This month’s Funds article focuses on the UK economy and the fast-approaching autumn budget. We revisit the benefits of VCTs and suggest a shortlist for further research. We also remind UK investors that the UK stock market hasn’t been a bad bet over the last decade, despite the prevailing sense of gloom and economic frustration.

UK doomsterism

There’s a strong negative economic vibe at the moment here in the UK. Most sentiment indicators are very dismal, and there’s a feeling that Britain is broken and heading back to the 1970s. I don’t think this sense of drift is entirely fair. Most macroeconomic indicators suggest that the UK is performing OK and is in the middle of the pack when it comes to growth measures. There are certainly some unique problems, not least sustained inflation above 3% and a challenging fiscal position for the government (more on that shortly); however, overall, the UK is probably just ‘middling’.

But that pessimism also has an impact on the UK stock market. The LSE has seen a wave of delistings or firms shifting abroad, and there’s also been a wave of take privates – the UK market is less liquid than it once was and is now a tiny part of most global equity benchmarks (around 3%). And of course, UK equities have lagged behind US equities – as have most other markets around the world.

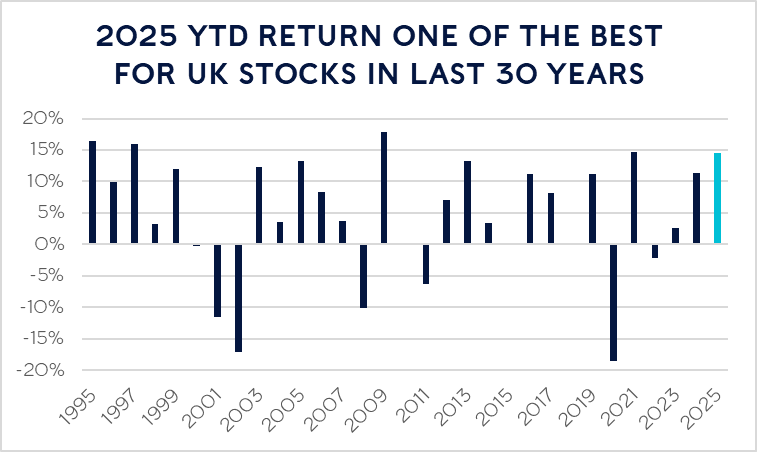

But that doesn’t mean that the UK market has been a failure. Far from it, as recent research from wealth manager Rathbones points out. They observe that the FTSE All-Share Index delivered a 14.5% total return in the year to August 31, 2025, outperforming all major markets except the German DAX. This makes 2025 the fifth strongest year for UK equities since 1995. By contrast, sterling investors in the S&P 500 have seen gains of just 3% due to a weak dollar, while the MSCI World Index has risen 5%.

“UK equities have defied expectations this year,” said Alexandra Jackson, Fund Manager of the UK Opportunities Fund at Rathbones. “Despite all the doom and gloom, the All-Share has delivered one of its best year-to-date performances in three decades – a reminder that markets often move ahead of the headlines.

Source: FactSet; total return of FTSE All-Share Index in years to 31 August

I’d also cite a recent analysis of the UK market by Morningstar, which observed that :

“The UK [market] has had a very decent performance so far in 2025, returning almost 9%, close to the exact level of return for the entire year in 2024. …The UK equity market currently stands at around a 12% discount to our fair value estimate, a wider discount than that of the broader European market. Overall, we view UK equities as moderately attractive. From a top-down lens, we view valuations as fair, while on the other hand, we find moderately attractive opportunities at the stock level.

From a macroeconomic perspective, the UK is in pretty good shape, with GDP growth forecasts pointing to an incremental improvement on 2024. Inflation remains high, relative to the rest of Europe, and indeed the Bank of England’s targeted level; however, some of this includes temporary effects that are likely to fall off in the coming months. Interest rates are still operating at elevated levels, which gives the bank significant room to cut over the coming months, an action that could be a boon for UK equity markets. Risks remain, but with a tariff agreement already in place with US, the UK market is unlikely to experience the same level of volatility in the second half of 2025 than it did earlier in the year. “

The budget

This brings me to the very obvious near-term negative: the impending budget, which is casting a dark shadow and much gloom over most decision-making in the corporate sector. What might happen in late November?

A few weeks ago, I sat through a compelling presentation by Panmure Gordon’s highly respected chief economist, Simon French, who also argued that, although the UK faces its unique challenges, we are not in a bad place macroeconomically speaking.

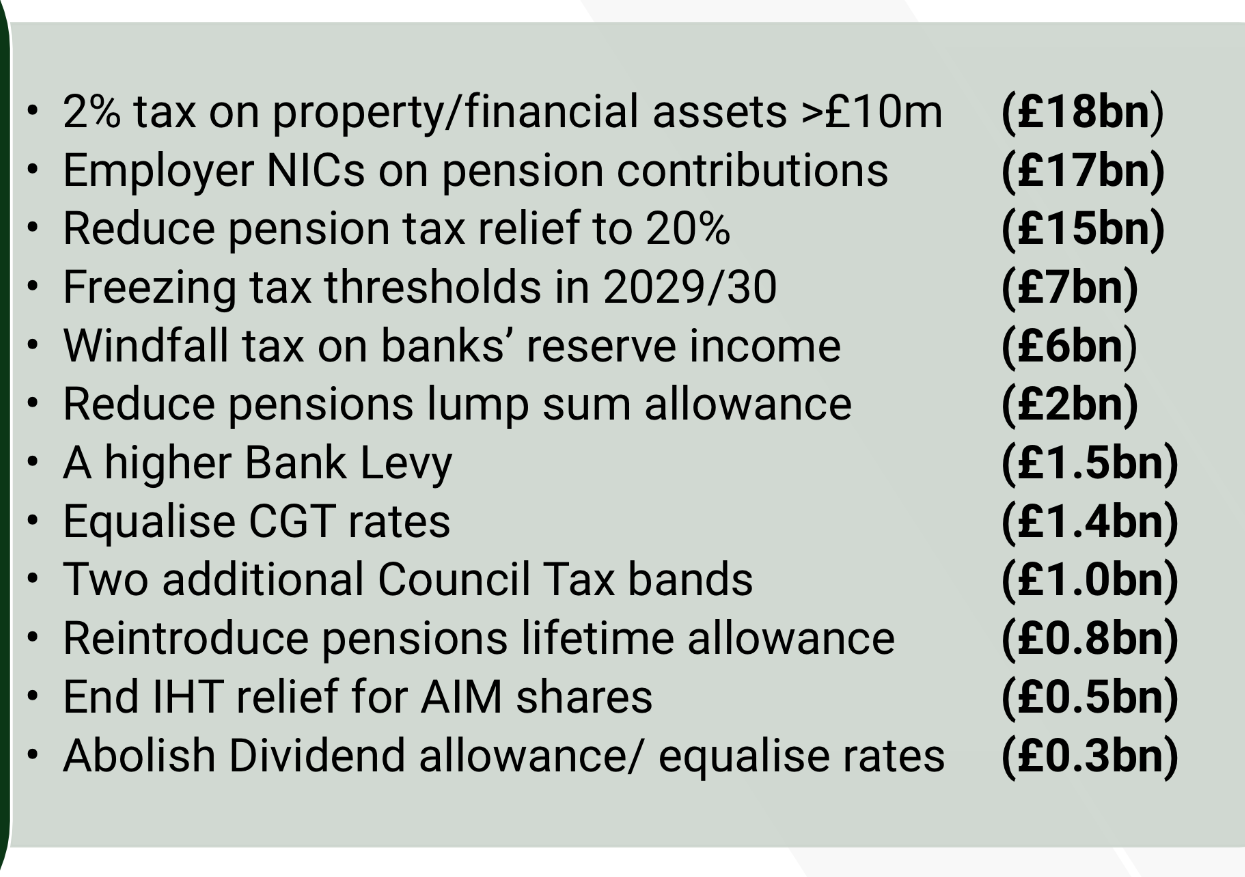

The most interesting section of the presentation was on the impending budget. He suggested that the likely fiscal black hole is probably around £25 to £26 billion, though it could be higher. Clearly, everyone and their aunt has their own ideas about how this fiscal hole can be filled.

I’d echo the Times economics editor David Smith in calling for the Chancellor to be bold and think about signalling reform of the tax system, focusing on making it less complicated, equalising rates on all forms of income and looking again at our broken property tax system, i.e avoid a long list of small gimmick tax fiddles.

In reality, the graphic below from Simon French’s presentation is the likely shopping list of tax changes. Having talked to some Labour folk in the last week or so, I’d suggest that the following represents a probable/possible hit list starting with the most likely first and ending with the least likely:

- Reduce pension tax relief to 20% for all tax payers (£15bn raised)

- Reduce the pensions lump sum allowance to £100,000 (£2bn)

- Freezing tax thresholds in 2029/30 (£7bn)

- Windfall tax on banks’ reserve income (to be honest, I’d be less sure of this one)

- Two additional council tax bands (a great idea in my book, even though I’d be personally hard hit, but also quite difficult to implement)

So, what does this all mean in terms of investment? I fear that higher rate tax relief is not long for this world and that the grim reaper is coming for those lump sum pension reliefs as well. If not this year, then almost certainly next year. Get those contributions in now! One follow-on implication is that the tax advantages of VCTs and EIS funds are likely to prove very much more powerful. That’s a net positive for investment platforms such as AJ Bell as well as specialist managers active in this space such as Foresight.

VCTs

I’ll finish with a quick deep dive into the venture capital trusts or VCTs. I believe these will become increasingly attractive to a broader range of investors. They are risky vehicles and there have been many ‘challenges’ (more on that shortly) but they can be very tax efficient. These tax advantages include the following:

- Investors can claim up to 30% income tax relief on the amount invested in new VCT shares in each tax year, up to a maximum investment of £200,000 (which could provide up to £60,000 of relief per year).

- To qualify, the investor must have an income tax liability in the tax year of investment, and VCT shares must be held for at least five years to retain the relief.

- The relief can reduce an individual’s income tax bill, cannot be carried forward, and does not apply to secondary market VCT shares.

- Dividends paid by VCTs are exempt from UK income tax, regardless of the investor’s marginal tax rate, offering an attractive source of potential tax-efficient income.

- Dividends do not need to be declared on a tax return.

- No capital gains tax is payable on profits when selling VCT shares, provided they are newly issued and meet the qualifying conditions.

- Any growth in the value of VCT shares is therefore tax-free.

So, in the round, I would argue that for the right investor – risk-friendly, happy to remain invested for at least five years – VCTs do serve a purpose, especially if they are the right VCTs, which brings me to my own research. The problem has been that VCTs have had their fair share of problems. I’d list the following headwinds:

- Octopus Titan has been a disaster for the sector, and in my opinion, the recent proposals by the board are woefully inadequate. Regardless, we – the investors – are where we are, and it’s not great for what was once the largest VCT by a mile. However, it would be unfair to single out this fund alone. The AIM funds have been a letdown (through no genuine fault of their own), and too many smaller funds (notably those from Oxford) have been underwhelming, to say the least. According to the AIC’s screener tool for VCTs the average total return for all VCTs has been just 52% over the last ten years. Over the last five years, that drops to a miserable 11.5%.

- Fees are too high. According to the AIC’s VCT screener tool, the average Ongoing charge is a whopping 2.62% which is eye-wateringly high

- Discounts also remain stubbornly high at 10.38% across all VCTs, though that drops to mid single digits for the more established funds

- I would maintain that there are too many sub-scale funds. Too many managers have assets of below £100m or under £250m with undifferentiated strategies. I sense that to run a properly staffed investment team, you need scale, experience and the right contacts

I have personally invested in VCTs and been badly burned, probably because I relied on external advice and didn’t conduct my own due diligence. I’m probably going to reinvest this year in VCTs, but this time around, I have decided to do my own research and due diligence. I’ve decided to focus on several factors in my screening process:

- I want a fund manager with scale, which means total AuM of at least £250m

- I also want a manager with a top-quartile total return over the last 5 and 10 years. I’m especially looking for persistence of returns. The caveat of course, is that past returns are no indicator of the future

- I’m also focused on managers whose key decision makers have been with the firm for many years and have thus acquired a deep set of contacts

- I’ve also looked at sector mix and the size of the portfolio

- Lastly, I want a manager who can point to a long track record of successful exits in the last five years

This screen lists five well-established managers who I think meet most of these criteria. The three tables below break out their key numbers. I then went to each of these managers and asked them to provide me with additional information, which I have included in this analysis. I’m not making any other comment on these five funds, suffice to say that if you’re looking for a well-established, high-performing (in the past), well-managed fund with a proven track record in past exits and an experienced team, these five funds tick most of the boxes. My own advice would be to dig a little deeper into what’s in the portfolio (check out their annual reports and accounts) and see how many more years key investments have until they are ready to be sold.

Fund data: headline stats

| Name | TIDM | Price | Total return % | Price return | Prem/Disc | Divs since 5y | |

| 10 years | 5 years | YTD % | to NAV % | ||||

| Albion Crown VCT PLC | CRWN | 29.1p | 76.7 | 31.5 | 0 | -7.09 | 11.65p |

| British Smaller Companies VCT PLC | BSV | 75.5p | 75 | 72.3 | 0.667 | -3.88 | 28.75p |

| Foresight VCT PLC | FTV | 64.5p | 60.4 | 81.4 | -12.2 | -7.86 | 42.5p |

| Gresham House Income & Growth VCT PLC | GHV1 | 62.5p | 73.3 | 88.6 | -5.3 | -8.31 | 36.5p |

| Northern Venture Trust PLC | NVT | 57p | 51.7 | 44.8 | 2.7 | -5 | 24.8p |

Source : ShareScope

Total return data

| Name | 10 year | 5 year | 1 year |

| Share price total return | |||

| Albion Crown VCT PLC | 107.20 | 36.85 | 0.64 |

| British Smaller Companies VCT PLC | 114.81 | 80.45 | 3.71 |

| Foresight VCT PLC | 102.81 | 92.08 | 3.29 |

| Gresham House Income & Growth VCT PLC | 146.35 | 67.35 | -1.48 |

| Northern Venture Trust PLC | 81.18 | 48.32 | 8.44 |

Fund portfolio data

| Fund | Number of holdings | Top sector in portfolio | Successful Exits last five years | IRR or average return on successful exits |

| Gresham House Income and Growth | 47 | Software – 45% | 12 | 3.1 x |

| Albion Crown | 70 | B2B Software | 27 | 3.7x |

| Foresight | 44 | Technology – 39% | 16 | 34% IRR |

| Northern Venture | 63 | Software – 33% | 19 | NA |

| British Smaller Companies | 43 | Application Software – 31% | 21 | 2.25 x |

Important note: The two Gresham House VCTs are not expected to fundraise this year.

David Stevenson

Twitter: @advinvestor

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.