Richard considers two shares that pass his 5 Strikes screening process. The first, Dunelm (DNLM), has almost flawless numbers. The second, Wilmington (WIL), is intriguing because of the flaws in its numbers.

Since I last updated you, seven shares have published annual reports and percolated through the minimum quality filter.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Wilmington | WIL | 10/10/25 | – Holdings – Growth ? ROCE | 2 |

| Dunelm | DNLM | 9/10/25 | – Debt | 1 |

| Smiths | SMIN | 9/10/25 | – Holdings – Growth ? ROCE | 3 |

| Hays | HAS | 6/10/25 | – Holdings ? CROCI – Growth – ROCE | 3 |

| Renishaw | RSW | 3/10/25 | – CROCI – Growth | 2 |

| JD Wetherspoon | JDW | 3/10/25 | ? CROCI – Debt ? Growth – ROCE | 3 |

| Barratt Redrow | BTRW | 2/10/25 | – Holdings – Growth – ROCE – Shares | 4 |

| Click here for our 5 Strikes explainer | 15/10/2025 | |||

After further scrutiny, three companies achieved less than three strikes. Renishaw primarily makes manufacturing machines and systems. I wrote it up at interactive investor last week. For observations about Dunelm and Wilmington, read on.

Dunelm [- Debt]

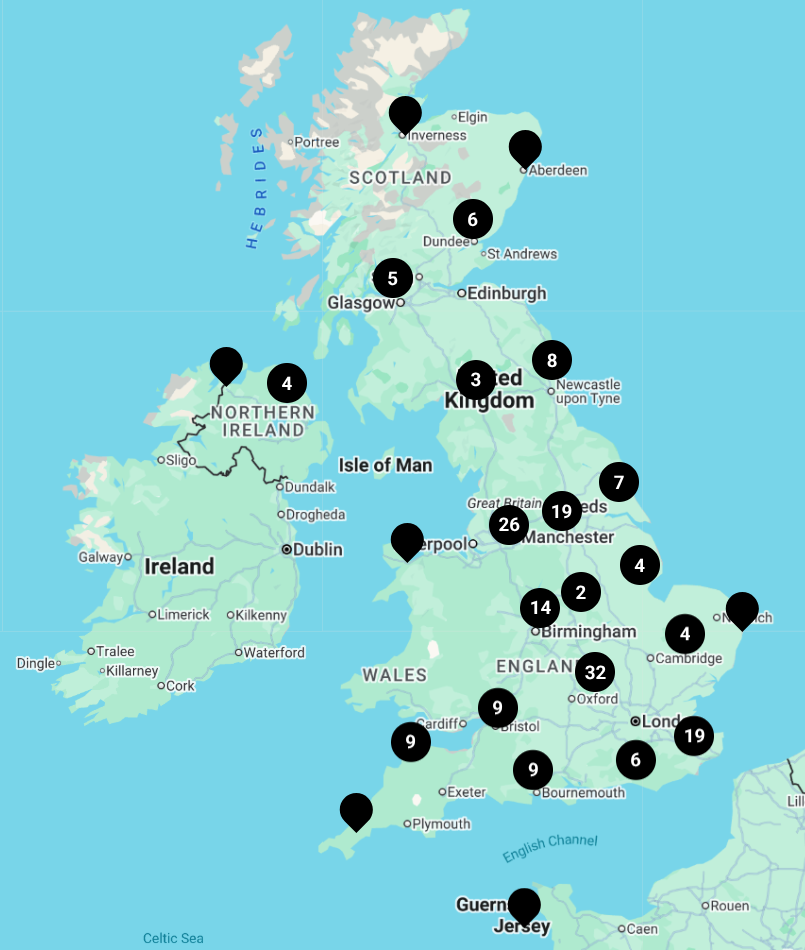

Dunelm is famous in the UK. Its homeware stores span the nation, from Truro to Inverness and from Londonderry (aka Derry) to Lowestoft. It also has a store in Jersey.

Source: Dunelm store locator (the numbers are the number of stores in a region too densely populated with stores to show individually. There are Dunelm stores in Exeter and Plymouth for example, even though it looks like there are not).

Because I mostly focus on kinks in the data, I am not going to pay much attention to Dunelm’s track record. Its numbers are almost pristine (for kinks, and what they can tell us about a business, see my commentary on Wilmington later).

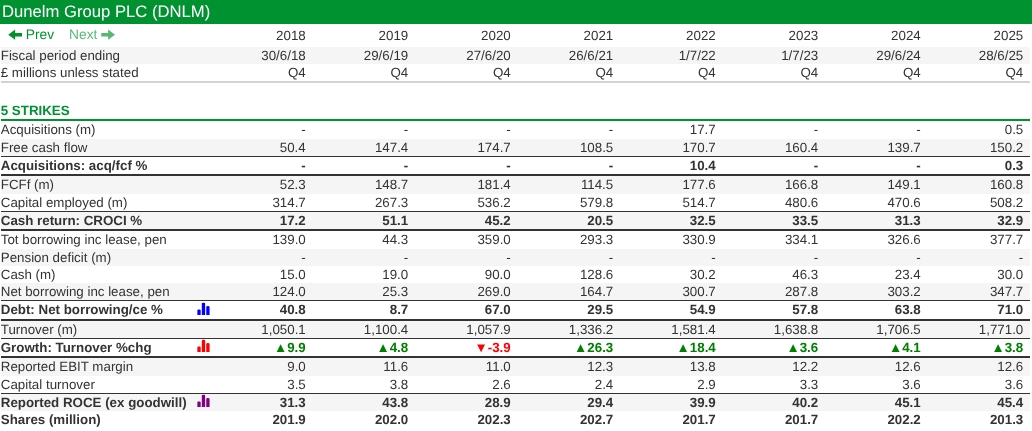

This custom table generated in ShareScope shows six of the seven 5 Strikes criteria in bold (they are calculated using the factors above them, which are not in bold).

The 5 Strikes custom table reveals a good business that has grown profitably under its own steam, knocked only slightly out of its stride by the pandemic.

The one strike on Dunelm is debt, which is a choice. Dunelm chooses to pay special dividends to shareholders rather than pay off debt, which I wrote about last year. It continued the tradition of paying a special dividend in 2025.

Dunelm also scores well because Bill Adderley, the son of the founders, remains the company’s biggest shareholder with 33% of the shares.

Naturally, Dunelm is on my watchlist, but it has never made it into my portfolio, partly because of the high share price, which reflects its reliability, and partly because of the chains’ ubiquity.

In 2025, Dunelm opened its 200th store in Merthyr Tydfil. It closed the year with 202, although this total includes 13 Home Focus stores in Ireland, which the company acquired last November (not included in the map of Dunelm stores).

At the beginning of the financial year, Dunelm had 184 stores, so ignoring the acquired Irish stores, Dunelm opened 5 stores, net, which does not look like a rampant roll-out.

Dunelm’s growth rate is steady, rather than spectacular, and I wonder whether it can maintain it without lots of new stores.

That puts the emphasis on expanding the product range, and perhaps online sales, to win a bigger market share. I think this is harder work than rolling out a successful format.

The person leading this effort is Clo Moriarty, a former chief retail and technology officer at Sainsbury’s. She became chief executive earlier this month, when Nick Wilkinson retired.

Wilmington [- Holdings – Growth ? ROCE]

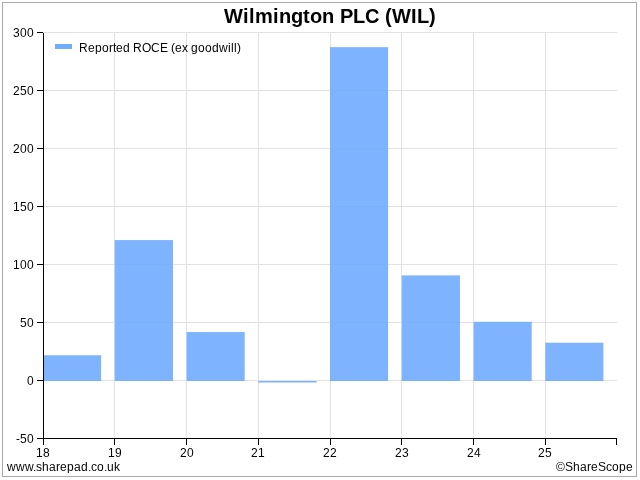

Wilmington might not have made the cut. The question mark against Return On Capital Employed allows me the discretion to score it 2 or 3.

I waved Wilmington through because generally it has been very profitable. It has only reported ROCE of less than 10% once in the last eight years and that was in the year to June 2021. Probably it was affected by the pandemic, which I usually forgive.

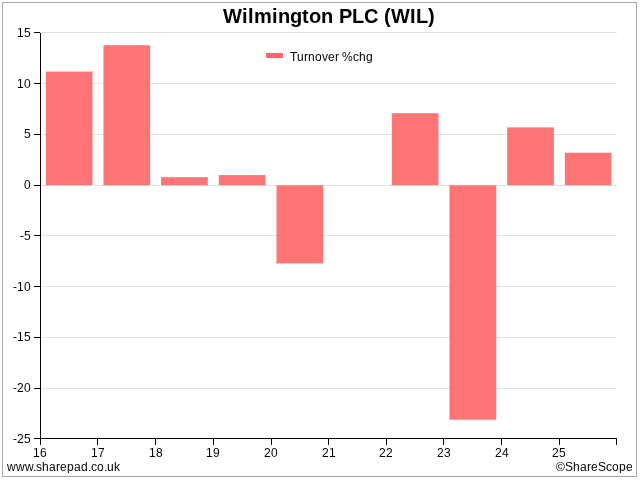

I was also curious. Despite earning impressive Cash Return on Capital Invested every year, Wilmington has not converted that cash, through investment, into revenue growth.

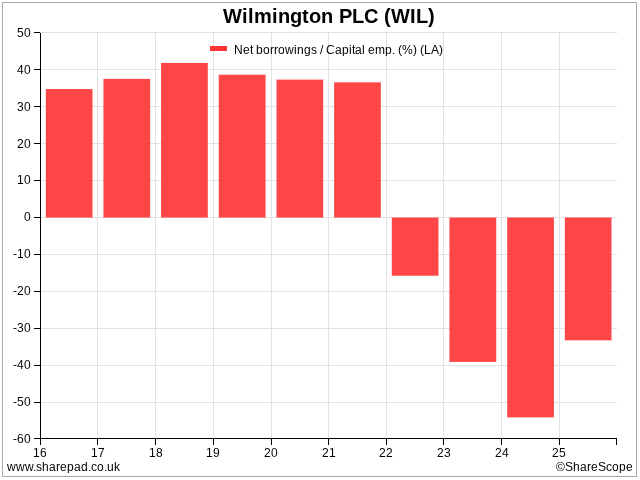

Instead, until the last two years, it has been content to let the cash pile up. Once 35-40% funded by debt, in 2022 it flipped into a net cash position.

However, the story is more complicated than the three charts so far imply: a highly profitable company doggedly stockpiling cash. It is a story of three thirds.

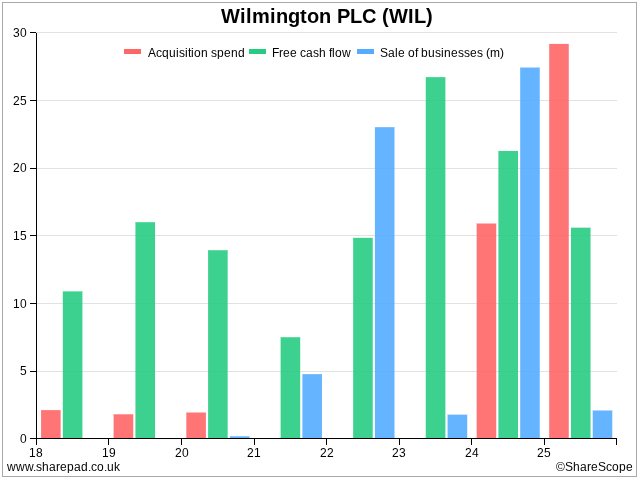

Free cash flow (green bars), the cash left over after deducting operating expenses and capital expenditure, has been healthy throughout the period.

The three parts to our story refer to acquisitions. The first third is the years between 2018 and 2020, when Wilmington was spending modest amounts on acquisitions (red bars). Then, between 2021 and 2023 it went into disposal mode (blue bars). Finally over the last two years, 2024 and 2025 it made its biggest acquisitions and disposals.

Acquisitions and disposals are money flowing out of the business, or into it, in addition to free cash flow. In recent years they have been significant, because in 2022 and 2024 the company received more cash from disposals than it did in the normal run of business. In 2025 it spent more on acquisitions than it earned in free cash flow.

Wilmington’s cash pile grew up until 2024 due to disposals as well as cash earned by the business. It contracted in 2025 because it spent so much on acquisitions.

It will contract again in 2026 because in August, after the financial year end, Wilmington made another substantial acquisition, this time funded by a combination of cash and debt.

This activity suggests that Wilmington is changing, and the pace of change makes me queasy. It makes Wilmington more difficult to analyse because the future will be less like the past.

However, Wilmington has also decided how to deploy its surplus cash, so, should we choose to accept the mission, we have something to go on: the nature of the businesses it has acquired.

Looking at the data can only get us so far towards understanding a share, but I am pleased that five of the seven 5 strikes criteria can get us so far.

The sixth is helpful too, insofar as we do not need to worry about it. The share count has not increased significantly, telling us that, up until 2025, it financed its operations and acquisitions itself.

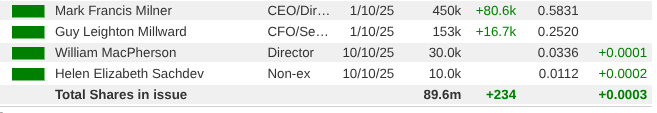

The seventh is a non-financial strike, director holdings.

Source: ShareScope

ShareScope tells us that of the directors, chief executive Mark Milner owns the most shares.

He holds 450,000, which at a share price of 350p is worth just over £1.5 million. It’s not an insubstantial holding, but not sufficient to be confident he would always act as an owner (without knowing anything else about him!)

Wilmington’s an interesting business, and perhaps at an inflection point. Whether that will be good for shareholders depends on what the company does, and why it is changing.

It doesn’t seem fair to leave you on that cliffhanger, so although I can’t tell you why it is changing yet, I can at least explain that Wilmington provides companies in the UK primarily, but also the USA and Europe, with data, training courses and events.

These help customers comply with rules and regulations relating to their legal, financial and health and safety affairs.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.