Only two companies pass Richard’s minimum quality filter. Luckily Associated British Foods and Softcat both pass the 5 Strikes test.

It’s been a thin fortnight for my 5 Strikes system since I last updated you. Only two of the 16 companies that published annual reports passed my minimum quality filter, which is a pretty low bar!

All it mandates is an average Cash Return on Capital Invested of 5% over the last five years, and that the company spent less on acquisitions over the same period than it earned free cash flow.

5 Strikes – two’s company

Luckily, I found little to worry about in their numbers. Both companies achieved two strikes, and perhaps I could have been a bit more lenient.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Associated British Foods | ABF | 6/11/24 | ? Growth ? CROCI ? ROCE | 2 |

| Softcat | SCT | 6/11/24 | – Holdings – Growth | 2 |

| This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version. | ||||

Associated British Foods – ABF [? Growth ? CROCI ? ROCE]

ABF is a conglomerate, a mashup of different businesses, some of which are not even tenuously connected.

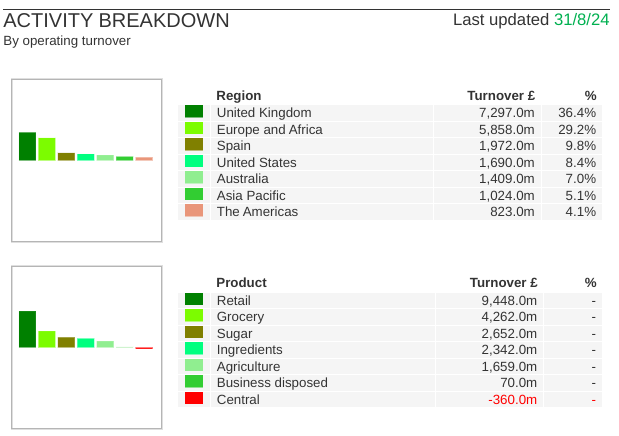

The bottom half of SharePad’s “activity breakdown” shows us the spread of the business.

Retail is Primark, a value clothing chain that flies under the radar because it does very little advertising and its website does not deliver (click and collect is the only option).

Good strategy is about choices, and Primark’s unusual choices have served it well. It earned ABF 55% of adjusted operating profit from 47% of total revenue in the year to September 2023.

The grocery business (26% of profit from 21% of revenue) owns too many famous food brands to list.

To give you a flavour, they include Twinings (tea), Ovaltine (malted beverages), Jordans (breakfast cereals, Ryvita (crisp breads) and Silver Spoon (sugar). If you are teleporting in from the USA or Australasia, it owns brands you will recognise too.

The remaining businesses produce sugar, baking ingredients like yeast, and animal feed.

Although ABF scored two strikes in three categories they were all borderline, which is why I awarded a question mark rather than a full strike to each, and why the strike count did not amount to three.

I do not normally penalise companies if they failed to grow in 2020 or 2021, because they were abnormal years. But ABF also grew turnover very modestly in 2018 (it made a significant disposal in 2017), 2019 and again in 2024.

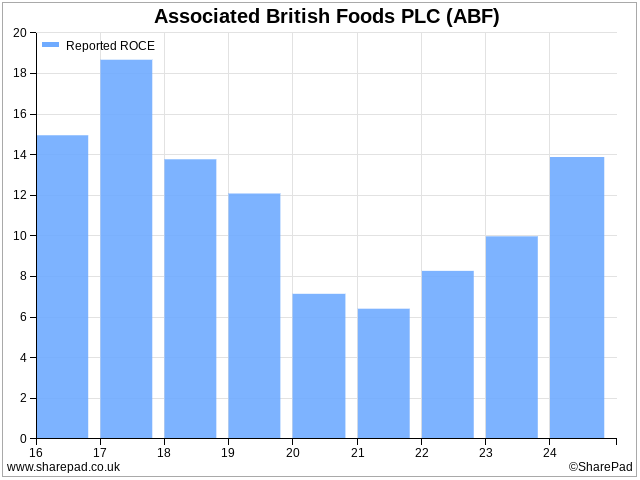

To my mind, returns on capital, both cash and profit are on the low side of what is desirable. As a rule of thumb I look for consistently positive Cash Return on Capital (CROCI) Invested, and ABF achieves that but sometimes only just. I also want Return on Capital employed to be above 10% routinely.

As with turnover, ABF failed this test in 2020 and 2021, which is forgivable, but it also failed in 2022 and was borderline in 2023:

The company’s remuneration report probably contains the biggest understatement I have seen in an annual report for a long time. It says: “George Weston’s shareholding very significantly exceeds the 250% of salary requirement.”

George Weston has been chief executive since 2005 and is the grandson of founder Garfield Weston. He owns about 4 million shares in his own name, which was 6,707% times his salary in 2024. But he also owns shares in Wittington Investments which owns 56% of ABF, alongside other family members and the Garfield Weston Foundation, a major charitable trust.

Weston family interests substantially own ABF, and my impression is that they have been great stewards considering it traces its origins to a bakery founded in 1935 and today its turnover is more than £16 billion. I wonder if it is the biggest listed family-owned firm.

ABF is interesting, but it is also complicated.

I want to know how businesses make money, why they might make more and what could stop them. ABF multiplies that problem by four or five.

Softcat [- Holdings – Growth]

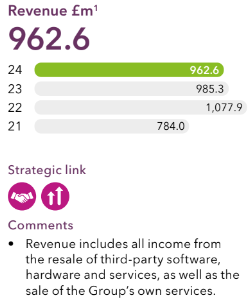

IT reseller Softcat is a company I have long admired, so it is somewhat surprising to have marked it down for growth. But in 2023 turnover declined 8.6% and it declined again in the year to July 2024.

There are complications in the way resellers report turnover though. Hardware sales are reported gross (including the cost of purchasing hardware from the supplier) and software sales are reported net (in technical terms Softcat is an agent and gets a commission).

In practice, this means hardware sales have a disproportionate impact on turnover, but software sales are much more profitable.

The company uses another statistic to correct the inconsistency: Gross invoiced income (GII). This grosses up the software sales, and on that basis, Softcat has continued its unbroken growth record (and looks like a much bigger business!):

|

|

|

|---|

Source: Softcat annual report 2024. Revenue and turnover are synonymous

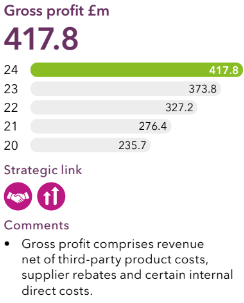

GII is a non-standard alternative performance measure so it is not available in SharePad. But since fluctuations in low-margin hardware sales can mislead us, perhaps we should be paying at least as much attention to gross profit as turnover.

Among other direct sales costs, gross profit nets off the cost of buying hardware from turnover, which is similar to the treatment of software (which is not bought by Softcat, the company receives a fee for selling it).

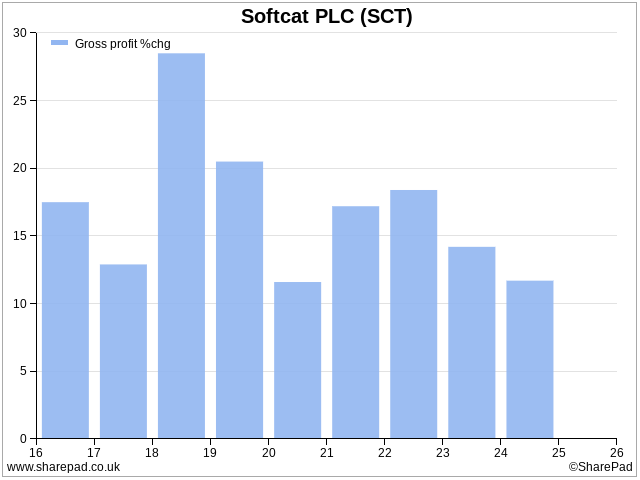

Softcat has routinely increased gross profit by at least 10% a year.

When I finish this article, my next task is to read the company’s annual report and fully evaluate the company because I investigate it every year for interactive investor.

Going into that process I feel some trepidation because:

- Softcat’s success has been built around the way it organises, enables and motivates sales teams. It is difficult to measure or appraise a company’s culture, especially for outsiders, beyond of course what the financial data tells us, and I am wary of taking it for granted that practices that once existed still do.

- Artificial intelligence is automating software implementation and customization, potentially making the process of selling it easier. I have no idea whether this would be positive or negative for Softcat.

I will, therefore, be focusing on what the company says about these challenges and how it is addressing them.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.