With Natural Gas down -20% YTD, renewable energy sources could be replacing demand for fossil fuels, reducing the risk of 1970’s style stagflation. Companies covered PLUS, MHA and ZTF.

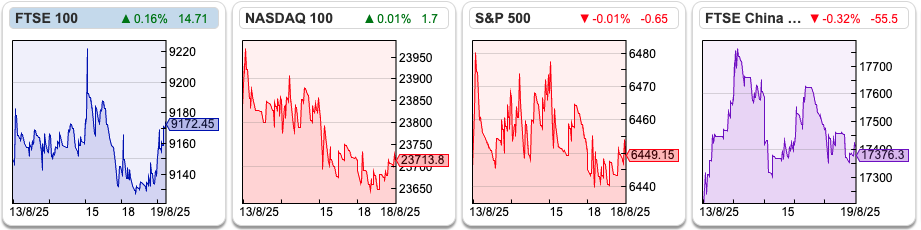

The FTSE 100 bounced around over the last 5 trading days, but finished flat versus the previous week at 9,172. The Nasdaq100 and S&P500 were up around +1% over the same time period. The Nikkei 225 was up +4.5% and is hitting new highs. Despite the ongoing conflict in Ukraine and the USA bombing Iran a couple of months ago, Natural Gas prices are down -20% YTD and down -70% since their peak in 2022.

Brent crude is at $65 per barrel, down -13% YTD causing problems for Saudi Aramco, which couldn’t cover its dividend from free cashflow in H1 and needed to borrow to pay its $43bn dividend in H1, according to Bloomberg. Saudi Crown Prince Mohammed bin Salman insisted Aramco was worth $2 trillion in 2016, while the market cap is currently $1.5trillion – perhaps he should try investing in smaller companies!

I think energy prices are starting to see the influence of the trillions invested in renewables, which an IEA reports puts around $2.2 trillion: nuclear, grids, storage, low-emissions fuels, efficiency and electrification, twice as much as the $1.1 trillion being spent on fossil fuels this year.

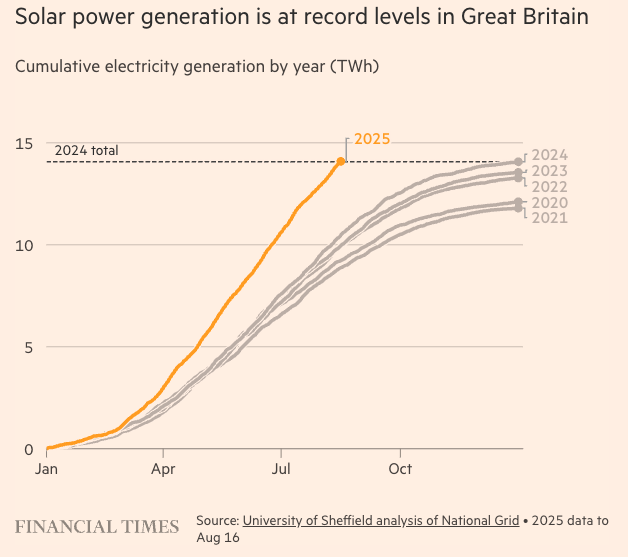

Around 70% of the increased spending on renewables came from net fossil fuel importers, as countries worried about energy security and energy independence. There’s a certain type of person on Twitter who seems to be ideologically opposed to renewables, believing the risks from climate change are being overstated. However, even if you think climate change is a hoax, surely it makes sense to invest in renewables rather than buy fossil fuels from countries with authoritarian leaders and poor human rights records? I have taken the chart below from an article in the Financial Times, which shows the increased capacity of solar power generation in the UK, up by a third versus Jan-Aug last year.

Solar power generation was up an impressive +25% Q1 v Q1 last year in Europe, but was more than offset by lower power generation from wind and hydro, down -8% and -12% respectively. That meant natural gas consumption in the first half of 2025 increased by 6.5% y-o-y in Europe. For 2026, gas demand in Europe is forecast by the IEA to decline by 2%, due to stronger renewables output. That could easily change, depending on the weather and the IEA says that its forecast is subject to an unusually wide range of uncertainties stemming from the broader geopolitical and macroeconomic environment.

As renewables are unreliable, the EU has been importing around €4.5bn of gas from Russia in Q1 of this year, according to TASS, the Russian news agency. That gives some context to Donald Trump’s threat of secondary tariffs for countries that continue to buy fossil fuels from Russia. Russia is still the second largest gas supplier to the EU, accounting for 18% of imports 3 years after Putin’s invasion of Ukraine. The EU’s largest supplier is the US which was 28% of gas imports, according to TASS.

So that strikes me as a risk worth keeping an eye on. If the investments in renewables keep energy costs and inflation under control (UK CPI currently below 4%) then that should be positive for markets. But, if we begin to see rising energy costs, then I would sell at the first signs of stagflation.

This week I look at Plus500 H1 Jun results and April IPO MHA which have both been performing strongly. Zotefoams, which makes foam for running shoes, aerospace and building insulation also reported an encouraging H1.

Plus500 H1 Jun 2025

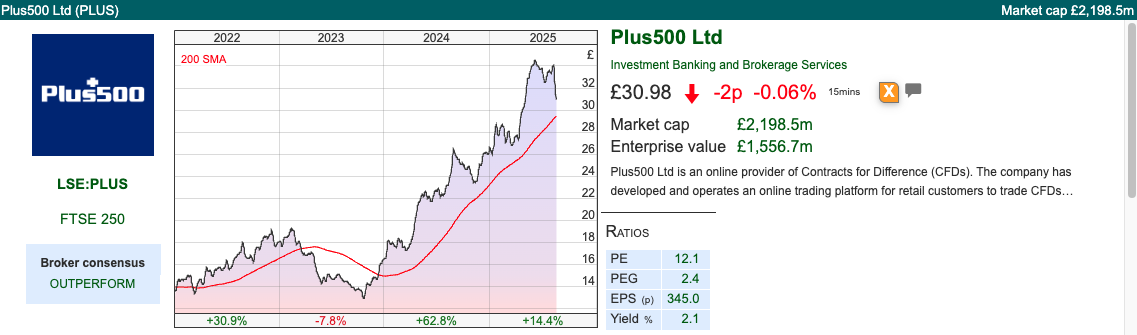

Plus500 describe themselves as a “multi-asset fintech group operating proprietary technology-based platform”. You could also call them a CFD trading company, headquartered in Haifa, Israel with an interesting history. Like the computer game publishers, the CFD platforms were victims of a sell-off as the pandemic ended, as people went out to pubs, concerts, festivals or the beach rather than sit indoors in front of a screen all day. Revenues peaked at $872m in Dec 2020, and fell to -23% Dec 2023, which resulted in a -46% decline in profits over the same time period. I have been surprised at how strongly the likes of PLUS and rivals, such as IG Group and CMC Markets, have recovered in the last 18 months.

Plus500 company reported H1 revenues +4% to $415m. That’s encouraging because the first quarter was weak, but they’ve benefited from tariff related volatility in Q2, up +15% versus the same quarter last year. Statutory PBT was down -1% to $182m, held back by an increase in marketing expenses, and other admin expenses. The increased marketing expenses are despite per customer acquisition costs falling to $1,237.

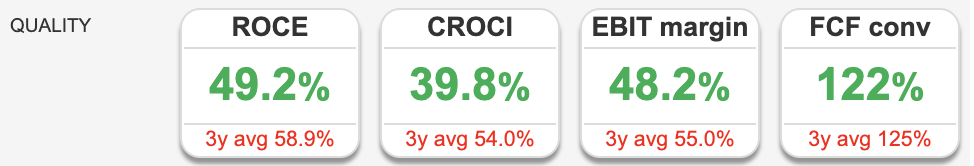

Given that around 80% of clients lose money trading CFD’s, marketing expenses (mainly annoying ads on YouTube and affiliate marketing) are required to attract new customers. Management say though that 47% of H1 2025 CFD trading revenue came from customers who have been trading with Plus500 for more than five years (up from 31% H1 last year). The EBITDA margin just reported is an impressive 45%, suggesting that the business model is highly profitable.

Given that around 80% of clients lose money trading CFD’s, marketing expenses (mainly annoying ads on YouTube and affiliate marketing) are required to attract new customers. Management say though that 47% of H1 2025 CFD trading revenue came from customers who have been trading with Plus500 for more than five years (up from 31% H1 last year). The EBITDA margin just reported is an impressive 45%, suggesting that the business model is highly profitable.

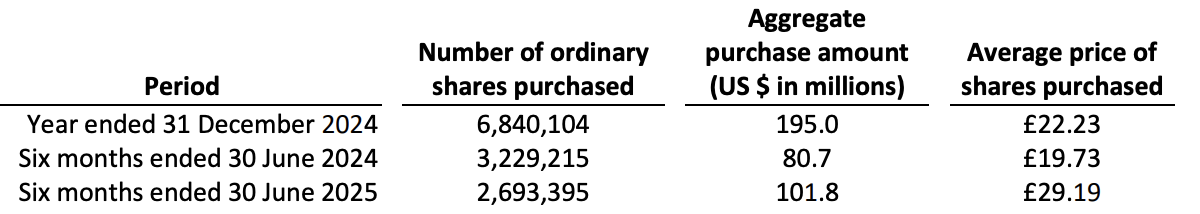

As of the end of June they had $938m of net cash on their balance sheet. Management have been using cash to buyback shares, as the table below with the average price paid shows.

Outlook: Management confirmed FY Dec results are expected to be in line with expectations. That implies revenue and EPS growing +5% this year and flat next year. A week after the H1 results, management announced that they have authorisation from the Colombian financial regulator to establish a representative office in Bogota. This is Plus550’s first expansion into Latin America with the new Colombian office allowing the Group to enhance relationships with local stakeholders. One of my friends told me her boyfriend does online CFD trading from Egypt, getting around the domestic ban by using a VPN; so I’m not sure whether authorisation from local regulators is significant. It does show Plus500 believe they have a global opportunity.

Valuation: The shares are trading on 11x Dec 2025F and 2026F PER. The large cash balance means EV/EBITDA is 6x those forecast years. This doesn’t seem like an area where investors will ever reward the shares with a high valuation multiple though, despite the strong track record.

Opinion: This has been a fantastic performer since it listed in London in 2013, with total returns to shareholders +7900%. I missed it, despite a friend tipping me off when they came to London that some smart fund managers were backing it as a high conviction idea. It just struck me that the numbers were real, but were not sustainable. That is, the business model assumed (correctly as it turned out) that PLUS would be able to replace the c. 80% of customers who consistently lose money, with more customers who would also lose money.

The mandatory FCA risk warnings that were introduced in 2019, which spelt out to customers that roughly 80% lose money, made much less difference than I had been assuming. I suppose it’s human nature that i) we all think that we are above average, ii) when we discover we’re not above average, we don’t like talking about how we lost money to warn others. Both of those points seem obvious in retrospect. It’s more than doubled since the end of 2023 so wouldn’t buy it here, but will make a note to follow developments more closely.

MHA FY Mar 2025

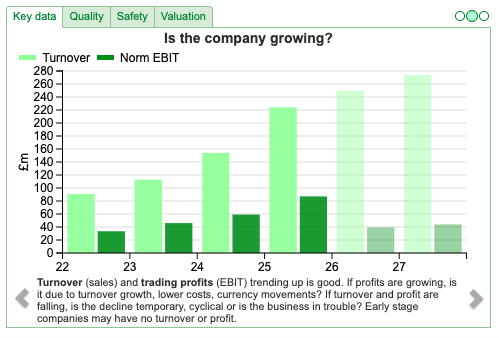

This professional services firm, which floated in April, produced a strong set of maiden results. FY Mar revenue was up +45% to £224m and statutory PBT was up +48% to £86m. There were a couple of acquisitions in the year Moore & Smalley, NW England and Roberts Nathan (Ireland) without which organic growth was +20%. Worth noting though, that there have been 7 acquisitions in the last 3 years. Perhaps indigestion from integrating all those businesses explains why it takes an accounting services firm so long to release its FY March results?

Net cash was £18m at the end of March, but then bolstered by their £96m capital raising in mid April. Just 14% of the net proceeds are receivable by the company to invest in technology to accelerate growth. Instead £77m of the proceeds raised will be used to repay loan notes to 19 Retiree Partners, as well as some continuing partners who are also selling out. There does seem to be some (deliberate?) vagueness in the Admission Document, I would have preferred more detail on the continuing partners cashing out.

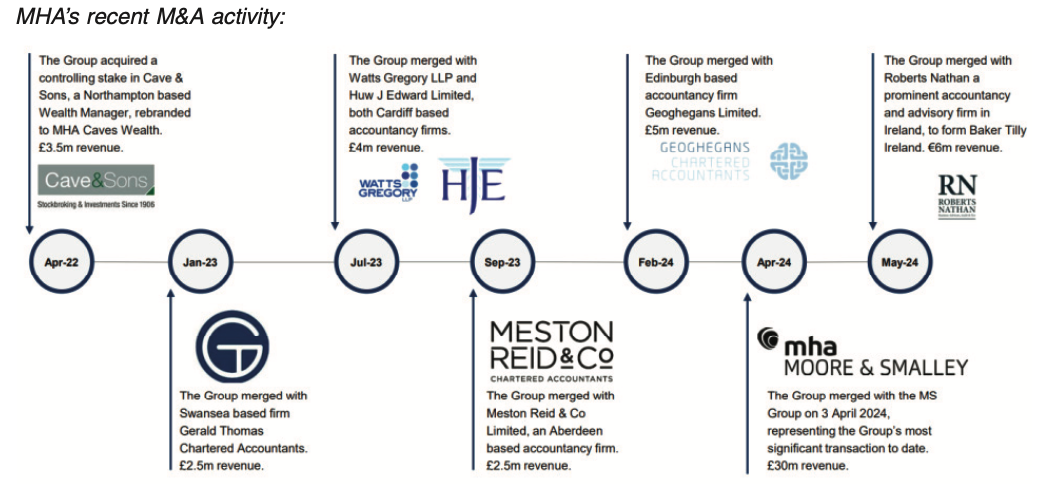

History: Macintyre Hudson can trace its origins back to 1869, but there’s been significant corporate activity since Rakesh Shaunak became a partner in 2010, establishing the MHA brand and joining the Baker Tilly International (BTI) Network in 2014. The BTI Network is a network of firms employing 43,500 people across 143 territories and generates c. $5.62 billion in revenue. MHA uses the MHA brand in the UK, but it benefits from being the UK and Ireland’s representative of the BTI Network – they have the right to use the Baker Tilly brand in Ireland. The Directors believe that MHA’s membership of the BTI Network presents further growth opportunities for the Group. Below is an infographic with the recent acquisitions.

Outlook: There’s been a strong start to FY Mar 2026 and they talk about building a £500m revenue business in the medium term. Cavendish are forecasting c. 10% sales growth this year and next, pointing out that 87% of revenue is recurring. PBT is forecast to halve in FY Mar 2026F and I couldn’t find any explanation for this in Cavendish’s note. Normally when you see an IPO, there are exceptional costs related to paying advisors for the IPO, but MHA’s FY Mar 2025F PBT at £86m implies the year just reported has seen an exceptional gain. Cavendish have FY Mar 2027F adj PBT of £43m forecast, which is below the £54m reported FY Mar 2024F.

Post reporting period: MHA announced 11th August, that it had acquired Baker Tilly South-East Europe, a leading professional services firm offering a comprehensive range of services to clients in Cyprus, Greece and South-East Europe, predominantly in audit, tax, advisory, legal and corporate services for €20m initial consideration in cash and shares.

Valuation: The shares are trading on just under 14x PER Mar 2026F, and around 9x EV/EBITDA the same year. That seems about right, on the one hand: it’s a people business paying goodwill to acquire people, on the other hand: client relationships should last years.

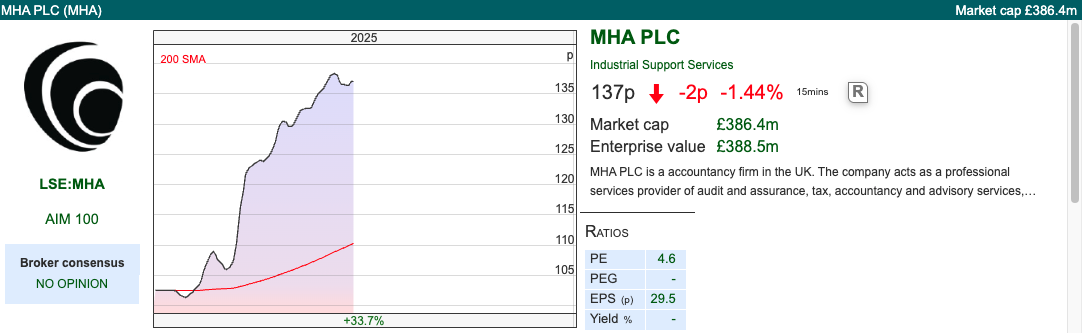

Opinion: Financials look very attractive with EBIT margins in the high 30’s and RoCE rising to 90% in the year just reported. Shares have been strong, up +33% since the IPO. The combination of growth and high profitability could be exciting, but I am also wary of it being a recent IPO. I will sit on the fence for now.

Zotefoams H1 Jun 2025

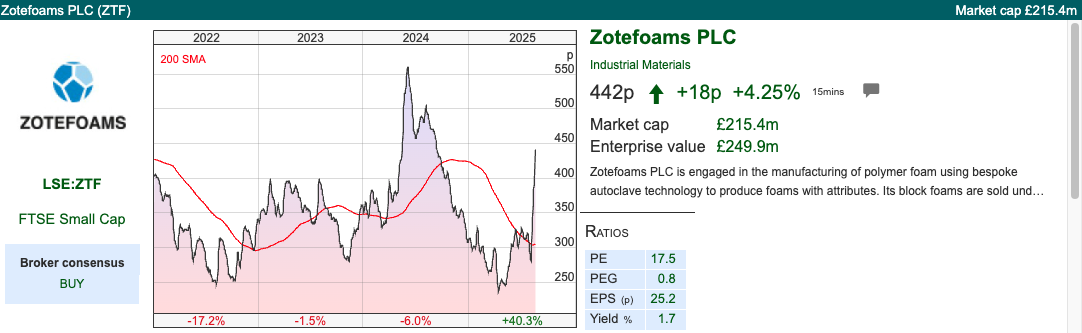

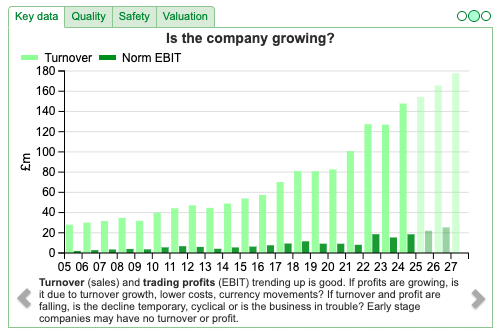

Cockney Rebel likes the investment case here. H1 Jun revenues were up +9% to £77m, the operating margin has improved by 2.2% to 15.8% so that PBT is +37% to £11.4m. Net debt adjusted for IFRS 16 is down -40% to £21m.

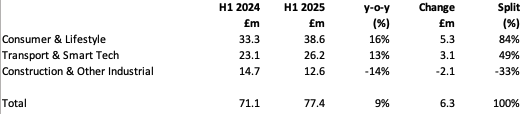

I’ve created an Excel table with the revenue growth split below, Consumer & Lifestyle is mainly the foam that goes into shoes, including Nike shoes. As last year was an Olympic year, they had been expecting the division to struggle to beat a tough comparator year last year, so the +16% growth achieved is particularly encouraging. The other divisions: Transport & Tech +13% is aerospace, industrial packaging and medical versus the declining -14% Construction division, which is insulation foam in buildings.

Theres’s also a joint venture announcement, with a Vietnamese shoe manufacturing company. Seoheung is to invest $10m for a 17.5% stake in the Vietnam JV, with an option to invest a further $14m to bring their stake to 35%.

Outlook: Given the strong H1 2025 performance and momentum carried into the second half, the Board now expects to deliver full year underlying profit before taxation ahead of current market expectations.

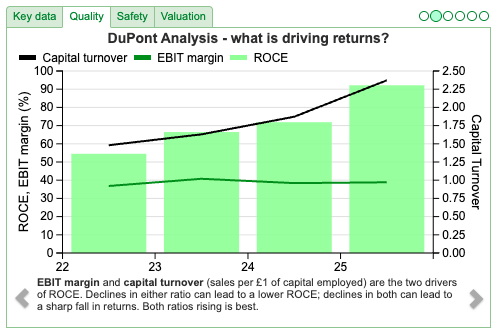

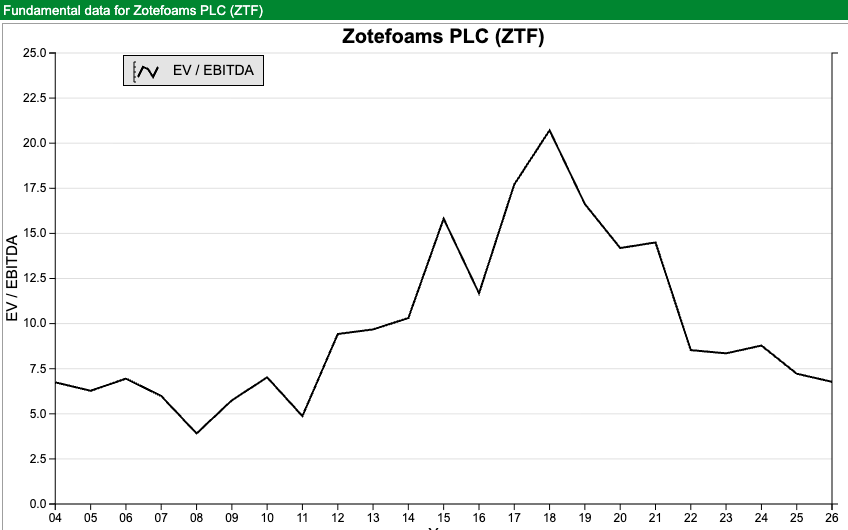

Valuation: The shares are trading on 13x PER Dec 2026F and 7x EV/EBITDA the same year. Below is a chart showing EV/EBITDA reached a peak valuation of almost 20x just before the pandemic, but 7x looks inline with the long term history.

Opinion: I think ZTF brands like ZOTEK®, AZOTE® and T-FIT® are fairly commoditised, and end demand for running shoes could disappoint at some stage. Good to see it enjoying a tail wind for now though. They did have a circular packaging technology with patent protection, called ReZorce, that would help recycle soft drinks cartons. The Chief Exec, Ronan Cox, came in last May and put that on the back-burner deciding to focus on the core business. That seems to have hurt sentiment with the shares falling below 250p in April, before bouncing strongly driven by reporting encouraging results in the core business. I think the investment case is OK, but I’m not as excited as Cockney Rebel is.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 20/08/2025 | PLUS, MHA, ZTF | A look at energy costs

With Natural Gas down -20% YTD, renewable energy sources could be replacing demand for fossil fuels, reducing the risk of 1970’s style stagflation. Companies covered PLUS, MHA and ZTF.

The FTSE 100 bounced around over the last 5 trading days, but finished flat versus the previous week at 9,172. The Nasdaq100 and S&P500 were up around +1% over the same time period. The Nikkei 225 was up +4.5% and is hitting new highs. Despite the ongoing conflict in Ukraine and the USA bombing Iran a couple of months ago, Natural Gas prices are down -20% YTD and down -70% since their peak in 2022.

Brent crude is at $65 per barrel, down -13% YTD causing problems for Saudi Aramco, which couldn’t cover its dividend from free cashflow in H1 and needed to borrow to pay its $43bn dividend in H1, according to Bloomberg. Saudi Crown Prince Mohammed bin Salman insisted Aramco was worth $2 trillion in 2016, while the market cap is currently $1.5trillion – perhaps he should try investing in smaller companies!

I think energy prices are starting to see the influence of the trillions invested in renewables, which an IEA reports puts around $2.2 trillion: nuclear, grids, storage, low-emissions fuels, efficiency and electrification, twice as much as the $1.1 trillion being spent on fossil fuels this year.

Around 70% of the increased spending on renewables came from net fossil fuel importers, as countries worried about energy security and energy independence. There’s a certain type of person on Twitter who seems to be ideologically opposed to renewables, believing the risks from climate change are being overstated. However, even if you think climate change is a hoax, surely it makes sense to invest in renewables rather than buy fossil fuels from countries with authoritarian leaders and poor human rights records? I have taken the chart below from an article in the Financial Times, which shows the increased capacity of solar power generation in the UK, up by a third versus Jan-Aug last year.

Solar power generation was up an impressive +25% Q1 v Q1 last year in Europe, but was more than offset by lower power generation from wind and hydro, down -8% and -12% respectively. That meant natural gas consumption in the first half of 2025 increased by 6.5% y-o-y in Europe. For 2026, gas demand in Europe is forecast by the IEA to decline by 2%, due to stronger renewables output. That could easily change, depending on the weather and the IEA says that its forecast is subject to an unusually wide range of uncertainties stemming from the broader geopolitical and macroeconomic environment.

As renewables are unreliable, the EU has been importing around €4.5bn of gas from Russia in Q1 of this year, according to TASS, the Russian news agency. That gives some context to Donald Trump’s threat of secondary tariffs for countries that continue to buy fossil fuels from Russia. Russia is still the second largest gas supplier to the EU, accounting for 18% of imports 3 years after Putin’s invasion of Ukraine. The EU’s largest supplier is the US which was 28% of gas imports, according to TASS.

So that strikes me as a risk worth keeping an eye on. If the investments in renewables keep energy costs and inflation under control (UK CPI currently below 4%) then that should be positive for markets. But, if we begin to see rising energy costs, then I would sell at the first signs of stagflation.

This week I look at Plus500 H1 Jun results and April IPO MHA which have both been performing strongly. Zotefoams, which makes foam for running shoes, aerospace and building insulation also reported an encouraging H1.

Plus500 H1 Jun 2025

Plus500 describe themselves as a “multi-asset fintech group operating proprietary technology-based platform”. You could also call them a CFD trading company, headquartered in Haifa, Israel with an interesting history. Like the computer game publishers, the CFD platforms were victims of a sell-off as the pandemic ended, as people went out to pubs, concerts, festivals or the beach rather than sit indoors in front of a screen all day. Revenues peaked at $872m in Dec 2020, and fell to -23% Dec 2023, which resulted in a -46% decline in profits over the same time period. I have been surprised at how strongly the likes of PLUS and rivals, such as IG Group and CMC Markets, have recovered in the last 18 months.

Plus500 company reported H1 revenues +4% to $415m. That’s encouraging because the first quarter was weak, but they’ve benefited from tariff related volatility in Q2, up +15% versus the same quarter last year. Statutory PBT was down -1% to $182m, held back by an increase in marketing expenses, and other admin expenses. The increased marketing expenses are despite per customer acquisition costs falling to $1,237.

As of the end of June they had $938m of net cash on their balance sheet. Management have been using cash to buyback shares, as the table below with the average price paid shows.

Outlook: Management confirmed FY Dec results are expected to be in line with expectations. That implies revenue and EPS growing +5% this year and flat next year. A week after the H1 results, management announced that they have authorisation from the Colombian financial regulator to establish a representative office in Bogota. This is Plus550’s first expansion into Latin America with the new Colombian office allowing the Group to enhance relationships with local stakeholders. One of my friends told me her boyfriend does online CFD trading from Egypt, getting around the domestic ban by using a VPN; so I’m not sure whether authorisation from local regulators is significant. It does show Plus500 believe they have a global opportunity.

Valuation: The shares are trading on 11x Dec 2025F and 2026F PER. The large cash balance means EV/EBITDA is 6x those forecast years. This doesn’t seem like an area where investors will ever reward the shares with a high valuation multiple though, despite the strong track record.

Opinion: This has been a fantastic performer since it listed in London in 2013, with total returns to shareholders +7900%. I missed it, despite a friend tipping me off when they came to London that some smart fund managers were backing it as a high conviction idea. It just struck me that the numbers were real, but were not sustainable. That is, the business model assumed (correctly as it turned out) that PLUS would be able to replace the c. 80% of customers who consistently lose money, with more customers who would also lose money.

The mandatory FCA risk warnings that were introduced in 2019, which spelt out to customers that roughly 80% lose money, made much less difference than I had been assuming. I suppose it’s human nature that i) we all think that we are above average, ii) when we discover we’re not above average, we don’t like talking about how we lost money to warn others. Both of those points seem obvious in retrospect. It’s more than doubled since the end of 2023 so wouldn’t buy it here, but will make a note to follow developments more closely.

MHA FY Mar 2025

This professional services firm, which floated in April, produced a strong set of maiden results. FY Mar revenue was up +45% to £224m and statutory PBT was up +48% to £86m. There were a couple of acquisitions in the year Moore & Smalley, NW England and Roberts Nathan (Ireland) without which organic growth was +20%. Worth noting though, that there have been 7 acquisitions in the last 3 years. Perhaps indigestion from integrating all those businesses explains why it takes an accounting services firm so long to release its FY March results?

Net cash was £18m at the end of March, but then bolstered by their £96m capital raising in mid April. Just 14% of the net proceeds are receivable by the company to invest in technology to accelerate growth. Instead £77m of the proceeds raised will be used to repay loan notes to 19 Retiree Partners, as well as some continuing partners who are also selling out. There does seem to be some (deliberate?) vagueness in the Admission Document, I would have preferred more detail on the continuing partners cashing out.

History: Macintyre Hudson can trace its origins back to 1869, but there’s been significant corporate activity since Rakesh Shaunak became a partner in 2010, establishing the MHA brand and joining the Baker Tilly International (BTI) Network in 2014. The BTI Network is a network of firms employing 43,500 people across 143 territories and generates c. $5.62 billion in revenue. MHA uses the MHA brand in the UK, but it benefits from being the UK and Ireland’s representative of the BTI Network – they have the right to use the Baker Tilly brand in Ireland. The Directors believe that MHA’s membership of the BTI Network presents further growth opportunities for the Group. Below is an infographic with the recent acquisitions.

Outlook: There’s been a strong start to FY Mar 2026 and they talk about building a £500m revenue business in the medium term. Cavendish are forecasting c. 10% sales growth this year and next, pointing out that 87% of revenue is recurring. PBT is forecast to halve in FY Mar 2026F and I couldn’t find any explanation for this in Cavendish’s note. Normally when you see an IPO, there are exceptional costs related to paying advisors for the IPO, but MHA’s FY Mar 2025F PBT at £86m implies the year just reported has seen an exceptional gain. Cavendish have FY Mar 2027F adj PBT of £43m forecast, which is below the £54m reported FY Mar 2024F.

Post reporting period: MHA announced 11th August, that it had acquired Baker Tilly South-East Europe, a leading professional services firm offering a comprehensive range of services to clients in Cyprus, Greece and South-East Europe, predominantly in audit, tax, advisory, legal and corporate services for €20m initial consideration in cash and shares.

Valuation: The shares are trading on just under 14x PER Mar 2026F, and around 9x EV/EBITDA the same year. That seems about right, on the one hand: it’s a people business paying goodwill to acquire people, on the other hand: client relationships should last years.

Opinion: Financials look very attractive with EBIT margins in the high 30’s and RoCE rising to 90% in the year just reported. Shares have been strong, up +33% since the IPO. The combination of growth and high profitability could be exciting, but I am also wary of it being a recent IPO. I will sit on the fence for now.

Zotefoams H1 Jun 2025

Cockney Rebel likes the investment case here. H1 Jun revenues were up +9% to £77m, the operating margin has improved by 2.2% to 15.8% so that PBT is +37% to £11.4m. Net debt adjusted for IFRS 16 is down -40% to £21m.

I’ve created an Excel table with the revenue growth split below, Consumer & Lifestyle is mainly the foam that goes into shoes, including Nike shoes. As last year was an Olympic year, they had been expecting the division to struggle to beat a tough comparator year last year, so the +16% growth achieved is particularly encouraging. The other divisions: Transport & Tech +13% is aerospace, industrial packaging and medical versus the declining -14% Construction division, which is insulation foam in buildings.

Theres’s also a joint venture announcement, with a Vietnamese shoe manufacturing company. Seoheung is to invest $10m for a 17.5% stake in the Vietnam JV, with an option to invest a further $14m to bring their stake to 35%.

Outlook: Given the strong H1 2025 performance and momentum carried into the second half, the Board now expects to deliver full year underlying profit before taxation ahead of current market expectations.

Valuation: The shares are trading on 13x PER Dec 2026F and 7x EV/EBITDA the same year. Below is a chart showing EV/EBITDA reached a peak valuation of almost 20x just before the pandemic, but 7x looks inline with the long term history.

Opinion: I think ZTF brands like ZOTEK®, AZOTE® and T-FIT® are fairly commoditised, and end demand for running shoes could disappoint at some stage. Good to see it enjoying a tail wind for now though. They did have a circular packaging technology with patent protection, called ReZorce, that would help recycle soft drinks cartons. The Chief Exec, Ronan Cox, came in last May and put that on the back-burner deciding to focus on the core business. That seems to have hurt sentiment with the shares falling below 250p in April, before bouncing strongly driven by reporting encouraging results in the core business. I think the investment case is OK, but I’m not as excited as Cockney Rebel is.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.