Markets have reacted well to the trade truce between the US and China, yet there may still be problems ahead. Companies covered SPA, ELCO, and OCN.

The FTSE 100 was flat at 8609 over the last 5 days. US markets responded much more positively to the trade truce, with the Nasdaq100 up +4.5% and S&P500 up +3.4%, most of which was on Monday when the surprise trade truce between the US and China was announced. The FTSE China 50 was also up +1.9%.

I am as confused as anyone. The US President seems to be picking fights with (former) allies, Canada, Denmark, Ukraine and the European Union while being conciliatory towards China and Russia. At the start of the week, he suggested that the EU was “nastier” than China. My thinking is that Trump has opened a can of worms and that he won’t find it so easy to put the lid back on. Or even if the lid does go back on, we all know that the can contains worms. In other words, global asset allocators must be questioning whether US capital markets are the default destination for their wealth.

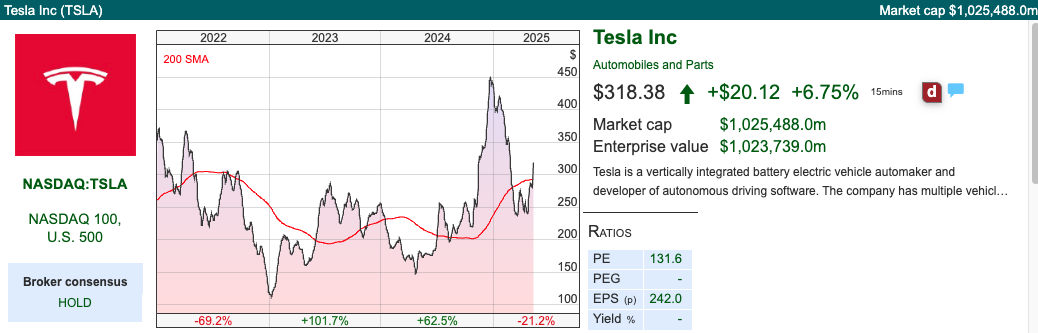

Tesla’s car sales in Germany were down -62% in Q1 2025 versus Q1 2024, according to German registration data (KBA). Across Europe as a whole, EV sales rose +28%, but Tesla lost share with sales down -38%. Like many other US tech stocks, Tesla shares have rallied strongly, up +31% since mid April. I’m not so sure that just because deals have been announced, consumers will continue to buy US brands, particularly those associated with Trump.

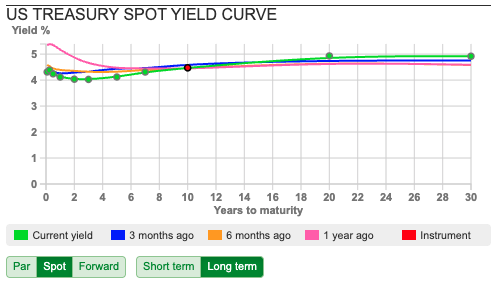

So we might see grassroots boycotts, and buying domestically made brands. Here’s an article about Canadians buying wine grown in Nova Scotia and Danish supermarkets putting a black star to identify European brands. In contrast, neither the stock market reaction nor the gently upward-slopping yield curve in the US is suggesting any problems.

Also, in the UK, the AIM chart (AXX) has bounced through both its 16-day and 64-day moving average. I am not putting new money into the market and remain cautious for now, but one signal that I’ll be watching for is if the 16-day moving average (red line) rises through the 64-day (blue line). If that happens, then I may have to change my mind and turn more positive.

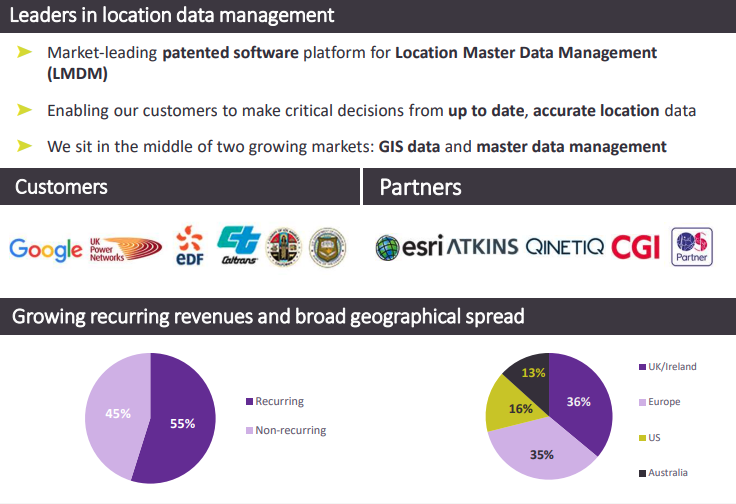

This week I look at 1Spatial, the location and data company, which has had a poor start to the year but ought to be a business with attractive economics. Plus Eleco, the software company for project management in the construction sector and Ocean Wilsons, which is disposing of its Brazilian ports business, creating a special situation with $600m of cash (net of transaction costs and tax).

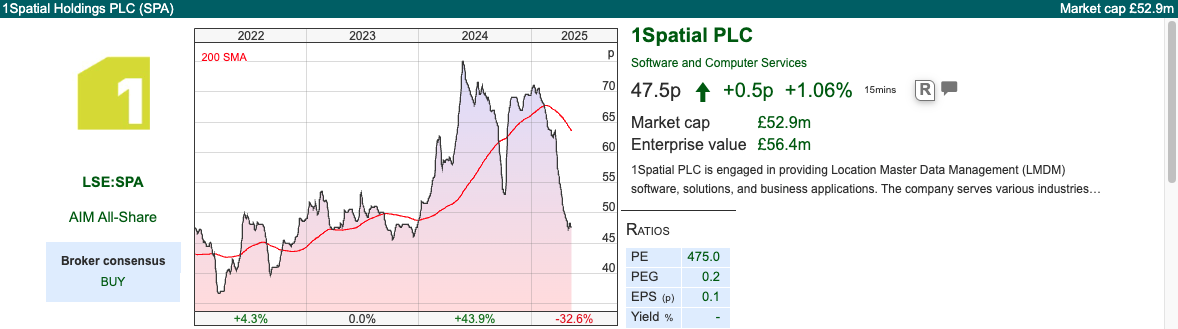

1Spatial FY Dec Results

This looks like yet another tariff-related earnings downgrade, blaming “slower pace of decision making” most notably in the US, which is impacting future growth. SPA sells Location Master Data Management (LMDM) software, so tariffs seem to be affecting services rather than just physical goods.

The company reported +3% revenue growth for FY Jan 2025 to £33m and statutory PBT down -79% to £0.2m. That fall was driven by higher interest charges, non-cash amortisation and impairment charges. That’s fair enough to highlight that the charges are not cash, but management’s definition of free cash flow is negative also went backwards, from minus £1.9m the previous year to minus £2.2m just reported.

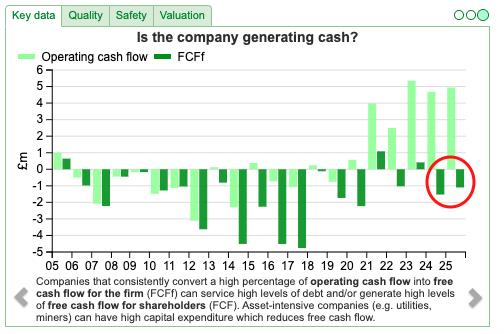

Sharescope’s definition of FCFf is also negative, but at least this seems to be heading in the right direction.

There was also a £2.1m swing from £1.1m of net cash last year to net borrowing of £1m end of January this year. The more flattering figure of adjusted EBITDA, which was a bullet point on the first page of the results, increased to £5.6m. All the more reason to be sceptical of adj EBITDA, I would suggest.

Outlook: Cavendish have reduced their revenue forecast by -7% for FY Jan 2026F, and slashed adj EPS by -69% to 0.85p. Management’s commentary in the outlook statement, gives a far more upbeat impression. For instance, management say that FY 2026 has “begun positively” and “the Board remains confident in delivering further progress in FY 2026”. Cavendish’s forecasts do show a strong rebound in FY Jan 2027F, with EPS almost trebling to 2.3p.

So I strongly suggest investors need to read the broker research to understand what’s happening to forecasts, and ignore management comments in the outlook statement. For my part, that counts as a black mark against the company for poor communication style.

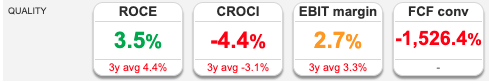

Valuation: The shares are trading on a PER of 56x FY Jan 2026F dropping to 21x the following year. So you’re paying upfront for the recovery in earnings, while the group’s historic 3 year average cashROCI is -3.1%.

Opinion: I last looked at this in 2022, when the share price was 41p and was put off by the expensive-looking PER of 38x at the time. Theoretically, this should be a business with good gross margin and recurring revenue from customers that are “locked in” to the service. But so far, Sharescope’s quality indicators show that the isn’t the case. I’ll keep an eye on this, it may come good in the end, but no reason to buy now, in my view.

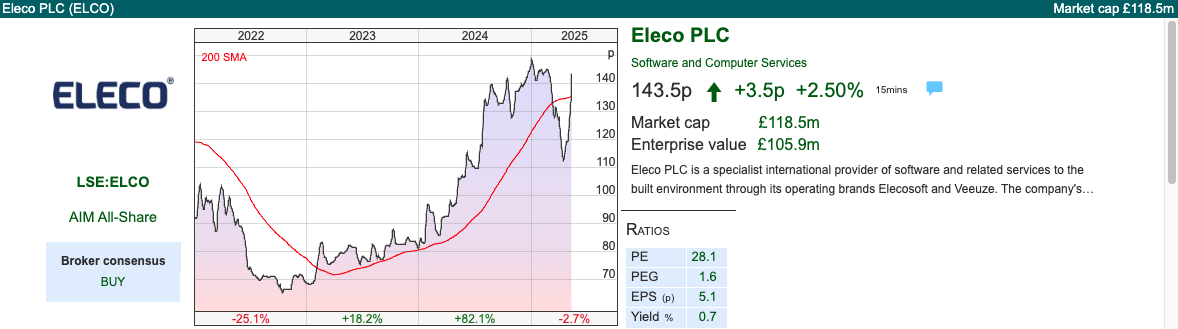

Eleco FY Dec Results

Paul Hill tipped this project management software company at Mello at the beginning of last year, and the shares were up +82% in 2024. This year, the share price has been volatile, but that seems to be driven by top-down concerns rather than anything that the company itself has announced. There was a trading statement at the end of January when management said revenue would be up +16% versus the year before to £34m or +9% on an organic basis. They also announced net cash of £14m at the year-end, versus the current market cap of £118m. Cavendish, their broker, reiterated their forecasts, which implied +22% revenue growth in FY Dec 2025F.

We now have more detailed results for FY Dec 2024, with PBT up +26% to £4.3m. Note that there was £3.3m of capex on intangible assets, however, free cash flow was still up an impressive £6.3m, up +66% helped by favourable working capital movements, specifically a £3.5m increase in payables and accruals. Looking at the face of the balance sheet, that seems to be driven by the accruals line, which has grown from £12.5m to £15.3m. There’s no explanation for that, but accruals are usually a current liability for services received and not yet paid for. So although there’s £14m of cash, I don’t think I would characterise the balance sheet as strong because of those accruals and also £29m of goodwill and intangibles, versus £30m of net assets.

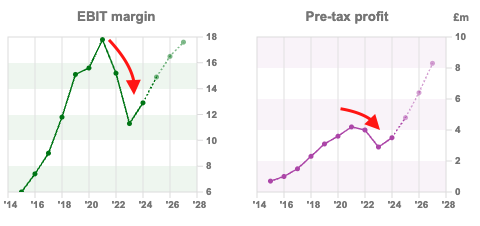

Outlook: Management emphasise that they are a high recurring revenue business with great customer satisfaction and high levels of predictability. That’s possibly true in a “normal” environment, but using Sharescope to verify the history, PBT did drop by -25% in FY Dec 2022 and the share price halved. So, I don’t think that this is as “recession proof” as management imply. I’ve shown the decline in EBIT margin and PBT, with a red arrow below.

Recession fears in the UK have receded though and Cavendish are forecasting EPS to grow +30% FY Dec 2025F and +21% FY Dec 2026F.

Valuation: The shares are trading on a PER of Dec 2025F 22x, falling to 18x the following year. That equates to 2.5x Dec 2026F sales, which seems about right – not obviously cheap though.

Opinion: This looks like a good company, but I’m cautious about Cavendish’s ambitious EPS growth rates, given the macro backdrop. So, I wouldn’t chase it here. Those EPS forecasts could be paired back, which would hit the share price and I would then think about that as an entry point. I could be wrong on this, Paul Hill knows the investment case well, and did well to highlight it 18 months ago.

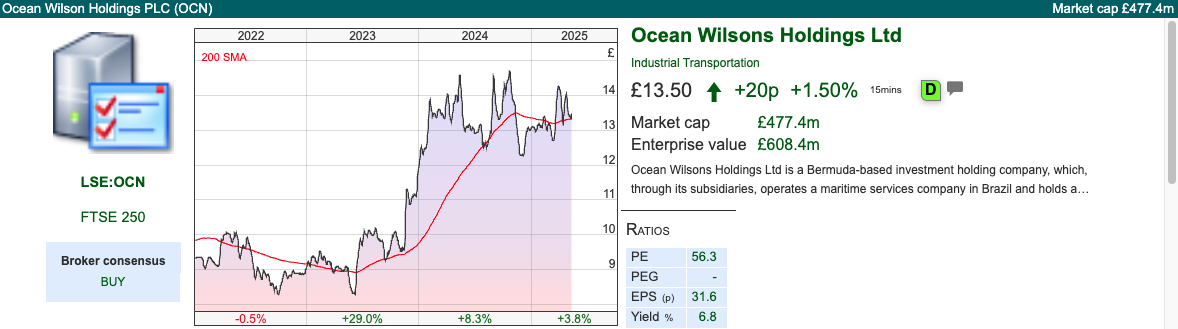

Ocean Wilsons Q1 March Update

This odd mix of Brazilian ports (Wilson Sons) and US hedge funds and private equity (Ocean Wilsons Investments) announced progress on their restructuring. They announced in October last year that they were going to sell the ports business for BR $4.35bn (or $593m at the time of last year’s announcement) and launch a tender offer to buy back 20% of the group’s shares. Since then, we’ve seen US dollar weakness, but I think that’s irrelevant to UK-based shareholders because the dollar has also weakened against the pound.

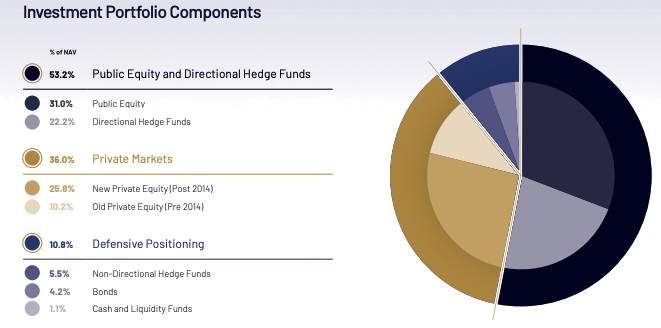

The investment portfolio is 31% public equity, 22% directional hedge funds and 36% private equity. I find the management commentary in the 2024 Annual Report lacking self-awareness. Management have consistently shown themselves to be poor allocators of capital, underperforming an S&P 500 index tracker. Of course, management are reluctant to admit that their public equity and directional hedge fund selections have underperformed the S&P500 (up +23% last year), so instead they say they were ahead of an equal-weighted global index that was only up +5% (MSCI ACWI Equal Weighted) in 2024.

The implied NAV of OCN is just over £21, versus a share price of £13.50. I think normally investors would shrug and point out that many investment groups trade a discount to NAV. Georgia Capital, which also reported Q1 Mar last week, said the NAV per share was £29.80, so the share price is at a 35% discount to book value. That’s despite CGEO, buying back over 13m shares or 27% of the share capital.

Similarly, many of the Renewable Energy Investment Trusts, like Hydrogen One or US Solar Fund, trade at less than 50% of NAV.

Opinion: The difference between the other investment vehicles that trade at a discount to NAV is that Oceans Wilsons is in the process of disposing of a significant asset at a premium to book value, and therefore will have the cash available to close the discount to NAV. There’s a risk that the majority shareholders (Hansa, Victualia) who own just over 50% decide to find interesting ways to set fire to their own and other shareholders’ money: perhaps i) invest in more underperforming US hedge funds? ii) convert to a hydrogen investment fund? iii) pivot to cryptocurrencies?

I am joking about iii) of course. If they had bought Bitcoin, they’d look like geniuses and trade at a premium to NAV. Nasdaq-listed MSTR began buying Bitcoin in Aug 2020 and owns over half a million bitcoins at an average cost of $66K. I’m not sure that strategy makes sense now though.

It seems to me that OCN is an interesting special situation, which should be an uncorrelated risk with the rest of the stock market. I own it, and the Value and Opportunity Blog wrote it up in more detail 6 months ago, and he bought it at 1370p per share. He is the chap who called Wirecard a fraud in 2010. He did make a mistake with the NAV calculation (forgetting to convert the value of the investment portfolio from dollars to pounds) but quickly issued an update and I think his logic still holds, with around 30% upside to the current market capitalisation if the deal completes later this year. Like all stocks mentioned, readers should be comfortable with the risk/reward themselves. To me, this seems a good way to be invested in the market but with uncorrelated risk, so you’re not dependent on what side of the bed Trump wakes up on in the morning.

Notes

Bruce owns shares in Oceans Wilsons

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.