Profit warnings are part and parcel of the experience of owning shares. They are not pleasant but they often contain valuable lessons which can benefit investors in the future.

Sometimes they can just reflect a temporary blip. But they can also be a reason to question the sustainability of a company’s strategy and business model.

Phil takes a look at last week’s profit warning from Diageo to see what can be learned from it and whether the company’s premium reputation with investors is over.

Source: Diageo

It’s a moment that investors dread. They start their day by being told that one of their holdings has issued a profit warning. What this means in practice is that a company’s profits are not going to be as big as was previously thought.

The amount the share price falls in reaction to the news depends on how big the profit miss is expected to be. The bigger the miss, the bigger the damage to the value of the investment.

Share prices are based on expectations of future profits. The more bullish investors are about a company and its prospects the higher a share price can go. Once expectations change, a share price can move sharply in a downward direction.

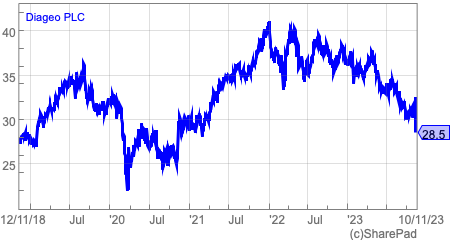

Last Friday was a bad day for Diageo shareholders. The company issued a profit warning and its shares then fell by more than 12 per cent. At 2850p, the shares are trading at their lowest values since April 2021.

One of the first things you will think about if you are on the wrong end of a profit warning is whether you could have spotted that something might have been not quite right in the months beforehand. Have you been too complacent and not diligent enough?

It is quite normal to think like this and you shouldn’t be too hard on yourself if you have missed something. It won’t be much comfort, but you will have plenty of company because most of the market will have missed it as well. If they hadn’t then the company wouldn’t have issued a warning.

However, it is also sometimes true that the signs of trouble were there.

Was this the case with Diageo?

Solid full-year results suggested the company was doing fine

At the beginning of August, Diageo released its full-year results for the year ending June 2023. They were fairly solid with the company sticking to its medium-term growth guidance and saying that it expected growth to accelerate during the second half of its 2023/24 financial year.

On 11th August, my analysis article on Diageo was published on the ShareScope website. It made the following key conclusions:

- Diageo is a very solid business with some great global spirits brands such as Johnnie Walker, Smirnoff, Baileys, Captain Morgan, Tanqueray, Guinness and Don Julio.

- It was well positioned to exploit the long-term growth in premium branded spirits drinks.

- It has good levels of profitability that has been underpinned by its continued investment in its business.

- It has been a solid rather than a great investment over the last decade.

- Its stock levels were high in relation to its revenues but its stock ratio had not increased and looked better than its main competitors.

- The key issue was the stock levels held by its distributors which investors cannot see. This had caused Diageo problems in the US in the past but the company said that distributor stock levels were back in line with normal trends.

- Revenue and EPS growth forecasts for the year to June 2024 seemed to be very low.

- Analysts forecasts had been on a downwards trend.

- The valuation of the shares had come down a lot.

- The shares could reward patient investors if it could accelerate its growth rate.

At the end of September, an AGM update saw no change to the company’s profit guidance.

Profit warning from Latin American business

Six weeks later, the company warned that its Latin American sales would decline by at least 20 per cent in the first half of its financial year.

Consumers are apparently feeling the pinch due to a tough economic climate and are buying fewer spirits drinks. If they are buying, then they are increasingly switching to cheaper brands in order to save money.

For Diageo which is basing its business strategy around selling more expensive drinks, this is not good news.

As a result, total first-half operating group operating profit will be lower than it was a year previously. Lower sales will see Diageo’s operating leverage work in reverse (Latin American profits will fall faster than revenues) and drag down margins whilst a change in sales mix towards lower margin profits will also contribute to lower profits.

Could investors have seen this coming?

Hindsight is a wonderful thing but there were some signs that the Latin American business was possibly slowing. However, it’s hard to argue that there were signs it was going to fall off a cliff.

It is possible that some investors might not have paid enough attention to the Latin American business as it only accounted for 11 per cent of total revenues in the year to June 2023.

A closer look at the financial results of the Latin American business would have shown a big slowdown in revenue and profit growth in the second half of 2023 after a very strong first half.

Revenues and profits actually fell in the second half, whilst volume growth fell from 6 per cent in the first half of the year to minus 3 per cent for the year as a whole. This implies a sharply downwards negative trend in the second half of the year.

Looking at second-half trends is a great way for investors to identify the strength and direction of momentum in a business’s financial performance, but in my experience, quite a few professional and private investors don’t do this.

Diageo: Latin American Business

| £m | H122 | H222 | FY22 | H123 | H223 | FY23 | H124F | H224F | FY24 |

|---|---|---|---|---|---|---|---|---|---|

| Revenues | 819 | 706 | 1525 | 1100 | 699 | 1799 | 880 | 559.2 | 1439.2 |

| Op Profit | 333 | 205 | 538 | 471 | 190 | 661 | 339 | 106.1 | 445.1 |

| Margin | 40.7% | 29.0% | 35.3% | 42.8% | 27.2% | 36.7% | 38.5% | 19.0% | 30.9% |

| Revenue growth | 34.3% | -1.0% | 18.0% | -20.0% | -20.0% | -20.0% | |||

| Profit growth | 41.4% | -7.3% | 22.9% | -28.0% | -44.1% | -32.7% |

Source: Diageo/My estimates

Strong comparatives from the first half of 2022/23 do make it difficult to grow from but the company did comment that there was “inventory normalisation” in the second half of 2023 which doesn’t suggest that sales would then fall off a cliff so suddenly in October.

In the conference call following Friday’s statement, the company said that it did not have the same level of understanding of wholesaler and retailer stock levels as it did with its distributors. That’s reasonable and should not be something to criticise the company for.

What is clear is that retailers and wholesalers are selling down their stocks – destocking – and are not ordering as much as they were from distributors – hence the revenue and profit warning.

How big an issue is this?

Investors will clearly be unnerved that trading has deteriorated so quickly and that management perhaps could have been quicker to spot this.

The hit to profit is hard to quantify. I have simply assumed that Latin American revenues have similar gross margins (c60 per cent) to the rest of Diageo’s business. The resulting gross profit fall from a 20 per cent decline in revenues is then assumed to drop straight through to lower profits.

Whilst gross margins could be lower due to price cuts or customers trading down to less expensive brands and costs could be higher due to higher marketing spending, it’s quite possible that first-half profits could be down by around 30 per cent in Latin America.

If the same revenue trend persisted for the whole year, then profits could fall by a third.

However, in the context of a company that was expected to make £5.3bn of trading profits next year, does a £220m plus reduction in Latin American profits justify a 12 per cent fall in the Diageo share price?

Could things get worse?

History suggests that once a company has warned on profits then weak business momentum often leads to another.

After all, Diageo was not expected to show much growth before its warning.

It has tried to reassure investors that the rest of its business is doing fine but it has alluded to slower momentum in Europe, a slower-than-expected recovery in China and that some Middle East markets have stopped trading altogether given the current troubles in the region.

It would therefore not be a big surprise if profit forecasts are reviewed downwards again.

What are its rivals saying about trading?

Last month, Pernod Ricard mentioned its Brazilian market had weaker travel sales.

LVMH and Remy Cointreau have both warned on a very difficult cognac market in the US due to destocking by distributors. LVMH’s wine and spirits business has seen a deteriorating sales trend throughout 2023 and has cited weakness in its champagne sales.

At the end of August, Brown-Forman had seen weakness in North America but its sales in Mexico had been very strong.

Yet there have been growing signs that consumers across the world have been cutting back on buying expensive, premium products.

High-end brands such as Richemont and Gucci have been suffering as even wealthy consumers pull back. The softness in the sales of premium spirits brands should not come as a major surprise.

Growth forecasts and valuations continue to fall

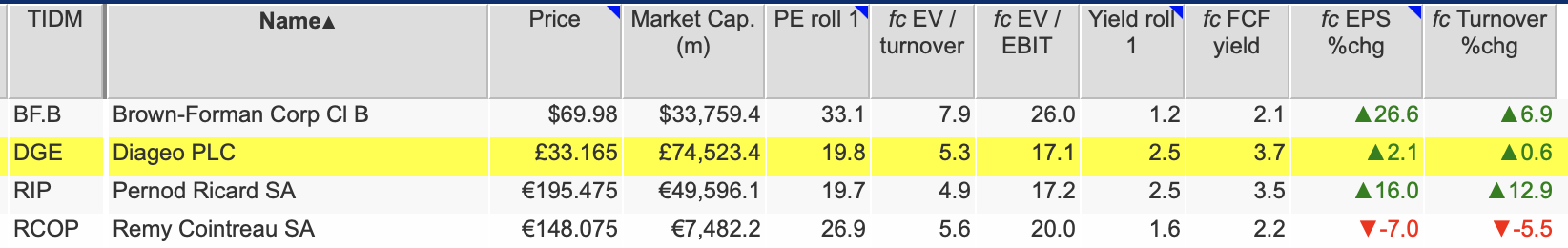

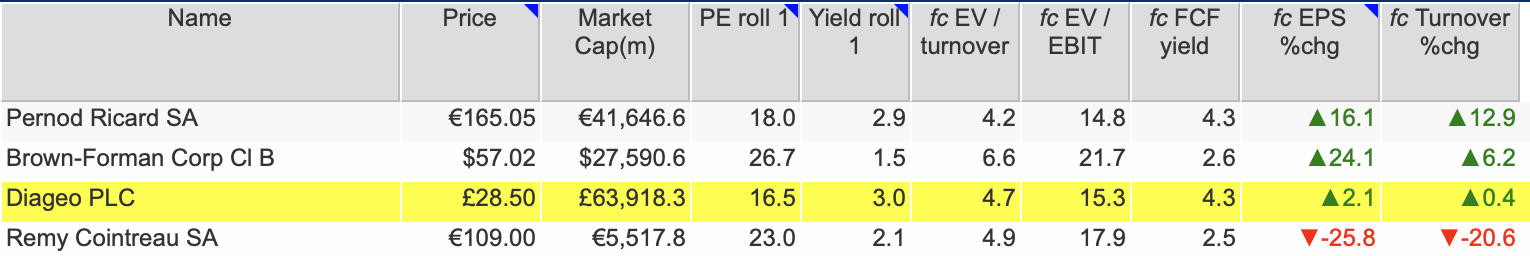

Whilst Diageo’s consensus forecasts in SharePad have yet to reflect the recent warning, growth forecasts(with the exception of Pernod Ricard) and valuations for global spirits have come down over the last three months.

Global Spirits: Growth and Valuation Forecasts August 2023

Source: SharePad

Higher interest rates have brought down share valuations in general, but weaker earnings stability and the growth potential for global spirits companies reasonably warrant a review of their attractions to investors.

Global Spirits: Growth and Valuation Forecasts November 2023

Source: SharePad

Has the premiumisation trend hit the rocks?

Not so long ago, the combination of low interest rates, high levels of profitability, and above all else, the expectation of steady and dependable growth saw the stock market attach high valuations to companies such as Diageo and sellers of high-priced, premium products.

We were led to believe that the world would have a growing monied class who would want to buy more expensive stuff.

What is worrying is that if consumers in Latin America can reduce the quantity of premium spirits they buy, so can consumers in other parts of the world.

If this happens, then Diageo’s unchanged guidance of 5-7 per cent revenue growth over the medium term begins to look questionable – certainly if it is banking on continued price hikes to achieve it.

Not only that, but it would become more difficult to warrant a high PE multiple on Diageo shares in this scenario. A mid-teens earnings multiple rather than one in the mid-20s might seem more appropriate.

On this basis, its shares might still have some way to fall.

~

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.