Gram for gram Bioventix must be one of the most profitable manufacturers in the UK. Richard also looks at Dotdigital. It too has an unblemished financial history.

Since my last update in mid-November, six companies have passed my minimum quality filter, and four of them have achieved less than three strikes.

These companies have achieved profitability and growth without recourse to debt, great gobs of new shares, and large acquisitions.

I focus my attention on businesses like these because they already know how to prosper under their own steam. Our job is to work out whether they can adapt to new challenges.

This is by no means easy. Plenty of once-prosperous firms fall by the wayside. But I think it is easier than predicting whether companies with untested or broken businesses will overcome the challenges they face.

5 Strikes

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Grainger | GRI | 22/11/24 | – Holdings – Growth – Debt – ROCE – Shares | X |

| Tristel | TSTL | 22/11/24 | – Holdings ? Shares | 1 |

| Netcall | NET | 18/11/24 | ? ROCE – Shares | 2 |

| Bellway | BWY | 11/11/24 | – Holdings – CROCI – Growth – ROCE | 4 |

| Bioventix | BVXP | 11/11/24 | 0 | |

| Dotdigital | DOTD | 11/11/24 | – Holdings | 1 |

| This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version. | ||||

Of the four companies with less than three strikes, I have yet to investigate Netcall (? ROCE – Shares). It has a well-established customer service software platform, Liberty, that is among many things helping NHS Trusts manage their waiting lists.

Tristel manufactures a unique hospital disinfectant, and I am about to write it up for interactive investor.

That leaves Bioventix and Dotdigital. Of the quartet, they have the best track records judging by the data.

Bioventix [0 strikes]

Bioventix is a developer and cloner of antibodies.

The whole business, research, development, cloning, commercial and administrative functions, is 14 people (12 full-time equivalent) and it produces a grand total of between 15 and 20 grams of antibody per year.

Yet in the year to June 2024, Bioventix made £10.6m pre-tax profit from £13.6m revenue. That’s over £500,000 per gram of antibody profit, and over £880,000 profit per full-time employee.

The antibodies are used in blood testing machines that help doctors diagnose disease

Although Bioventix sells antibodies by weight, which might be an issue because blood testing machines are improving over time and require fewer antibodies per test, most of Bioventix’s revenue comes from royalties earned per blood test.

Its biggest selling antibody by far is vitD3.5H10, which is used around the world to test for vitamin D deficiency.

In the year to June 2024, vitD3.5H10 brought in £5.9 million of revenue, but it is so well established that Bioventix does not expect the revenue stream to grow much.

The company’s next biggest seller is a troponin antibody (£1.4 million revenue).

Troponin is a protein found in heart muscle cells. When it leaks into the blood, it can mean the heart is damaged. Troponin antibodies are currently used to diagnose heart attack in patients with chest pain.

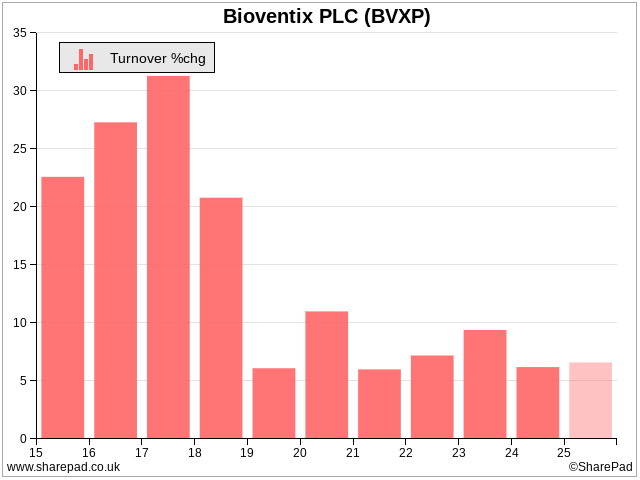

Troponin was developed under contract for blood testing company Siemens Healthlineers and although the associated sales are growing modestly (3% this year), Bioventix’s overall turnover growth has moderated compared to the last decade when vitD3.5H10 sales were growing strongly.

However, a new application developed by Siemens measures troponin levels to determine the risk of heart attack in patients with heart conditions. Bioventix expects this to increase the size of the market, and consequently antibody sales.

In a future clouded somewhat by the end of Bioventix’s troponin agreement with Siemens in 2032, the most promising new antibody in the company’s pipeline tests for Alzheimer’s Disease.

It is in the early stages of commercialisation.

There is little competition for established antibodies because they take a few years to develop. Then, Bioventix’s customers need more time to secure regulatory approvals and commercialise the antibodies. The whole process can take four years to a decade.

But the long gestation of new antibodies makes developing them risky because other suppliers might come to market with antibodies that address the same need first.

No doubt Bioventix has lots of know-how in cloning antibodies derived from sheep, its specialty, but to me it is like a rare orchid that flowers once a decade.

Every time it develops a new antibody, we wonder how spectacular the show will be. Will it be a blockbuster antibody-like vitD3.5H10, a lucrative one-line troponin, or perhaps something of a non-event?

I love that Bioventix exists, but I think maybe it is too precious to own. I wonder whether its founder and chief executive Peter Harrison is irreplaceable, and how many of its tiny pool of employees are too.

Dotdigital [- Holdings]

You know those emails you get when you leave something in your online shopping cart? They ask you if you still want it, or offer you other similar products.

These emails are sent by Dotdigital’s CXDP (Customer Experience and Data Platform), or something like it.

Dotdigital integrates with e-commerce software and uses the data companies hold on us to personalise and automate marketing messages by email and other digital channels like online chat, social media, and WhatsApp.

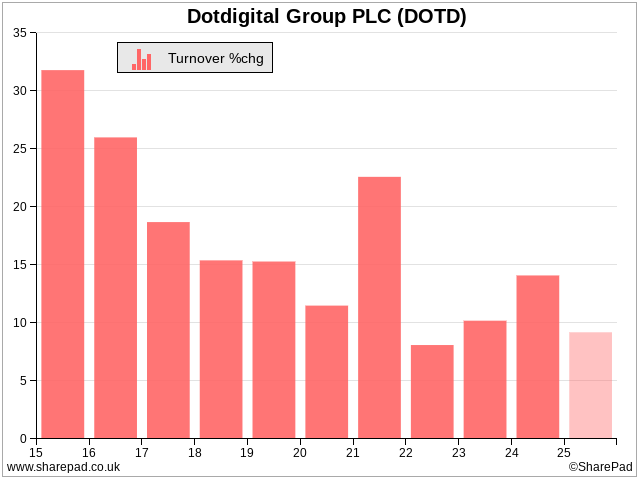

The company has a very impressive track record. High levels of profitability and growth, and no debt, although the growth rate has moderated somewhat.

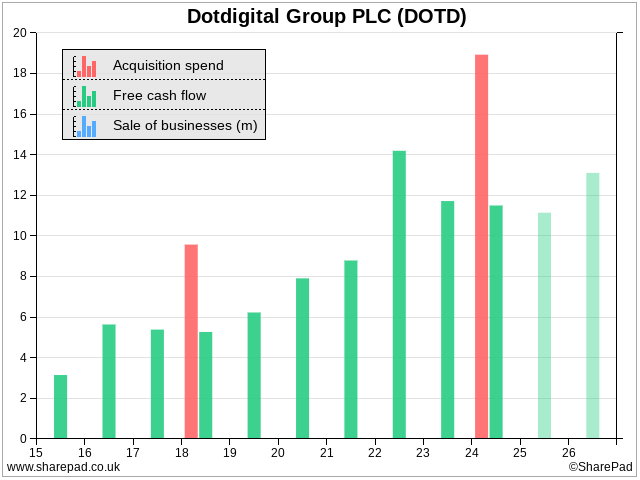

That may explain why Dotdigital broke with form and used some of its cash pile to acquire Fresh Relevance in September 2023.

Not including Fresh Relevance, Dotdigital grew turnover by 9% in the year to June 2024. Include the nine months of revenue from Fresh Relevance, and turnover increased by 14%.

Acquisitions have not been a major part of the Dotdigital story so far.

The last time Dotdigital acquired another business was in 2018 when it bought Comapi: an “omnichannel” customer messaging and two-way conversation platform. The technology was subsumed into Dotdigital to help it evolve from being an email marketing platform (dotmailer). Comapi gave Dotdigital some of its SMS, chat, and social media capabilities.

Like Dotdigital, Fresh Relevance is also a personalisation platform, although it evolved from a different starting point: Website personalisation. Like Dotdigital it has developed multichannel capabilities.

Before the acquisition, the two platforms had already been integrated behind the scenes. Fresh Relevance provides data like new stock alerts and price changes to the Dotdigital platform, which triggers real-time marketing messages.

Dotdigital is keeping the two platforms, although it is blending them. They now have a single login, and a similar look and feel to make it easier for customers who use both.

It’s probably an oversimplification, but I think Dotdigital can sell the superior web capabilities of Fresh Relevance to Dotdigital customers, and the superior email functionality of Dotdigital to Fresh Relevance customers.

Perhaps the two companies can make more money together than they do apart, and cost less to run.

Although Dotdigital spent more to acquire Fresh Relevance than it earned in free cash flow in 2024, I do not hold that against it because, for many years, it has not spent any money on acquisitions.

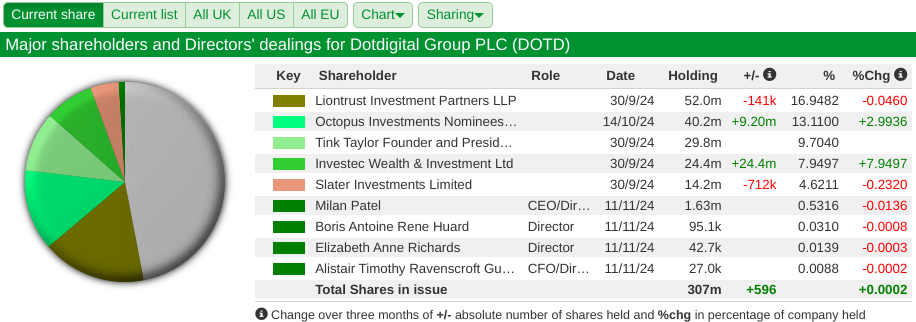

The only strike against Dotdigital is – Holdings. Collectively the board owns a little over 0.5% of the shares, worth a little more than £1.5 million. The vast majority of those shares are in the hands of chief executive Milan Patel.

Patel joined the business in 2007 and was promoted to chief financial officer in 2015 and chief executive in 2016.

Founder, Tink Taylor, owns nearly 10% of the shares though. He holds the probably symbolic title of president but remains an enthusiastic supporter judging by his X feed.

Source: ShareScope

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.