It is four out of four this time, as Cerillion, Hollywood Bowl, Ramsdens and RWS all pass the 5 Strikes test. Richard Beddard explains why Cerillion is the pick of the bunch, with a rare perfect score and a financial track record that merits closer scrutiny.

5 Strikes

I’ve got good news and bad news. Only four shares have published annual reports and made it past my minimum quality filter since my last update. This is bad news, but not many companies publish annual reports after Christmas.

The many companies with year-ends coinciding with the end of the calendar year will be gearing up to publish their annual reports later in the spring though.

The good news is that on further scrutiny, all four scored less than three strikes.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Ramsdens | RFX | 15/1/26 | – CROCI ? Growth ? ROCE | 2 |

| Cerillion | CER | 12/1/26 | 0 | |

| RWS | RWS | 8/1/26 | ? Acquisitions – Growth – ROCE | 2 |

| Hollywood Bowl | BOWL | 5/1/26 | – Debt | 1 |

| Click here for our 5 Strikes explainer | 21/01/2026 | |||

One, Cerillion scored no strikes at all.

Cerillion [-]

Only 15 of the 221 shares that pass the minimum quality filter achieve no strikes, so to celebrate, this is what a perfect financial track record looks like, at least according to the 5 Strikes criteria:

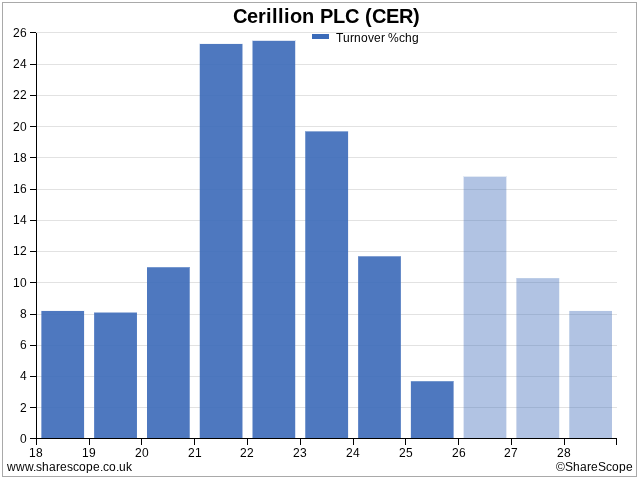

The company has made no acquisitions. The lowest Cash Return on Capital Invested (CROCI%) over the last eight years, was a very healthy 13.2% eight years ago. Net borrowing as a percentage of capital employed has been negative (net cash) for the entire period. The company has grown turnover every year, although 3.7% growth in 2025 is well below par. Return on Capital Employed has never fallen below 10% and is usually much higher and, unusually for a software company, the share count is static.

Cerillion has grown by developing and selling billing and customer relationship management software to telecoms companies. It has funded its own growth, which is basically what I am looking for in a candidate for investment.

The one non-financial 5 Strikes criterion is also positive. Founder and chief executive Louis Hall has skin in the game. He sold a large slug of shares in a placing last summer, but retains a 20% holding.

Scrutinising the financial statistics is just the beginning of understanding a business and its qualities. When I have examined Cerillion before, its annual report revealed three risks that persuaded me not to proceed any further.

Cerillion has traditionally made money from fixed line and mobile telephone calls, but we are increasingly using internet services. The company is replacing this diminishing income with services that monetise 5G and fibre broadband.

At a very simple level, which is all I am capable of articulating at the moment, Cerillion provides software that allows telcos to charge people to use data, play games, or watch TV for example. It also charges and bills business customers, and even smart cities. It is providing the billing and customer relationship management platform for Egypt’s new connected administrative capital near Cairo (with Nokia and Orange).

The second risk is that to scale up and operate more efficiently telecom companies are consolidating. The company sees this as an opportunity, because they will often seek to move their operators onto common platforms. However consolidation could mean it loses custom.

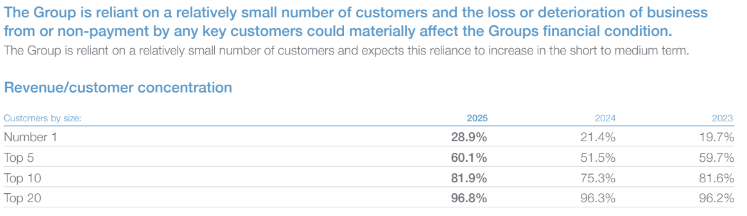

The third risk may be a consequence of the second. Cerillion already serves very big customers and customer concentration increased in 2025. When your biggest customer brings in 29% of revenue and the top 5 bring in 60%, the loss of a customer could have a very severe impact:

Source: Cerillion annual report 2025

Judging by Cerillion’s financial track record its customers must be very sticky. The annual report says the average software contract is five years long, but customers typically remain for at least ten.

In the past I have been put off Cerillion by the fact that telcos companies have not been great value creators, but that doesn’t mean that the companies that supply them are bad businesses. I also have been put off by the fact that it is a highly technical product in an industry I do not know.

Having chipped away at Cerillion only very slightly, maybe I should chip some more. These case studies reveal more.

The only criterion Cerillion passed marginally in 2025 was turnover growth of 3.7%. If it had contracted I’d have awarded a strike and perhaps wondered whether some of my doubts were weighing on its performance.

The company says that it achieved a 25% increase in orders in 2025, but due to the timing of the contracts wins (presumably late in the year). The full benefit will be realised in subsequent years. No doubt that has influenced the analysts’ forecasts, which anticipate growth rates closer to 10%.

Taking that at face value, the dip in turnover is not much to worry about.

Hollywood Bowl [- Debt]

I won’t dwell on Hollywood Bowl because I am much further along the research process, all the way in fact. I own the shares, and hold them in the model portfolio I run for Interactive Investor. You can read my write-up there.

Hollywood Bowl gets a strike (no pun intended) because borrowings are more than 25% of capital. This I think is an occupational hazard. It locates tenpin bowling centres in prime locations in retail and leisure parks, so it has to deal with the landlords. ShareScope’s definition of debt includes leases, which is effectively all of Hollywood Bowl’s debt.

Given high levels of profitability and cash generation I think it can afford the leases except in the most extreme times, which we witnessed during the pandemic. Hollywood Bowl closed its centres, and landlords deferred and reduced rent.

Ramsdens [- CROCI ? Growth ? ROCE]

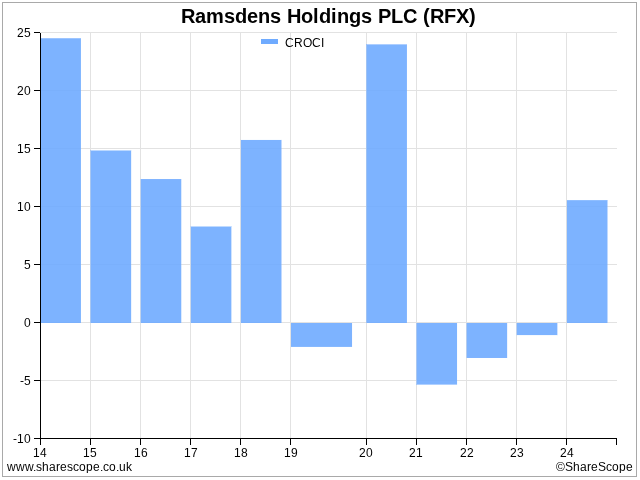

Ramsdens is in roughly equal measure a pawnbroker, a buyer and seller of precious metals, currency exchanger, and jewellery retailer. The share price took off in 2025, at least in part because gold prices did too. Ramsdens is sitting on appreciating gold stock, and the collateral against its pawnbroking loans is often gold too.

Ramsden’s track-record merits further investigation, but I fear the impact of gold and precious metal prices on its performance, and I would need to consider its chequered history of cash flow too:

RWS [? Acquisitions – Growth – ROCE]

RWS is complicated for different reasons. Not long ago, people were at the heart of its strategy. It employs translators with specialist knowledge in profitable niches, like intellectual property and pharmaceuticals. More and more of the work is being done by technology though, and now it puts artificial intelligence at the forefront of its pitch to customers and investors (people are still involved).

It’s a fascinating pivot, but perhaps so dramatic I fear the company’s track record doesn’t tell us much about the future.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.