Richard looks at one of his least favourite kinds of business – asset managers. Love them or loathe them, many London-listed asset managers are profitable and financially sound.

Investors, aka asset managers, are not my favourite category of share. The financial world is precarious to me, which is why long ago I decided to take care of my own finances rather than trust the job to advisers or, with the odd exception, fund managers.

Not every individual and not every organisation can manage their own money, though, which is why there are many asset managers listed in London.

In fact, the majority of companies that published annual reports, passed my minimum quality filter and achieved less than three strikes since my last update two weeks ago, were in the business of asset management or servicing it one way or another.

5 Strikes – mostly financials

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Renishaw | RSW | 27/9/24 | – CROCI ? Growth | 1 |

| PZ Cussons | PZC | 26/9/24 | – Holdings – Growth – ROCE | 3 |

| City of London | CLIG | 24/9/24 | ? Holdings – Growth – Shares | 2 |

| Hargreaves Lansdown | HL. | 24/9/24 | – Holdings – Growth | 2 |

| Brooks Macdonald | BRK | 20/9/24 | – Holdings – ROCE | 2 |

| Arcontech | ARC | 17/9/24 | ? Growth | 1 |

| Ashmore | ASHM | 17/9/24 | – Growth | 1 |

| Barratt Developments | BDEV | 17/9/24 | – Holdings – GROWTH – ROCE | 3 |

This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version.

City of London (- Growth – Shares) profits in the time-honoured fashion, by earning a percentage of the funds it manages for clients. Typically, these are financial institutions in the UK, but following a merger with Karpus in 2020 they are also financial advisers and wealthy individuals in the USA.

City of London also uses a time-honoured investment strategy. It invests in closed-end funds, commonly known as investment trusts in the UK.

Unlike OEICs (Open-ended investment companies), closed-end funds are listed on the stockmarket. This means their share prices depend on demand just like any other company share.

The price we pay for the shares does not track the value of the investments in the funds exactly.

City of London is an old-school value investor. It buys closed-end funds when their share prices are below net asset value per share.

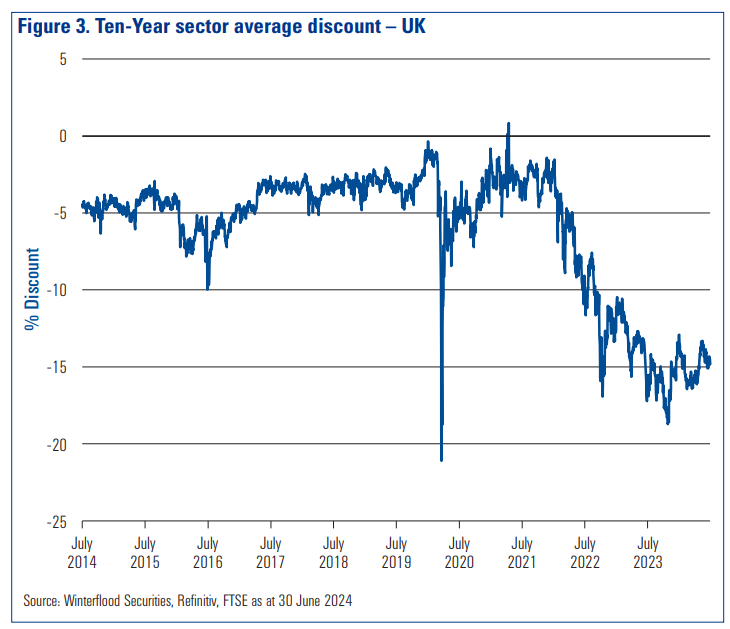

The strategy is particularly interesting because discounts, when the share price is lower than the net asset value, have widened significantly from a 10-year average of 6% in the UK to 14.5% in June.

Widening discounts are bad news for investment trust performance. It is much harder to make money from them, when the product, in aggregate, keeps getting cheaper.

That will change when confidence returns and the average discount narrows. City of London calls this scenario “Regime Change”, and it believes regime change is already underway.

Source: City of London Annual Report 2024

The company says its business is built around long-term outperformance based on quantitative analytical procedures and proprietary tools. These supplement macroeconomic analysis and trading expertise.

It says it is an open book to institutional clients, which helps it retain them when the strategy is performing less well.

Performance is a slippery thing to measure though. After nearly three decades of investment I still sometimes wonder to what extent my own returns are due to luck or skill. Procedures and tools do not necessarily add value just because they are quantitative and proprietary.

City of London scores two strikes.

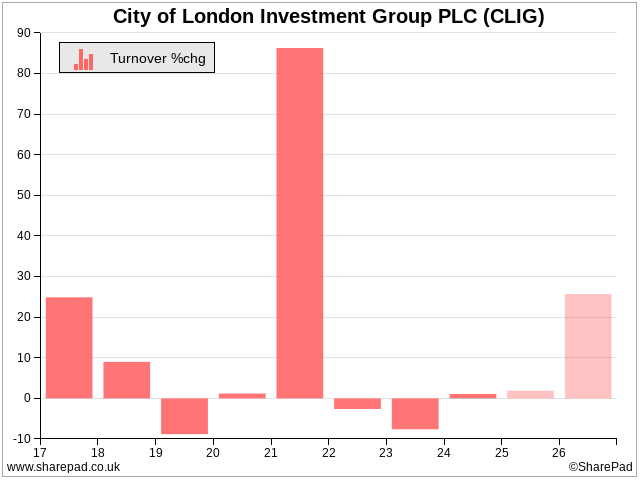

Lumpy growth is an occupational hazard for an asset manager as fee income fluctuates with assets under management. Customers tend to withdraw funds when the asset manager is not performing well, or trouble may be ahead, but volatility is inevitable.

The 86% surge in turnover in 2021 is related to the second strike, a near doubling of the share count in the same year. The shares were issued to facilitate the merger with Karpus.

George Karpus, the former owner of Karpus, became City of London’s largest shareholder due to the merger. He owns 31.5% of the shares, and he is frank about changes he would like to see to pep up profitability.

My colleague Maynard spoke with Mr Karpus last year, and I suspect both of them will welcome news in this year’s annual report that City of London has closed its REIT (Real Estate Investment Trust) strategy due to lack of interest, a cost-cutting measure Mr Karpus advocated.

Frankly, I am unlikely to bet on another investor’s strategy when I can invest in my own, so I am unlikely to take City of London any further.

The same is true of Ashmore (- Growth), and Brooks MacDonald (- Holdings, – ROCE), two other asset managers that have passed the minimum quality filter and published annual reports recently.

Hargreaves Lansdown (- Holdings) is more investable. Its main business is enabling private investors, you and me, to choose for ourselves from a wide range of shares and funds and manage our own portfolios.

Well maybe you, but not me as I use its smaller, cheaper, and far from insubstantial rivals interactive investor and AJ Bell to manage my investments.

Hargreaves Lansdown’s higher fees have always put me off it as a customer, which in turn has deterred me from considering the company for investment. Further digging might reveal that it provides value in some other way.

One of the few non-financial shares in the latest selection serves the financial industry. Arcontech (? Growth) makes software that manages financial market data.

It is not a data provider, like Bloomberg, rather the software aggregates trade and pricing data from sources data providers and makes it available to a company’s systems. It describes the software products collectively as a data distribution platform.

Even though City of London has grown, it is still tiny (revenue is approximately £3 million). That makes it a slow burner given its long history.

Arcontech was founded in 1979, floated in 2000, and reconfigured itself to focus on its main product, CityVision in 2009.

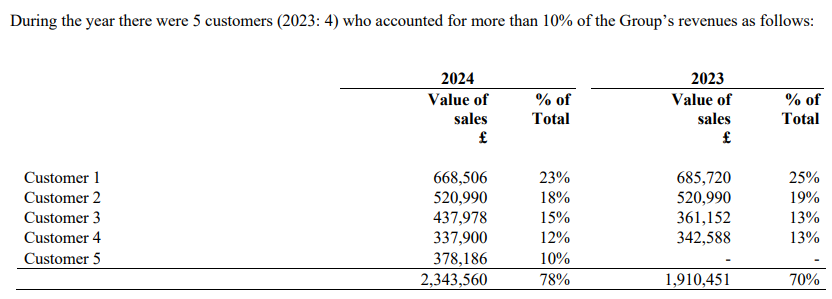

Despite the large size of the UK financial sector and the applicability of financial software outside the UK, Arcontech is reliant on a small customer base of large unnamed banks.

Source: Annual Arcontech Annual Report 2024

This implies that CityVision’s appeal may occupy a very small niche.

Last but definitely not least is Renishaw (- CROCI ? Growth), a manufacturer of tools used in factories, 3D printers, and exotica-like neurosurgical robots.

Renishaw is one of the high-quality companies I write up every year for interactive investor (this year’s evaluation is imminent).

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.