Richard presents the latest companies to make it through his 5 Strikes process. Volution, a manufacturer of extractor fans and more sophisticated ventilation systems achieved only one strike, making it a prime candidate for research.

Since my last update, five companies have published annual reports and passed my minimum quality filter.

Having briefly scrutinised their financial track records with a custom “5 Strikes” filter, I awarded only two of them: FW Thorpe and Volution less than two strikes. In other words, there is nothing much glaring at me from their financial histories to worry about.

I think companies with a record of financial stability and profitable growth are easier to analyse and more likely to prosper over the long term because they are building on firm foundations.

Lighting manufacturer FW Thorpe (0 strikes) is an example, I write about it every year – most recently a fortnight ago.

Volution (1 strike), which makes ventilation products, has hitherto evaded me, which is why I am writing about it now.

I must have written about FW Thorpe over a dozen times. Maybe in a decade or so, I will be able to say the same thing of Volution!

But first, the near misses and strike-outs.

5 Strikes – all the strikes

The table below contains more than five shares because I neglected to include a table in my last update. This table brings us up to date, showing every strike I have awarded since 4 October:

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Gattaca | GATC | 24/10/24 | – CROCI – Growth – ROCE | 3 |

| Volution | FAN | 23/10/24 | ? Shares ? ROCE | 1 |

| DFS Furniture | DFS | 22/10/24 | – Holdings – Growth – Debt – ROCE – Shares | X |

| Thorpe (F W) | TFW | 18/10/24 | 0 | |

| Bellway | BWY | 15/10/24 | – Holdings – CROCI – Growth – ROCE | 4 |

| Wilmington | WIL | 12/10/24 | – Holdings – Growth – ROCE | 3 |

| Dunelm | DNLM | 10/10/24 | – Debt | 1 |

| Smiths | SMIN | 10/10/24 | – Holdings – ROCE – Growth | 3 |

| Hays | HAS | 7/10/24 | – Holdings – ROCE – Growth | 3 |

| Wetherspoon (JD) | JDW | 4/10/24 | – Debt – ROCE | 2 |

| James Halstead | JHD | 30/9/24 | – Growth | 1 |

| This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version. | ||||

James Halstead, the vinyl flooring manufacturer, sneaks in at the bottom of the table either because SharePad reported that it had published its annual report a bit late, or I missed it last time around.

Like FW Thorpe, I review James Halstead every year (the review is imminent on interactive investor).

Volution (FAN)

Volution’s ticker code gives away what it does.

If you habitually notice brands, you will probably have stumbled upon a Vent-Axia fan in the bathroom. It’s one of 22 brands, many of them acquired since Volution listed on the stock market in 2014.

Volution sells a wide range of ventilation products, from the humble extractor fan to whole building ventilation systems with heat recovery. It earns 40% of revenue in its home market, the UK, and the rest across Europe and Australasia.

Its customers are distributors mainly, who supply contractors that refurbish and build homes, offices, schools, and hospitals.

The flotation was one of those exceptions that proves the rule that Initial Public Offerings (IPOs) make terrible investments, although it took a while to really get going:

The precipitous growth of the share price during the pandemic makes me wonder whether it took hundreds of thousands of deaths from an airborne pathogen to wake people up to the importance of indoor air quality.

There may be something to this theory. Volution says Covid was a wake up call. It also credits an “acute focus” on reducing mould in housing for increasing demand.

Other tailwinds that are, or could, help the business include government initiatives to boost housing supply, regulation of carbon emissions in buildings which drives sales of more expensive heat recovery ventilation systems, and higher fuel costs, which favours similar systems.

End-user demand for prettier, quieter, more configurable, and more environmentally friendly products, gives the company an opportunity to differentiate itself.

No doubt Volution sometimes faces headwinds. Nearly a third of revenue comes from new builds (as opposed to repair, maintenance and improvement (RMI)) and 77% of revenue comes from residential property (as opposed to commercial).

While the business is diversified, house building and construction are sensitive to economic conditions.

I like focused businesses like this, when their track records demonstrate they are focusing on the right things because they are earning good profits.

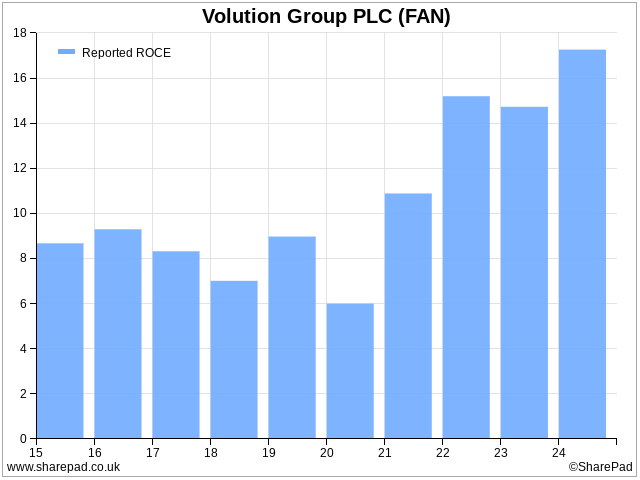

This is where things get a bit tricky for my 5 Strikes system, because at first glance Volution’s profitability has not always been impressive. That is why I allocated it a question mark for ROCE:

Return on capital employed is both a very important financial statistic and a discombobulating one. The numerator, return, is profit (Earnings Before Interest and Tax or EBIT), and the denominator is capital employed, the money invested in the business to generate returns.

Both numbers can be calculated many ways, giving accountants leeway to present the best case for their business and investors the opportunity to pull the wool over their own eyes.

This is why I select reported (unadjusted) profit and capital employed without excluding goodwill or all intangible assets in SharePad. This will usually be the most stringent test. If a company achieves more than 10% ROCE through thick and thin, it passes. That’s the gold standard.

Volution just fails the test, habitually returning 8% or so before 2021.

Volution’s questionable track record is not enough to rule it out of contention, though. Most years it narrowly missed my 10% yardstick, and the businesses themselves were more profitable than Volution’s ROCE implies.

That is because ROCE is skewed by acquisitions. Companies must account for money they spend when they buy other companies by putting intangible assets on the balance sheet that they would not be allowed to recognise had they developed them internally. They must then amortise (depreciate) some of these assets over time.

A quick check of the latest annual report suggests most of Volution’s intangible assets were created this way, principally goodwill and its acquired customer base.

The amortisation of the customer base reduces profit and the recognition of the goodwill and the customer base increases capital employed. Both reduce ROCE.

The money spent on acquisitions is a real cost and we might legitimately wonder whether Volution overpaid for some of them, given modest ROCE between 2014 and 2020.

But we would be wrong to conclude the businesses themselves weren’t generating decent returns. You can get a feel for how profitable they are by removing the acquisition accounting in SharePad.

Exclude goodwill, and ROCE is consistently 10% or more. Exclude all intangible assets and allow adjustments to profit and you can get to 40% in some years.

Intangible assets are particularly slippery, though, because it is difficult to determine which are created internally and which were the result of acquisition. We can only use these different flavours of ROCE as guidelines, limits on a range of possibilities. The truth will very likely be somewhere in between them.

I think Volution is a high quality business. It has earned returns on capital of at least 10% and probably considerably more. Taking a long-term view it may not have overpaid for acquisitions, considering ROCE including all intangible assets is now over 20%.

We cannot be sure the current high levels of return on capital are sustainable, although more investigation of the company’s financial history and strategy might give us confidence.

One confidence building factor I have noted already is that chief executive Ronnie George is immensely experienced (even though his shareholding is modest).

He joined the company in 2008 as managing director of Vent-Axia. He led a management buyout from its private equity owners in 2012, listed the firm in 2014, and executed its largely overseas expansion.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.