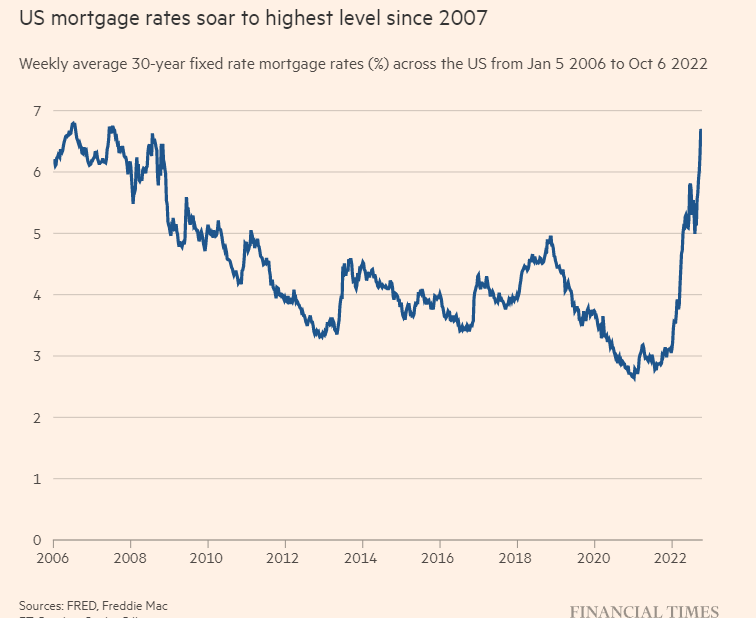

We’re not alone – if it makes you feel better. Look at the Americans.

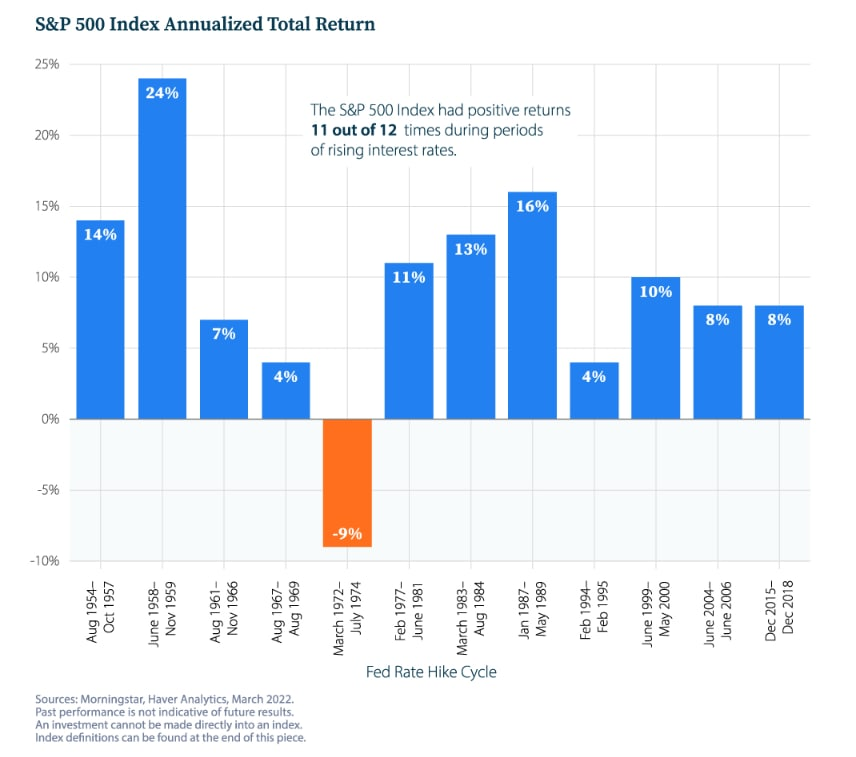

Of course, you could argue that the market will help when rates are rising according to history:

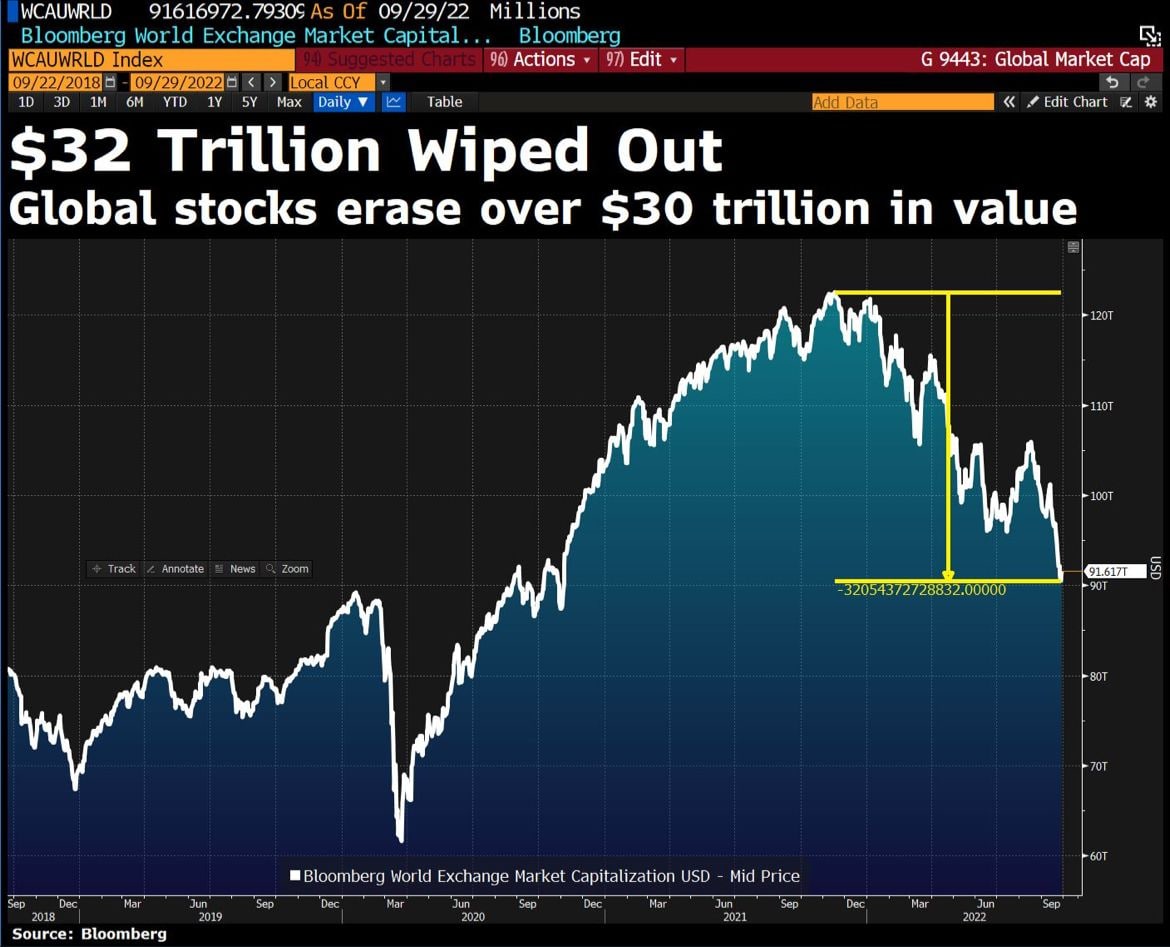

It’s no secret that inflation can have a significant impact on your portfolio. During times of high inflation, it can be difficult to maintain your original allocation and protect your investments.

In this blog post, we will take a look at what some experts are saying about portfolio allocation during high inflation. We will also explore the options available to you, such as hedge funds, stocks, and ETFs.

What is the impact of inflation on investments?

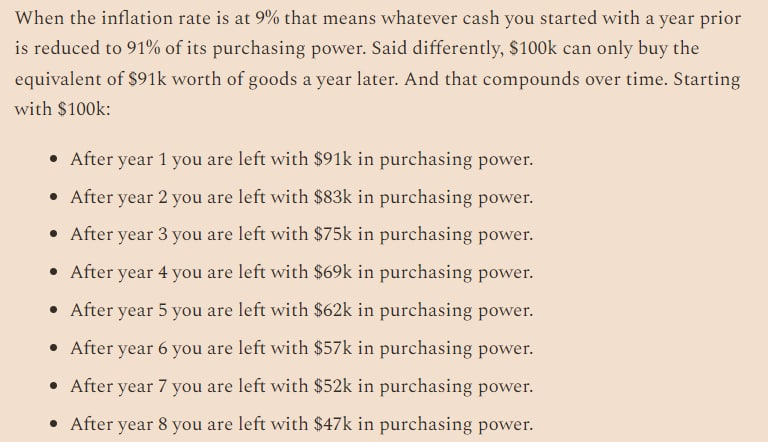

Inflation is the general increase in prices and fall in the purchasing power of money. It occurs when the cost of living goes up, and your money doesn’t go as far as it used to.

Investments are not immune to inflation. In fact, they can be a key driver of inflation. When the price of goods and services goes up, so does the cost of production. This often leads to wage increases, which then drives up the cost of living even further.

Investors must be mindful of how inflation will impact their portfolios. If an investment is not able to keep up with inflation, it will lose value over time. This is why it’s important to have a diversified portfolio that includes investments that can protect against inflation.

The best ways to hedge against inflation

There are a number of ways to hedge against inflation. Here are some of the most popular methods:

Invest in Treasury Inflation-Protected Securities (TIPS)

TIPS are bonds issued by the government that provide protection against inflation. The principal and interest payments on these bonds adjust with the rate of inflation, so they can keep pace with rising prices.

The major downside of TIPS is that they tend to have lower interest rates than other types of bonds. This means that you may not earn as much in interest payments, but you will be protected against inflation.

Invest in commodities

Commodities are natural resources that can be used to produce goods and services. They include things like oil, gold, silver, and copper. Commodities tend to do well when inflation is high because they become more expensive as the cost of producing them goes up.

However, commodities can be very volatile, so they should only make up a small part of your portfolio. You can invest in commodities directly by buying futures contracts or mutual funds that invest in them.

Invest in EFTs

EFTs are a type of investment that tracks an underlying index, such as the S&P 500. They are similar to mutual funds, but they trade like stocks on an exchange.

Inflation-protected EFTs are a good choice for investors who want to protect their portfolios from inflation. These EFTs invest in assets that are not affected by inflation, such as government bonds.

Some of the ones to catch my eye for performance and low volatility are below. Explore them on Sharescope.

Build a MOAT

In investment terms, a moat is a sustainable competitive advantage that a company has over its rivals. A wide moat means that the company can maintain its market share and profitability even in tough economic conditions.

Some companies have built-in moats that protect them from inflation. For example, companies with high barriers to entry, such as utilities, tend to do well during periods of high inflation. This is because it is difficult for new entrants to compete with established companies.

For me, I ended up holding a lot of cash, knowing that if stocks fall, then I will in the short term bypass that, and have, on the sidelines and then pick up bargains which will eventually on the rebound trounce inflation. So do I care that technically my cash in the last 10 months did not beat inflation? No. I care how it will do going forward.

Alpesh Patel OBE

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.