Phil looks at the income on offer from UK government bonds and asks whether sticking with shares might still be a better option.

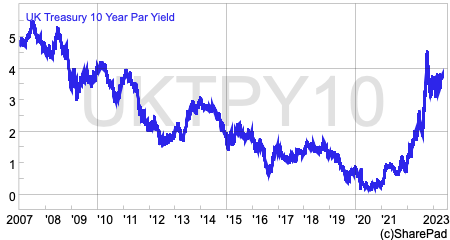

Since the 2008/09 financial crisis, investing in government bonds for income has not been very fruitful. The policy of very low-interest rates as a response to the crisis meant that many governments could borrow for very little cost. In return, investors in bonds received a much lower interest income than they had been getting previously.

Investors looking for income had to look for alternatives such as shares or property.

The world has now changed again. Inflation is back and interest rates have been going up in order to try and bring it back down. Government bonds now pay much higher rates of income than they have for much of the last decade (although still less than the rate of inflation), but should income seekers be buying government bonds now?

In this article, I am going to look at whether UK government bonds – also known as gilt-edged securities or “gilts” – make sense for income-seeking investors.

If you want to understand more about gilts, bonds and the characteristics of them, please refer to my step-by-step article here.

Why income seekers might want to buy Gilts

The main reason is that the income on offer is higher than most savings accounts and safer.

Looking around the best buy tables at the moment shows that you can get around 3.5 per cent on your savings if you put your money with a provider you might have heard of.

However, your savings are only covered up to a maximum of £85,000 per account if the provider goes out of business.

This is a reason why savers with larger amounts of money to invest might look at gilts instead. Unless the UK government goes bankrupt -which is unlikely given that it can print its own money – you will get your money back.

Individual UK Gilts

Private investors can buy individual gilts through most online brokers and hold them in tax-free accounts such as an Isa or Sipp.

Investors might consider individual gilts if they are looking for a guaranteed income stream over a period of time. This is adopted in a strategy known as bond laddering where investors buy bonds of varying maturities in order to give themselves a predictable income stream into the future.

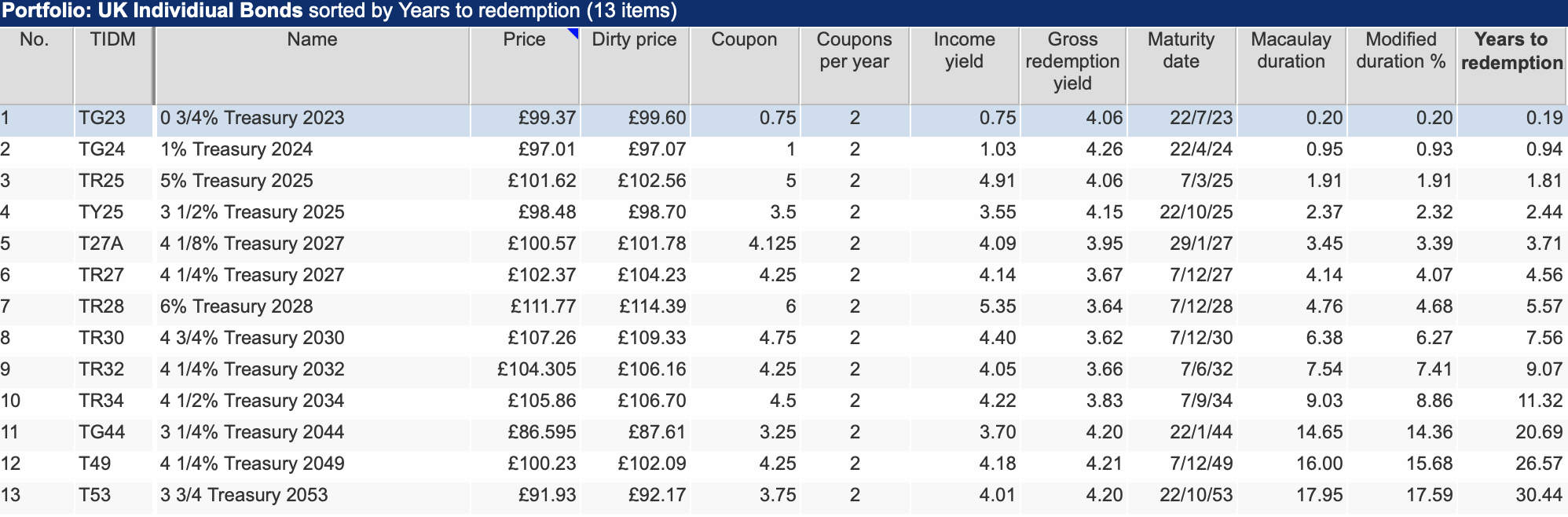

In the table below, I’ve taken a selection of individual gilts from SharePad to see what’s on offer right now.

Source: SharePad

The key column to focus on if you are an income seeker is the income yield – the annual bond interest (or coupon) expressed as a percentage of the bond price.

What you can see is a number of gilts with different maturities offering income yields of between 4 and 5 per cent.

Very short-dated gilts such as 1% Treasury 2024 is offering an income yield of just over 1 per cent. 5% Treasury 2025 currently gives a yield of 4.9 per cent, whilst 6% 2028 is offering 5.35 per cent.

If you are looking far into the future, you could buy 3 ¾% Treasury 2053 and get an annual income on your purchase price of 4 per cent per year for the next thirty years.

By paying just over £92 today and getting £100 back in 2053, investors will also make a small capital gain. This is reflected in a gross redemption yield – or yield to redemption – of 4.2 per cent. This is the annual total return you will receive from holding the bond to maturity.

The security of these income streams can be very attractive for investors who value predictability and don’t want to take lots of risk.

The drawback is that unless you buy index-linked (or inflation-protected) gilts, the amount of money you receive each year is fixed. It cannot fall like when a company cuts or scraps its dividend but it cannot grow either, unlike company profits.

If inflation remains high or increases then £4 of income on each gilt received today is going to buy a lot less in thirty years’ time than it will today.

If you believe that the current inflation is temporary and prices will fall or stay stable then you might see the current £4 on offer as a good deal.

Investors who hold bonds until they mature will not worry about changes in interest rates or interest rate expectations, but if you hold long-maturity bonds they can have a big effect on their price.

The modified duration tells us the expected change in the price of the bond for a one per cent change in interest rates. Remember, that bond prices move in the opposite direction to interest rates.

In the case of individual gilts, a bond maturing in 2025 might only move by 1.9 per cent in response to a 1 per change in interest rates. One maturing in 2053 would move by 17.6 per cent.

If you think interest rates in the UK will keep on rising, then buying a long maturity gilt could mean you end up losing money if you need to sell over the next thirty years. Short-dated bonds will help you sleep better at night and avoid big losses.

However, if you think that we are going back to a world of ultra-low interest rates in the next few years then you could make some capital gains by buying a 2053 gilt as its price could rise substantially.

UK Bond ETFs

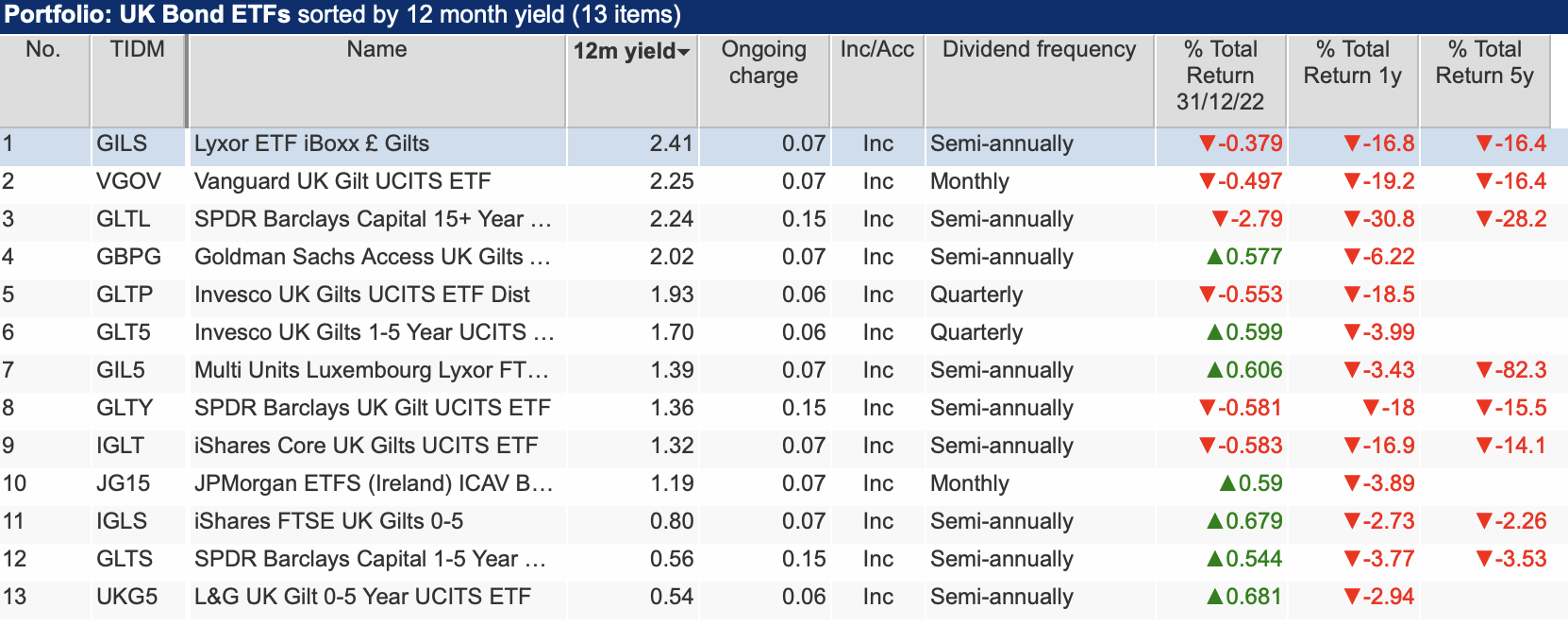

If you don’t want to buy individual gilts, then you could buy an exchange-traded fund(ETF) or a managed bond fund instead.

This means that you will be owning a basket of different bonds with different maturities. You will not have the same predictability of income and could experience large changes in the capital value of your investment.

At the moment, UK gilt ETFs are offering very low-income yields (12m yield). This is because many of them are stuffed with gilts that have had very low coupons (interest rates) issued in recent years.

As the low-coupon bonds begin to mature – and assuming that interest rates do not change – they will be replaced by higher coupon gilts over the next few years which should see the yields on these ETFs gradually increase.

Source: SharePad

What is very striking when looking at the performance of some of these bond ETFs is how bad they have been, not just only in the last year but also over the last five years. It is a very good example of showing how bonds can be anything but safe and generate losses that are often seen with shares.

Some investors might be happy with 4-5 per cent income yields from individual gilts right now – especially if they are nervous about the possibility of falling dividends and share prices.

Corporate bonds are more risky as companies can and do go bust. However, a look at the income yields currently on offer from corporate bond ETFs suggests that investors aren’t getting much more income for the extra risk they are taking on compared with gilt ETFs.

Individual corporate bonds can have much higher yields but the risks and potential losses can be significant if the bond-issuing company gets into financial difficulties.

Corporate Bond ETFs

Source: SharePad

Should income seekers stick with shares instead?

Whilst the income yields on gilts and corporate bonds are higher than they have been in the recent past, there’s still an argument that shares could still be a happier hunting ground.

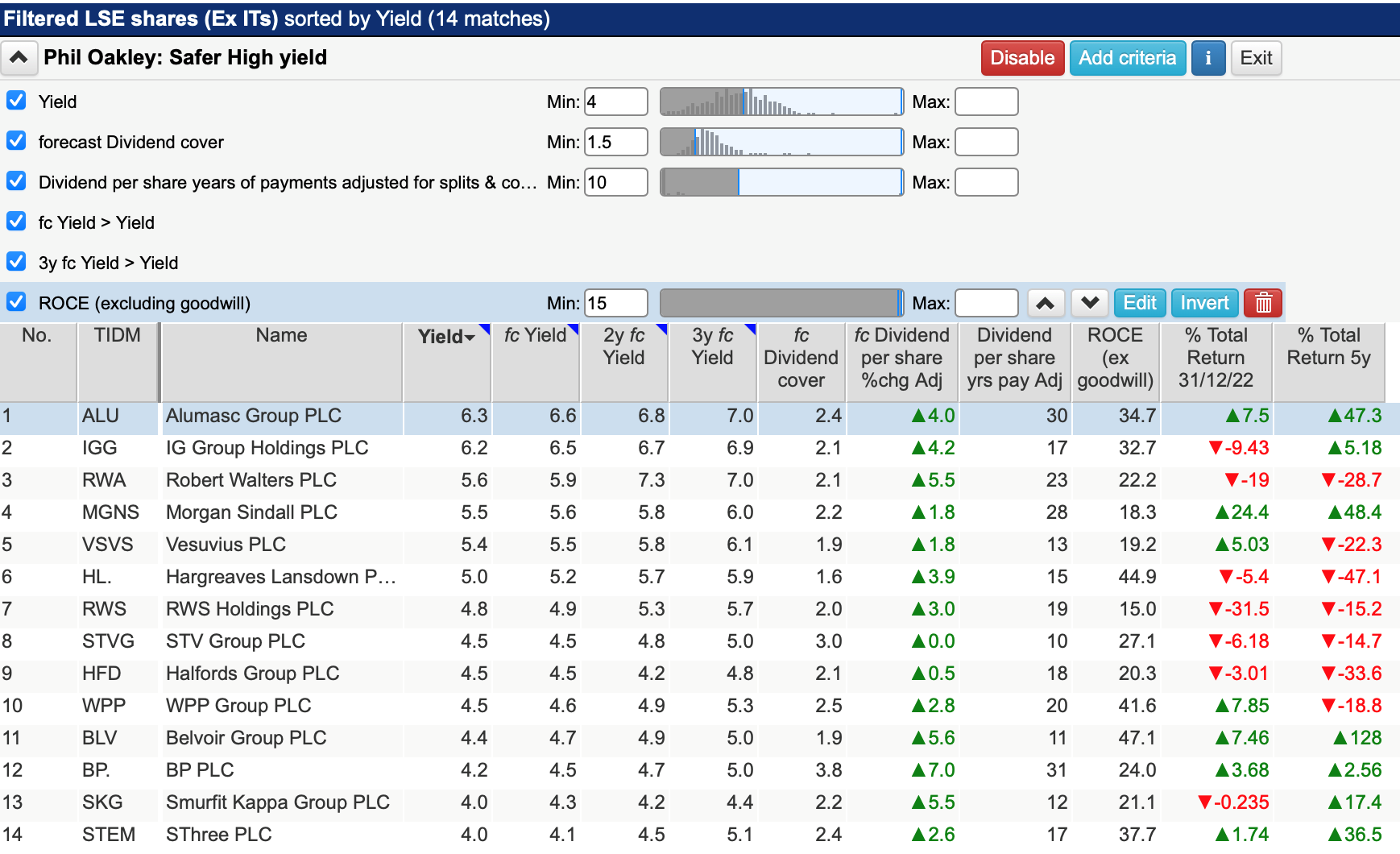

Here, I have asked SharePad to find me shares with the following criteria:

- A trailing dividend yield of at least 4 per cent

- Forecast dividend cover of at least 1.5 times

- A minimum of 10 years of continuous dividend payments – to weed out weaker companies.

- Forecast yield higher than trailing yield – in other words the dividend is expected to grow.

- Three-year forecast yield to be more than trailing yield. This eliminates currently high-yielding shares where a dividend cut may be expected in the next few years.

Source: SharePad

You can see here that there are some particularly chunky yields on offer, albeit with modest expected dividend growth in most cases.

High yields often coincide with high risks and poor total returns. Imperial Brands, for example, may offer a very high yield with further expected dividend growth but investors have made no money from the shares if they have held them for the last five years.

Dividend aristocrats – focus on quality dividend growth instead

I am very much in agreement with Ben Hobson’s recent article advocating dividend growth as a strategy rather than focusing on yield alone.

Source: SharePad

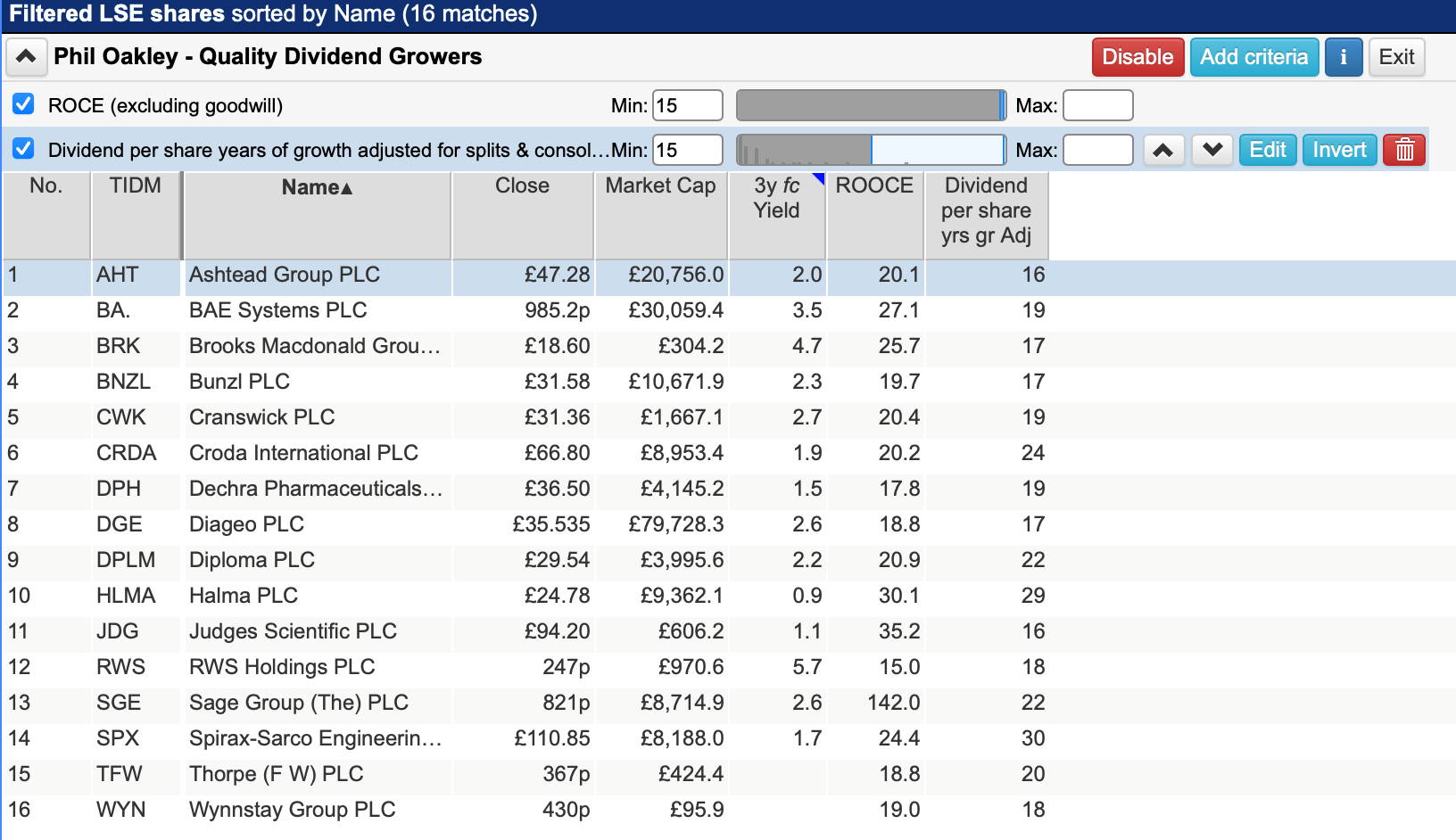

I have run a SharePad screen which focuses on quality companies with an excellent track record of dividend growth. It has come up with a selection of what I call “dividend aristocrats” of companies with a minimum return on operating capital employed (ROOCE) of 15 per cent and at least 15 years’ of consecutive dividend growth.

SharePad has also calculated the dividend yield on the share price 10 years’ ago – the yield on cost. The lesson here is that buying growth companies and being patient can actually deliver investors with a very handsome income on their original purchase price.

Ashtead only offers a trailing dividend yield of 1.4 per cent at the moment. However, that same current dividend gives a yield of more than 10 per cent on the share price of 10 years’ ago.

Yield on cost is a very simple but powerful view of the merits of long-term investing. Warren Buffett has regularly referred to it in his annual shareholder letters when discussing his investment in Coca-Cola.

Berkshire Hathaway completed its purchase of 400 million Coca-Cola shares in 1994 for a total cost of $1.3bn. In 2022, it received a dividend from the company of $704 million – a yield on cost of more than 54 per cent.

Just as a theoretical exercise, I have looked at the potential five and 10-year yields on the current share prices of my dividend aristocrats if dividends keep on growing at their current projected rate.

Of course, all the companies are unlikely to deliver this but this can be a useful exercise for weighing up whether a share still has income attractions.

Dividend yield on current share price at current rate of dividend growth

| TIDM | Name | Price(p) | DPS(p) | Yield | 1yr f/c DPS gr | 5yYield on Cost | 10-year yield on cost |

| AHT | Ashtead | 4728 | 66.6 | 1.4 | 13.1% | 2.6% | 4.8% |

| BA. | BAE Systems | 985.2 | 27 | 2.7 | 7.3% | 3.9% | 5.5% |

| BRK | Brooks Macdonald | 1860 | 71 | 3.8 | 5.9% | 5.1% | 6.8% |

| BNZL | Bunzl | 3158 | 62.7 | 2 | 5.6% | 2.6% | 3.4% |

| CWK | Cranswick | 3136 | 75.6 | 2.4 | 3.5% | 2.9% | 3.4% |

| CRDA | Croda International | 6680 | 108 | 1.6 | 4.3% | 2.0% | 2.5% |

| DGE | Diageo | 3553.5 | 76.2 | 2.1 | 6.5% | 2.9% | 4.0% |

| DPLM | Diploma | 2954 | 53.8 | 1.8 | 8.0% | 2.7% | 3.9% |

| HLMA | Halma | 2478 | 18.9 | 0.8 | 8.7% | 1.2% | 1.8% |

| JDG | Judges Scientific | 9420 | 81 | 0.9 | 10.0% | 1.4% | 2.2% |

| RWS | RWS Holdings | 247 | 11.7 | 4.8 | 3.0% | 5.5% | 6.4% |

| SGE | Sage | 821 | 18.4 | 2.2 | 4.9% | 2.8% | 3.6% |

| SPX | Spirax-Sarco Engineering | 11085 | 152 | 1.4 | 8.0% | 2.0% | 3.0% |

| WYN | Wynnstay | 430 | 17 | 4 | 4.1% | 4.8% | 5.9% |

Source: SharePad/My calculations

Phil Oakley

Got some thoughts on this week’s article from Phil? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.