A fresh batch of companies has cleared Richard Beddard’s 5 Strikes filter, with Tristel and Bioventix standing out for their unusual strengths and resilience. Netcall also makes the cut and could be one to watch.

5 Strikes

Since my last update, five shares have passed my minimum quality filter. Primarily, this weeds out companies that have earned very weak cashflow over the last eight years. It also excludes companies that have spent more on acquisitions than they earned in free cashflow.

It’s a small but high quality group. Four of the five, achieved less than three strikes after brief scrutiny of their financial track records in ShareScope:

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Grainger | GRI | 20/11/25 | – Holdings – Growth – Debt – ROCE – Shares | X |

| Netcall | NET | 18/11/25 | ? ROCE – Shares | 1 |

| Tristel | TSTL | 18/11/25 | – Holdings ? Shares | 1 |

| Bioventix | BVXP | 11/11/25 | – Growth | 1 |

| Associated British Foods | ABF | 4/11/25 | – Growth ? ROCE | 2 |

| Click here for our 5 Strikes explainer | 26/11/2025 | |||

Netcall: staying relevant

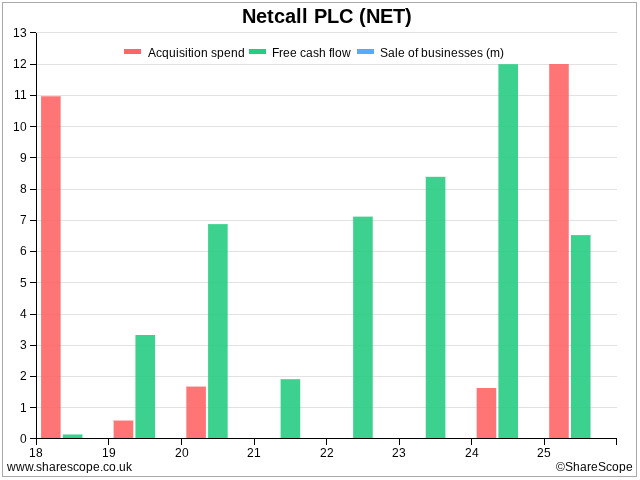

There is little doubt, Netcall (? ROCE – Shares) makes good money.

The question mark against return on capital employed (ROCE) is undeserved, which is why I chose not to award Netcall a strike for this measure. It relates to the year ending June 2018 when Netcall acquired another business and ROCE was just 7.5%:

Amortising the intangible assets of the acquired business reduced profit in this and subsequent years. This is an accounting necessity to balance the books when a company pays more for a business than the value of its tangible assets, rather than an ongoing cost. Ignoring this amortisation gives a better impression of how the business itself performed.

The acquisition was MatsSoft, which Netcall acquired in August 2017. MatSoft was a pioneering developer of cloud-based low-code software. It enables the rapid development of applications. Netcall used it to enhance its Liberty contact centre management platform, develop new applications for the Liberty platform, and make low-code application development available to its customers.

You can get a feel how low-code works by watching this video. And you can read about how Netcall’s Liberty software platform has helped a large base of customers like NHS Trusts, banks, and local councils connect with customers here.

The Matsoft acquisition could be one of those examples where an acquisition transforms a business for the better. The low-code capability improved Netcall’s software, collected under the Liberty platform, and broadened its appeal.

This modular approach, with AI embedded, is easy to extend and improve as technology marches on and organisations automate more of their interactions with customers.

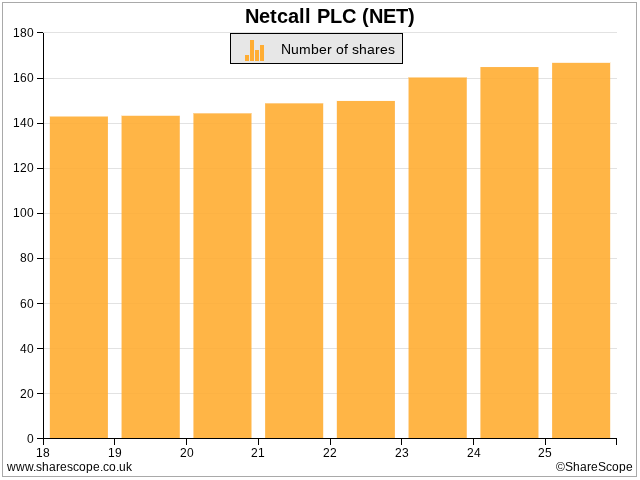

The acquisition also partly explains the bump in the share count in 2023, the single strike I gave Netcall.

In 2017, Netcall had borrowed £7 million to partly fund the investment in Matsoft. The loan note had share options attached, which were exercised in 2023. Added to employee share option schemes, Netcall’s share count has increased by more than 1% a year on average, the point at which I give a share a strike.

After MatSoft in 2017, Netcall did not spend much on acquisitions until the year to June 2025. In August 2014, it acquired Govtech, which provides digital process automation to local government. In September 2014, it acquired Parble, which provides intelligent document processing.

The company says GovTech brought Liberty the capability to deal with council tax enquiries, which it integrated using its low-code capability. Parble uses AI to extract data from documents and emails without human assistance, another service it can sell through Liberty.

After those deals the company still had £26 million of net cash on its balance sheet at the year end.

Tristel: Unique, in a good way

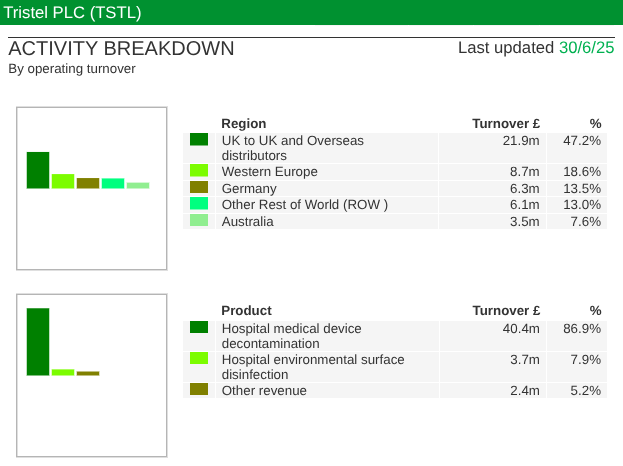

Tristel (- Holdings ? Shares) has a relatively new executive team, and they do not own a significant number of shares.

Like Netcall, Tristel’s share count has increased by more than 1% a year, but unlike Netcall none of the new shares funded acquisitions. The shares have been issued to fund executive share options. While I don’t like this level of incentivisation, it would be churlish not to recognise that shareholders have done well out of Tristel, which has grown strongly as it has entered new geographical markets:

Tristel makes a unique hospital disinfectant. It is the only disinfectant made from chlorine dioxide, and it is increasingly popular around the world because it can be handled relatively easily yet it is highly effective and requires no capital equipment. This quality means it is one of the shares I write up routinely on interactive investor (it is next on my to do list).

Bioventix: Unique in a baffling way

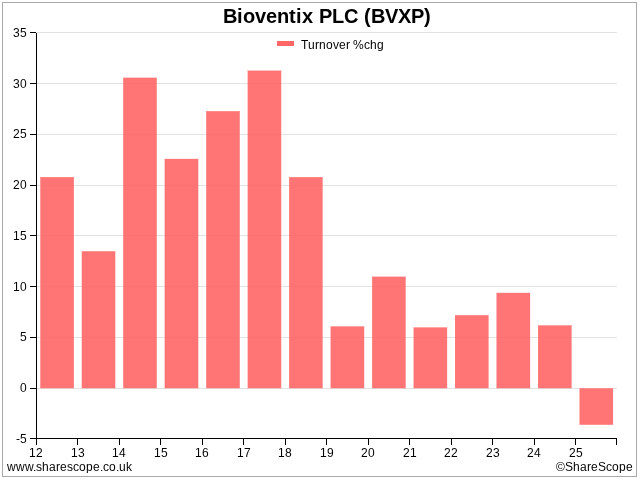

Bioventix (- Growth) is like a rare and potentially fragile species.

Hugely profitable, the company invents sheep monoclonal antibodies. Mostly, these are used in blood testing machines to diagnose medical conditions. Antibodies take years to develop and approve, and then the company receives royalties for many more years. That’s because long lead times deter other companies from developing rival antibodies if there is a successful one already in the market.

Historically, Bioventix’s ability to pick successful antibodies has achieved rapid growth as well as strong returns, however turnover growth has slowed and in 2025 it turned into contraction:

Bioventix is experiencing the squeeze being felt across European manufacturing due to China’s drive for self sufficiency (The Chinese Government’s China First policy). Sales and royalties are also coming under pressure as the Chinese Government bears down on procurement costs.

China First is pushing Chinese labs to switch to Chinese blood testing machines instead of using Western machines powered by Bioventix antibodies. Western diagnostics companies are also reducing their prices and ultimately Bioventix’s royalty. In addition, Chinese diagnostics companies, which formerly used Bioventex tests are switching to local royalty free antibodies.

Bioventix does not disclose how much turnover it earns in China, but it is obviously significant (81% of turnover is earned outside Europe). In addition, royalty agreements going back a decade or more are ending, and Bioventix’s newer antibodies are not catching on as quickly as hoped.

To get back on the front foot, Bioventix is developing blood tests for Alzheimer’s, which it believes have the potential to match or exceed its biggest-selling historical blood test, for Vitamin D. So far it is only selling assays for research use, so it will be some years before they are widespread in hospitals and the royalties are rolling in.

Combine these uncertainties with the fact that Bioventix is dependent on the smarts of just 12 people (full time equivalent), and you have the reason I am putting the share on the too hard pile (again).

Associated British Foods (-Growth ? ROCE)

Family-owned ABF is an agricultural and food ingredients conglomerate that also owns high street fashion chain Primark.

Turnover declined in the year to September 2025, and the company is considering splitting Primark from the rest of the business to make two more focused entities. It’s probably a good idea.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.