Richard writes an obituary for RM, his investment, rather than RM the business. It surprised him when it updated its risk report mid-term last week, despite what he had already learned.

Perhaps it is because I do not scrutinise interim (half-year) results very often, or perhaps it is because I generally avoid heavily indebted companies, but last week RM, the educational supplier, did something I have not seen before.

It added a new item to its list of principal risks and uncertainties.

All companies update and publish this list in their annual reports, but it is unusual I think to amend it between reports.

The risk report, and changes to it, tell us a lot about the challenges that face a business and by extension, what it must do to be prosperous.

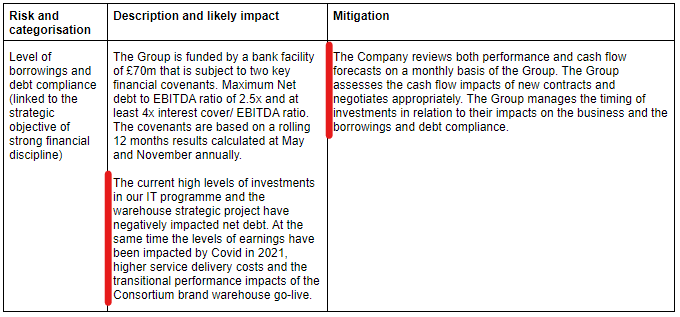

RM’s new item related to debt, and it is, to my mind an admission of failure:

Source: SharePad/RNS RM Interim Results to May 2022 (23 August 2022)

To paraphrase, the company says there is a risk its borrowings will breach the limits it has agreed with its bank.

The cause is a familiar one: Increasing costs have sucked up cash, and decreasing profit means the company is earning less.

Specifically, it has been consolidating the warehouses of its educational resources business, which distributes educational products to schools. It should complete the move to a new automated and centralised facility this year.

It has also been rationalising the IT systems used by its three divisions, the distribution business, a business that supplies schools with IT systems, and its assessment division, which provides examiners with digital marking and testing services.

The company says it monitors performance closely and invests accordingly, but it did not cut its cloth to fit.

RM Redux

I took a shine to RM back in the spring of 2019, devoting not one but two articles to the company.

Then, I looked favourably on the business. It is a well-known brand in education and although it had struggled to grow for a long time, it was highly profitable.

Bits of RM were growing rapidly though, particularly its assessment division. The company still says it is a matter of if, not when, examinations are routinely set and marked electronically. I thought the business might have a lot of potential (it might still).

The growth had been negated by a contraction in RM’s original business supplying IT to schools, but the company had gradually been seeing out long-term contracts that were not very profitable. As a result of these contracts concluding, profitability in the division had improved.

I was a bit wary of constant restructuring and the acquisition of a less profitable educational supplies business to scale up RM’s own more profitable distributor TTS, but I thought the shares were undervalued.

Perhaps other investors did not appreciate that the drag of unprofitable contracts was coming to an end, and that growth in other parts of the business would then become apparent.

The investment did not work out well.

Notes: The ‘b’ (for buy) and ‘s’ (for sell) represent trades in the model portfolio I run for the investment platform, Interactive Investor. As always I also took a position in the shares myself.

The share price declined 40% between May 2019, when I bought the shares and April 2022 when I did not have enough confidence in my original verdict to hold them any longer.

For the sake of investors who enjoy a bit of schadenfreude, shareholders still holding the shares who might appreciate another opinion, and traders thinking this might be a buying opportunity, here are the reasons I changed my mind.

No new dawn

In short, the new dawn I anticipated has not yet happened. Initially, it looked like the pandemic might be the reason, because schools closed and exams were cancelled. Actually, it was only partly to blame.

RM’s balance sheet is weaker than it looks because it has to make big payments to plug a deficit in its pension scheme. Heavy investment and pension payments turned cash flow negative in 2021, which is not a good position for a company that also has considerable borrowings and lease obligations.

I began to doubt the quality of the individual businesses more. For all its name recognition, the original but newly badged RM Technology business only has 9% market share in the UK and like the distribution business, it has limited opportunities to grow abroad.

RM Assessment, a software business serving an international market, may have a bright future. But the market is new and it will be difficult to pick winners. RM’s traditional strength is e-marking (until recently it was called RM Results), but in 2019 it acquired a platform that does testing as well.

RM Assessment requires investment, and it is not clear RM has the resources to commit to it. The loss of a customer, AQA, an exam board, in 2020 revealed another risk. It took the decision to do its own e-marking.

I remained unconvinced about the merger that created the RM Resources (educational supplies) division.

It now seemed to me RM was investing from a position of financial weakness, which is unsustainable in the absence of a rapid turnaround.

Yet under new management, RM’s strategy is focused on new problems.

The three divisions’ IT systems do not work well together, requiring more investment, and the company hopes that by bringing them onto the same platform and reorganising their management, they can be more than the sum of their parts.

Perhaps RM needs to tell us more, but I doubt there are many synergies. The divisions serve different customers with different things on the whole. RM Resources (educational supplies) mostly sells to primary schools, RM Technology (IT) mostly sells to secondary schools, and RM Assessment mostly sells to exam boards.

Maybe if RM did not exist, nobody would invent it. Trying to understand three distinct businesses in one feels even more difficult than analysing three individual businesses. That is probably also true of running them

RIP RM?

This is beginning to read like an obituary, but the company has not died. If it can complete its warehouse and IT projects it should be more efficient, and that may be a springboard for a growth strategy.

But this is a belated obituary for my investment. When I appraised it in April, the risks were more palpable than the strategy, which is how a company addresses the risks and ultimately prospers.

When that is true, I cannot say with confidence a business is a good long-term investment.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.