Many investors like to buy shares that are popular or those of companies that are doing well. Phil takes a look at why sometimes buying shares that professional investors are betting against can generate big gains.

Finding unpopular shares

Most investors make money by buying shares that eventually go up in price. However, it is possible to make money by betting on share prices falling.

Professional investors do this by a process of shorting or “going short” of a share. They do this by borrowing shares from other investors – in return for paying them a fee – and then sell them in the hope that they can buy them back at a lower price later on and pocketing the difference.

For example, borrowing shares and selling them at 100p and then buying them back at 50p would give a profit of 50p per share.

Private investors can also place a spread bet on a share price falling to achieve a similar result.

While big gains can be made if a share price falls, the gains are capped as a share price cannot fall below zero. However, if the bet does not pay off and the share price rises then the losses are unlimited.

Shorting is therefore a very risky strategy that should only be practised by very experienced investors and those who can cope with taking big risks.

Investors looking for shorting candidates look for the shares of companies where they believe that its fortunes will get worse causing the share price to fall.

Share prices fall for a number of reasons. The main reason is that profits or profit forecasts fall, often due to a downturn in trading caused by economic weakness or a deteriorating competitive position.

Investors also short shares because they believe that they are overvalued or that a company has too much debt. Sometimes the integrity of its accounting can be questioned which if true can lead to huge share price falls.

It used to be very difficult to know which shares had lots of short interest. However, it is now very easy to find out through websites such as shorttracker.co.uk.

Fund managers who take a short position in a share have to inform regulators. This allows data to be compiled on how much of a company’s outstanding shares are out on loan and how many funds are betting on the shares falling in price.

The top 10 most shorted UK shares as of 13th September 2024 are shown in the table below.

Source:short tracker.co.uk

How investors can profit from buying shorted shares

Sometimes the reasons for investors betting on a falling share price do not materialise and remove the potential profit opportunity. This often happens when a company reports much better results than expected or sees an improvement in its finances. A takeover approach is another reason why shorting strategies fail.

When this happens, the shorting investor buys back the shares they have sold and returns them to the original owner who had lent them out. This process is known as “short covering” and the buying that is involved can sometimes lead to big increases in a company’s share price.

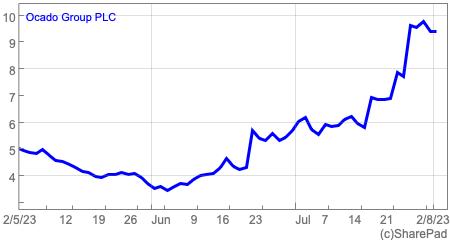

A great recent – and regular – example of short covering can be seen in Ocado during the summer of 2023.

The company’s business model has struggled to produce meaningful profits which makes it a favourite target of short sellers. However, rumours of a potential takeover bid for the company saw short sellers head for the exits which lead to a rapid appreciation in the share price.

Anyone buying the shares at the end of May 2023 would have experienced a stellar return on their investment.

Investors can identify possible takeover candidates but predicting when they will happen is virtually impossible. That said, sometimes short sellers are barking up the wrong tree which can lead to a share price falling too far. This is where buying heavily shorted shares could be a profitable strategy.

Using SharePad to check out heavily shorted shares

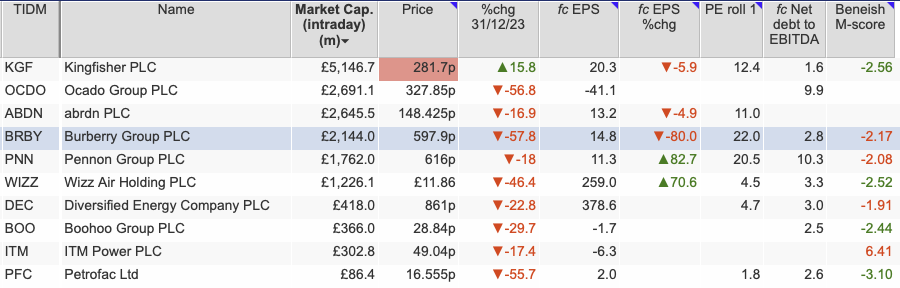

I have taken the 10 most shorted shares from shorttracker.co.uk and put them into a SharePad portfolio. I’ve then added various data columns to try and help me identify shares that could bounce.

Source:SharePad

This is not an easy strategy. Short sellers are some of the most diligent and impressive investors out there. They are renowned for doing their homework well and will not have entered into a short position likely given the potential losses if they are wrong.

However, it is possible to use SharePad to quickly look at potential catalysts for a share price bounce.

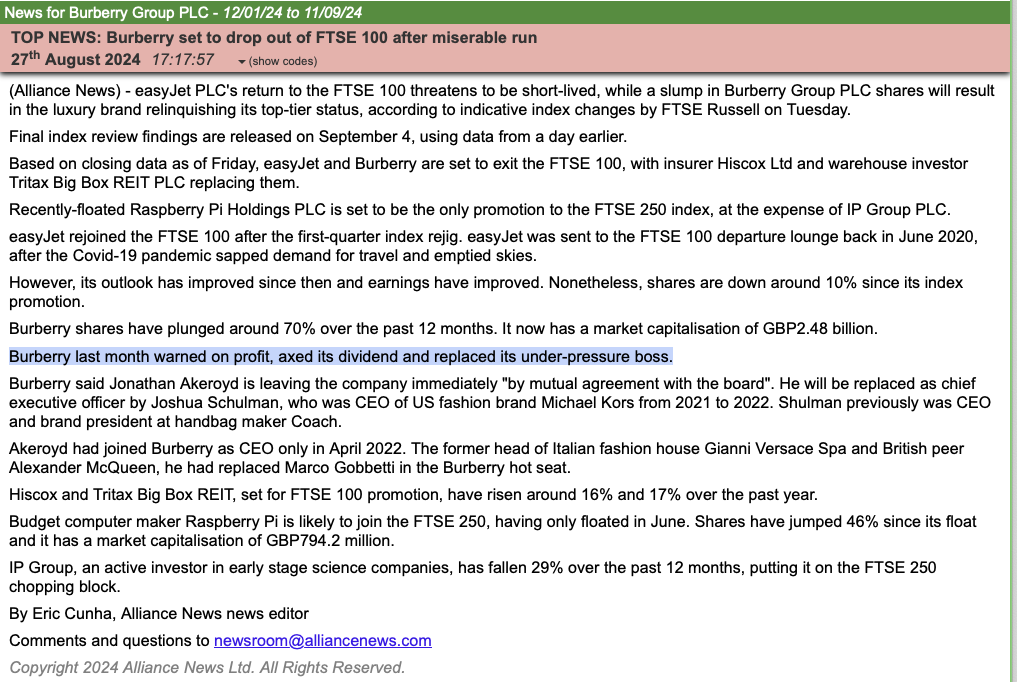

Before you look at numbers, it is a good idea to check out the company news on SharePad to find out the latest issues surrounding the company and its business. We can see that Burberry has had a profit warning, slashed its dividend and replaced its chief executive which are classic signs of a company going through a tough time.

Here are a few numbers that you might want to look at in order to try and work out any potential share price recovery.

Market capitalisation

How much is the company’s stock market valuation? Is it a big meal for a potential bidder or something that a rival could easily pay for?

For example, all of Burberry’s shares are currently worth £2.1bn. While a bidder will have to take on debts and other liabilities, this might be an attractive price tag if a buyer can turn the company around and return it to health.

How far have the shares fallen year to date?

A big fall might suggest that a share price might not fall much further. It could also be the beginning of the end for a business in real trouble.

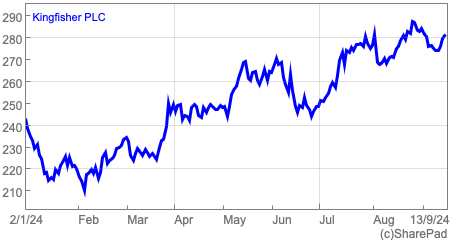

Interestingly, Kingfisher’s shares have actually gone up despite 5.7% of its shares being out on loan.

This rise may be causing short sellers to sit on unrealised losses. Will they capitulate and cause the share price to go up further?

Is the company forecast to be profitable or loss making?

A loss making company is already in trouble. You can ask SharePad to show you the latest EPS forecast to see whether a profit or a loss is expected.

Additionally, looking at the forecast EPS change can give you a feel for how badly a company is doing. Burberry’s EPS is forecast to fall by 80% which is a bad sign.

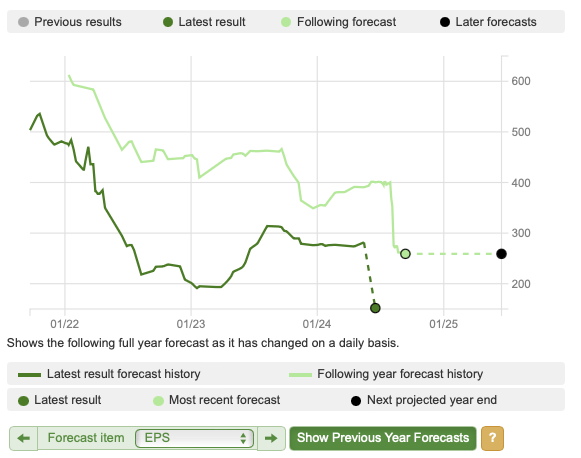

However, Wizz Air’s is expected to increase by 70% which is a sign of a very healthy business. Further digging tells us that the EPS forecast has come down a lot in recent months which is not a great sign.

Source:SharePad

Kingfisher’s forecast EPS decline looks to be quite modest which could be supportive to a share price recovery, especially as they are expected to start growing again the year after.

Are the shares cheap or expensive?

The price to earnings (PE) ratio based on the next year’s forecast EPS (PE roll 1) is a decent valuation yardstick. Burberry shares look expensive on this measure but may be decent value if earnings can recover.

Wizz Air and Petrofac shares look to be very cheap. Could they be cheap enough to attract a takeover bid?

Does the company have too much debt?

Too much debt can eventually lead to bankruptcy or a big cash call on shareholders which is usually bad news for a share price.

Using net debt to EBITDA as a measure of indebtedness shows companies such as Pennon to be in some difficulty, even for a utility. Kingfisher’s debt looks to be quite comfortable.

Are the accounts dodgy?

The Beneish M-Score is a quick indicator of aggressive accounting. SharePad colour codes the M-Score Number in red if there are possible signs of trouble in this area. Accounting irregularities tend to cause share prices to crash heavily.

Burberry and ITM Power do not look good on this measure but Kingfisher currently does.

Of the top 10 most shorted shares, Kingfisher perhaps looks the most interesting in terms of foiling the short sellers.

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select Share Chat or search for the specific share covered in this article.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.