Richard brings you the latest shares to pass his 5 Strikes process and takes a look at Raspberry Pi, a rare British technology company that will not pass the 5 Strikes test for at least 7 years.

Since this is my last article before Christmas, I am (temporarily) passing up the opportunity to write about accounting software giant Sage and asset manager Impax, the latest shares to pass the 5 Strikes process.

The table of 5 Strikes passes and fails is at the end of this article, first I am bringing you up to speed with a side project. A share that does good, and a Christmas bauble.

Unusual investment

Raspberry Pi would be a very unusual investment for me because it has a short track record. I prefer to be able to see how businesses have performed through thick and thin.

The Raspberry Pi Foundation, a charitable trust, not the business we can invest in, was founded in 2008 to help children learn about computing by encouraging them to program.

The first Raspberry Pi, launched in 2012, was a credit-card-sized single-board computer (SBC) that cost just $25. An SBC contains the brains, the microprocessor, the memory and everything needed to run an operating system, but you have to connect it to peripherals like a keyboard and screen to use it.

Because the Raspberry Pi was cheap but powerful, it gained an enthusiastic following among parents, hobbyists, and businesses as well. In 2013 the Foundation spun off its engineering and trading activities into a limited company, which it wholly owned.

This company floated on the stock market last May, but to give you an impression of how far it has come in a short space of time, chief executive Ebon Upton told the FT that up until 2019, “We didn’t have a single person you would recognise as a salesperson”.

Today it mostly sells directly to resellers and original equipment manufacturers (OEMs). Then it relied on licensees.

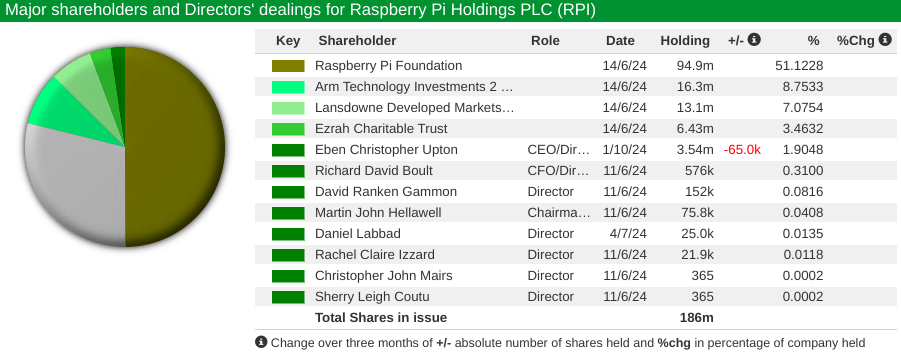

Were we to invest, we would still be investing alongside the Foundation, which retained 77% of the shares:

Source: ShareScope

Through a trademark agreement, the Foundation binds Raspberry Pi to make a low-cost general-purpose computer and to ensure they are generally available for purchase. The cost is flexible and related to the cost of manufacturing.

To my mind, the Foundation’s control is probably a good thing. It should want Raspberry Pi to prosper for the long-term so that it is a stable source of computers for the Foundation’s charitable work and a valuable source of funding through dividends and capital gains (it does not pay a dividend at the moment).

Blinded by the technology

The technology is accessible, but also quite involved. The obvious way for me to understand Raspberry Pi’s main products, SBCs, compute modules, and microcontroller boards, was to buy some tech and have a go at programming.

So many companies rely on technologies like Raspberry Pi, and understanding Raspberry Pi might help me understand other businesses too.

For example, the latest Raspberry Pi (version 5) is powered by two Arm microprocessor cores. Although it is listed on NASDAQ, chip designer Arm is the UK’s pre-eminent tech business, and like Raspberry Pi, it’s headquartered in Cambridge.

The diminutive Pi also contains two Risk V microprocessors, an open-source alternative to Arm that may become a significant challenger.

As you can see in the shareholder table, Arm and Raspberry Pi are close. Arm has a 3.5% holding in Raspberry Pi. Sony, which assembles Raspberry Pi’s in Wales, also has a small holding.

The Cambridge store is Raspberry Pi’s only store. Staffed by what looked like fairly recent alumni from its educational programmes, it was a daunting place for a washed-up sub-par technologist from a different generation like me to enter.

Nevertheless, I went in. And I did not come out with a Raspberry Pi. I felt that would be too easy. The danger is you plug it into a keyboard and screen and use it like any other computer.

I wanted something I had to program before it would do anything, hence the Pico 2. It is a microcontroller board. This is not a general-purpose computer, although it does contain a microprocessor and memory and you can run programs on it, one at a time.

To give a simple example from industry, microcontrollers are commonly used to control equipment or processes while a Raspberry Pi might manage the whole production line.

My Pico cost £4.80, about a tenth of the price of the cheapest Raspberry Pi 5, and so far I have done little more than wire it up to a resistor and an LED and program it to control the light.

Raspberry Pi technology is often embedded in electronic equipment, from airport arrivals and departure boards to pinball machines. A third product category, compute modules, is the Raspberry Pi computer in a more compact form that is easier to embed (though many customers still embed the standard Raspberry Pi).

Raspberry Pi in the wild – Stansted airport shuttle, returning from Rome in October

Embedded computers are everywhere – in our cars, televisions and washing machines for example, and industrial and medical equipment.

Concurrent Technologies, an embedded computing specialist, is listed in London, but if a company is making electronics it is likely to be using embedded computers.

While Raspberry Pi still supplies the education and hobby markets, which have spawned a proliferation of amazing gizmos, most of its revenue comes from commercial customers.

Then there is artificial intelligence. Raspberry Pi sells AI modules, so if I graduate from switching lights on and off, improving my understanding of a technology that promises to revolutionise almost everything may be on the cards.

90% confident I am a “Person” – Raspberry Pi store, Cambridge.

The company’s determination to deliver the biggest bang in terms of computing power, for the lowest amount of bucks in terms of initial outlay and running costs, impresses me. It reminds me of Arm.

The brand is famous, and perhaps strengthened by its association with the Foundation and bolstered by its flotation.

But its short history is also unlikely to be representative of the future. The business has been tested but in an atypical way.

Looking to the future

Companies tend to float when all is well so selling shareholders get a good price.

Raspberry Pi floated at the end of a very strong year as turnover and profit rebounded after two years of contraction. Chip shortages after the pandemic meant the company’s new sales force was, according to Upton, almost using “anti-sales skills” to manage demand.

The subsequent buying frenzy rebuilt customers’ stocks, which means demand has slackened.

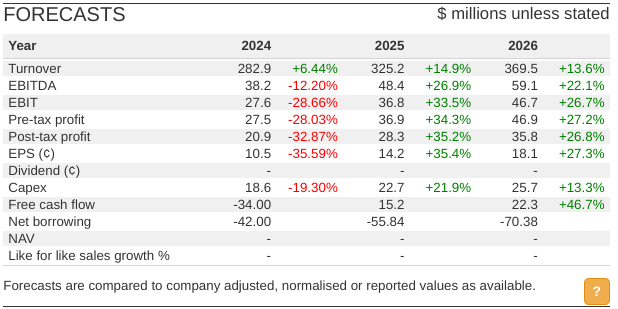

Although turnover is expected to increase slightly in Raspberry Pi’s first year as a public company, costs will increase more. These, the UPI prospectus predicted, would be due to a higher amortisation charge on the development cost of the relatively new Raspberry Pi 5, staff and pay increases, and the additional cost of operating as a listed company.

Profit is expected to be lower in the year to December 2024 than it was in 2023,

although brokers anticipate growth after that.

The financials are not much to go on and I am not sure how long it will take me, if ever, to get more comfortable with Raspberry Pi, the business, especially as its valuation is quite fruity:

But as time goes on, my understanding will improve and Raspberry Pi’s track record will lengthen. I may have a new hobby, and as I hinted, a Pico 2 powered bauble sits on our kitchen window sill.

Happy Christmas!

5 Strikes

|

Name |

TIDM |

Prev AR |

Strikes |

# Strikes |

|---|---|---|---|---|

|

Britvic |

BVIC |

10/12/24 |

– Holdings – Debt ? Growth |

3 |

|

Victrex |

VCT |

10/12/24 |

– Holdings – Growth -ROCE |

3 |

|

Tracsis |

TRCS |

6/12/24 |

– Holdings – ROCE ? Growth ? Shares |

3 |

|

Future |

FUTR |

5/12/24 |

– Holdings ? Acquisitions – Growth ? ROCE ? Shares |

4 |

|

Sage Group |

SGE |

5/12/24 |

– Holdings |

1 |

|

Oxford Metrics |

OMG |

3/12/24 |

– Holdings – CROCI – Growth – ROCE |

4 |

|

IMPAX |

IPX |

29/11/24 |

– Growth |

1 |

|

Focusrite |

TUNE |

27/11/24 |

– Acquisitions – Growth – ROCE |

3 |

|

Topps Tiles |

TPT |

26/11/24 |

– Holdings ? Growth – Debt ? ROCE |

3 |

|

This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version. |

||||

Only Sage and Impax have passed the Minimum Quality filter and scored less than three strikes since my last update.

Despite an aversion to asset managers, Impax (- Growth), a pioneer in sustainable investing intrigues me. While turnover decreased by 4.6% in the year to September 2024 (- Growth), it was the first decrease since 2015 and the company’s financial track record is otherwise spotless.

In commentaries like this one, Bruce has noted the backlash against ESG (Environmental, Social, and Governance) investing. But I doubt the problems Impax’s investments seek to address are going away, and I wonder whether passive investments can capture the returns as well.

Sage (- Holdings) is a big successful accounting software business and surely deserves a place on any long-term investor’s watch list.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.