Phil takes a look at the subject of factor investing and whether quality factor exchange-traded funds (ETFs) can deliver better returns than those that track the stock market.

Factor investing 101

To some extent, most investing is based around factors. Factors are used to deliver sources of return from portfolios and to explain the performance of them. The most common factors relate to themes such as quality, value, momentum, size and minimum volatility. They form the basis of many fund managers’ strategies in their attempt to beat the returns of the stock market as a whole.

Factors have also been embraced by the big providers of ETFs. They have put together oven ready factor ETF portfolios which save the hassle,time and costs of investors doing it themselves or giving their money to an active fund manager.

But do they actually deliver vastly superior results?

The evidence over the last five years suggests that they do not. A look at the returns of some of the key factor US ETFs available to UK investors from iShares shows a very mixed bag of performance.

Source: SharePad

If we take a look at the US stock market over the last five years, only a quality factor ETF has beaten the total return of the S&P 500 index and only just. A momentum strategy is outperforming the S&P 500 quite significantly so far in 2024 but has significantly underperformed on a five-year view.

Longer-term returns from minimum volatility, value and small-cap strategies have also been disappointing. Things might be different in the future, but the case for putting some of your money to work in these kinds of ETFs is not particularly compelling based on recent evidence.

The appeal of quality investing

Buying and holding the shares of quality companies has become a very popular investing strategy in recent years. The definition of a quality company is open to some debate, but a company that is good at what it does is highly profitable, well-financed and can keep on growing ticks a lot of boxes in this respect.

Quality companies are rarely available for bargain valuations, but the argument made by quality investors is that this is not a problem over the long haul. This is because the ability of these superior companies to remain highly profitable and grow allows their shares to significantly compound in value if you are patient enough and Don’s pay ridiculously high prices for them.

Just as paying up for other things in life such as houses, holidays, clothes and furniture can be more satisfying than cheaper alternatives, the same logic applies to the shares of good companies.

The track record of legendary investors such as Warren Buffett suggests that this could be true but quality investing looks like it is going through a bit of a rough patch right now.

Quality funds struggle to make a big difference.

The very popular Fundsmith Equity Fund’s investment strategy is based around buying and owning the shares of good companies. While this fund initially delivered market-beating returns, it has been significantly underperforming over the last few years.

The high valuation of the fund’s portfolio could indicate that many of the shares in the fund are fully priced or overvalued relative to their earnings which is holding back returns.

However, it does seem that as in the US, quality factor ETFs in European and global markets have been marginally outperforming their comparable broader stock market indices on a five-year view.

Source: SharePad

iShares quality factor ETFs are based around three broad criteria. The companies included in their portfolios have the following characteristics:

- A high percentage of company earnings allocated to shareholders. In other words, the companies have a high return on equity (ROE).

- Low levels of debt. This means that the company’s finances do not pose substantial risks to shareholders’ interests.

- A low volatility of year-on-year company earnings. Companies with more predictable profits are inherently less risky and tend to command higher stock market valuations than companies whose profits move up and down a lot over an economic cycle. Their shares also tend to perform better in economic downturns which can be a key determinant of long-term investment performance as it reduces the possibility of big losses from falling company profits.

This is a simple set of criteria that seems reasonable. However, the recent very modest outperformance of these quality factor ETFs does beg the question as to whether they are really worth bothering with compared to a simple index tracker.

Can Quality ETFs meaningfully outperform stock markets going forward?

The strength and growing size of technology companies such as Nvidia has made it hard for active investors to outperform US and global stock markets. The whole reasoning behind investing in quality shares is that it can generate market-beating returns but can they?

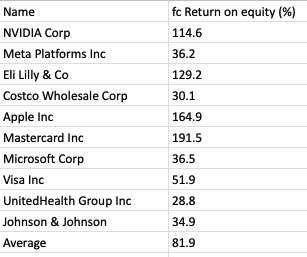

The first thing to acknowledge is that when measured by its forecast ROE, the Quality Factor ETF does seem to have more quality than the S&P 500.

We can see from the top 10 holdings that it contains some highly profitable business with an average ROE of 82 per cent.

iShares USA Quality Factor ETF: Top 10 Holdings ROE

Source: SharePad

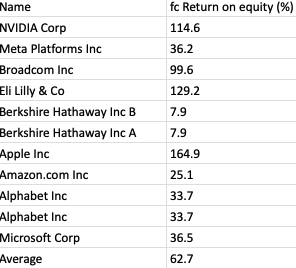

The S&P 500 is not too shabby either with a forecast average ROE of over 62 per cent.

Source: SharePad

Superior quality on its own is not sufficient to generate outperformance. We need to consider other key factors.

Investment outperformance can come from many sources. Four significant ones are:

- Cheaper valuations. It is often easier for a cheaply valued share to make bigger gains than one that is expensive or overvalued.

- Superior earnings growth is arguably the key driver of share price gains over the long haul. If growth exceeds investors’ expectations then those gains can be stellar.

- Portfolio concentration. Having a greater proportion invested in winning shares can deliver market-beating gains.

- Portfolio differentiation. To beat the market, a portfolio must be meaningfully different from the index.

If we look at the iShares US Quality Factor ETF on these issues, we can begin to get a feel as to whether it can outperform.

On valuation, the fund currently trades on 24 times forecast earnings compared with 21.6 times for the S&P 500. Its higher valuation looks as if it presents a headwind to outperformance versus the S&P 500.

Turning to earnings growth, we can use SharePad to look at the top 10 holdings of both ETFs and look at earnings forecasts.

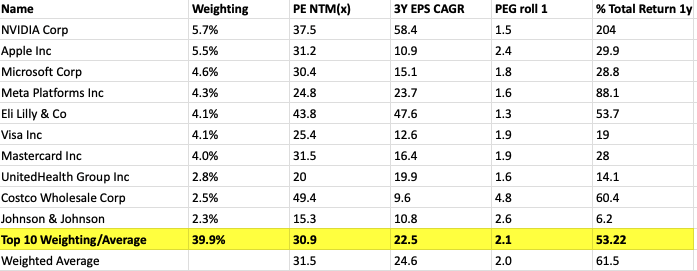

iShares USA Quality Factor ETF: Top 10 Holdings

Source: SharePad

The weighted average three year forecast earnings per share (EPS) growth for the quality factor ETF is an impressive 24.6 per cent. This is heavily influenced by the forecasts for Nvidia and Eli Lilly.

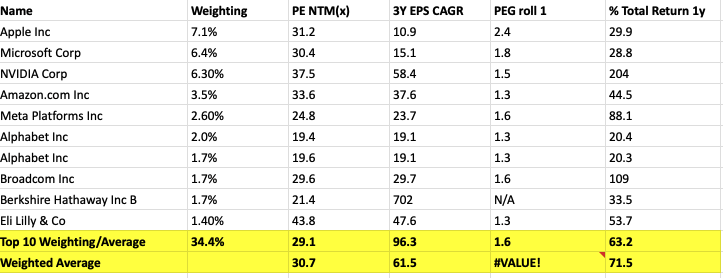

iShares S&P 500 ETF: Top 10 Holdings

Source: SharePad

The S&P 500’s forecast EPS growth is heavily skewed by the outsized gains predicted for Berkshire Hathaway (this is due to the big influence that changes in the value of its investment portfolio and insurance liabilities have on its profits).

If Berkshire is excluded, then the weighted average expected EPS growth is better than the quality ETF at just over 28 per cent.

Comparing the one-year forecast EPS growth with the PE ratio to get a price-to-earnings growth (PEG) ratio puts the S&P 500 top 10 on 1.6 times compared with 2.0 times for the quality ETF. This suggests that the S&P 500 is more attractively valued.

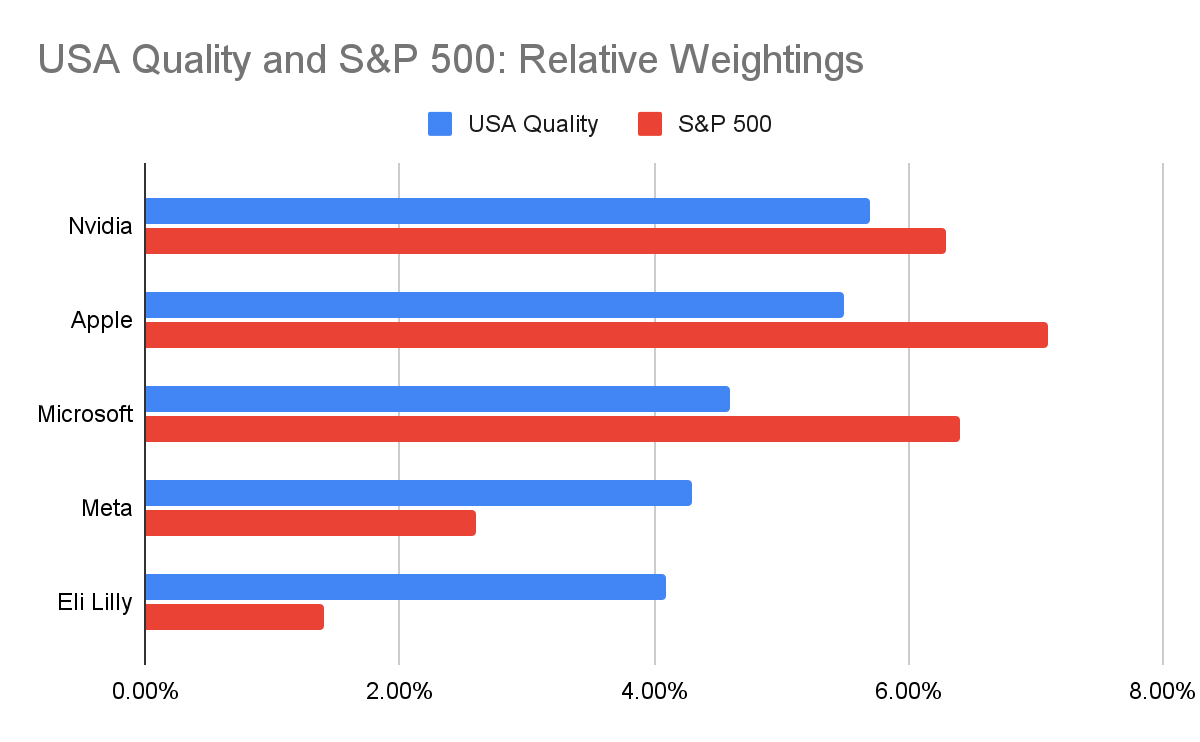

The S&P 500 is also a less concentrated portfolio with 34.4 per cent in the top 10 shares compared with 39.9 per cent for the quality ETF. However, if we look at the relative bets the quality ETF is making it offers some interesting insights.

Source: SharePad

The quality ETF is underweight the S&P 500 in Nvidia as well as Apple and Microsoft where the holdings of the two ETFs overlap. Given that Nvidia looks good value relative to its expected earnings growth, continued outperformance from it could see the quality ETF underperform in the future.

This is countered by the overweight positions in Meta and Eli Lilly which have served the quality ETF very well recently.

The other quality ETF’s big top 10 bets such as Visa and Mastercard shares as well as holding the high-performing Costco shares do suggest that the makeup of the portfolio is sufficiently different from the S&P 500 index to perform differently from it as well.

It could be that the difference in future performance will be more driven by the smaller weightings outside the top 10 than has been the case recently.

Are quality ETFs worth bothering with?

Predicting the future and consistently outperforming the stock market is very difficult. The theory behind quality investing is well founded but the recent historic outperformance over a simple index tracking ETF has been very modest.

To make a compelling case for including them in portfolios, investors need to be confident that outperformance in the future will be better than it has been in the recent past.

The higher valuations of quality ETFs will arguably need higher rates of earnings growth or superior earnings stability to deliver this.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select Share Chat or search for the specific share covered in this article.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.