A major shift in the market cycle has forced investors to think more defensively over the past 18 months. But with expectations of a recovery on the horizon, where can you look for some of the early winners when markets rebound?

_________________

When markets began to slide in early 2022, it was an acknowledgement that rising inflation was going to put the boot into company earnings. Higher costs and lower demand would hurt the profits of those that couldn’t quickly pass them on to customers.

Naturally, small and mid-cap indices were the worst affected. It was here where go-go growth had been such a powerful return driver since the financial crisis – helped by easy monetary conditions. The promise of profit further down the line kept investors enthralled by smaller, more speculative stocks.

But with rising inflation and interest rates and the possibility of recession came a switch. Suddenly, it was larger, more defensively positioned companies that were popular. Especially those with strong cash flows and shares that were lower volatility and, just as importantly, cheap. Value was back.

Winners in the next phase of the market cycle

Nobody knows exactly what lies in store for the economy and the stock market. Turmoil in the banking sector in March showed how problems can come from left field – and there could be more hiccups to come. But some analysts now reckon that the current rate-hiking cycle is nearing an end.

Over the past couple of weeks, I have been exploring ideas and strategies that can offer a bit of defensive resilience to your investing in times of trouble. They included How to build defence into your portfolio and How to use low volatility to your advantage.

While it still feels like investors are playing “wait and see” with small and mid-cap stocks, the relentless market cycle does offer a few hints about where the early beneficiaries might be when sentiment improves.

The table below is based on work by the investment management firm Invesco, and it uses historical performance to show the preferred factors at different stages of the market cycle:

| Bear market | Early cycle | Mid-cycle | Late cycle | |

| Description | 20%+ drawdown | Rebound | Grinding higher | Surge |

| Factor | Low volatility | Size and Value | Momentum | Quality and Momentum |

| Preferred sectors | Healthcare, Drug and grocery stores, Food, Beverage & Tobacco, Telecoms, Utilities, Energy,

Consumer products and services, Retailers |

Banks and financial services, Insurance, Basic resources, Autos & parts, Retailers, Technology | Real estate, Financial services, Insurance, Industrial goods & services, Healthcare | Basic resources, Travel & leisure, Technology, Construction & materials, Industrial goods & services, Consumer products & services |

Source: Invesco

This shows how bear markets – where equity prices fall by more than 20% – tend to work out best for lower volatility shares in defensive sectors like healthcare, consumer staples (like beverages, food and tobacco), utilities, energy, consumer products and retail. That certainly rings true from the experience here in the UK since early 2022.

But what about the future? According to this analysis, once the threat (or reality) of recession passes and corporate earnings expectations rebound, ‘size’ and ‘value’ are expected to be the two big factors to benefit as a new cycle starts.

That makes sense when you consider that cheap shares rallied hard in the aftermath of major bear markets like the dot-com bubble in the early 2000s and the financial crisis in 2008/09.

In this group of early potential winners, there is a slightly more pro-cyclical feel to things. Banks and financial services, insurance, basic resources and consumer discretionary can typically do well early on. Sectors exposed to improving consumer confidence and higher borrowing can benefit, such as retail and autos and parts.

So what should you look for? Here’s a checklist of things to think about in the search for stocks that might be worth watching:

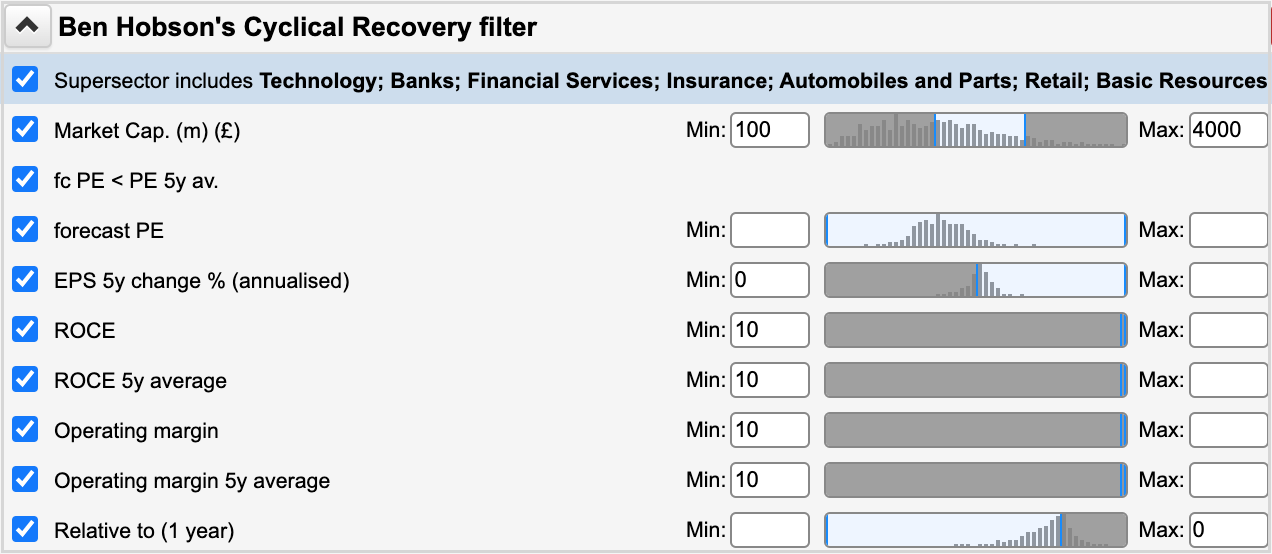

#1. Sectors. Focus on those that could benefit first in a recovery: Banks, Financial Services, Insurance, Basic Resources, Automobiles and Parts, Retail and Technology.

#2. Size. Given that small and mid-cap shares have sold off sharply over the past year, they could offer better value. This filter focuses on the £100m – £4bn range.

#3. Value. Is the share price cheaper than it has been on average? Inspired by a rule that Phil uses in some of his screens, this looks for a forecast P/E ratio that is lower than the company’s five-year average P/E.

#4. Quality. Apply some basic quality limits to focus on profitable firms. That might include those that have seen earnings growth over the previous five years, double-digit margins both now and in the past, and the same with return on capital employed (ROCE).

#5. Momentum. Negative price trends are usually the opposite of what most investors look for. Yet shares that have undershot the market over the past year could be the place to start looking for those that still have a long way to recover. You could add a nearer-term positive momentum rule to look for early signs of strength.

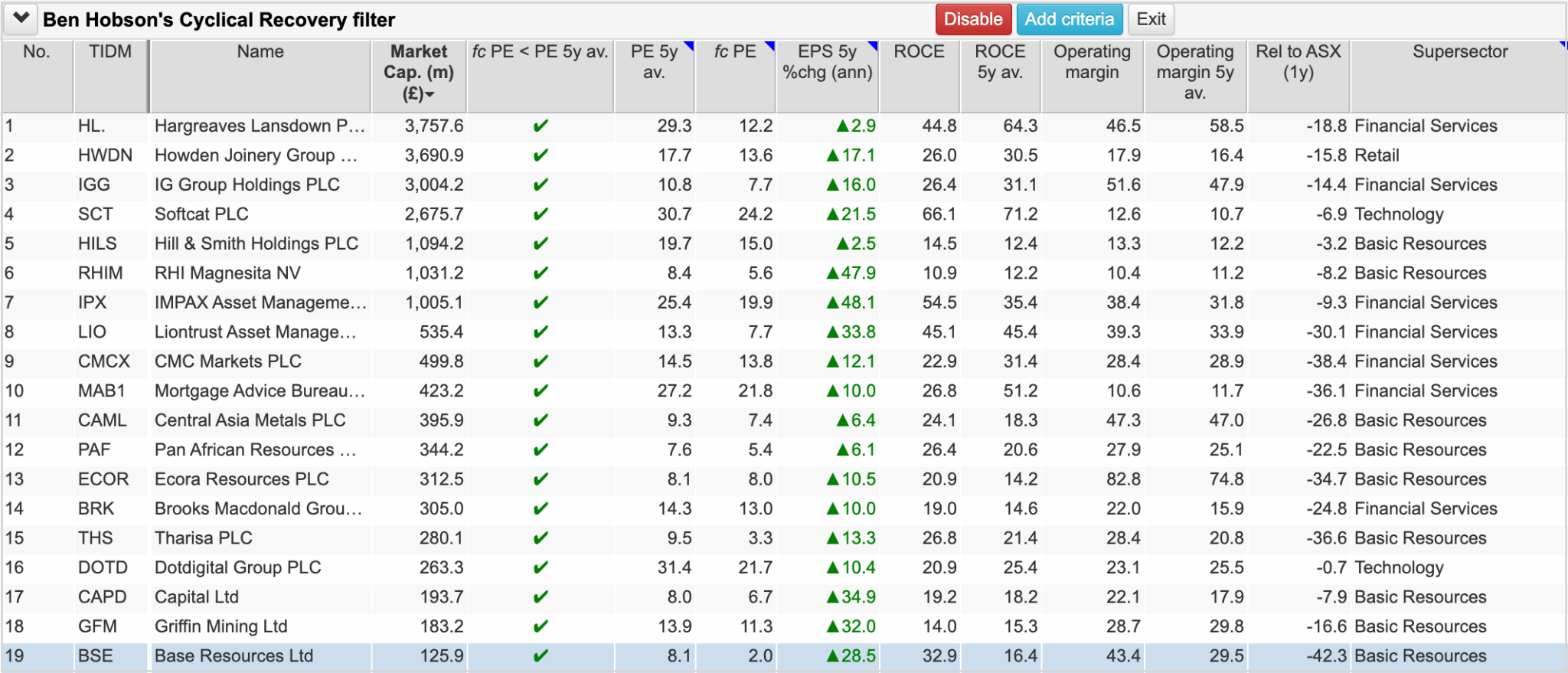

At the moment, this set of rules – and you can tailor them however you want – pick up an interesting range of shares. Financial trading platforms and even asset managers, for example, are historically profitable but quite cyclical businesses, where prices suffer when the market is uneasy – and you see that in these results. Likewise, smaller mining stocks often come with a good story, which means they demand careful handling. But these at least have an earnings track record to go on.

What can we learn from this early-stage recovery strategy?

With the market cycle constantly on the move, most investors are not going to be regularly adjusting their holdings to take account of what comes next. And neither should they. But what has been striking about the market over the past year, is just how ‘textbook’ it has been in terms of those shares and sectors that held up better than others. It has been a stark reminder of why defensives have a role to play in portfolio construction.

Looking ahead, the next stage of the cycle (the early rebound phase) has historically brought strong returns. It may be some way off, and there could still be more trouble to come, but when sentiment lifts it might be worth keeping an eye out for the beaten-down stocks and sectors that will lead the recovery.

_________________________________________

Portfolio Surgery

In the weeks ahead we are considering introducing a new Portfolio Surgery to the editorial line up, where you can anonymously pose questions to our writers about your portfolio or strategy. As ever, you should always do your own research before buying or selling any investment or seek professional financial advice but we hope this new series will offer ideas or suggestions to explore that you and other subscribers will find educational.

If you are interested, give us some background with the help of these questions and send us a message at marketing@sharepad.co.uk

● How long have you been investing/trading?

● What is your primary reason for investing/trading?

● What types of shares are you interested in and how would you describe your investment approach and risk appetite?

● What shares do you have in your portfolio?

● What question would you like to ask about this portfolio?

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.