MP Evans boasts a very reliable dividend and profits surging beyond $100m suggests further income growth to come. Maynard Paton assesses the group’s palm-oil KPIs, high-margin accounts, intriguing board and record-high share price.

I can’t be the only investor who likes to collect a reliable dividend.

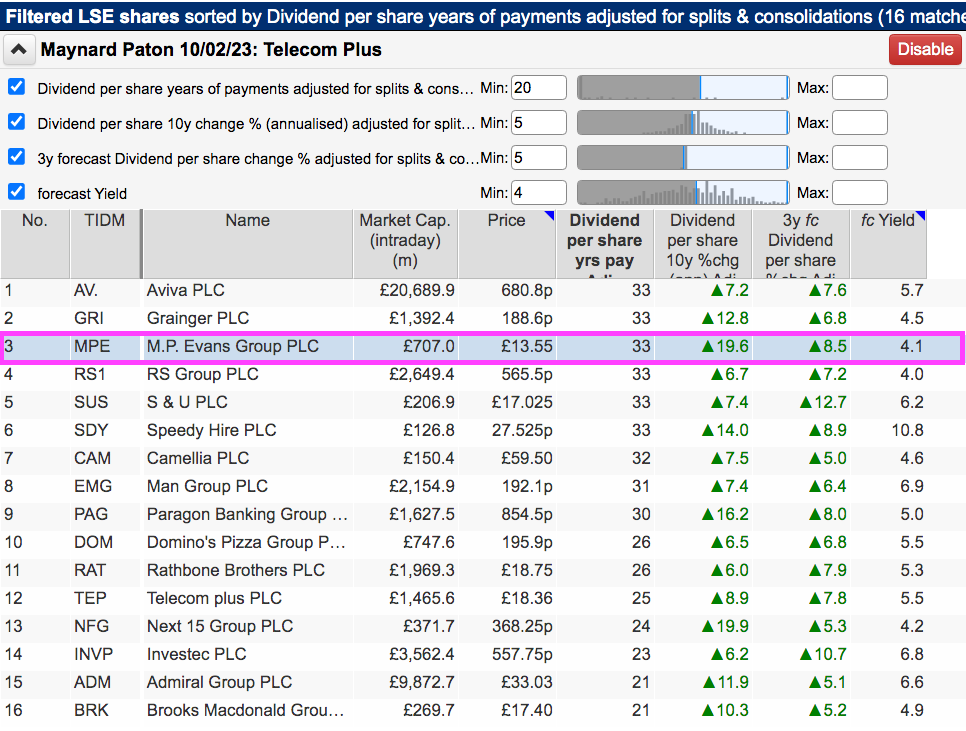

Hence this revisit to an old screen that pinpoints companies boasting a long-running payout, a meaningful yield and respectable prospects.

The exact criteria I redeployed for this search were:

- A history of dividend payments spanning at least 20 years;

- A 10-year dividend growth record of 5% or more;

- A minimum forecast three-year dividend growth rate of 5%, and;

- A forecast dividend yield of at least 4%.

I applied the screen the other day and ShareScope returned 16 matches:

(You can run this screen for yourself by selecting the “Maynard Paton 10/02/23: Telecom Plus” filter within ShareScope’s magnificent Filter Library. My instructions show you how.)

Names on the shortlist included Camellia, Domino’s Pizza and Telecom Plus.

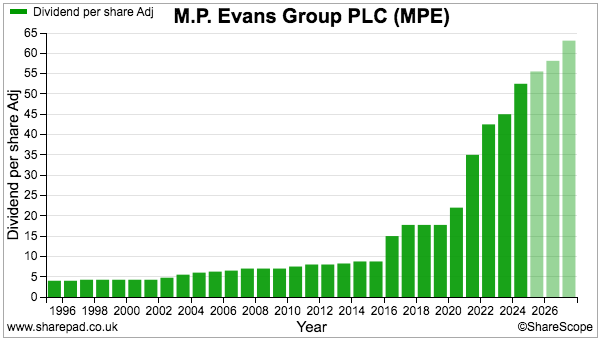

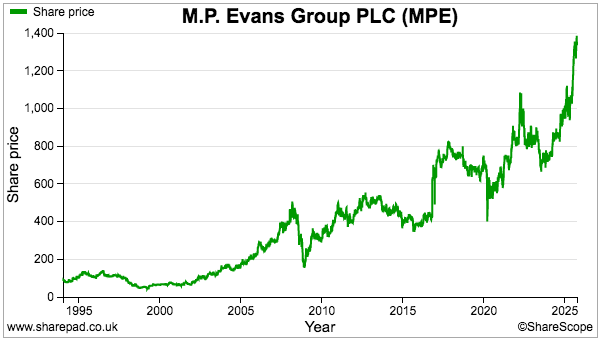

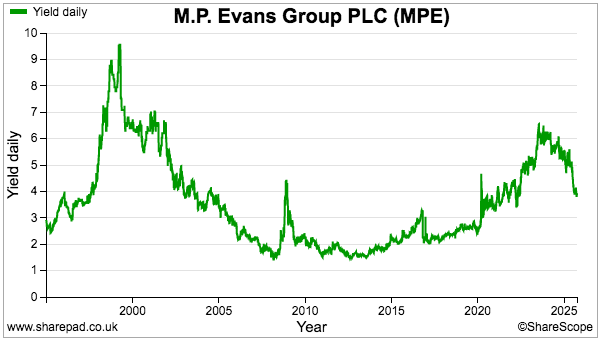

I selected MP Evans primarily because the company has never cut its dividend during the last 33 years:

The payout has in fact advanced by a near-20% CAGR during the last decade, while future income growth also appeared very reasonable.

Let’s take a closer look.

Introducing MP Evans

MP Evans can trace its history back to when Matthew Pennefather Evans began importing tea from Sri Lanka into the UK during 1872.

Initially as a partnership and then as a limited company, MP Evans would for the next 100 years operate Sri Lankan tea plantations until the “superior financial rewards” from harvesting Indonesian palm oil became “increasingly clear“.

A merger with tea importer Rowe White brought MP Evans to the stock market during 1981 under the name Rowe Evans, after which the group complemented its Indonesian palm-oil operations with Malaysian property development and various Australian activities including sheep and cattle farming.

What had become a messy investment conglomerate was restructured and renamed back to MP Evans during 2005, and by 2017 the business had become focused entirely on Indonesian palm-oil plantations in which it had majority or full control.

Today MP owns or manages more than 66,000 hectares of Indonesian palm-oil plantations and last year harvested 1.2 million tonnes of crop that converted into 372,000 tonnes of crude palm oil.

MP’s website hosts several videos that provide informative introductions to palm-oil production as well as comprehensive reviews of MP’s operations:

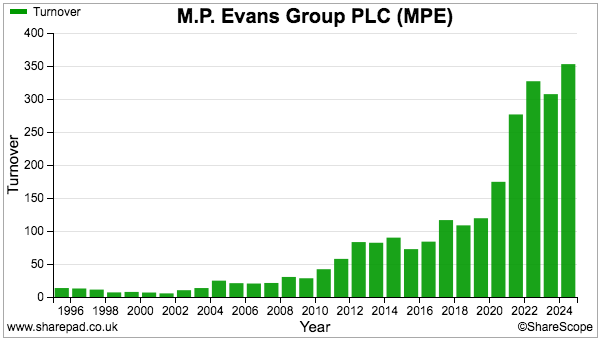

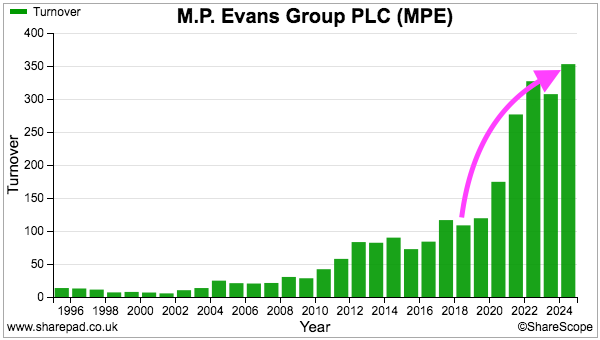

MP’s long-term financial history is not the easiest to interpret given the group’s restructure and disposals. But the general picture is one of very modest revenue until 2012, and then revenue really taking off during 2021 towards $300 million…

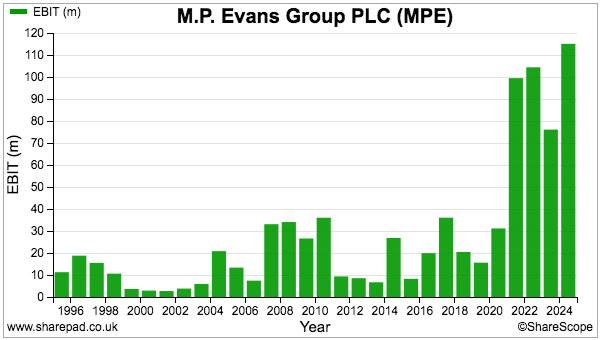

…which in turn led to profits surpassing $100 million during three of the the last four years:

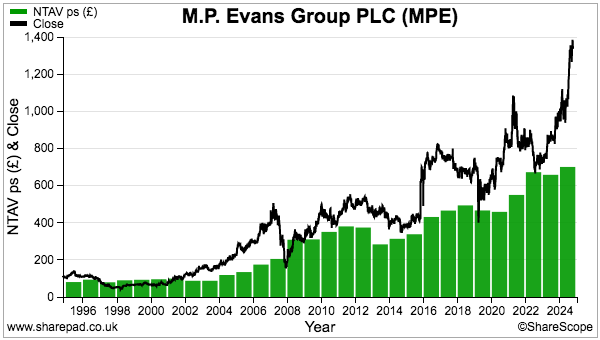

The share price has reacted accordingly, surging beyond £13 to support a £707 million market cap. The shares transferred to AIM during 2002 when they were priced at approximately 70p:

The Indonesian palm-oil industry is not an obvious source of investment growth, so what has actually happened to accelerate profits and the share price?

Palm oil

MP’s website provides some useful facts about the palm-oil industry.

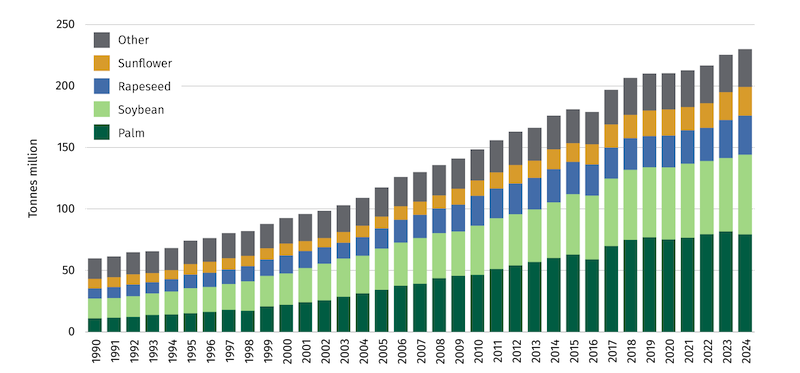

Palm oil is the most popular of the four major vegetable oils, with almost 80 million tonnes produced during 2024 of which 57% were from Indonesia. Since 1990, worldwide demand for vegetable oils has  increased at an average 3% a year, with palm-oil usage growing at 6%:

increased at an average 3% a year, with palm-oil usage growing at 6%:

Palm oil is used mainly as a cooking oil although it can, according to MP, be found within “approximately half of products in a UK supermarket… including shampoos, cosmetics, ice cream, biscuits, chocolate and cereals“.

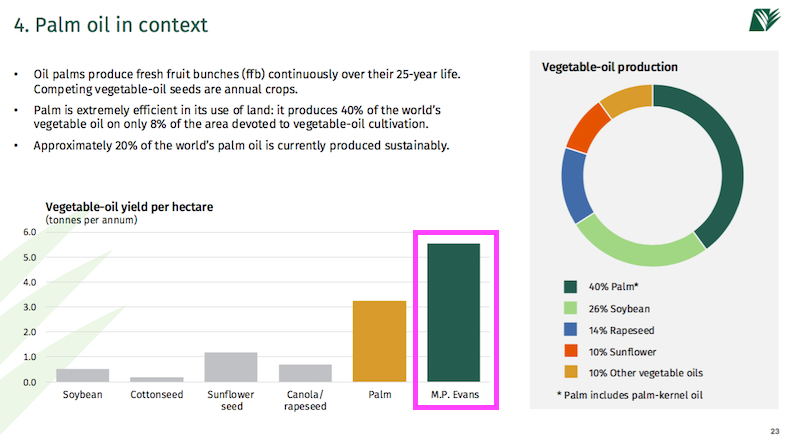

A particular financial attraction to palm oil is its greater ‘yield per hectare’:

Although palm oil supports 40% of the vegetable-oil market, palm-oil plantations represent only 8% of the land devoted to vegetable-oil production. The lower requirement for land — and therefore the greater yield per hectare — is due to oil palms producing fruit multiple times a year as opposed to just annually.

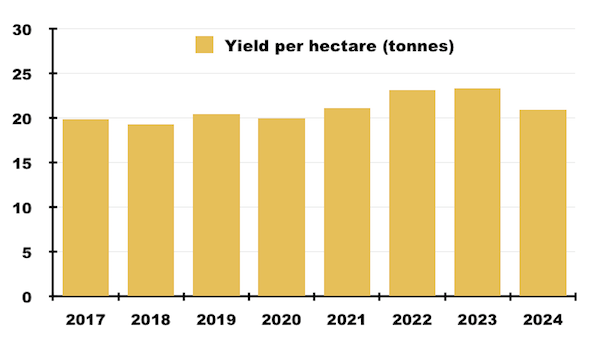

MP describes yield per hectare as the “most important measure of agricultural efficiency” and has reported the ratio to shareholders since 2017:

Yield per hectare has bobbed between 19 and 23 tonnes of crop during the last few years, and therefore does not obviously appear to have prompted that recent profit surge:

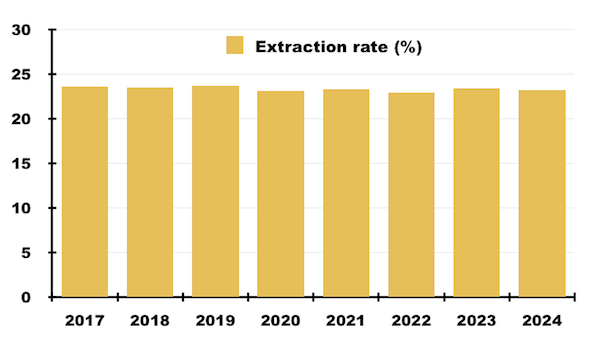

Another measure reported to shareholders is ‘extraction rate’, which reflects the amount of oil produced from each tonne of crop harvested. This rate has been very steady at approximately 23% for some years:

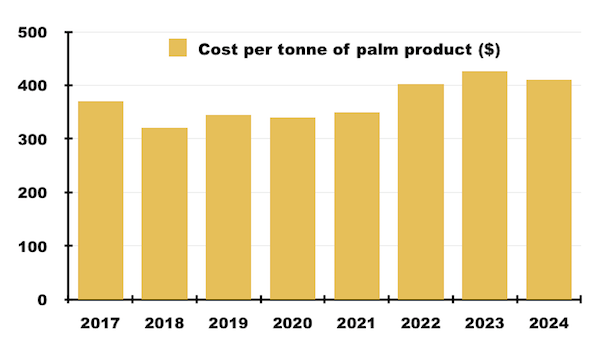

‘Cost per tonne of palm product’ is, according to MP, a “key determinant of profitability” and has crept beyond $400 during the last few years:

Those KPIs do not suggest immense productivity gains have supported profits racing beyond $100 million…

…which therefore leaves higher prices and greater volume to underpin the profit surge.

Indeed, the price of crude palm oil has in recent years consolidated above $1,000 per tonne for the first time since 2012:

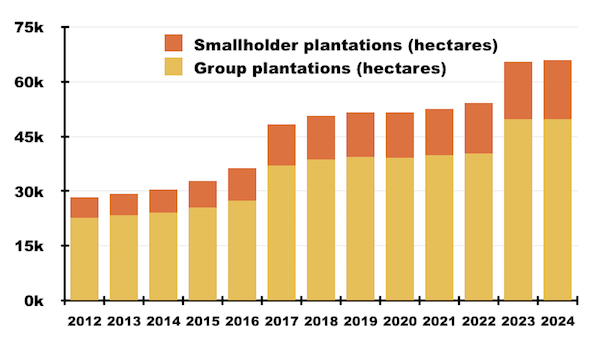

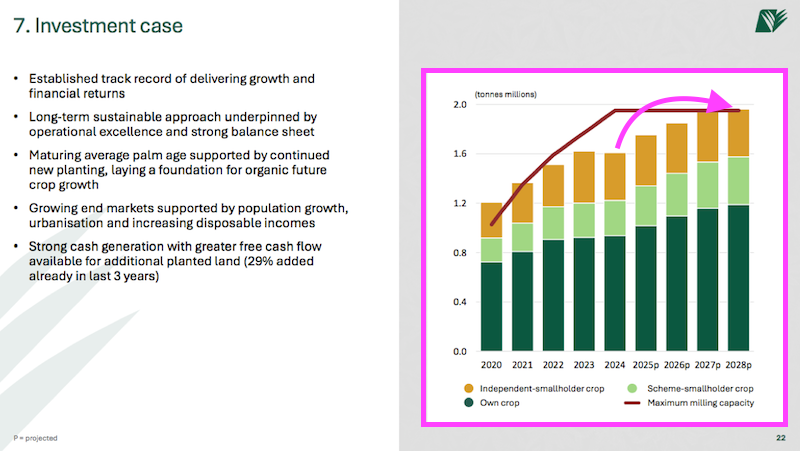

The size of MP’s plantation area has meanwhile more than doubled…

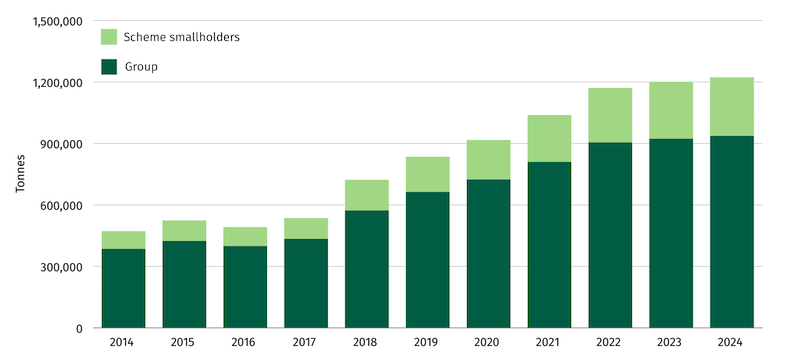

…which has allowed the volume of crop harvested from the group’s own plantations (and those of associated smallholders) to more than double as well:

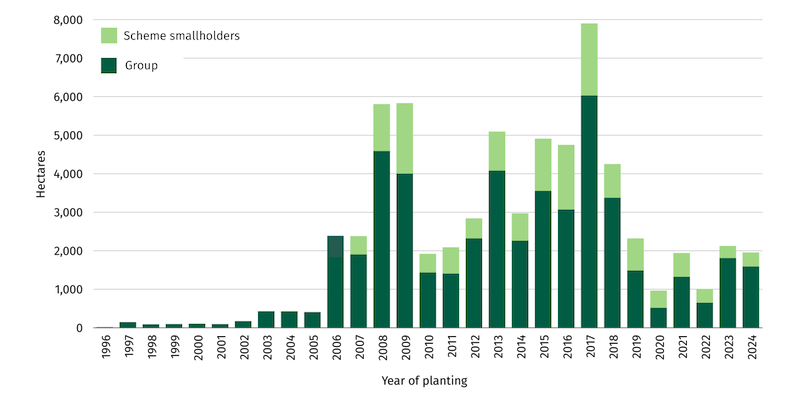

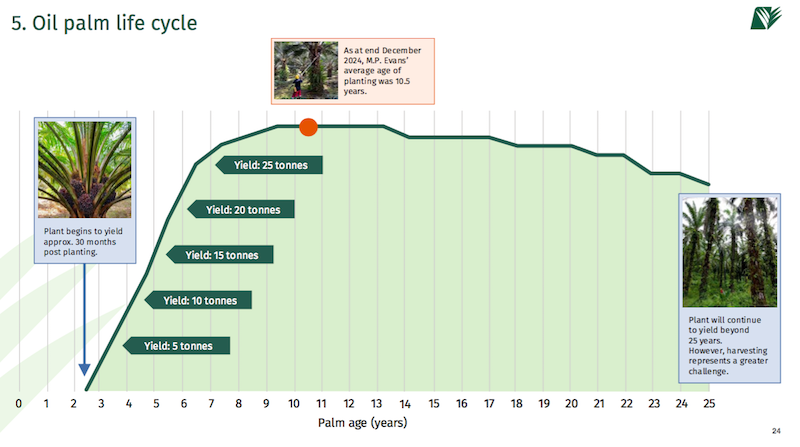

Another factor to consider is the improved maturity of MP’s plantations. This chart confirms the group undertook lots of new planting between 2008 and 2018…

…and oil palms apparently reach their maximum fruit yield after ten years:

MP’s plantations are on average 10.5 years old.

Financials

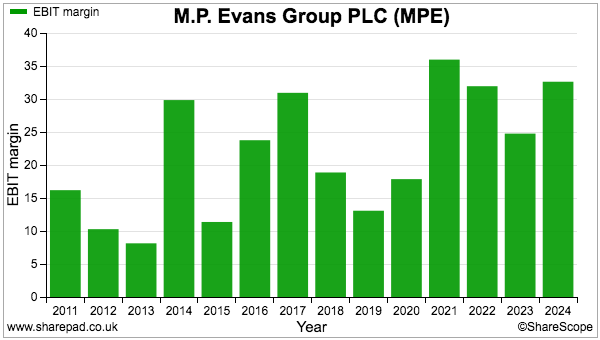

Probably MP’s most surprising ShareScope chart is shown below:

MP has many times during the last decade converted a healthy 20% or more of revenue into profit.

I must confess I am not exactly sure why MP can at times enjoy such an appealing profit margin when palm oil is essentially a commodity item.

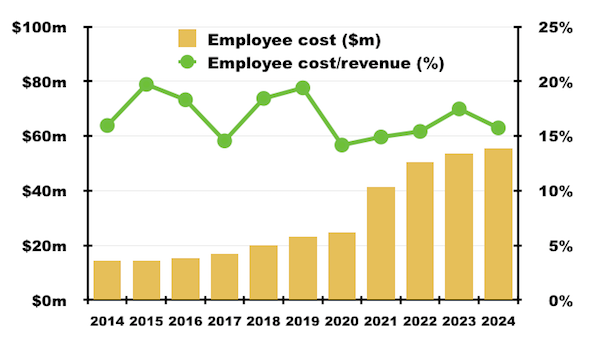

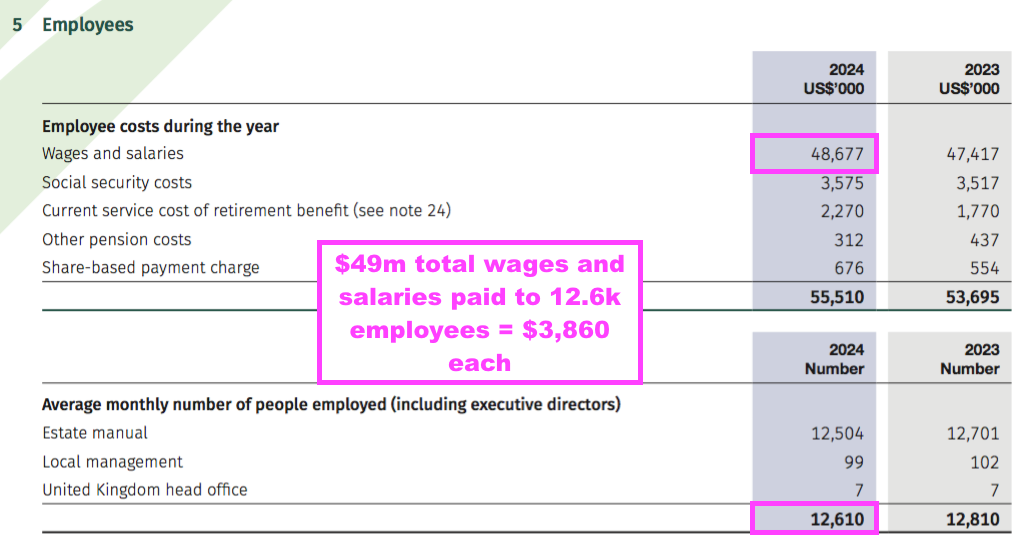

But helping matters are MP’s employee costs, which typically absorb only 17% of revenue:

Note the vast majority of MP’s employees are Indonesian plantation workers and the average group salary is less than $4k:

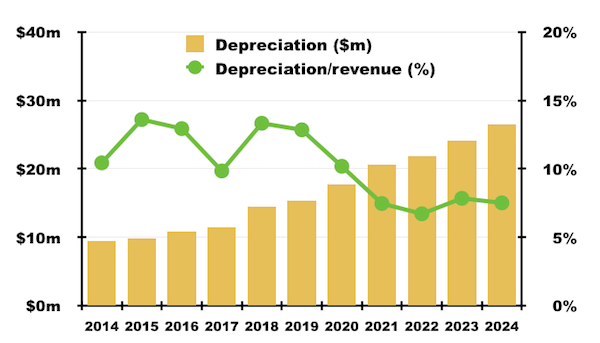

After employee costs, MP’s next-largest disclosed expense is depreciation, which during recent years has reduced from more than 12% to less than 8% of revenue:

Perhaps that high margin is due to MP depreciating its plantations over 20 years, which is a very long time to write down any company asset but may well be plausible for a palm-oil plant that can bear fruit for 25-plus years.

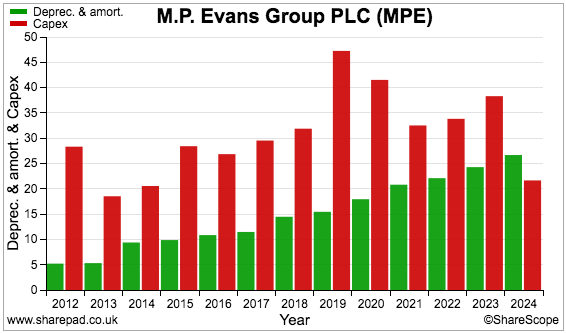

Note that cash capital expenditure has typically exceeded the depreciation charge by some distance as new land has been acquired, new facilities have been constructed and new plantations have been seeded:

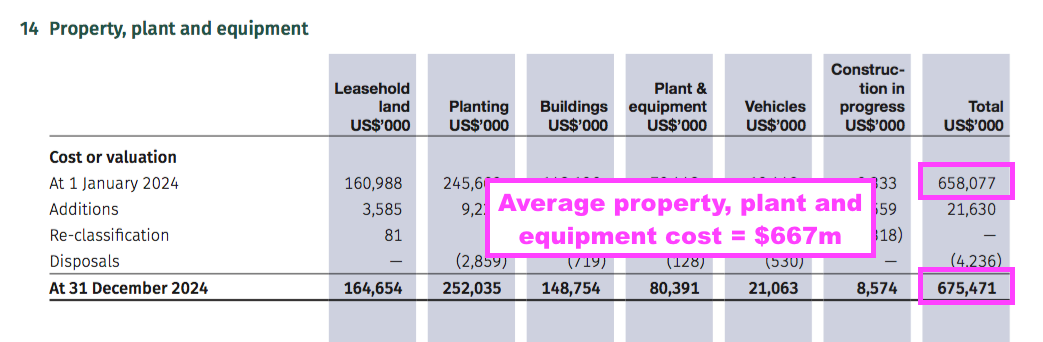

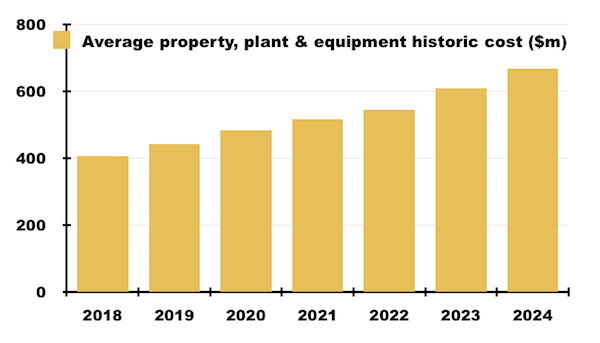

But the hefty capex seems to have paid off. For example, the 2024 accounts showed the average historic cost of all property, plant and equipment to be $667 million…

…versus an average $405 million for 2018 — an increase of 65%:

During the same time, revenue has advanced from $109 million to $353 million — an increase of 224%:

Enjoying a 224% revenue improvement after increasing plant, property and equipment by 65% seems like a very good payoff to me.

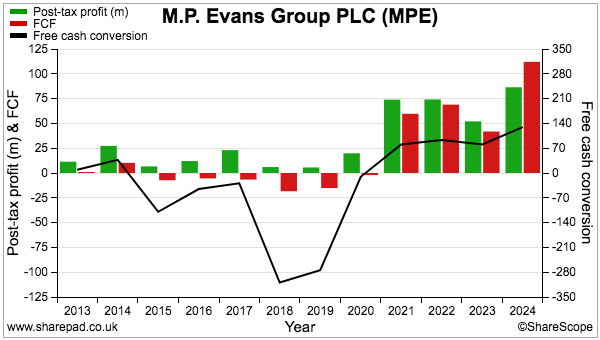

That payoff from the hefty capex can therefore excuse the resultant adverse cash conversion witnessed prior to 2021:

The bumper cash conversion since 2021 explains why the dividend then surged from 22p to 52.5p per share!

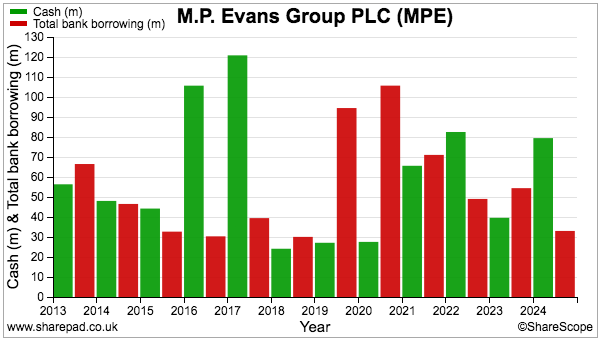

The bumper cash conversion also left the 2024 balance sheet net cash positive to the tune of $46 million:

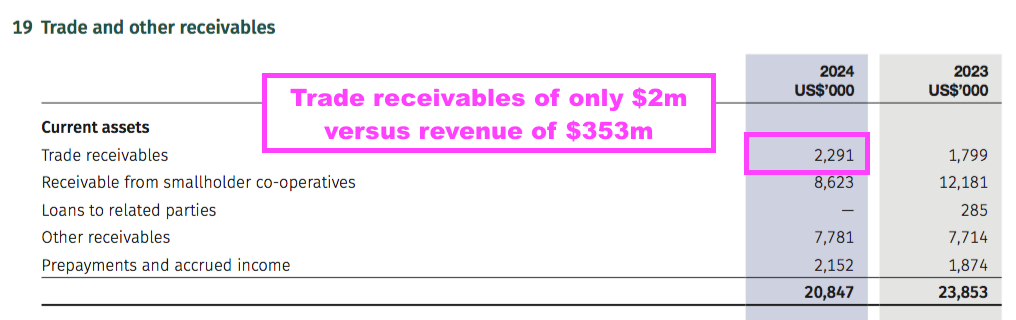

One remarkable feature of MP’s business is the very favourable payment arrangements with customers. According to MP, “the majority of palm-oil sales are made for cash payment in advance of delivery“.

Trade receivables at the end of 2024 were therefore a minuscule $2m versus revenue of $353 million:

Boardroom

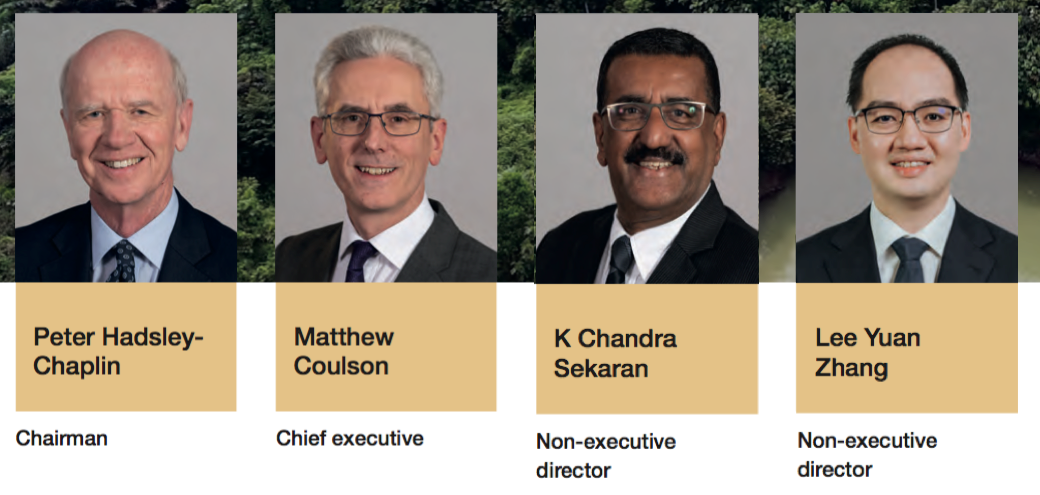

A long-running family presence within the boardroom may well have led to MP’s illustrious dividend record.

Chairman Peter Hadsley-Chaplin was first appointed a director during 1989 while his father, Edwin Hadsley-Chaplin, joined the company during 1947 and served on the board between 1981 and 1999. Peter Hadsley-Chaplin’s brother-in-law, Philip Fletcher, undertook various board roles between 1987 and 2023.

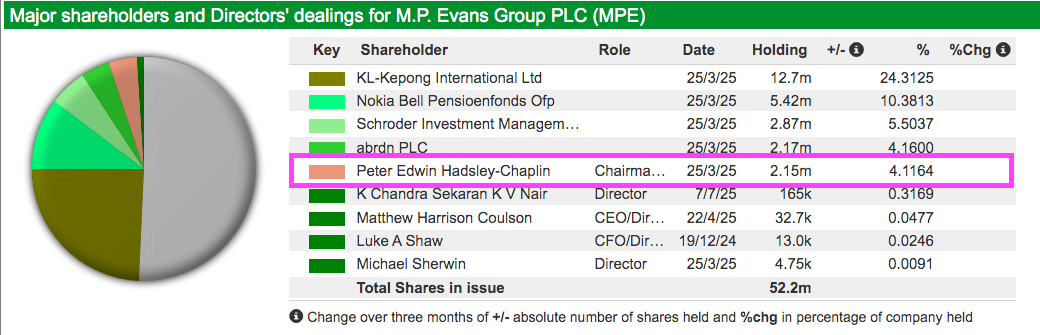

Peter Hadsley-Chaplin still owns a useful 4% stake valued at approximately £28 million:

Accompanying Mr Hadsley-Chaplin on the board is chief executive Matthew Coulson, who has been in charge since 2022 and is very much a numbers man rather than a plantation man. He previously served as MP’s finance director and before that was an audit director at Deloitte:

For a business now reporting a profit in excess of $100 million, the board does not seem overpaid with the chief exec collecting £818k and the finance director collecting £539k total remuneration (before option gains) last year. I note one of the non-execs collects a handy £344k “advisory fee” from a subsidiary, while granted options represent just 0.5% of the share count.

This year’s AGM Q&A was very convivial, with shareholders obviously pleased about the rising share price and greater dividend. I get the impression the annual meeting is a popular event attracting many regular, long-time attendees — who clearly identified MP’s dividend potential much earlier than me.

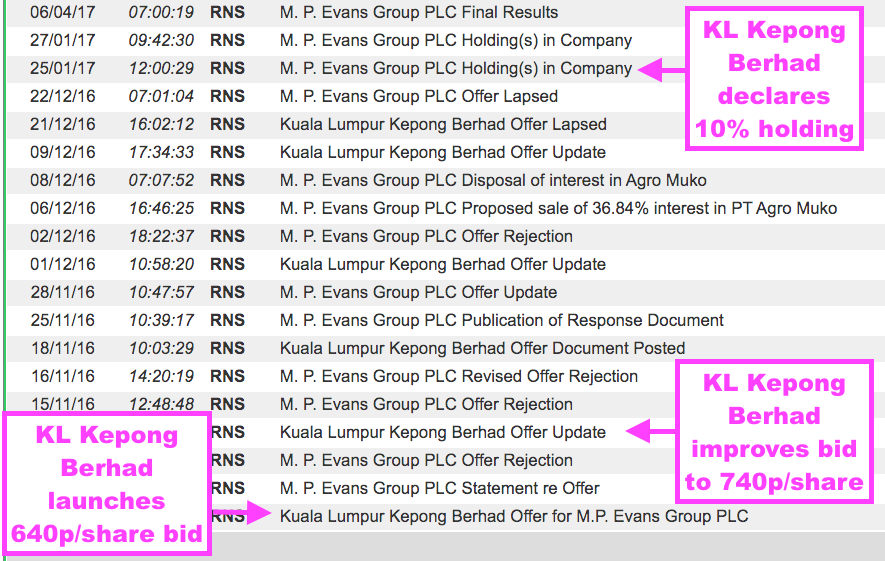

By far MP’s most intriguing director is non-exec Lee Yuan Zhang, who represents Kuala Lumpur Kepong Berhad, a £4 billion market-cap Malaysian group that owns 300,000-plus hectares of plantations in Malaysia and Indonesia.

KL Kepong Berhad failed to acquire MP for 740p per share during a 2016 bid approach:

KL Kepong Berhad presently owns 24% of MP and presumably rates the group very highly — and I speculate may one day reach an agreement to acquire the other 76%.

Valuation and summary

Half-year results published last month revealed further positive progress:

- Group harvest up 9% to 619k tonnes;

- Revenue up 10% to $179 million;

- Operating profit up 50% to $62 million;

- Earnings per share up 60% to 72p per share;

- Interim dividend up 20% to 18p per share, and;

- Net cash up $24m to $70m.

The superb profit advance was due mostly to i) the price of crude palm oil climbing 18%, and; ii) MP buying much less third-party crops for production.

The interims also noted the first two months of the second half had witnessed group harvest volumes up 6% and palm-oil pricing remaining “robust“.

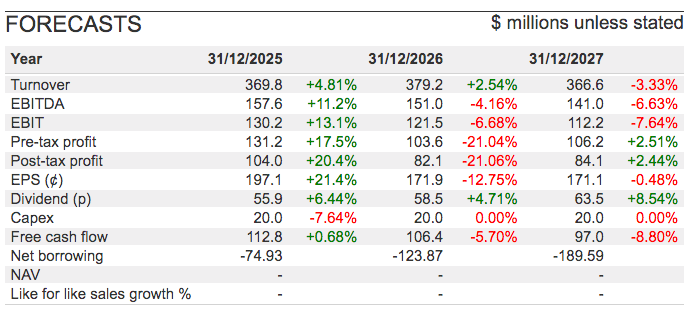

Brokers have translated the interims into the following forecasts:

The 2025 estimates imply the second half will largely match the second half of the prior year, which feels conservative to me following the strong first-half performance. The predicted 55.9p per share 2025 dividend in particular seems extremely cautious given the trailing twelve-month payout already stands at 55.5p per share.

I don’t know why the 2026 projections then show a profit setback.

The 4.1% yield is not as high as it was, but is higher than seen between 2005 and 2020:

Just so you know, MP through an independent valuation reckoned its plantations and other assets were worth £16.88 per share at the end of 2024 versus a 732p per share accounting net tangible asset value.

I presume the £16.88 per share calculation reflects the improved maturity of the plantations following their original purchase, but do bear in mind the stock market may not be entirely convinced about such ‘hidden value’. These shares have in fact traded close to their accounting book value on occasion:

Although MP is confident about total harvest volumes improving from 1.6 million to 1.9 million tonnes by 2029…

…I suspect MP’s financial progress will be dictated mostly by the price of palm oil.

Believe the palm-oil price will continue to trade above $1,000, then that high margin should create ample profit to lift the dividend further while also funding the purchase of new plantations for future growth.

But should the palm-oil price sink below $1,000 for a while, then future dividend advances may well become somewhat muted. Mind you, I am confident net cash now standing at $70m alongside the veteran, shareholder-friendly chairman can ensure the payout does not go into reverse.

Let me finish by congratulating those MP investors who have already bagged multiple dividends from this share. The business seems a very commendable operator within a very unglamorous sector, and the returns earned so far have been thoroughly deserved.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Maynard writes about his portfolio at maynardpaton.com. He does not own shares in MP Evans.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.