Let’s look at the data. Yes, I am data-obsessed. Too many people speak twaddle without looking at the facts or data. By the way, here’s a good trick on social media when you find annoying twaddle, just put this into the comments “Data?”.

Out of the 350 largest quoted companies on the London Stock Exchange this the data year to date:

- RPS Group is up 77% and the best performer.

- Energean is second with Pearson both at 61% returns this year.

- Telecom plus come in at 57%

I will share my pics for next to APSE subscribers (www.alpeshpatel.com/sharescope) on January 5th.

Of the 350 stocks, only 75 have risen so far this year.

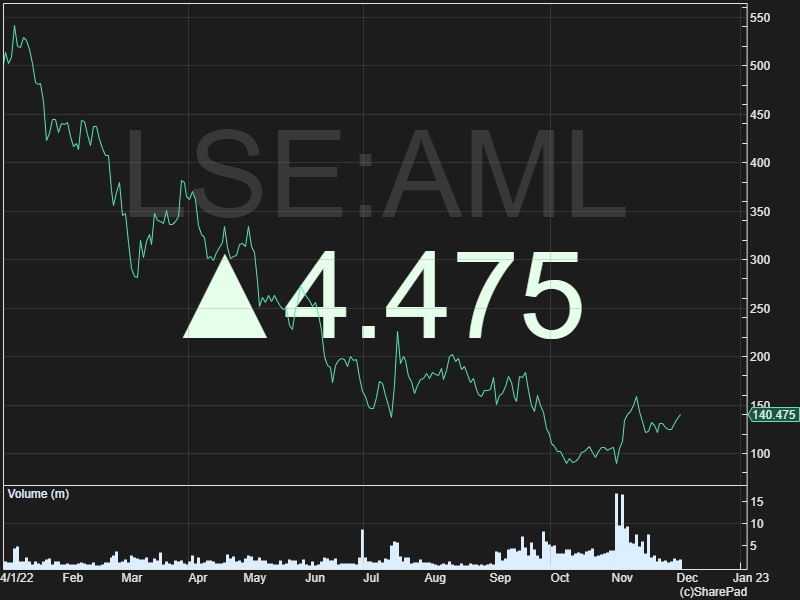

- The worst fallers are Aston Martin (down 75%)

- Tied with ASOS and 888 coming in at down 65%.

Household names have had a mixed year. The ones which are down a lot include Ocado (down 62%), Moonpig (down 58%) and Dr Martens (halved in price). You also lost half your money with Wizz Air and Wetherspoons.

Household names that did well include BP, Shell, BAE Systems – all benefiting from the Ukraine war and giving you a 50% return.

So, where do we put our money?

None of the data gives you wisdom on where to put your money. Where is that then?

Well, the UK FTSE 350 is down (just) for the year. The Mumbai BSE 100 is up 5% by comparison. The Dow is down 7% and the China 50 index down 32%.

The FTSE 350 is at 2017 levels. It’s up 25% from the lows of Covid in 2020. And it’s now far of all-time highs.

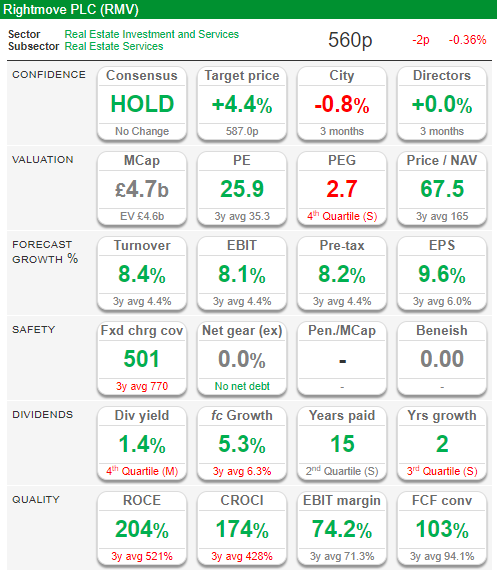

The company giving the best cash return on capital invested (the company’s cash on it’s capital) is Rightmove with 175% cash return on the capital the company invests.

The least volatile is Capital Gearing Trust. Hmm. None of these are factors to buy. The most volatile are Tullow Oil, National Express and Ocado. I don’t like volatility.

One measure of value is share price compared to the growth in profits. BP, Shell are cheap on this measure. So is Harbour Energy.

Companies hitting all-time highs are Homeserve, Pearson, Unilever and Burberry.

Those giving the best dividend yields look like Persimmon, Ferrexpo.

Over the past 10 years, you would have made the most money by having bought JD Sports (1,600%) and Ashtead (1200%). You would have lost almost all your money in Tullow, Petrofac and Harbour Energy over the same period.

Right, enough of the data for now. APSE subscribers keep an eye out in January for my annual picks to give you more idea of which companies look good for a pension, SIPP or ISA.

Check out my www.campaignforamillion.com too.

Alpesh Patel OBE

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.