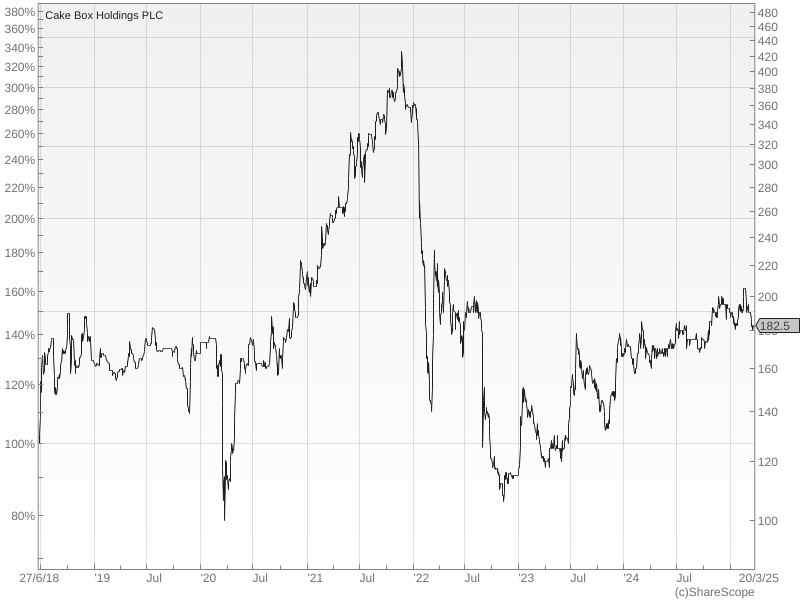

In 2021, traders gobbled up shares in cake store franchise Cake Box, then spewed them back out. Today, the company earns twice as much in turnover than it did in 2020, but the share price is not much higher.

Bonanza!

5 Strikes

Twenty-nine shares have published annual reports and passed my minimum quality filter in the last fortnight. Upon cursory examination, fifteen of them scored less than three strikes:

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| Antofagasta | ANTO | 31/3/25 | 4.3 | – CROCI – Growth – ROCE | 3 |

| Drax | DRX | 28/3/25 | 0.5 | ? Holdings – Debt – Growth – ROCE | 3 |

| IMI | IMI | 28/3/25 | 0.7 | – Debt – Growth | 2 |

| London Stock Exchange | LSEG | 28/3/25 | 0.0 | ? Holdings – Debt – ROCE – Shares | 3 |

| Morgan Advanced Materials | MGAM | 28/3/25 | 0.3 | – Holdings ? CROCI – Debt – Growth | 4 |

| Rightmove | RMV | 28/3/25 | 0.0 | – Holdings | 1 |

| Robert Walters | RWA | 28/3/25 | 0.2 | – Holdings – CROCI – Growth – ROCE | 4 |

| Forterra | FORT | 27/3/25 | 0.2 | – Holdings – CROCI ? Debt – Growth – ROCE | X |

| ITV | ITV | 27/3/25 | 0.1 | ? Holdings – Debt – Growth | 2 |

| Jupiter Fund Management | JUP | 27/3/25 | 0.2 | – Holdings – Growth – ROCE – Shares | 4 |

| Aptitude Software | APTD | 26/3/25 | 0.4 | ? Holdings – Growth ? Shares | 2 |

| Luceco | LUCE | 26/3/25 | 23.6 | ? Acquisitions ? CROCI – Debt ? Growth | 2 |

| Reckitt Benckiser | RKT | 26/3/25 | 0.0 | – Holdings – Debt ? Growth ? ROCE | 3 |

| Rotork | ROR | 26/3/25 | 0.0 | – Holdings – Growth | 2 |

| Inchcape | INCH | 25/3/25 | 3.5 | ? Debt ? Growth | 1 |

| M.P. Evans | MPE | 25/3/25 | 4.5 | ? Acquisitions – CROCI – Growth – ROCE | 3 |

| Shell | SHEL | 25/3/25 | 0.0 | – Holdings – Growth – ROCE ? Shares | 3 |

| STV | STVG | 25/3/25 | 0.1 | – Holdings – CROCI – Debt – Growth – Shares | X |

| Domino’s Pizza | DOM | 24/3/25 | 0.4 | ? Holdings – Debt ? Growth | 2 |

| Morgan Sindall | MGNS | 24/3/25 | 7.6 | ? Growth | 0 |

| Nichols | NICL | 24/3/25 | 8.2 | ? Growth | 0 |

| Persimmon | PSN | 24/3/25 | 0.0 | – Holdings – CROCI – Growth | 3 |

| RTC | RTC | 24/3/25 | 6.5 | – CROCI – Growth – ROCE | 3 |

| Intertek | ITRK | 21/3/25 | 0.4 | ? Holdings – Debt ? Growth | 2 |

| Johnson Service | JSG | 21/3/25 | 0.3 | – Holdings – Debt | 2 |

| Weir | WEIR | 21/3/25 | 0.1 | – Holdings – Growth ? ROCE – Shares | 3 |

| Bunzl | BNZL | 20/3/25 | 0.1 | ? Holdings – Debt ? Growth | 2 |

| ConvaTec | CTEC | 19/3/25 | 0.2 | ? holdings – Debt ? Growth – ROCE | 3 |

| Nexteq | NXQ | 19/3/25 | 22.3 | – CROCI | 1 |

| Click here for our 5 Strikes explainer | |||||

On zero strikes, we have Morgan Sindall and Nichols.

Morgan Sindall is “harnessing the energy of our people to achieve the improbable.” It is a construction and fit-out firm that, judging by the numbers, has achieved the improbable: decent un-geared returns through thick and thin. Nichols makes Vimto, the soft drink.

Motor vehicle distributor Inchcape (already on my radar), Nexteq, a company that makes slot machines and betting terminals, and Rightmove, the online property marketplace, all have one strike.

Ten companies got two strikes. Some notable ones are Bunzl, the global distributor of everyday essentials, takeaway franchise Domino’s Pizza, Intertek, a quality assurance consultancy, ITV, as much a maker of programmes as a broadcaster, and industrial equipment manufacturers Rotork and IMI.

Source: ShareScope

Great cake bubble of 2021

The pandemic bubble I reported on in an earlier article about Dotdigital seemed somewhat rational. Dotdigital’s software service enabled online marketing, which was even more significant than usual during the pandemic.

Maybe it’s no less obvious in hindsight that one of our responses to the pandemic was to eat more cake. Judging by the rise in Cake Box’s share price during 2020 and 2021, that’s what we did.

Cake Box floated in 2018 with an interesting story. The company ran the only national cake shop chain specialising in egg-free cakes.

Taking eggs out of the cake increases the size of the market, because Cake Box cakes can be eaten by people on lacto-vegetarian diets and people with egg allergies. The fact that they taste great shouldn’t put the rest of us off.

Perhaps more people are lacto-vegetarians than you think. Some adopt the diet because it is healthy. It is also popular with followers of religions like Hinduism, Jainism, Buddhism, and Sikhism. The company’s founders are lacto-vegetarians.

Cake Box’s financial year ends in March, so the year to March 2020 was hit by the onset of the pandemic (the first lockdown started that month).

Initially, the share price tanked, but once traders realised Cake Box was delivering more cakes than ever (ordered online) there was a rapid reappraisal.

Profit in the years to March 2021 and March 2022 rose strongly, but the share price had already peaked in November 2021.

In the half-year results that month, the company expressed confidence while admitting to “uncertainty in the operating environment”.

Then on 24 November, around the time the share price peaked, chief executive Sukh Chamdal sold 3 million shares, representing about 7.5% of Cake Box’s share capital.

If that was a portent, the rout started on 21 January 2022, when ShareScope published an article by Maynard Paton that detailed discrepancies in the annual report.

They were not material to profit, but raised questions about competency that had already been asked by the company’s auditor when resigned months earlier, citing doubts about the company’s financial controls.

The share price fell 22% on the day of Maynard’s article, and much more in the following months as worrying news followed. The company had declared an “unlawful dividend” payment – another accounting issue. The chief financial officer stepped down.

An interim chief financial officer was appointed, along with hires to bolster the board and support the finance and other functions.

Then, in August 2022, two months after strong full-year results, the company warned that the hitherto uncertain economic environment had become “increasingly challenging” due to inflation and a slowdown in sales. Clearly, profit would be whacked in the year to March 2023.

Chief executive Sukh Chamdal started buying some of his shares back, a permanent CFO was recruited from a large Domino’s Pizza franchise group in October, and confidence in the company started to return.

While 2021 may have been the peak for Cake Box’s share price, it wasn’t peak cake. The company’s turnover in the year to March 2024 was more than twice what it was in 2019.

The same is not true of profit.

Profit margin conundrum

Between 2019 and 2024, turnover increased by 124%, but profit (EBIT) increased by 34%. Profit margin decreased to a still healthy 16%.

| £’m | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % change |

|---|---|---|---|---|---|---|---|

| Turnover | 16.9 | 18.7 | 21.9 | 33.0 | 34.8 | 37.8 | 124% |

| Adjusted EBIT | 4.6 | 3.8 | 4.7 | 7.0 | 5.6 | 6.2 | 34% |

| % change | -17% | 25% | 49% | -21% | 11% | ||

| Adjusted EBIT margin | 27% | 20% | 22% | 21% | 16% | 16% | -40% |

Source: Reported revenue and profit numbers from ShareScope, adjusted using numbers from Cake Box financial reports.

I think it is possible to use what we have learned about Cake Box and its financial statements to explain why costs have grown faster than turnover.

One clue is in Cake Box’s trading statement of August 2022, when it blamed inflation. But inflation of which costs?

My first guess was the cost of cake ingredients, basically sponge and cream. This is by far Cake Box’s biggest expense. It is called “inventory recognised as an expense” in the accounts, but surprisingly it has not quite doubled over the period.

That means it has decreased as a proportion of turnover (from 54% to 47%):

| Cake Box (£m) | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % change |

|---|---|---|---|---|---|---|---|

| Turnover | 16.9 | 18.7 | 21.9 | 33.0 | 34.8 | 37.8 | 124% |

| Inventory recognised as an expense | 9.2 | 10.0 | 8.8 | 17.1 | 17.6 | 17.9 | 95% |

| % of turnover | 54% | 53% | 40% | 52% | 51% | 47% | -13% |

| Staff costs | 2.1 | 2.8 | 3.7 | 5.3 | 6.1 | 7.6 | 269% |

| % of turnover | 12% | 15% | 17% | 16% | 18% | 20% | 65% |

Source: Cake Box financial statements

Moving down the league table of costs to second place, we get to staff costs (salaries and bonuses). Staff costs have nearly quadrupled. They have risen from 12% of turnover to 20% of turnover.

This is significant. If staff costs had stayed at 12% of turnover and everything else was as reported in 2024, the company would have earned a profit margin of 24%. That is a little below the 27% it achieved in 2019, but a lot higher than the 16% it achieved in 2023 and 2024.

Staff costs couldn’t stay low though. Cake Box had to beef up its financial function, and no doubt other parts of the business.

I am sure there is more to the story, but it seems the team that opened the first Cake Box store in 2008, grew the business and listed it a decade later, did not have all the capabilities it needed to operate as a larger listed firm.

Those capabilities came at a cost and were compounded by general wage inflation after the pandemic.

The question for investors now is whether this is a one-off increase in the cost base.

The fact that margins were stable in 2024 is a good sign, and I don’t see why staff costs should necessarily increase faster than turnover in future. I will run the numbers again when the results for the year to March 2025 are published in June.

A sweet postscript

Maybe you are wondering why I’m interested in Cake Box now. Well, apart from the fact that it only has one strike to its name (an increasingly distant IPO in 2018), the company acquired Ambala last month.

Ambala is famous in my family. My wife’s father would drive them down from Wrexham in North Wales to eat at Ravi Shankar, a vegetarian restaurant behind London’s Euston station in Drummond Street. Afterwards, they would buy sweets at the nearby Ambala sweet shop and return with a bootload.

In a, to us, amazing coincidence, I had made the same pilgrimage a couple of times from Sussex. Obviously, we’ve been back a few times since!

Ambala makes Asian sweets. Cake Box makes cakes that appeal to certain Asian traditions. Surely there are synergies…

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.