Richard is tempted by a growing business that employs 18 people and only earns £3m turnover. If it were up to him, all firms would disclose their chief executive to median employee pay ratio.

Just one company has published an annual report and passed the minimum quality filter since my last update. To pass the filter, a share must have been listed for more than eight years, averaged at least 5% Cash Return on Capital Invested over that period, and not spent more than it earned in free cash flow on acquisitions.

5 Strikes

The minimum quality filter is the first step in working out whether a company has made money adequately and grown under its own steam.

The second step is to cast an eye over the financials, to see how profitable it has been, how much debt it carries, how consistently it has grown, and to confirm the firm has not had to issue lots of shares to fund its activities.

Each time a company fails to meet my expectations, it receives a strike. If it receives more than two strikes it goes on the back-burner. Five strikes, and I forget about the share for a year at least. Two strikes or less, and I start thinking about whether I might want to invest for the long term…

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Rank | RNK | 16/9/25 | – CROCI – Debt – Growth – ROCE – Shares | X |

| Brooks Macdonald | BRK | 12/9/25 | ? Acquisitions – Holdings – Growth – ROCE ? Shares | 4 |

| Arcontech | ARC | 11/9/25 | – Growth | 1 |

| Click here for our 5 Strikes explainer | 18/09/2025 | |||

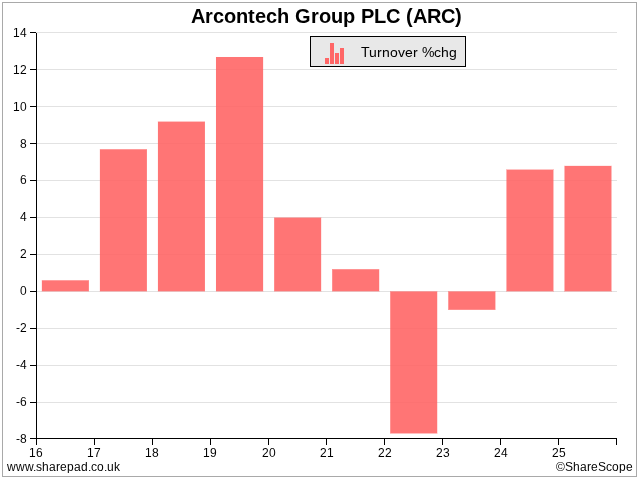

Arcontech (- Growth) has a good track record. The only strike is turnover growth, which has been modest in most years and negative in 2022-2023:

Arcontech develops software that uses price data for stock market instruments like shares, bonds, currencies and derivatives from suppliers like Bloomberg and LSEG Data & Analytics (formerly Refinitiv).

It integrates and displays the data through its own ShareScope-like terminal and third party software. It is a data distribution layer that allows financial institutions to pick and mix their data sources. Companies can sign up for Arcontech’s platform of off-the-shelf products or bespoke solutions.

Blue chip customers on Arcontech’s home page

The company is tiny. Despite the big customers advertised on its website and the fact that Arcontech has grown in eight of the last ten years, turnover was only £3.1 million in the year to June 2025. Profit (EBIT) was about £1 million.

Profitable, growing companies this size are fascinating because they fly below the radar of most investors, but there is so much we don’t know. The annual report reveals Arcontech has two main competitors, which suggests they are larger or the company exists in a tiny niche.

Personalities will be critical in a business this size. Arcontech only employs 18. It has a number of major individual shareholders on the register, the current chief executive, a former chief executive, a former chairman, a former non-executive director and a couple of individual investors. Most of them are long-term shareholders, and while it is reassuring that they appear to be committed, I’d like to know what they know.

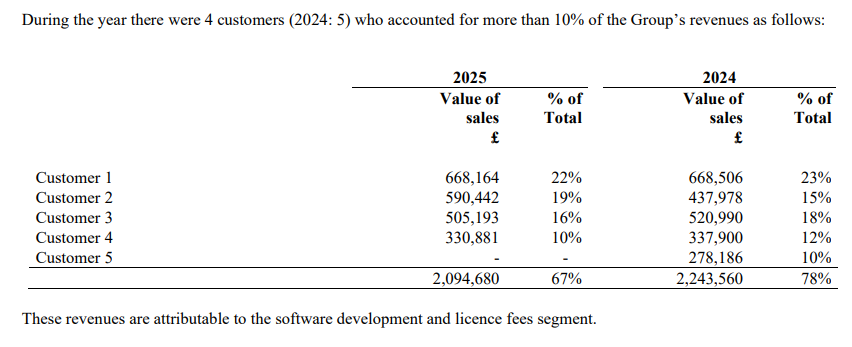

Each individual customer will be important too. Five of them were responsible for 67% of revenue in 2025:

Source: Arcontech full-year results, 2025

The loss of one of these customers, or the acquisition of a new one, could make a big difference to Arcontech.

Because of the risks, companies this size tend to be cheap. Arcontech’s PE ratio is 16, but that is deceptive. The £7 million of net cash on its balance sheet at the year end is worth more than half of its market capitalisation. The debt-adjusted PE is only 7.5 according to ShareScope.

Assuming we could get comfortable with the risks, trading is another hurdle. The abundance of major long-term shareholders further limits how many shares are available.

Out of curiosity, I spoofed one of the investment platforms I use to find out how many it would sell me. It would only give me a quote for 400 shares (£440). While we could probably get more if we put in a bigger order, or more than one order, shares that are difficult to buy in quantity tend to be difficult to sell too…

Filtering out fat cats

I have promised the chief financial officer of a large AIM listed firm a survey of its peers to support my request that it publish the ratio of the chief executive’s pay to the pay of the median employee.

Large fully listed firms have been required to report the ratio since 2020. This has given investors a useful method to judge whether companies pay employees fairly.

Fairness is a big deal for me. I want to hold shares for at least ten years. While businesses can take liberties in the short-term, gouging customers, suppliers, employees or shareholders over the long-term is not only unpleasant but also, I think, unsustainable.

Like all statistics, the median pay ratio must be considered in context. Some companies employ armies of relatively unskilled workers, and others small numbers of highly skilled employees. We should expect a chief executive of the former type of company to earn a bigger multiple of the median, or typical, employee’s pay than the latter.

I have had modest success lobbying small fully listed firms to include the ratio (they don’t have to if they employ fewer than 250 people in the UK). One promised to include it in its next annual report and subsequently complied. Another has promised, but has yet to publish an annual report.

So far, I have found only two AIM companies that publish any kind of chief executive to employee pay ratio.

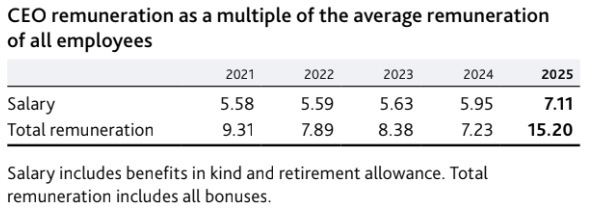

At Cohort, a gaggle of defence technology companies, chief executive Andy Thomis earned 15.2 times the average employee including benefits in 2025. In most years, he has earned less than 10 times average pay.

Source: Cohort annual report 2025 – page 68

These figures imply the average employee earned £53,000, which is pretty decent.

Cohort tells me this is the average it used is the mean though, which is less useful than the median because the mean can be distorted by a small number of high earners.

The company also tells me the median is probably quite similar because many employees are postgraduates so high earners are typical. It will collect the median next year if “practicable”.

Cohort appears to be the second kind of company I described. One you might expect to have a low ratio of chief executive pay to median employee pay.

Renew, an engineering company that maintains and improves road, rail, water, and energy infrastructure, employs less skilled workers in general. It employs over 4,000 people, many of them civil, mechanical and electrical engineers.

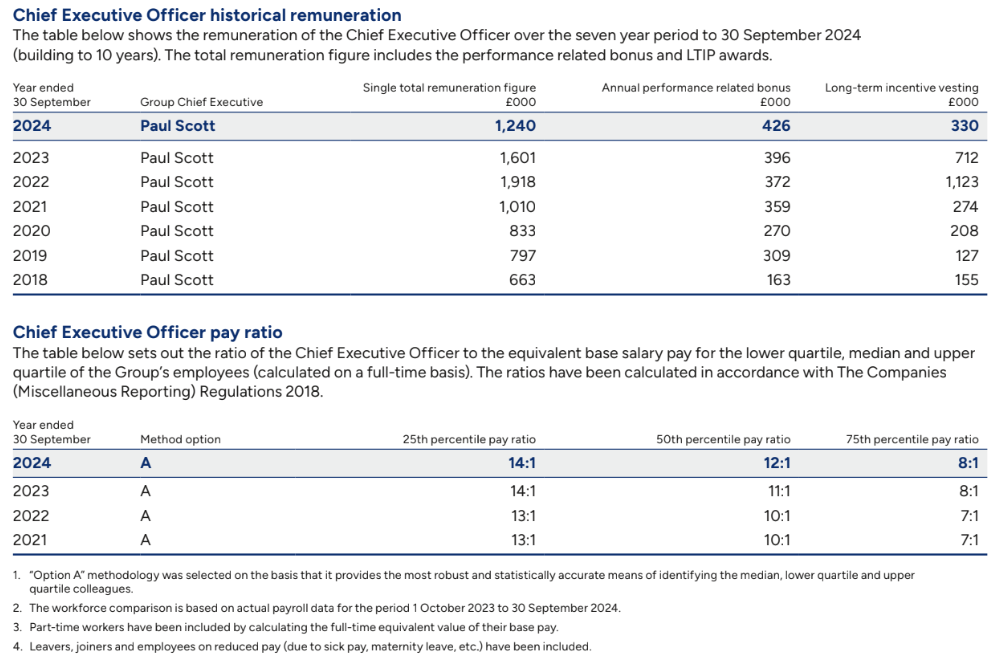

Although it is an AIM firm, Renew publishes the ratio of chief executive pay to the median employee:

Source: Renew annual report 2024

Paul Scott, Renew’s chief executive, earned 12 times the median income in 2024, which also looks restrained. Here, though, the rub is that the statistic compares base salary only.

Executives tend to receive a much greater proportion of their pay in bonuses, and fully listed firms disclose the ratios for both basic pay and total pay.

If we deduct Mr Scott’s performance related bonuses in 2025, and the long term share incentives that vested, we can calculate his base pay (just over £400,000), which means the median employee probably earned £34,000 and an employe on the 25th percentile (a low paid worker at Renew) earned about £29,000.

These are not particularly impressive salaries, but they are above the National Living Wage, and may well be good for the sector.

In my quest to persuade AIM firms to disclose more about pay, I am working through the annual reports of 79 AIM shares that pass my minimum quality filter.

Starting with the A’s, Cohort was the first share that made any kind of disclosure in its remuneration report. It was the 19th.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.