Richard makes a rare find, a company with no strikes to its name. He also stripped down his 5 Strikes system and checked its components to make sure it was fit for the purpose in 2025.

Happy New Year!

And a propitious one it is too, because the only company to have scored less than 3 strikes on my 5 Strikes test since the last update is completely untarnished.

Cerillion (0 strikes) provides billing, charging and customer relationship software as a service, mainly to Telecoms companies.

|

Name |

TIDM |

Prev AR |

Holdings (%) |

Strikes |

# Strikes |

|---|---|---|---|---|---|

|

Character Group |

CCT |

18/12/24 |

20.8 |

– CROCI – Growth |

2 |

|

Chemring |

CHG |

17/12/24 |

0.3 |

– Holdings – Growth – ROCE |

3 |

|

Imperial Brands |

IMB |

16/12/24 |

0.1 |

– Holdings – Debt – Growth |

3 |

|

Cerillion |

CER |

13/12/24 |

30.5 |

0 |

At this time of year, I document changes to the 5 Strikes system so that you have an up to date guide, and I can make sure the system still coheres.

Intro to 5 Strikes

5 Strikes is my way of deciding how likely a share is to be a good candidate for in-depth research. I look for reasons I might not want to invest in a share and award each one a strike.

The fewer the strikes, the better.

The process, which takes maybe a minute per share, requires me to examine a company’s financial track record in a ShareScope custom table.

To reduce the number of shares I must examine, I employ a ShareScope filter to weed out shares that are very unlikely to interest me.

I award strikes once a year for every company that passes the filter, soon after it has published its annual report.

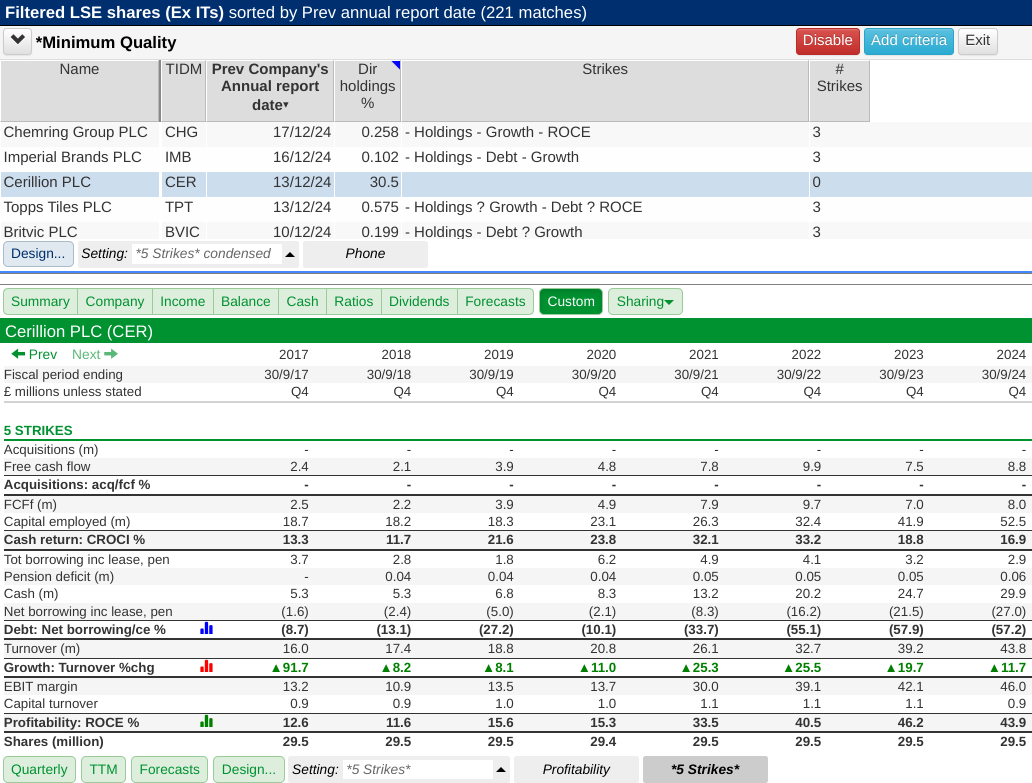

To show you how let us take a closer look at my “Minimum Quality” filter and “5 Strikes” custom table. Here they are arranged in a vertical ShareScope layout:

In this screenshot, the Minimum Quality filter is collapsed (we will open it up soon).

The list view is sorted by Previous Company Annual Report Date. This is how I know which companies have published annual reports recently.

The list view also tells me the proportion of shares owned by directors, and I use two note fields to itemise the strikes I have awarded each share and sum them up.

The 5 Strikes custom table shows Cerillion’s financial track record.

Minimum quality filter

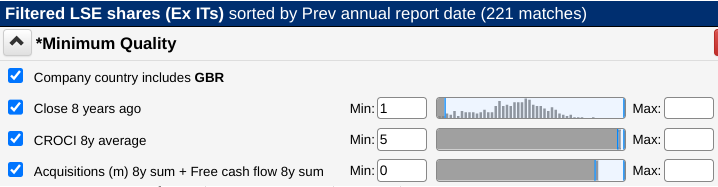

I apply the Minimum Quality filter to one of ShareScope’s standard lists (LSE shares ex. investment trusts). Currently, this list contains 1,405 shares. The following criteria reduce it to a more manageable 221:

Company country code includes GBR

This criterion restricts the Minimum Quality filter to companies headquartered in the UK. That way I do not have to worry about why a company domiciled abroad has chosen to list here, overseas legal, tax and regulatory regimes, and getting to the annual general meeting should I become a shareholder.

Close 8 years ago (Minimum 1p)

This criterion excludes all companies that have been listed in the UK for less than eight years. I do this for two reasons:

- An eight-year track record should be enough to judge how a firm has performed in different economic circumstances.

- There is also strong evidence that older “Seasoned” companies tend to perform better in aggregate than younger ones.

CROCI 8-year average (minimum 5%)

CROCI is a measure of return. It shows how efficiently a company converts the money it has invested into cash.

In choosing a 5% threshold I deliberately set the bar low. A company could probably do almost as well collecting interest from a bank account as investing in its own operations if the return is just 5%.

I did not set the bar higher because there are often good reasons why the cash return might be low.

For example, capital invested includes new investment, as well as the investment required to maintain a company’s existing capital base (its equipment and facilities for example).

CROCI can be depressed if companies are deferring gratification – making investments now, to earn even more cash in future.

Acquisitions (m) 8y sum + Free Cash Flow 8y sum

To my mind, companies that spend more than they earn in free cash flow on acquisitions are living beyond their means. They cannot keep raising funds from shareholders or lenders forever to fund expansion.

Also, highly acquisitive companies are changing radically. The historical record we are looking at may not be relevant to the business today.

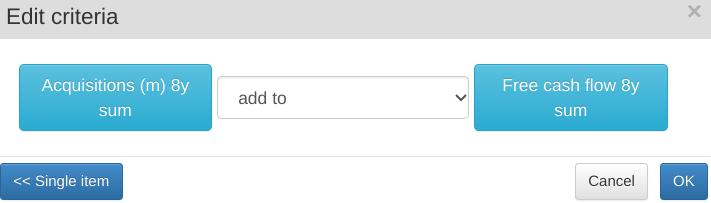

Unlike the other filter criteria, this is not a standard ShareScope data item.

To work out whether acquisitions exceed free cash flow, I combine two items, adding the sum of Acquisition spending (which is negative because it is spending) to the sum of Free Cash Flow (which is positive).

Any companies that achieve a positive result have earned more Free Cash Flow than they have spent on acquisitions.

5 Strikes custom table

The 5 strikes table lays out a business’s financial track record for us. You can see the whole table in the first screenshot in this article.

These statistics help us evaluate how well a company has performed over the long term.

Interpreting them requires judgment. For example, I often give companies a pass if they contracted during the pandemic because pandemics are rare and their impacts are different to those we experience in more common events like recessions.

Here are strikes I have awarded recently, to give you a flavour:

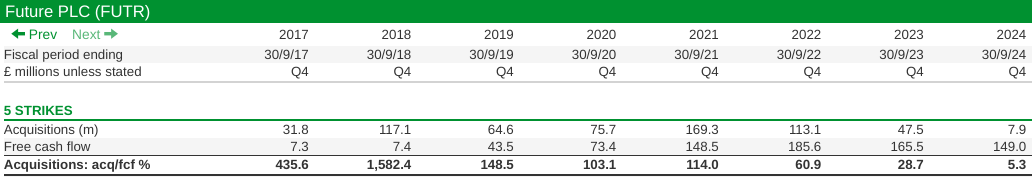

Acquisitions as a % of Free Cash Flow

I gave Future, a consumer publishing and events company, a “?” for Acquisitions. “?” means it is not obvious whether I should award a strike. When I sum up the strikes, I can use my discretion.

Future has often spent more than it has earned on acquisitions, but its major transgressions were some time ago, in 2017 and 2018. In recent years it has calmed down and overall it has spent less than it has earned (or it would not have passed the Minimum Quality Filter).

Cash Return on Capital Invested

Because investment can reduce CROCI and operating cash flow can be lumpy too, I am quite tolerant of low CROCI in any particular year. But I do not like to see it turn negative.

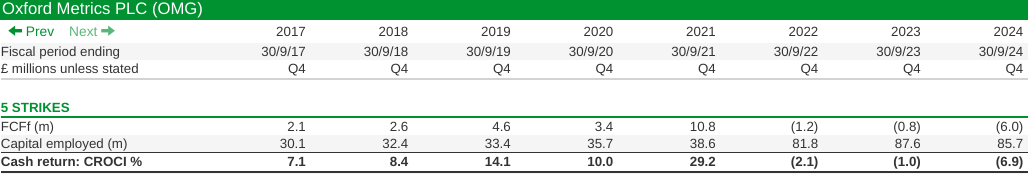

Oxford Metrics is a pioneer in motion sensing, but I sensed a deterioration in cash return, which has been negative for three years:

Debt

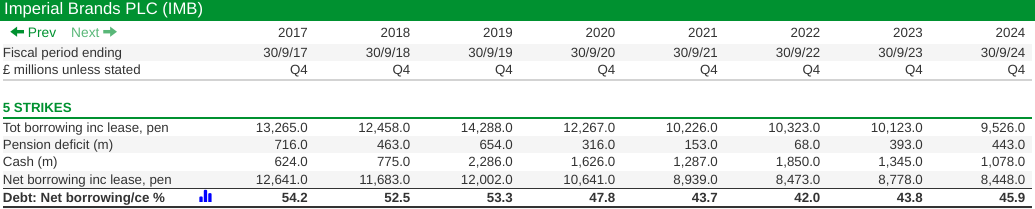

Imperial Brands’ dependence on leases and borrowings is quite high.

I prefer businesses that have more cash than financial obligations at their year-ends. I will give them a strike if net debt was over 25% or has often been over 25% in the past.

Leverage is a way mature businesses like tobacco companies can improve returns to investors. Some would argue that addiction is a very steady business that can support a lot of debt. I hope it is a declining business, and would fear debt could become burdensome.

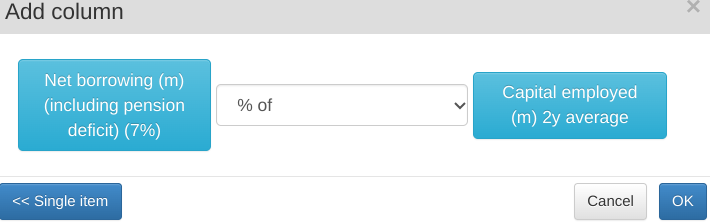

I use a combined item to work out Net debt to capital employed:

Growth

The more a company sells and the more it charges per unit, the greater the turnover. Growing turnover, therefore, is often a sign of a healthy business.

For this reason, turnover is another of these numbers that I do not like to turn negative although I might go easy on a company that achieved a small decline, especially if it was a few years in the past.

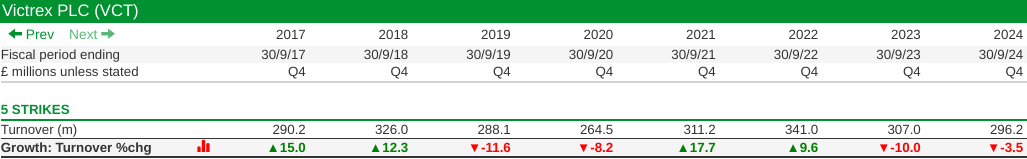

Victex, a manufacturer of high-performance PEEK polymers, is not one of those.

Turnover has declined in the last two years, and it declined at the end of the last decade as well. In 2024, turnover was little more than it was in 2017.

It’s a strike.

Return on Capital Employed

ROCE, a measure of profitability, is the hardest number to interpret. Its numerator, profit, and its denominator, as well as capital employed, are contentious because of the judgement that goes into determining them.

I look for companies that have earned an ROCE of 10% even in the worst years and will penalise those that have not achieved that benchmark in recent years with a strike.

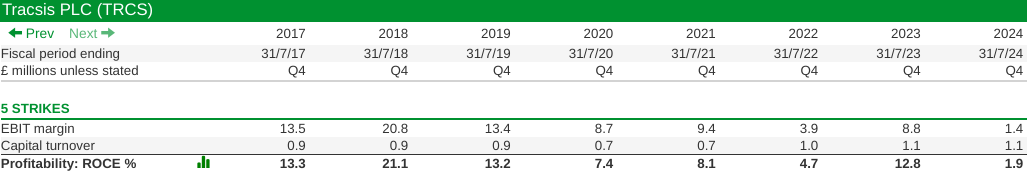

Tracsis, which supplies technology and services to transport companies, has failed to beat the benchmark in four of the last eight years.

It looks like an obvious strike, but Tracsis is moderately acquisitive and acquisition accounting unfairly, to my mind, depresses Return on Capital Employed.

I also know, because I follow Tracsis, that it restructured in 2024, which resulted in one off costs.

It is likely that Tracsis is a better business than reported ROCE implies, but it would take effort to adjust the numbers and they would be less authoritative because of the judgements.

Tracsis gets a strike.

Shares

I want to own shares in companies capable of self-funding investment and executive pay. Lifting the share count dilutes shareholders. If a company has lifted the share count by more than about 1%, I wonder if it is playing fast and loose with our capital.

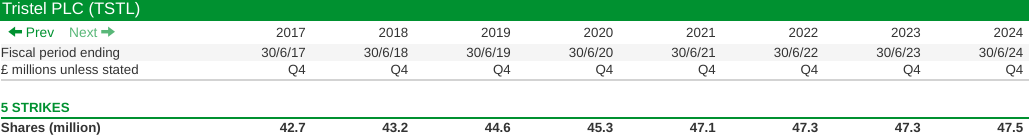

Tristel, an otherwise exemplary business that makes hospital disinfectants just crosses this threshold:

As far as I can tell, the shares have been given to executives.

Considering what they have achieved you might regard my strike as churlish, but we have to draw the line somewhere.

Using 5 Strikes

That’s 5 Strikes in a nutshell, or perhaps a bag of nuts.

Currently, 16 shares have no strikes, 37 shares have 1 strike, and 54 shares have 2 strikes.

When I give a share less than 3 strikes, I download the annual report and put it in my ShareScope watchlist.

This means the report is at hand when I have time to research the share further. In the meantime, since I regularly scan my watchlist’s news feed, I am getting to know the share a bit better.

In fact, ShareScope helps me tame the news feed too. I filter out Irrelevant News.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.