In the latest in the series, we have experienced investor and long-term subscriber – Harry sharing a bit about his investing history and how he uses ShareScope.

If you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about you and them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!

Harry

Investing experience

I have been investing for around 40 years.

ShareScope experience

I started out with ShareScope. I think that must have been around 20 years ago. I transferred to ShareScope last year.

How often do you use ShareScope?

I use the programme as required – typically once or twice a week.

How I use ShareScope

When a company of interest crops up that I want to research, I start with ShareScope.

Firstly, I look at the share performance year-to-date and over longer periods such as 1 year, 3 years, 5 years and 10 years to ascertain consistency and profitability (for the investor) as well as any other salient points. Looking at the share performance over time can bring up all sorts of questions relating to what has changed and why.

Next, I look at the following financials:

- Market Cap

- P/E

- Price to NAV

- Turnover

- EBIT

- EPS

- Debt to Market Cap

- Fixed Charge Cover

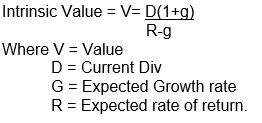

If necessary, these enable me to do some further calculations of my own. Starting with Intrinsic value:

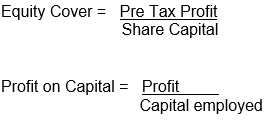

Then to try and measure profitability:

It is also sometimes useful to get an idea of productivity.

For a manufacturing company this often works:

![]()

For service companies this may be more appropriate:

![]()

I then take a break from ShareScope and have a look at the company website. One thing I look for is information on the directors. If there isn’t sufficient detail, I try to Google them to see how long they have been there, their background, their successes and failures etc.

After looking at their website I search the FT and Economist for any related articles.

All this helps me to arrive at a conclusion on the company.

~

Got some thoughts or questions on the ‘How do YOU’ above? Leave them in the comments below.

And remember, if you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Very interesting but what figures/ratios/percentage are you looking for that makes you decide whether to look into a company more or decide it is no longer worth investigating further and to steer clear

Well, it’s rather the other way round. If a company comes to my notice or something in the news alerts me (EG Defence spending is to increase so I look at defence contractors. AI is full of hype, so I steer clear). It is then that I look at the stats. If these don’t reinforce my first thoughts then I leave well alone. I’m only interested in developed markets – say G7 and EU.

Good article! What do you use for your expected rate of return? Return on Assets, Return on Equity, Return on Capital Employed, or something else?

Well for me the important metrics are not always on the stats. I like companies which have a strong moat (i.e not easy to set up competing companies). Then the next important is low debt. I prefer 20% debt to turnover as a max. I then like to see how the share has performed over various periods. Then P/E these taken together may show whether there is current hype or that the firm is steady. Then the dividend if capital gain isn’t the main impetus. Then all the other factors as mentioned above. I prefer to invest in G7 and developed Europe. I use Investment Trusts for some exposure to other world markets and private equity. I’m not keen on new companies, although there are exceptions (EG Dark Trace). I also use OEICS for certain specialities EG Picter WAter, Timber and such like although I avoid all the hype around EVs, Solar, lithium etc. The shares have been mightily disappointing, although at their current depressed levels some may consider them worth a punt. (EG Ceres Power – Hydrogen. SDCL Energy Efficiency – Investment Trust etc)

I hope that helps