Recent attempts to turn Hornby into a consistently profitable and growing business have failed. Phil looks to see if last week’s purchase of a minority stake in Warlord Games provides the catalyst for a profit revival and a higher share price.

Hornby is in a mess

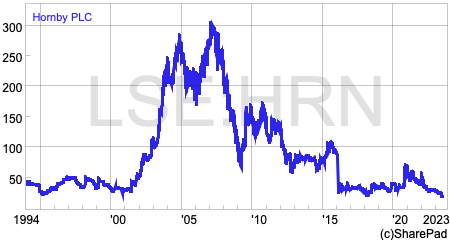

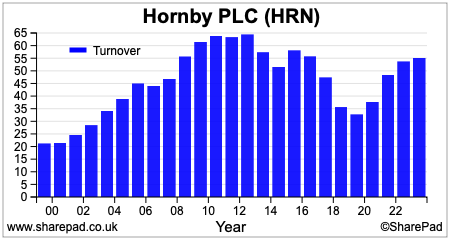

Whatever way you look at Hornby the company is in a mess. Its revenues are no bigger than they were fifteen years’ ago whilst it is losing money and bleeding cash.

The investment returns for shareholders have been horrible. Even after a share price rally at the start of this week the shares are still down 30 per cent year to date and have lost three-quarters of their value over the last decade.

Phoenix Asset Management, who bought 74 per cent of Hornby back in 2017 at 32p per share are experiencing a lot of pain at the current share price of 20p which is very close to an all-time low.

What has gone wrong?

On paper, Hornby should have the attractions of a strong consumer brands company. It has been in business since 1901 and has some iconic model brands in the form of Hornby, Airfix, Scalextric and Corgi. Many of its customers are avid collectors and modellers who have grown up with these brands.

Source: Company Report

Despite this, the company has been struggling for many years. It has found it hard to stay relevant in a world of video games and the internet. Also, many of its long-standing customers have died off and have not been replaced.

However, there is more to its problems than this. By its own admission, Hornby has made a lot of mistakes.

A new chief executive has been in place since January and is taking his opportunity to say what he feels is wrong with the business.

He believes that the company has not had a coherent strategy with any workable structure. It has not been focused enough on its brands and its customers.

Its products have arguably been too expensive with the lack of entry-level products making it very difficult to attract new and younger customers.

For a business with hardly any retail stores – apart from a visitor centre in Margate -Hornby has also been very slow to embrace the internet and direct-to-consumer sales.

Last year, only 15.5 per cent of its sales and 8 per cent of its sales volumes were over the Internet, although this has been improving. The majority of its sales are still made through third-party distributors.

One of the key benefits of direct-to-consumer sales is that it allows companies to collect a lot of data about their customers. Used well, it can allow businesses to market their products better and generate higher sales and profits. Hornby has not embraced this opportunity.

Digging into its accounts, there are also some worrying signs. It’s tooling and moulding assets have a gross value of £81.6m and have been depreciated to £11.7m. This means that they are over 85 per cent written off.

Not only does this make the business look underinvested with old and tired assets, it also gives some credence to the view that Hornby has relied on selling old models for too long.

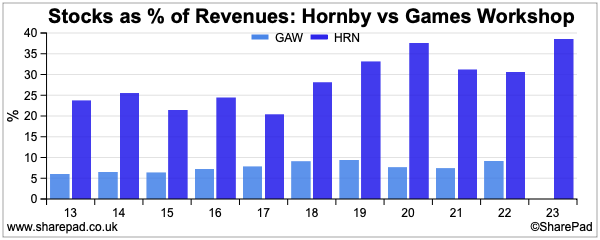

Arguably the most glaring red flag from the accounts is the evidence of horrible stock management.

Hornby is carrying a very high level of stocks compared with its sales with the ratio increasing in recent years. High stock levels eat up cash and increase capital employed whilst risking future price discounting and the lower profits that come with this.

If you compare Hornby with the best in class in Games Workshop, you can get some idea at how badly the company is performing on this key measure.

The company significantly overestimated demand for its key third-quarter selling period last year – October to December – and trashed its cash flow in the process.

What’s more alarming is that Hornby did not carry enough stock of its new TT120 railway products which were very popular with customers and lost sales as a result.

Another worry is that apart from the non-executive chairman, there appears to be a distinct lack of operational industrial experience at the board level.

Hornby’s problem in numbers

Put simply, Hornby cannot currently make enough gross profit from selling its products to cover its fixed costs and is therefore making a trading or operating loss.

Hornby: Gross profit vs fixed costs

| £m | 2022 | 2023 | 2024F |

| Revenues | 53.74 | 55.11 | 61.17 |

| Gross profit | 25.72 | 26.94 | 30.58 |

| Gross margin | 47.9% | 48.9% | 50.0% |

| Fixed Costs | -24.63 | -28.01 | -29.68 |

| Op profit before exceptional items | 1.09 | -1.07 | 0.91 |

Source: Company Reports/My estimates

Assuming the company’s recent guidance of high single-digit/low double-digit percentage sales growth this year with higher gross margins, it will only make a small operating profit, if inflation sees fixed costs grow by around 8 per cent.

Its shareholders need it to do a lot better than this.

How profits can grow

The company is trying to address its problems.

A key task is to grow the percentage of direct-to-consumer sales. In doing this, Hornby must also improve its website, email marketing and social media presence.

More direct-to-consumer sales will reduce the reliance on distributors and will bring the following benefits:

- Higher average selling price.s

- Higher gross margins.

- Full control of prices and discounting.

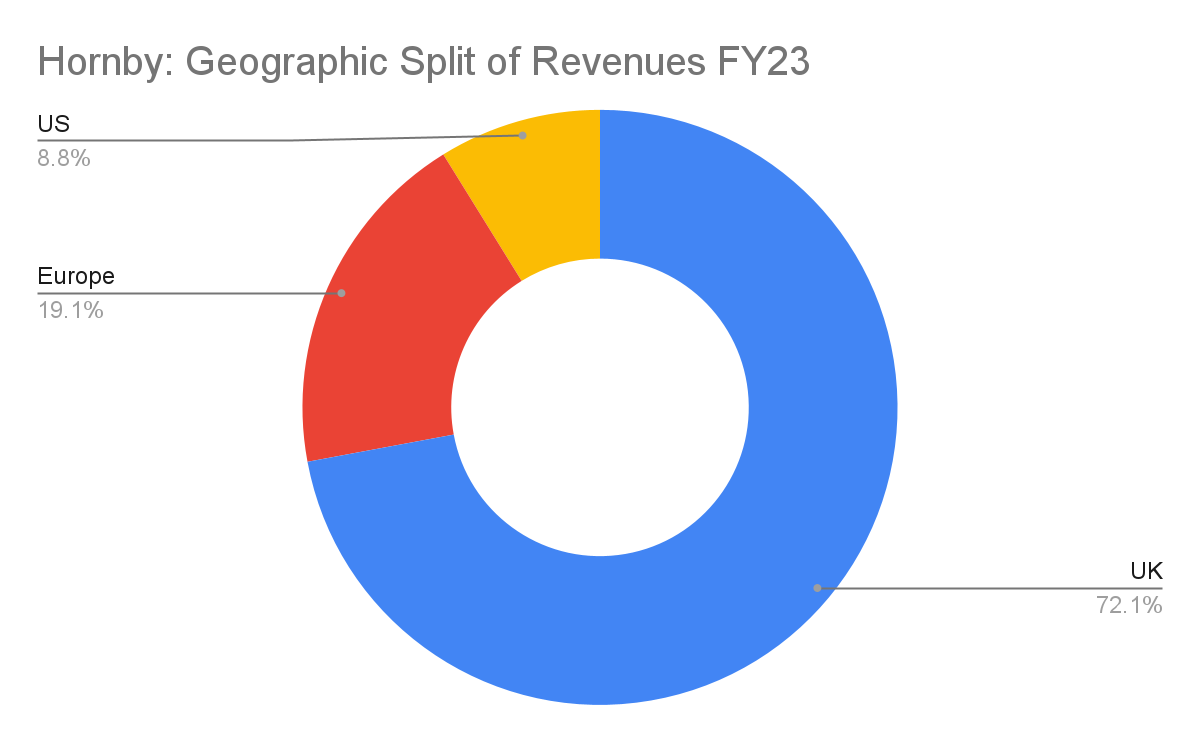

Hornby is also beefing up its sales efforts. A new head of export sales is in place with the company seeking to hire another sales director.

The company’s loyalty scheme, Hobby Rewards, has a lot of potential to grow sales. It currently has 36,000 members who on average, spend around two and a half times more than non-members.

Hornby has also been releasing new products which can help grow sales. Its Table Top 120 (TT120) railway sets have been well received by customers.

With a scale of 1:120, they are smaller than the very popular 00 gauge which at 1:76 needs a lot of space to set up and has arguably put some people off buying Hornby models. With new locomotives and sets to come this year, this seems like an encouraging development for Hornby.

Hornby also needs to develop new entry-level products from Airfix, Scalextric and Hornby at lower prices to open up new markets from retailers who focus on cheaper and value-for-money products.

One other issue is that Hornby may have too many brands that aren’t profitable enough. It needs to significantly improve its gross margins and this could be done by slimming down the brand portfolio.

The good news is that Hornby does have some very profitable products. If you look in the notes to its accounts about testing goodwill for impairment, Corgi (bought in 2008) and Airfix (bought in 2006) are valued on the basis of respective gross margins of 61.4 per cent and 65.6 per cent.

As well as improving gross margins, Hornby is going to have to increase its sales volumes and leverage its fixed overheads to boost profits. Management believes that its current cost base can deliver much higher sales than it is at the moment.

Why Warlord Games could be a very good acquisition for Hornby

Last Friday (7th July), Hornby announced that it had bought a 25 per cent stake in Warlord Games for £1.25m. It also has the option to buy a majority stake and the entire company in the future.

This is not a big deal in financial terms, but operationally and strategically it could make a big difference to Hornby and the long-term value of its shares.

Unless you are an avid follower of the gaming industry you probably have never heard of Warlord Games. It was founded in 2007 by two former Games Workshop employees – John Stallard and Paul Sawyer -who set out to build plastic historical miniatures starting with Romans in 28mm scale.

The company started life based around Stallard’s kitchen table but today is based in Nottingham, not too far away from the hugely successful Games Workshop.

Warlord also has Rick Priestley – one of the founders of Games Workshop’s Warhammer brand – as a 10 per cent shareholder. He has been responsible for creating and developing many of the rules and rulebooks that accompany Warlord’s military games. He brought Black Powder to the company which is used in Waterloo games amongst others.

Warlord offers military games from ancient battles to World War Two and into the future. Its rules are highly regarded amongst military gamers and include the following:

- Hail Caesar (ancient period)

- Pike & Shotte (English civil war)

- Blood Red Skies (Fighter aircraft battles)

- Cruel Seas (Seaborne battles)

- Bolt Action (WW2 battles)

As well as miniatures and games, Warlord sells paints, equipment, books and magazines. It is essentially a smaller, military version of Games Workshop.

Warlord looks like it could be a very good deal for Hornby.

First of all, Warlord Games is a very well-respected company and Hornby looks like it has bought its stake for a very good price. It has bought a 25% stake for £1.25m which values the whole business at £5m.

No details of Warlord’s profits were given in the RNS announcement, but a look at Warlord’s last published accounts from Companies House for the year to October 2022 shows a movement on the profit and loss account reserve on the balance sheet – which is usually the retained profit for the year – of £494,000.

There is no mention of dividends paid – which reduces retained profits – but taking this profit into account then it looks as if Hornby has paid 10x historic earnings for Warlord. There is also no mention of earn-outs for future years or what value the remaining stake will be bought for but this looks like a very good price.

If £494,000 was the true net profit for 2022, then Warlord’s return on equity (£2.3m) was a very respectable 21.2% which shows that Hornby is getting its hands on a good business here.

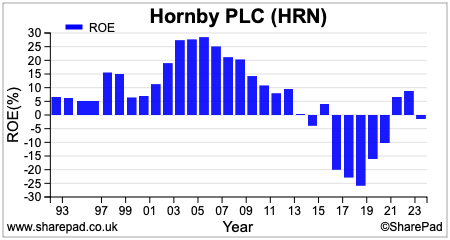

According to SharePad, the last time Hornby made a return on equity of more than 20% was back in 2008.

From a profit point of view, it looks as if Warlord is a superior business to Hornby, providing its historic performance can be maintained.

Warlord has a decent sales model and sells to over 600 distributors. It has an established direct-to-consumer website and an online Warlord community which engages with its customers – something that Games Workshop has done so well.

With access to Hornby’s distribution network and combining marketing efforts, Warlord looks in a good position to grow faster than if it was a standalone company.

What Warlord brings to Hornby is entry into the gaming business. When well executed, gaming miniatures that efficiently utilise the manufacturing footprint involved can make very high-profit margins and returns on investment.

The obvious benefit is combining Hornby’s very strong Airfix brand with Warlord’s existing military gaming business. By adding gaming revenues to Hornby’s existing sales mix, overall revenues and gross margins can increase.

Another possible attraction of acquiring Warlord is the management experience that it brings to Hornby. John Stallard has many years of experience in gaming and miniatures which is something that Hornby arguably does not have enough of.

Warlord would also bring UK manufacturing capacity that can be leveraged with Hornby products reducing transportation costs, leading to better quality control and more profit.

Whether this would replace Hornby’s current manufacturing in China has not been mentioned yet -Humbrol has already brought a large chunk of its manufacturing back to the UK from China – but it might make sense from both a financial and brand image point of view.

Valuing Hornby Shares

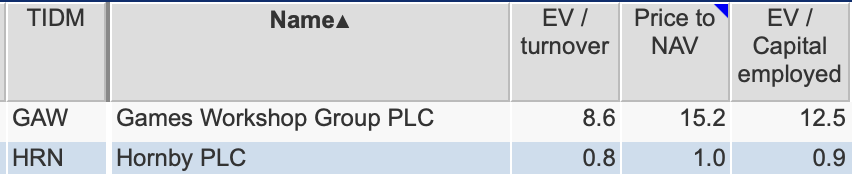

Hornby’s current loss-making status and lack of broker forecasts make it harder to value than most shares. We can still use SharePad to look at historic values based on its revenues or turnover, net assets or capital employed.

Source: SharePad

Unsurprisingly, given its poor profitability, Hornby trades on very low valuations. In other words, the shares are cheap for a reason.

The lack of forecasts need not be a problem for investors. As long as you have a company’s current share price or market capitalisation you can estimate what level of steady state profits are implied by it.

I’ll show you how to do this.

Hornby: Steady state profits implied by current share price

| Current share price(p) | 20.5 |

| Shares in issue(m) | 169.9 |

| Market Cap | 34.83 |

| Cost of Equity | 11.60% |

| Required Net Profit | 4.04 |

| Add back: | |

| Tax @ 25% | 1.35 |

| Pre-tax profit | 5.39 |

| Net Interest | 0.832 |

| Required Op Profit | 6.22 |

Source: My calculations

The value of an annuity – a fixed annual sum paid forever – is the profit divided by an interest rate. We already know the value which is the market capitalisation. The interest rate I will use is the rate used by Hornby to value the goodwill on its balance sheet. In this case, it is 11.6 per cent after tax. (after-tax interest rates are being applied to after-tax or net profits).

By multiplying the market capitalisation by the interest rate we get the required steady state net profits needed to justify the current share price. In this case, it is just over £4m.

Adding back tax at 25 per cent and net interest gives an implied operating profit of £6.2m – a level last exceeded in 2009.

To be worth more than the current share price of 20.5p, you have to believe that Hornby can earn more than £4m in net profits sustainably going forward.

This is not going to happen anytime soon but buying Warlord Games could help it on its way.

A word of warning on liquidity and large spreads

Hornby shares only have about 10% free float excluding the shareholdings of Phoenix Asset Management and Artemis. Bid offer spreads – the difference between the buying and selling price – are usually wide which means you can immediately be sitting on a material unrealised loss when you buy.

Like many small company shares, if things go well then a clamour for shares will see a sharp rise in the share price. If there are further profit warnings then it will be a painful experience as sellers stampede for an exit which could result in serious losses.

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.