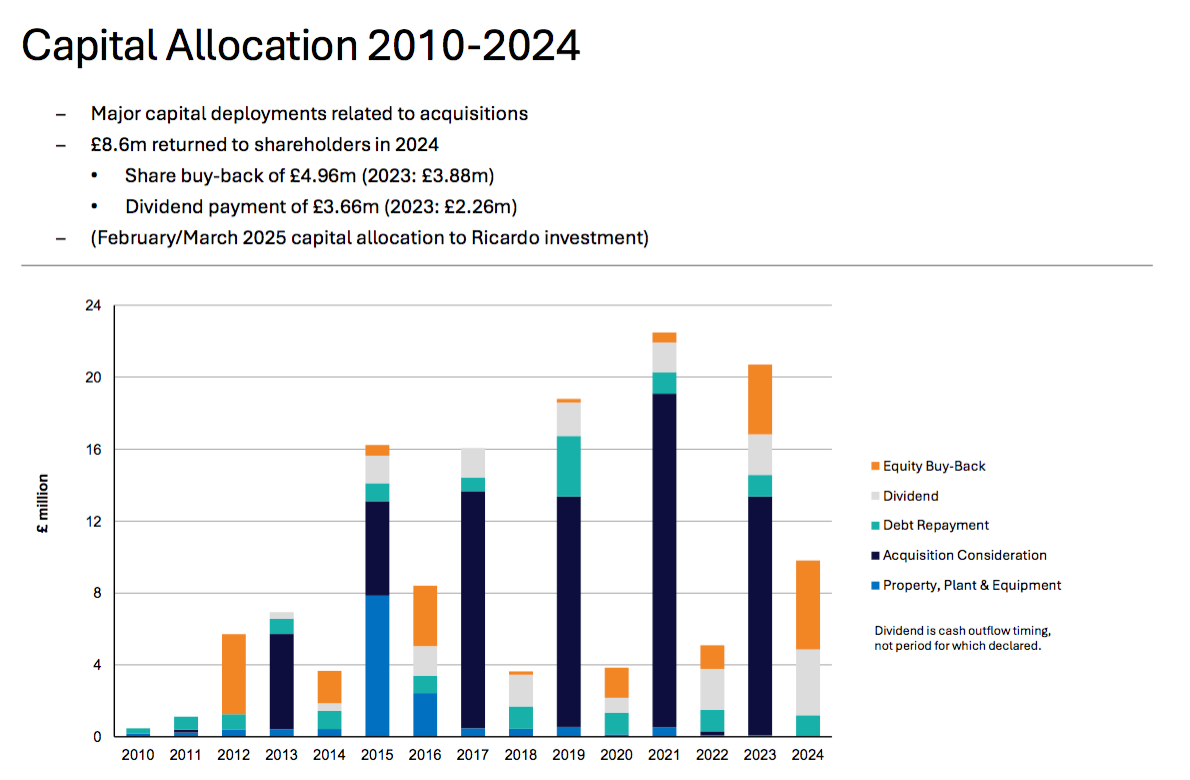

Capital allocation and return on equity

The ‘capital allocation’ slide below tells me Science operates very differently to most UK small caps:

All quoted companies should really follow Mr Ratcliffe’s lead and publish a chart that recaps how shareholders’ money has been deployed.

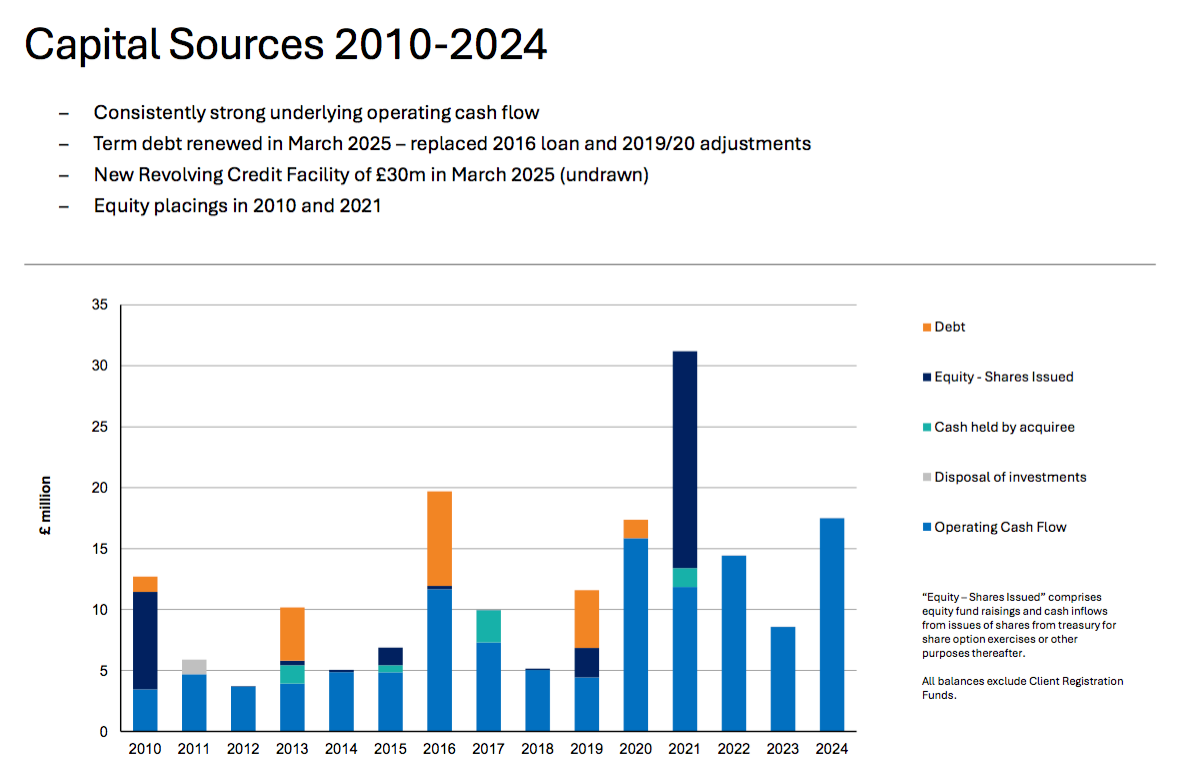

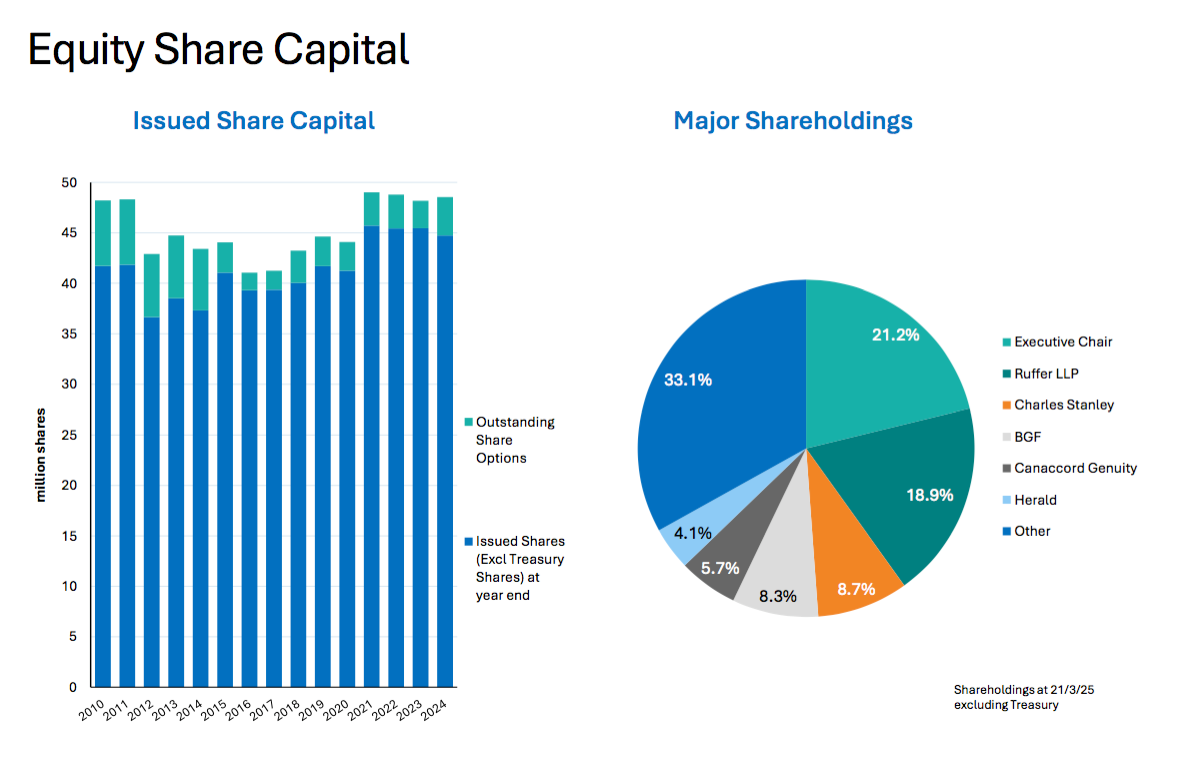

Science’s powerpoints include a few other welcome slides that emphasise Mr Ratcliffe’s shareholder focus:

This slide for example details the sources of group funding…

…while this slide — probably unique among UK listed companies — highlights the potential dilution to shareholders through outstanding options:

At the end of 2024, the potential maximum dilution from granted options was a notable 8.5%. The options vest upon earnings per share and share price targets that are irritatingly not disclosed.

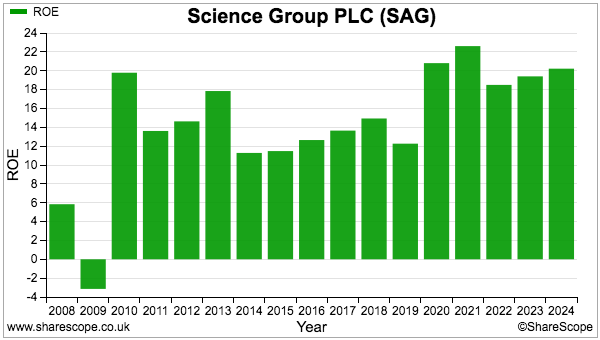

I would have imagined a business so focused on capital allocation would benchmark its progress (and option awards!) against return on equity (ROE) or a similar ‘capital efficiency’ ratio.

ShareScope shows Science’s ROE surpassing a very useful 18% during the last five years:

Even adjusting the ROE sums for the amortisation and impairment of acquired intangible assets leads to a worthwhile 15%-plus since 2020.

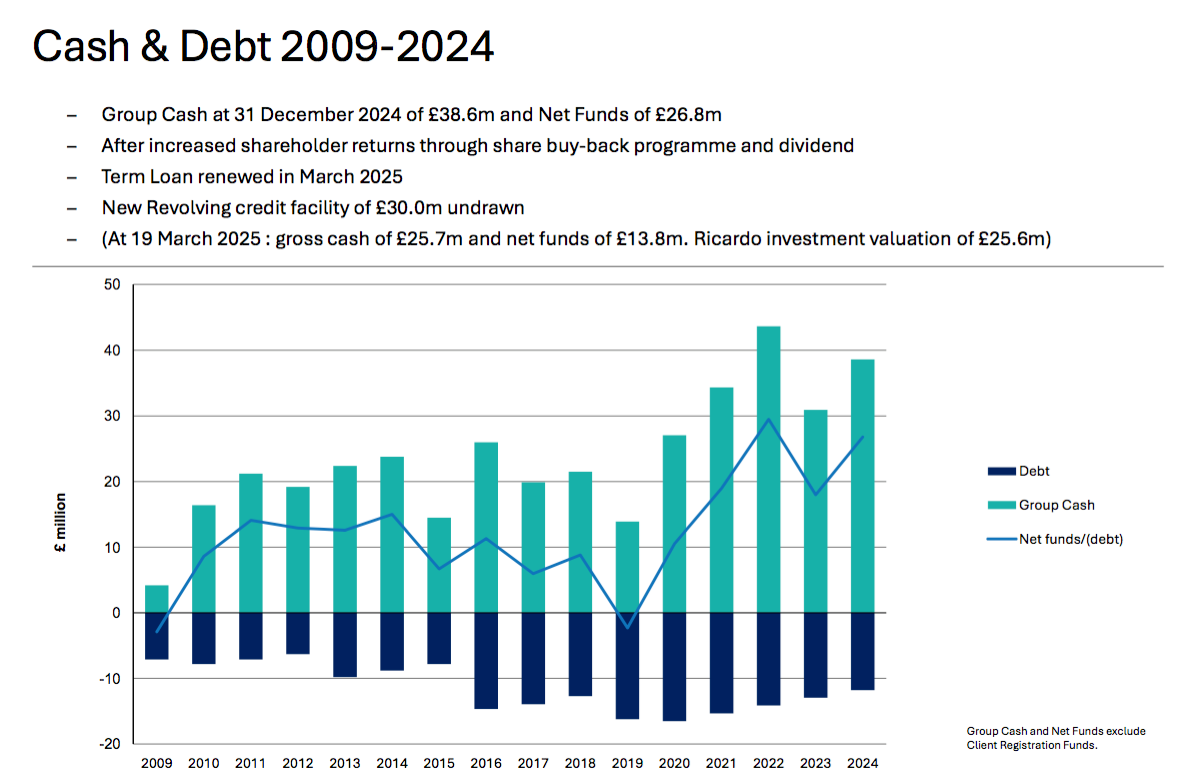

Note that Science is also proud to recap its net cash position, which stood at almost £27 million at the end of last year:

Science’s 15% or 18% ROEs are arguably suppressed by the balance sheet’s significant cash position, which collects relatively modest amounts of interest.

Employees

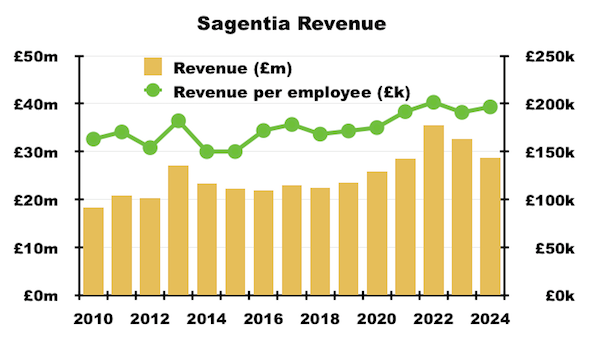

A useful insight into Science’s evaluation of Ricardo concerned employee productivity. Mr Ratcliffe compared revenue per head at the two companies:

“Margin is a function of organisational efficiency and productivity, often measured by revenue per head. In the last published annual reports, Science Group annual revenue per head was £163,000, compared to Ricardo annual revenue per head of £130,000 (excluding Defence), a productivity difference of around 25%. This productivity delta reflects poor cost control and inefficiency in Ricardo which is particularly evident in the high Ricardo PLC costs…”

Science’s revenue per employee has generally tracked higher over time, albeit with setbacks probably due to acquisitions:

My own calculations for Science’s main subsidiary — the original Sagentia business — show revenue per employee gently improving towards a worthwhile £200k:

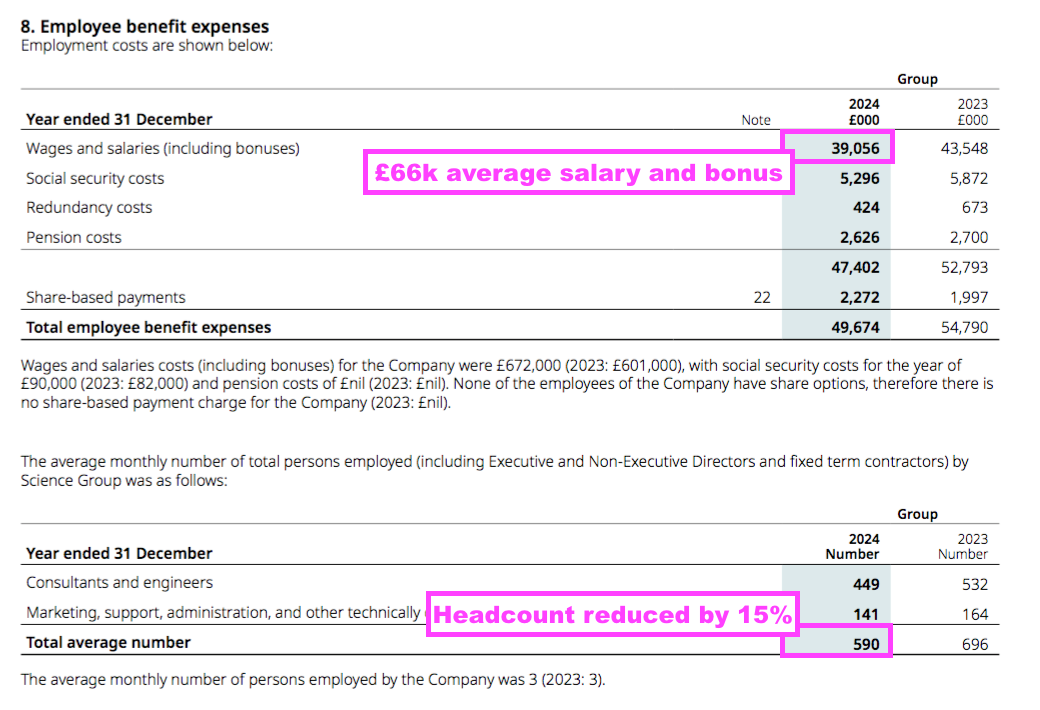

I note Science’s total workforce — which includes fixed-term contractors — was reduced by a hefty 15% during 2024:

The 2024 results referred to “management action to reduce some legacy, low margin activities” that presumably led to the exit of the 106 less productive workers. Despite all the redundancies, 2024 revenue declined only 3%.

The average salary and bonus last year was £66k, which does not seem enormous given the consultants conduct expert R&D projects and boast scientific or technology degrees.

The annual-report small-print reveals 24% of the headcount was paid £75k or more, so I speculate the bulk of consultants are younger, less experienced graduates. Science does not disclose utilisation rates or levels of staff turnover, which would help shareholders assess the effectiveness of this ‘people’ business further.

Mr Ratcliffe was paid £450k last year and does not participate in the group’s bonus scheme nor its pension scheme. Nor does he hold any options.

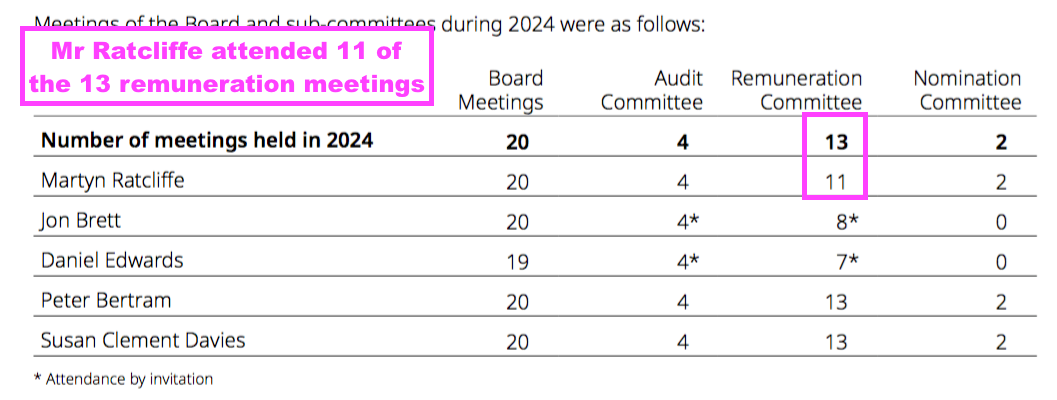

I get the impression staff pay is very important to Mr Ratcliffe. Despite not being a member of the remuneration committee, Mr Ratcliffe sat in on 11 of the 13 rem-comm meetings last year (and seemingly all without invitation):

I suppose Mr Ratcliffe can attend any meeting he wishes given he retains an 18%/£44 million shareholding. Be aware he has reduced his stake by 35% since his initial 2010 purchases, with his latest disposal raising £8 million at 550p just two months ago.

Despite his share sales, Mr Ratcliffe’s dividend income (£600k-plus) remains in excess of his salary.

Financials

A quick skim through ShareScope does not show anything too untoward with Science’s financials.

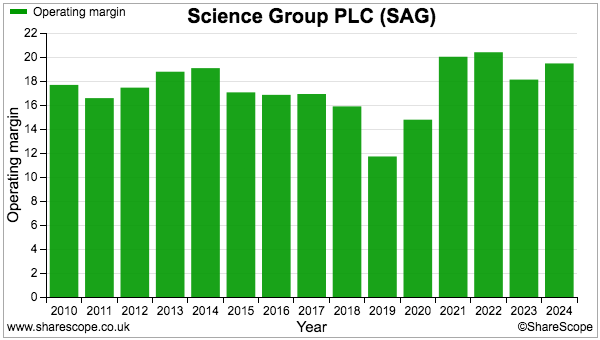

A profit margin typically surpassing 15% suggests clients are happy to pay a premium for the group’s R&D consultancy. I suppose the decent margins may also reflect Mr Ratcliffe’s eagerness to keep a lid on workforce pay:

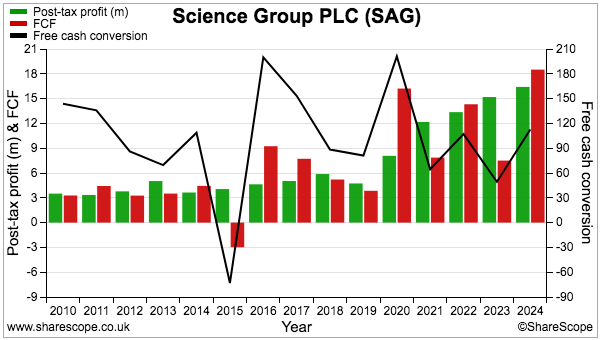

Conversion of profit into cash has fluctuated from year to year due to the timing of customer payments:

Some projects require clients to pay upfront and the resultant changes to ‘contract liabilities’ can bolster cash flow, most notably during 2020.

In contrast, other projects require Science to undertake the work before billing the client, and the resultant changes to ‘contract assets’ can suppress cash flow, most notably during 2023.

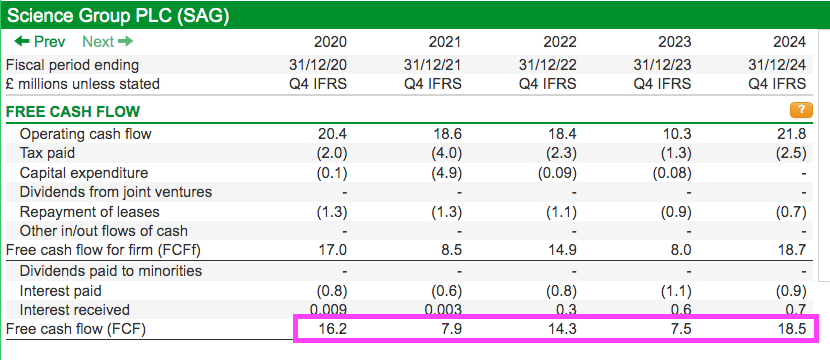

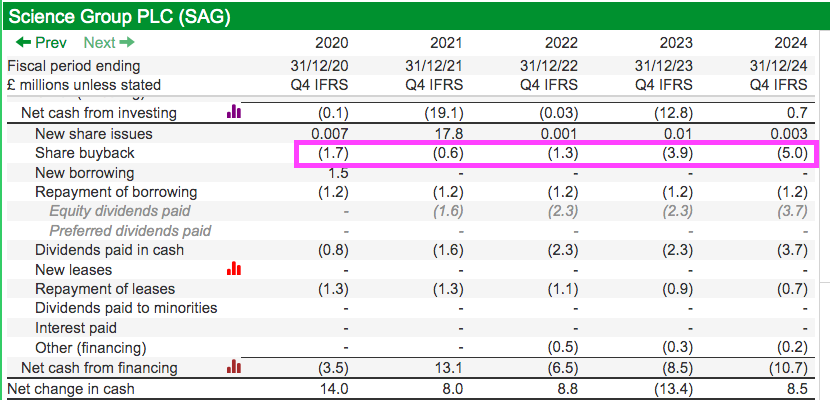

Between 2020 and 2024, aggregate free cash flow amounted to £64 million…

….which just about matched aggregate adjusted earnings of £65 million:

Mind you, £12 million of that five-year free cash flow was then spent on buying shares to be held in treasury, which I am sure will be used to mitigate the dilution from the aforementioned options:

At the end of 2024, Science had granted 3.8 million options yet held only 1.5 million shares in treasury.

Elsewhere in the accounts, the balance sheet includes two freehold properties with a combined book value of £21 million. Last year these sites saved group subsidiaries from paying rent of £3 million to external landlords, which also helps explain the aforementioned healthy margins.

The goodwill small-print meanwhile reveals five-year projected subsidiary-revenue CAGRs of generally between 2.5% and 5.1%, which implies superior sales growth is likely to require further acquisitions.

Valuation and summary

Interim results published during July were positive. They showed:

- Revenue up 6% to £57 million;

- Adjusted operating profit up 3% to £11 million;

- The aforementioned £24 million Ricardo profit;

- Favourable working-capital movements supporting free cash flow of £21 million;

- £1 million spent buying shares to be held in treasury, and;

- Net cash at £70 million.

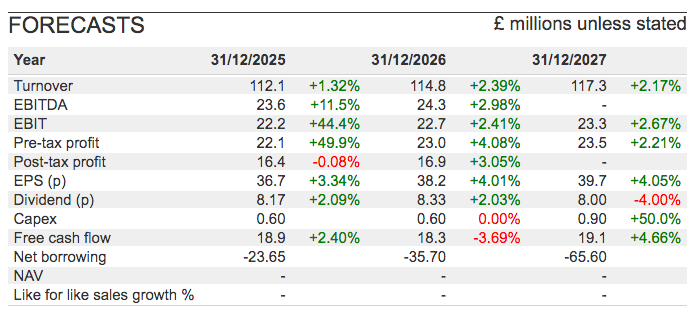

A statement during September then said 2025 adjusted operating would be in line or “slightly ahead” of board expectations. Brokers have translated that update into the following forecasts:

(The hefty profit-growth projections for 2025 are due to ShareScope comparing Science’s unadjusted 2024 numbers to the City’s adjusted 2025 estimates.)

The revenue and profit growth forecasts for 2026 and 2027 are very modest, emphasising that further acquisitions will indeed be required to replicate the past rate of expansion.

Note the first-half commentary owned up to a “limited” number of potential purchases:

“Furthermore, with a limited UK-centred population of potential acquisitions and/or investments, there may or may not be suitable opportunities to deploy the capital in accordance with the Board’s investment criteria.”

But the first-half commentary did raise the possibility of a tender offer:

“Accordingly, and taking into account the buy-back programme constraints, the Board shall keep under review the possibility of a return of capital to shareholders via a tender offer. “

The Ricardo gain has an anticipated £5 million tax liability, which in theory leaves a surplus £19 million — equivalent to approximately 43p per share — to support a Ricardo-funded tender.

Science’s 545p shares trade at 14-15x near-term earnings and Mr Ratcliffe announcing a tender at that price — or even at a higher price! — might just be the signal investors need to take a much closer look at this stock.

After all, Mr Ratcliffe has 22-bagged his initial Science investment since 2010 and has just collected a 72% pre-tax gain via Ricardo within five months. I think it is safe to say Mr Ratcliffe is much more likely to extract a near-term gain from a struggling small cap than you or me.

I should add that, at least with a tender, Mr Ratcliffe will not have to become embroiled in another RNS battle and unseat uncooperative directors to create further value for his shareholders!

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in Science Group.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.