As we all know, there is a lot of functionality in ShareScope and there are many different ways to use and customise it. Last year’s customer survey also showed us that the majority of you use ShareScope every day.

Inspired by this and some social posts from long-term subscribers who talked about their daily ShareScope routine, we thought we would put an article series together to celebrate the different ways you, our subscribers use ShareScope.

In the latest in the series, we have two very experienced investors who you can readily find on X, (the social media channel formerly known as Twitter) – Patxi and WheelieDealer sharing a bit about their investing journey and how they use ShareScope.

If you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about you and them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!

Patxi | @patcat68

Investing experience

I have been a shareholder for just over 40 years since being gifted 100 shares in BICC (later renamed to Balfour Beatty) by my grandfather for my 12th birthday. When I started working, I saved a small amount into an ISA (PEP back then) and started accumulating Investment Trusts. I have been a more serious investor for around 20 years.

ShareScope experience

I subscribed to ShareScope about 2 years ago, moving from a competitor product. I was hesitant at first as I wanted to keep all my portfolio transactions intact, but the import and transfer process was easy and everything worked well.

How often do you use ShareScope?

I use ShareScope daily, first checking the RNS in the early morning, reading articles and market news during my lunch break or seeing how my portfolio has performed after the market has closed in the evening.

How I use ShareScope

Besides tracking the trades I make to my own portfolio, my SIPP and my wife’s ISA; I monitor their weekly and monthly performance against a synthetic benchmark which I create based on the general portfolio composition. I find ShareScope very intuitive in this area, with dividends and even stock splits/consolidation easily added.

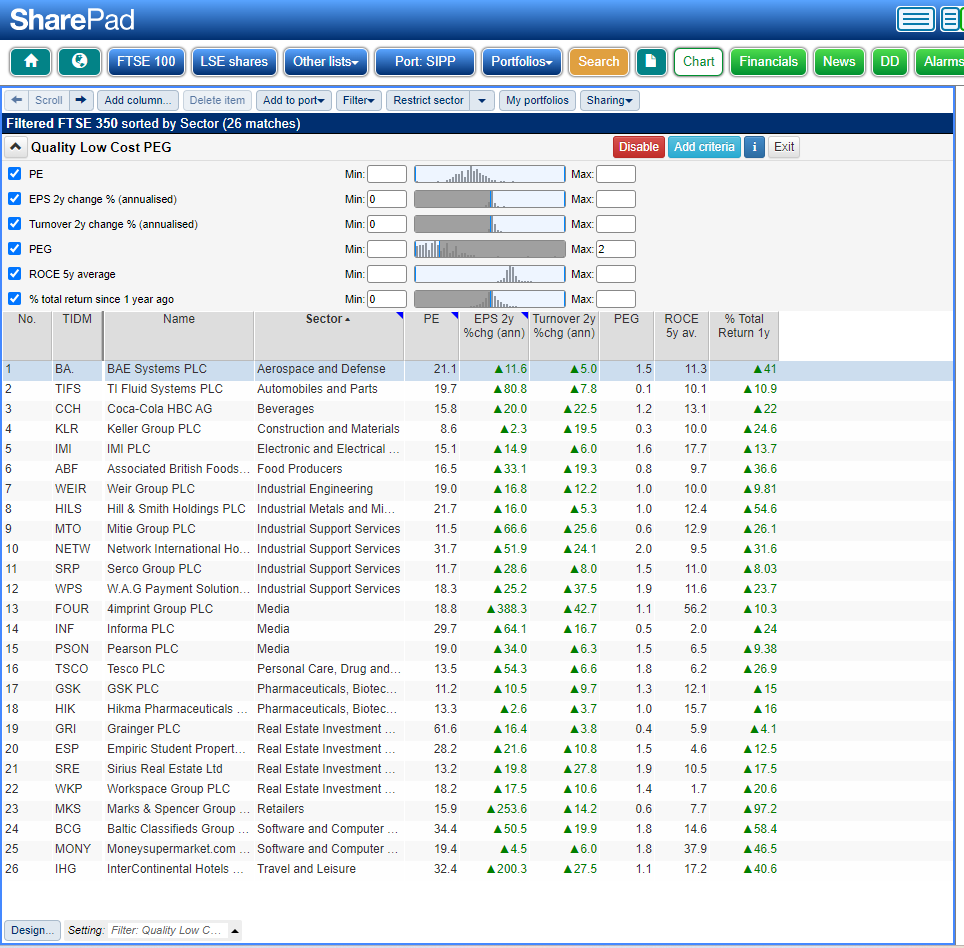

I create filters to screen for stock ideas which I add to a watchlist portfolio. For example, I recently created a “Quality Low-Cost PEG” filter to look for high-quality but low-cost stocks in the FTSE 350 using the PEG ratio favoured by Jim Slater.

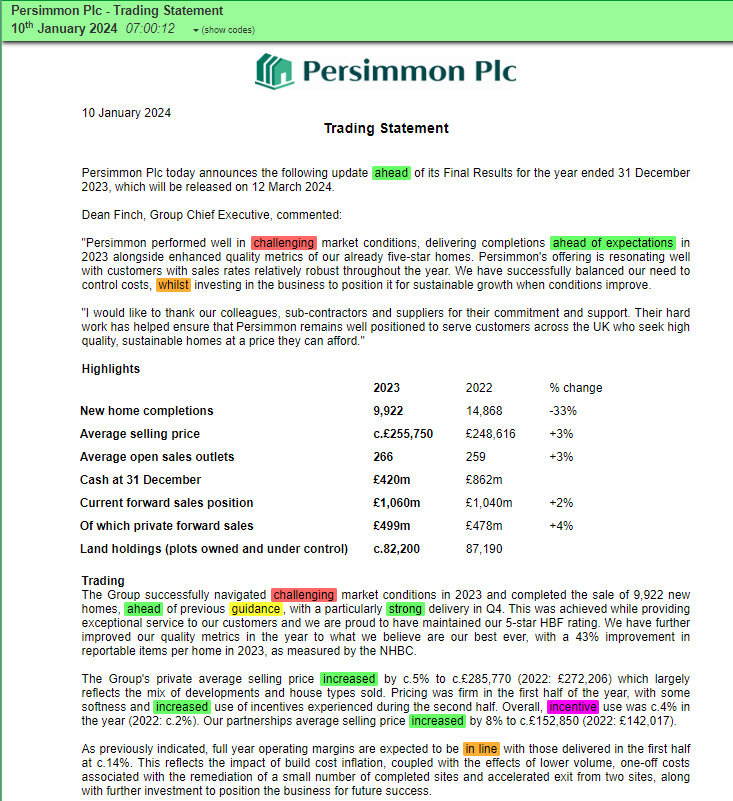

I then investigate these in more depth using the financial tools to compare my ideas to other shares in the same sector. Having access to the full history of RNS announcements is a huge benefit when conducting research. The text in the articles is displayed with automatic colour highlighting for keywords (there is an article by Michael Taylor showing how to do this). I find creating filters is a great way to really develop an understanding of the link between a company’s key data and the share price performance. It did not take me long to become quick and confident in this.

Finally, I love diving into the data sets. I have an interest in market cyclicality and the wider economic factors that influence the overall market. ShareScope allows me to dig into the history of prices and volumes of literally hundreds of shares, investment trusts, sectors and indexes. There is even access to prices for commodities, currencies and general economic data that includes unemployment, inflation, interest rates and house prices. I really am spoilt for choice!

WheelieDealer | @Wheeliedealer

Investing experience

Around 20 years.

ShareScope experience

I was previously subscribed to ShareScope and must have used that for about 16 years or more. I have been using ShareScope for roughly 4 years.

How often do you use ShareScope?

ShareScope is an essential part of my daily routine and I probably use it for at least 2 hours a day; I tend to dip in and out of it throughout the day.

How I use ShareScope

I wake up at 8am and take a first look at the moves on my portfolio of stocks at 8.20am on ShareScope – this gives time for the market to settle down from the initial gyrations and distortions of the opening period.

On my first look at my stocks, I am just getting a sense of what moves are happening, and the first bit I look at is the indexes. I then move on to the news items for my stocks and I use ShareScope for this on my 7-inch Tablet.

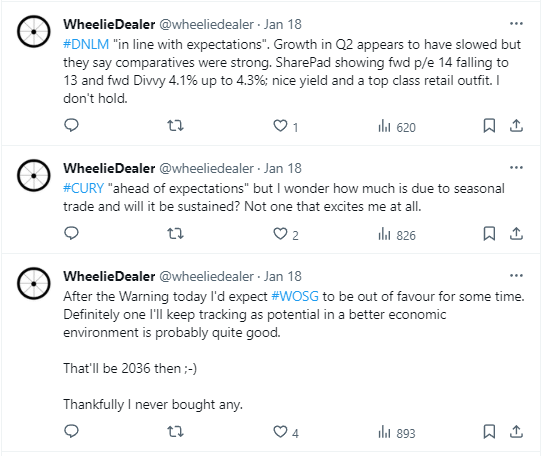

I am quite active on Twitter and I tend to tweet out any news of relevance regarding my stocks and perhaps some information regarding valuation etc, which I get from the ShareScope ‘List’ screen which I have set up for things like p/e ratio, fwd p/e ratio, 2-year fwd p/e ratio, dividend yield, fwd dividend yield, 2-year fwd dividend yield, ROCE, fwd ROCE, Market Cap, etc.

I next move on to the general news for the day on ShareScope. The filtering functions are very useful here because a lot of the daily RNS announcements are pretty useless and irrelevant for a long-term investor.

Between 10am and 6.30pm, I am regularly looking at how my stocks are doing and at particular chart patterns and suchlike on my stocks and on the major indexes. The US Markets open around 2.30pm UK time and I don’t tend to look at them until about 3pm (again this gives time for the gyrations of the open to settle down).

Over the weekends, either on a Saturday evening or Sunday evening, I will look at the index charts and tweet out what I see.

The best bit about ShareScope for me is how I can rely on it to be my daily ‘workbench’ and on the reliability and accuracy of the data. In truth, much of the data/information can be found for free on various websites, but it takes a lot of time and a lot of faffing about, whereas with ShareScope the information is all there in one place and it saves me an immense amount of time and effort.

~

Got some thoughts or questions on the two How do YOU’s above? Leave them in the comments below.

And remember, if you have your own routine you would like to share, or some interesting custom settings, layouts or screening filters – we would love to hear about them! Just send them in to marketing@sharescope.co.uk. When we publish them, we’ll even add a free month to your account!

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.