Our funds specialist returns with another new suggestion for the Dynamic 35, Digital 9 Infrastructure, although he argues it could also sit inside the Prudent 15 list as well. This fund is an asset-backed infrastructure fund with an exciting technology customer base who want to buy into a new digital world through mobile phone towers, fibre optics and data centres.

My latest addition to the Dynamic 35 list is something of a hybrid. It could easily sit inside my cautious Prudent 15 list. Like many more cautious, defensive peers, this fund is income-oriented and invests in real assets in the infrastructure space. But its customer base – the big tech giants amongst many others – is anything but boring. That’s because this infrastructure fund – Digital 9 – invests in digital infrastructure. For the non-technical amongst our readers, that means three main areas.

The first is mobile phone towers, which have sprouted up throughout the world carrying everything from Edge through to the new 5G standard. This has been described by some investors as quite possibly one of the best business opportunities in history – it’s relatively low cost up-front, but produces an ever-expanding stream of revenues.

The next focus is on data centres. As you read this article, I think it a certainty that all the data underlying this text and the web page is actually being fed to you via a computer or more specifically a server sitting inside a large data warehouse. These are called data centres. Traditionally they’ve either sat in city centres next to major business hubs or in the middle of nowhere – sometimes the arctic – where electric power is cheap. It also helps if these data centres sit at the end of a thick optical fibre link.

Which brings me to the last focus – fibre optic networks. Here in the UK the most famous fibre network is owned by BT and goes by the name of Openreach. But this is just one of many fibre networks around the world and its own fibre is connected to a network of undersea cables which link up all the main continents.

Traditionally this data-led physical infrastructure has been accessed in one of two ways. Prior to the IPO of this fund, investors had been able to access digital infrastructure through diversified portfolios such as 3i Infrastructure, and to a smaller extent International Public Partnerships. Private equity businesses are also very active in this space.

The other choice was to own actual operating businesses, either of broadband fibre networks or of tower companies (called towercos) or data centres. The latter investment category – specialist towercos and data centre operators – has been a hugely lucrative though specialist investment segment.

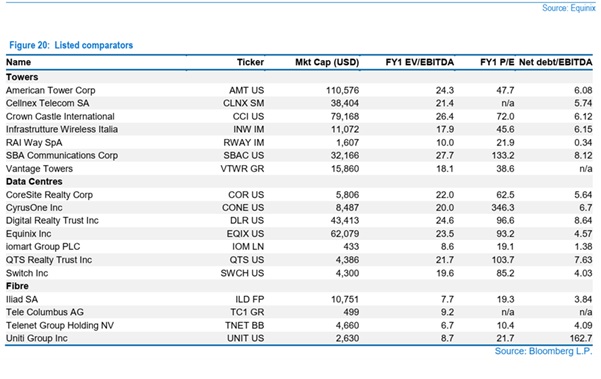

Investment fund analysts at Investec recently released a very comprehensive report on the funds in this space – which alongside D9 also reports on a rival listed fund called Cordiant. I’ll mention this report a few times but for now I’d simply cite the following observation from the Investec report which is that “Digital infrastructure valuations in the public markets remain robust, towers are currently trading at 24-28x EV to forward EBITDA, data centres 20-24x, whilst fibre companies trade at a material discount”. The businesses that were backed into Digital 9 came in at an EBITDA measure of less than 15 by comparison.

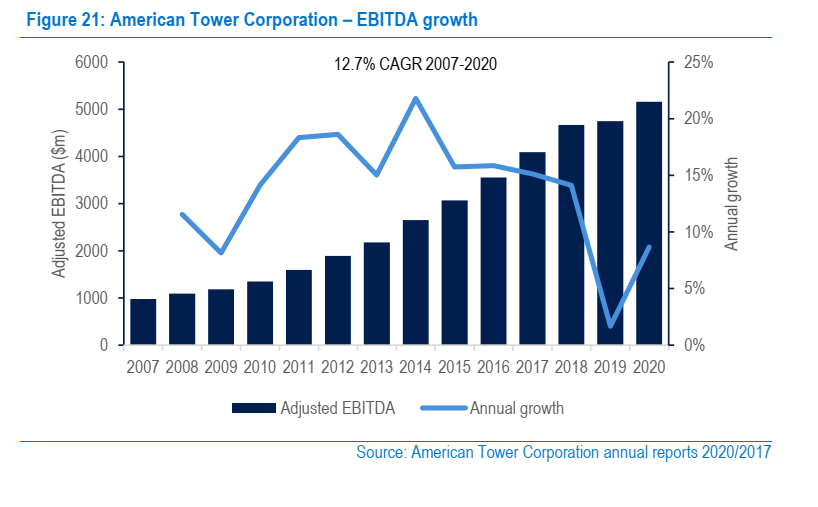

But for me the key Investec observation is as follows – towercos in particular are money-making machines that keep growing their earnings in a steady compound fashion. To quote the Investec report “the power of reinvesting excess cashflows into new and complimentary assets can have a profound effect on EBITDA growth and NAV progression over the long term. As seen in [the graphic below] American Towers [ an existing US operating company in this space] grew its EBITDA at a CAGR of 12.7% between 2007 and 2020”.

The next chart from the Investec report gives us a little more detail on the existing peer group. This is mostly a US space with many of the leading towercos turned into income-focused REITs i.e they’ve turned the operating companies into a property fund structure which pays out dividends.

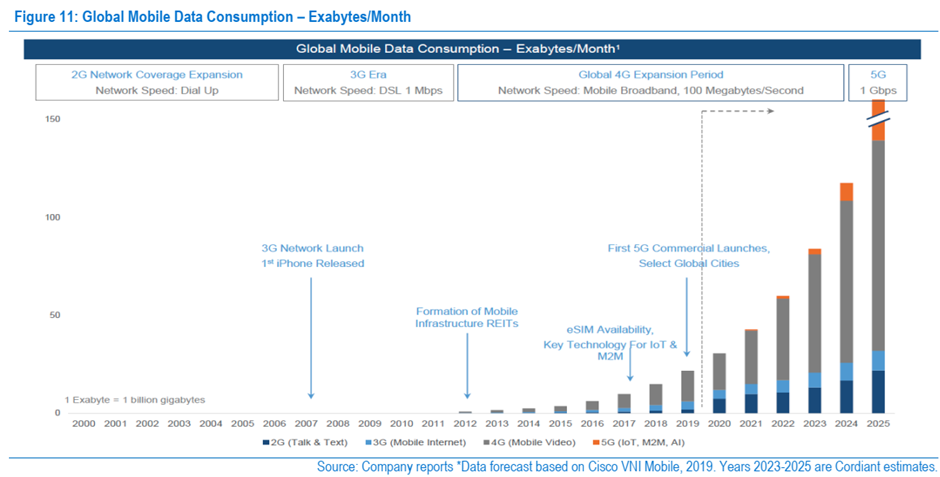

The driving force behind this remarkable compounding in growth – and the massive valuations on many operating companies – is obvious to anyone with a computer. As a society we are gobbling up ever more data, all via a profusion of devices. First came computers, then smart phones and now the internet of things i.e. connected fridges. The chart below from that Investec report gives graphical form to this exponential growth.

Each of the niches – towercos, centres and fibre – have their own idiosyncrasies. I’m probably most enthusiastic about two – towercos and undersea fibre. These are both very static pieces of physical digital infrastructure that exist purely to charge a rent to operators. In the case of towercos, network operators plug their new antennae for new networks on towers and then simply pay rent. Hopefully maintenance costs for these towers is kept to an absolute minimum and as new technologies come along more revenue opportunities open up.

With undersea cables it’s a very similar model. All the capacity in those twisted fibre optic cables jammed inside think cables on the ocean floor are rented out to giant technology companies who want to carry your data. This strikes me as a more manageable business model than digging up thousands of miles of the UK street architecture to lay expensive fibre cables – as is the model of BT Openreach.

The data centre model has been around for a number of decades and has constantly evolved. The first wave of data centres sat on the end of international fibre links and probably sat close to city or business centres. Racks of servers were lined up and rented out to varying end customers. But as the big tech giants have steadily increased their grip, this model is also changing.

For tasks that do not require instant response, it might make more sense to position the data centres in areas with cheap and renewable electricity supplies. That exposes the slightly sordid reality that data centres gobble up huge amounts of electricity. For tasks that require almost instant response – such as gaming or movies – the new development is to position data centres on the ‘edge’ of the network (in relation to your usage) i.e. closer to the end user in the suburbs.

Ideally investors should probably prefer a diversified portfolio of these assets (data centres, towers, fibre) in one investment structure. That’s where D9 – and its rival Cordiant – comes in. In a section below I’ll compare the two but at the very outset I’d make one important point. Both Cordiant and D9 are similar propositions and I think both are excellent. I have invested in both. Both could work for your portfolio. But on balance if I had to choose one over the other, on balance, I would go for D9.

Digital 9 Infrastructure fund details

- Price 114p

- Est NAV 99p

- Fund yield 5.3%

- Market Cap £532m

- Premium 14%

A relatively new fund

DGI9 originally raised gross proceeds of £300m (at 100p a share) at its IPO on 31 March 2021. Almost immediately it then started rolling out its pipeline of developments starting with the acquisition of Aqua Comms for £160m, a platform owning and operating 14,300km trans-Atlantic sub-sea fibre systems at a valuation of US$215m. I’ll talk in a bit more detail about this business later.

Within the space of a few months Digital 9 Infrastructure then raised another £175m (at a placing price of 106p) which was significantly over-subscribed. The cynic might ask why the need to raise so much extra money so quickly after launch?

According to Triple Point, the fund management firm behind D9, it has a thick pipeline of potential acquisitions which includes “£600m of opportunities capable of completion in the next 12 months” according to a report by fund analysts at Numis,”comprising £200m under active discussion and/or through initial investment committee review and/or in exclusivity, which are capable of completion within the next three months; and c.£400m which have a completion timeframe of three to 12 months”.

Specifically, this pipeline includes “a number of US, UK and northern European data centres, UK terrestrial fibre platforms, and a UK wireless infrastructure business, alongside further opportunities within the expansion of subsea fibre systems” according to a research note from Liberum’s alternatives team.

The main operating asset in the fund is Aqua Comms which is a platform owning and operating c.14,300km of trans-Atlantic sub-sea fibre systems. The assets are fully operational and have a customer base that includes the likes of the FAANG stocks and other global content providers. Liberum’s fund analysts have provided a more detailed deep dive into Aqua Comms:

“Aqua’s reported revenues and EBITDA in 2020 were $30.2m and $18.6m, respectively. Based on these figures, the agreed enterprise value represents c.11.6x historic EBITDA. EBITDA grew c.13% in 2020 and has increased almost five-fold since 2017. Revenues are diversified across c.50 customers, including content providers (c.50% of revenue), telecoms companies (44% of revenue) and industrials (6% of revenue).

Global international bandwidth demand has grown at a CAGR of 51% between 2002 and 2019 and is expected to continue growing at a CAGR of c.40% from 2020 to 2026. Significant investment in subsea cables is required to meet this growing demand, which should provide plenty of opportunities for businesses like Aqua Comms.”

In terms of recent performance, Aqua Comms has already delivered significant positive operational performance, including outperformance on its annual budgets, with nearly 50% of expected revenue from lease renewals achieved in the first four months of 2021. The fund has also reported that this strong performance means that the 6p per share annual dividend is already fully cash covered with the first dividend of 1.5p to be paid in respect of Q2 2021.

Now, at this point, I think it’s crucial to repeat that D9 has a direct competitor in the shape of Cordiant, which is also listed on the London stock market as a fund. For all intents and purposes this is a very similar structure. Both are funds. Both invest across a range of digital operating assets, both are income oriented, and both have raised a very large amount of money on the LSE. The table below gives some comparisons between the two.

Cordiant vs D9

|

Key variable |

D9 Digital Infrastructure PLC |

Cordiant Digital Infrastructure |

|

Investment focus |

Data centres, terrestrial fibre and 5G networks comprise further pipeline assets. Data centre pipeline portfolio includes >20,000 m2 of operating assets, with crossover to the Aqua Comms customer base and connected into their existing sub-sea network |

Digital infrastructure asset values are supported by long-term contractual cash- flows and offer attractive growth characteristics from the provision of additional infrastructure units. Tenants are typically telecom operators, software/technology companies and governments.

|

|

Market Cap |

£532m |

£589m |

|

Seed Assets at launch |

£165m. 30% invested immediately on IPO into Initial Assets, over $3 billion in proprietary pipeline, of which $1 billion is ready to invest in the next 12 months. Initial Assets (Aqua Comms): fully operational, highly resilient and reliable sub-sea fibre systems, long term contracts with the highest quality counterparties, primarily with the FAANGs + Microsoft |

The Investment Trust currently has an opportunity pipeline of approximately €1.5 billion. Includes tower operators (UK and UK), backbone fibre data centres, US edge data platform. On ramp up : Substantially committed within 12 months through active and existing pipeline of ~€ 1.5 billion |

|

Geographical mix |

The overall mix is likely to be c60% global : 40% UK on the initial £400m raise |

Nothing specific I can see but the prospectus states that it has “the aim of achieving a long-term balance between North America and Europe.” |

|

Dividend target |

6% divi in yr 1, payable from IPO. In detail: 6.0% dividend payable from IPO, 2/3 cash covered on day one, progressive thereafter |

Progressive dividend targeting 4p a share, in detail 1pps in year 1; 2 – 3pps in year 2; progressive thereafter with target dividend rising to at least 4pps within 5 years |

|

Total Return Target |

10% net return, including an initial annualised 6p dividend yield for the first financial year ending December 2021 (significantly cash covered from IPO). It is targeting a first interim dividend of 1.5p from admission to 30 June 2021, payable in September. |

Over 9% net return |

|

Performance Fees |

None |

12.5% over a 9%/p.a. hurdle |

|

Investment into IPO – Investment manager as well as vendor of Initial Assets |

£25.0m into the IPO (£5m+ from Triple Point and £20m from vendor of Initial assets) |

£1.2m into IPO |

|

Retail access? |

SFM But professional or advised retail investors can access the IPO via Primary Bid |

SFM |

|

Management Fee |

Management Fee: 1% of adjusted NAV (of which 20% paid to development partner) up to $500m, reducing to 0.9% to $1bn, and 0.8% above $1bn |

1% p.a. of the first £500 million of average market cap; 0.9% p.a. on average market cap £500 million – £1 billion; 0.8% p.a. on average market cap above £1 billion. Fees to be charged based on % capital deployed until 75% of IPO funds committed or invested. 10% of management fees paid in shares and subject to a 12 month lock-up |

|

Of note |

Experienced chairman: Jack Waters – over 30 years in digital infrastructure, most recently as COO at Zayo, operating 13 million miles of fibre and 45 data centres across Europe and the US, Zayo was listed on the NYSE prior to its $14bn acquisition and take private by Digital Colony and EQT in 2019 |

Cordiant issuing subscription shares: Issued on a 1-for-8 basis to IPO investors for nil consideration Subscription right to acquire one ordinary share until February 2026 (monthly between 1 March 2021 an 31 August 2021; semi-annually in February and August thereafter) Subscription price of 100p in the first six months; thereafter increasing by circa 9% p.a. (from IPO) less dividends paid |

|

More about the manager | Triple Point is a 16 year old London based investment management firm, with an AUM of c.£1.8bn and a client base consisting of private investors, institutional investors, pensions funds and UK Government (Department of Business Energy & Industrial Strategy). They focus on essential infrastructure with long-term, stable cash flows underpinned by rigorous ESG considerations. The firm employees c.140 people and key investment themes include essential social housing, energy and infrastructure, leasing, and digital infrastructure. |

A ~$2 billion AUM institutional asset manager, Cordiant is a sector-focused investor in infrastructure private equity and private debt. Digital Infrastructure is one of four key sectors for the firm. The client base consists of large insurer, pension plans and governments in North America and Europe. Partner-owned and run, the firm has fully registered entities in Luxembourg (AIFM), the U.S. (SEC) and Canada |

Why D9?

As I mentioned towards the beginning of this article, there is another fund that runs essentially a parallel strategy to this fund, and it is called Cordiant. I am perfectly happy owning both but as I said, on balance if I had to pick one fund, I would pick D9. Why?

Both Cordiant and D9 are following a diversified strategy of investing across fibre, towercos, and data centres. In fact arguably Cordiant is probably making more progress on assembling a diversified portfolio of assets as it has recently announced a series of very large acquisitions, some of them in Eastern Europe and Norway. I would also concede that the managers behind the Cordiant fund arguably – and I suspect Triple Point would argue – have broader industry experience.

But D9 has a bunch of operational assets that are already pumping out cash flow, enough to pay the dividends. It’s also got a slightly higher target return (10% versus 9%) and is paying out a bigger dividend (6p versus 3p). As D9’s shares have traded at a premium, that yield has now come down to around 5.3% but my hunch is that the shares will trade even higher.

By and large, established digital infra-assets in the US trade at EBITDA multiples above 20 and yields of around 2 to 3%. On this basis, all things being equal and assuming that D9 can ramp up its ambitious pipeline, I think the shares might end up trading closer to the industry norm which in my view might imply a target price of 150p a share and a dividend yield of closer to 4% over time (6p / 150p).

One sign that this might be the case is that Cordiant has set its dividend target closer to the industry average of 3 to 4%. Another way of making the same point is that the operational assets bought in by the fund were, possibly, arguably, bought cheaply and that the market might now reprice those assets closer to an industry average. This is all highly speculative but I think one can begin to understand why D9 might be a more attractive proposition at this point in time.

Risks?

It’s important to say that all of these optimistic assumptions are just that – assumptions. There’s plenty that could go wrong. The pipeline of operational assets might prove underwhelming in execution terms and not produce the expected cashflows. There’s also the risk that highly valued assets which trade almost like bond substitutes might underperform in the next leg of the recovery – as will tech equities more generally.

There’s also industry-specific risks such as security attacks and outages which could cause negative publicity for the whole sector. It’s these risks that make me more cautious about putting D9 in the Prudent 15 list. By contrast I feel more confident including it in the Dynamic 35 list. It is a risky equity investment in the tech sector and that’s why its manager is anticipating a 10% annualised return. But I think the downside risks are manageable and I believe the upside potential might be quite substantial. And if nothing else you’ll also pick up that useful, generous dividend yield.

David Stevenson

Do you think D9 belongs on both the Dynamic 35 and Prudent 15? We’d love to hear from you in the comments section below

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.