In these articles about funds, I have tended to steer clear of the many, many alternative funds listed on the London market.

That is not because these funds are not interesting – many of them are – but because I felt their business model hasn’t entirely been proved.

That is particularly the case for the growing army of alternative funds that lend money to all manner of sectors, ranging from SMEs through to ships and the life sciences sector. Clearly, good money can be made from lending, but in truth, the easy bit is lending out the money. The harder bit is getting back both the interest and the original advance at the end of the term.

And the elephant in the room here is a recession. Lending can look very lucrative up until a recession comes along. Suddenly in a recession, borrowers start to struggle over cashflow and defer repayment or amortisation.

So, although I can understand why careful, prudent, income hungry investors might like the idea of a steady high yield from a well-managed alternative lending fund, I have been extremely cautious up till now.

I am though relaxing a little bit with my new fund BioPharma Credit.. This launched a few years ago and specialises in various structures that involve lending to large and small pharma and life sciences businesses. I say various structures because in some cases, it takes a royalty on drug sales, in other cases it used senior secured lending on the core business. The model varies but the key point is that this is a specialist segment where borrowers tend to have a lot of valuable intellectual property which also happens to be difficult to value in a traditional balance sheet sense. That forces many perfectly credit worthy businesses in this segment to seek alternative funding, which is where the experienced team behind BioPharma comes in. Based in New York, the small team have been working in this space for well over a decade now and have all the contacts to the decision-makers they need.

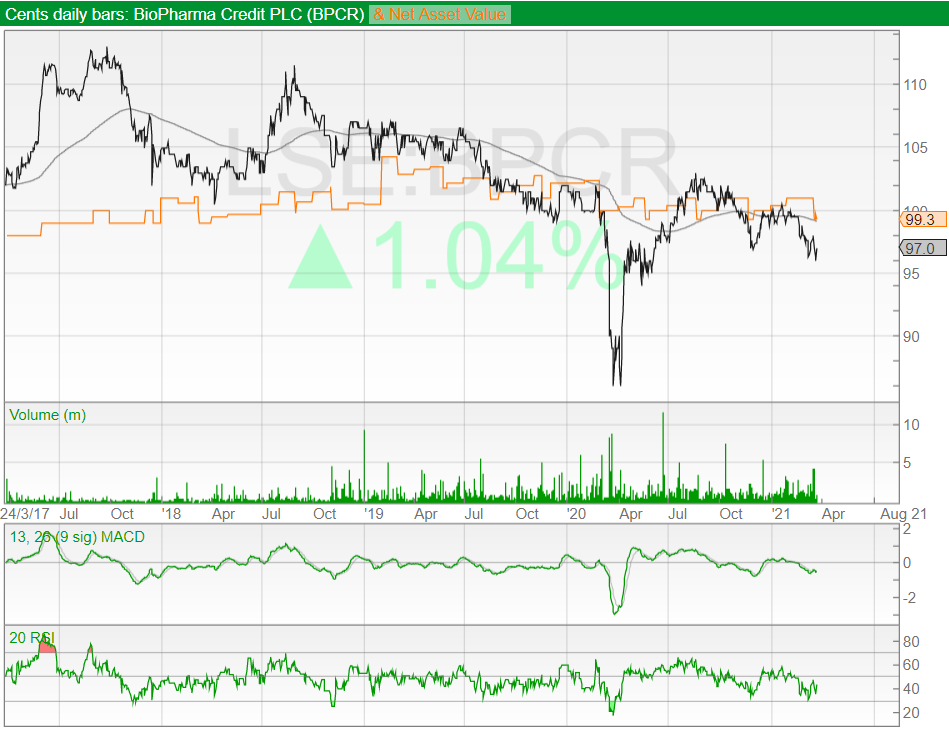

Source: SharePad

But all this promise of expertise and contacts is just that. It needs to be evidenced. And here is where the key variable for me comes in – BioPharma has a very solid track record of having lent to businesses in this space and been repaid, in many cases early. That is a crucial last point to make. Many of the borrowers have chosen to repay their loans before the agreed redemption date and that has triggered some very substantial pre-payment charges which are added on to any repayment over and above the original borrowed sum. Ironically those examples of early repayment actually places the fund in a bit of a quandary. It ends up with a mountain of cash (which includes extra fees) which it must then redeploy into new loans that can generate interest. The fund has a good track record on this score (early redemptions) but the downside of repayments is that at some stages the dividend paid out by the fund is not fully covered i.e for every £1 of cash going out in regular dividend cheques, not quite £1 is received in net cash earnings.

And that dividend is crucial. The yield, paid in dollars, is equivalent to 7.2% per annum. That is far in excess of the yield paid on most other investments and certainly way in excess of the returns on most bonds. Note though, that dividend is paid in dollars – which are then transferred back into sterling in your account. That reminds us that there is some FX risk here, not only with the dividend but also the share price. That could work both to your favour, if sterling depreciates, and your disadvantage, if sterling strengthens. But overall, I think the long-term target return of over 7% (there might also be some capital gains over the long term) per annum is a very acceptable one for cautious investors. As I have already noted in passing, there might be some potential for capital upside, but overall, this is a relatively pure play income play for the prudent investor.

Fund Details

- BioPharma Credit

- Ticker BPCR

- Price $0.97c

- Discount 3.2%

- Market Cap $1340m

- Dividend yield 7.2% or 7 cents per share, FY20 dividends 7.3 cents per share

- Strategy : Debt investments in the life sciences industry

- Fees: Management fees are 1.0% pa of net assets plus a performance fee of 10% of returns in excess of 6% pa, subject to a high watermark (if the fund trades at a discount wider than 1% in the last month of a performance period then 50% of the performance fee, less taxes, will be used by the manager to buy shares in the market). As of 31 December 2020, the manager invested $5.2m from the performance fee paid in relation to the year ended 31 December 2019 acquiring 5.6m shares. Ongoing charges were 1.2% excluding the performance fee versus 1.0% in 2019, or 1.6% including the performance fee (FY19 2.0%).

Recent Numbers

BioPharma Credit’s annual results through to 31 December 2020 were released very recently and they provide an excellent snapshot of how the fund generates revenues to pay for that generous dividend. As expected, the net asset value of the fund didn’t really change very much – NAV was $1.0037, down 1.8% during the year. During the period, the fund invested $548m including $308m of commitments entered into prior to the start of the year, $165m for the new senior secured loan with Colegium Pharmaceutical, and $75m as part of the amendment and upsizing of the loan with Epizyme. Crucially BioPharma Credit benefitted from three significant prepayments by Amicus, Novocure and Lexicon totalling $425m with additional prepayment and other fees totalling $14m, enhancing returns to 13.4%, 10.2% and 12.1% gross IRRs respectively. Overall, that leaves the fund with $251m of cash, equivalent to 18% of net assets. It also has an undrawn credit facility worth $200m.

Here is a summary from BioPharma of the key points from these annual results:

- 8.29 cents per share in total dividends during period referencing net income for the four quarters ending 30 September 2020

- Post period end, the Company declared a further dividend of 2.04 cents per share including a special dividend of 0.29 cents per share in addition to the ordinary quarterly dividend of 1.75 cents per share

- Company NAV was highly stable during the period decreasing by $0.018 from $1.0217 to $1.0037

- The Company reported total net income for 2020 of $89m. This is down from $122m reported during 2019 which included $46m in fees linked to the prepayment of the Company’s Tesaro loan

- No material impact on the credit quality of any loan as a result of the global disruption caused by the Covid-19 pandemic

INVESTMENT HIGHLIGHTS

- The Company and its subsidiaries invested $548m in the period

- This included $308m of commitments entered into prior to the start of the year, $165m for the new senior secured loan with Collegium Pharmaceutical, Inc. (NASDAQ: COLL) announced 7 February 2020 and $75m as part of the amendment and upsizing of the Company’s loan with Epizyme (NASDAQ: EPZM) announced 9 November 2020

- The Company saw increased liquidity from three early attractive repayments from Amicus, Novocure and Lexicon totalling $425m. Additional prepayment and other fees totalled an additional $14m enhancing attractive overall rates of return on these investments:

- Novocure 10.2% Realised gross IRR

- Lexicon 12.1% Realised gross IRR

- Amicus 13.4% Realised gross IRR

The table below outlines the current portfolio of loans and other financial structures.

| ($ in millions) | As at 31 December 2020 | As at 31 December 2019 | % Change |

| Sarepta Therapeutics senior secured loan | 350 | 175 | 100% |

| BMS purchased payments | 160 | 150 | 6.7% |

| Collegium Therapeutics senior secured loan | 134 | – | – |

| Epizyme senior secured loan | 110 | 13 | 746.2% |

| Sebela senior secured loan | 92 | 130 | -29.2% |

| Global Blood Therapeutics senior secured loan | 83 | 41 | 100% |

| BioDelivery Sciences senior secured loan | 80 | 60 | 33.3% |

| OptiNose senior secured note and warrants | 72 | 46 | 56.5% |

| Akebia senior secured loan | 50 | 40 | 25.0% |

| BioDelivery Sciences equity | 11 | 17 | -35.3% |

| Novocure senior secured loan | – | 150 | – |

| Amicus senior secured loan | – | 150 | – |

| Lexicon senior secured loan | – | 125 | – |

| Convertible bonds | – | 20 | – |

| Cash and cash equivalents | 250* | 297 | -15.7% |

| Other net assets | (13) | (9) | 44.4% |

| Total net assets | 1,379 | 1,405 | -1.8% |

The biggest loan, by a long distance, is to a listed life sciences business called Sarepta Therapeutics. Here is some blurb about that business from its own website:

“At Sarepta, we are leading a revolution in precision genetic medicine and every day is an opportunity to change the lives of people living with rare disease. The Company has built an impressive position in Duchenne muscular dystrophy (DMD) and in gene therapies for limb-girdle muscular dystrophy diseases (LGMD), Charcot-Marie-Tooth (CMT), MPS IIIA and other CNS-related disorders, totalling over 40 therapies in various stages of development. Our programs and research focus span several therapeutic modalities, including RNA, gene therapy and gene editing. “.

There is also a very helpful investor presentation at this website which gives you a lot more detail about the business.

The business seems to have at least six products (out of 40) based around its gene therapy specialism that are in clinical trials and two products (based on RNA technology) that are already in the market. Another presentation – to an investor conference at an investment bank – suggests that it had $1.9bn in cash at the end of last year and is projecting revenues of between $537m and $547m for 2021. At $84 a share, the busines appears to be worth $6.7 billion, with 22 out of 25 analysts rating the shares a buy or strong buy.

I have no idea whether the business is a good investment – in fact I suspect that is rather beside the point. The loan is a senior secured loan worth a small proportion not only of Sarepta’s total equity value, but also of the existing cash reserves. Encouragingly the business is generating strong revenues though it must be said that because of all that R&D spending the firm is losing money. Long term debt totals around $1 billion from my reading of the accounts, below the level of cash.

Opportunities and risks

A pessimist looking at those numbers above might worry that outfits such as Sarepta are loss making and spending a huge amount of money on R&D. But that is both the opportunity and risk for a lender like BioPharma. If these were conventional, hugely profitable mainstream drug companies, such as AstraZeneca, then the cost of debt would be very, very low and the giant investment banks would be falling over themselves to lend. But there is more risk in these businesses, not least because they have to have enough cash to pay for all those expensive clinical trials. That need for cash helps explain why within the broader life sciences sector there was a 129% increase in convertible issues by value in 2020, as well as a 110% increase in equity issuance and a 50% increase in IPO proceeds.

The flip side of this need for capital is that there is also an active M&A market, although M&A volumes were adversely impacted by Covid-19, down 40%. As for the biotech sector generally, analysts at Investec note that “2020 was a volatile year, with the NYSE Biotech index declining 12% in Q1 before recovering quickly and ending 2020 with a 13% increase over the year. Companies in the industry took advantage of the increased volatility and sudden recovery in share prices to issue $15.3bn in convertible notes, a 129% increase from the previous year as well as $130bn in equity, a 110% increase from 2019. The strong equity market also allowed for a 50% increase in IPO proceeds raised, compared to 2019”.

That potential for M&A activity reminds us that some of the businesses which BioPharma has lent to end up being acquired, thus triggering early repayment, plus additional fees. As analysts at Jefferies observe, these early redemptions “represent a double-edged sword for the fund. …. make whole and prepayment fees can help cover the dividend in the year in which the prepayment activity occurs (as well as increasing individual loan IRRs), but this also results in more cash to reinvest before the subsequent year”.

Turning to the dividend, these same Jefferies analysts early on this year calculated that the 2021 dividend cover run-rate as probably around 90% although they add that “this is contingent on certain assumptions, including around the rate of LIBOR, albeit most of the floating-rate loans currently make use of floor provisions. As it stands, the level of cover is likely to be high enough to end up with a fully covered full-year dividend. This is primarily due to the potential for the further deployment of cash as new investments are made, and the related receipt of upfront fees. BPCR’s dealflow is notoriously lumpy, but if the remaining cash can be deployed before the half-year stage this would leave the full-year dividend covered on a run-rate basis.”

If we step back from the minutiae, put simply and baldly, a return of over 7% will not come from zero risk businesses swimming in cash. The risk here is that you are lending money to a lender that in turns lends to specialist, IP-heavy businesses that are ramping up their revenue model but are in need of extra capital to grow. That means the borrowers could be risky and that they might not make all their payments. But there is also an opportunity there, to charge higher interest rates and to levy loan fees which could in turn result in an uplift if the borrower is acquired – which has been the case on multiple occasions in the past.

Bottom Line

So, it’s clear from this narrative that BioPharma Credit is absolutely NOT zero to low risk, but I would maintain it is lower risk, providing you understand the constant risks associated with lending and the possibility that the exchange rate might move against you. It’s also worth repeating that this is not a long-term capital gain story, more a steady annual generator of useful dividends. A return of over 7% – from income – is not to be sniffed at if you are a prudent, income-focused investor and you have the choice to either take that as income or re-invest in more stock. On a more short-term basis, I also think that the shares might trade at a little higher once the spare cash on the balance sheet has been deployed into new lending. The fund is currently trading at a 3% discount whereas over the last few years that discount has been closer to 1% on average and at times has moved to a premium of over 4%. So, there is a small chance of capital gains of a few per cent above and beyond the income return.

Numis views

“We believe BioPharma Credit has a unique investment approach. The manager structures its facilities to protect profitability against early repayments, which has benefitted the fund, as it received a number of significant prepayments during the period. As a result, BioPharma Credit is in a strong liquidity position to fund further commitments and take advantage of opportunities. The manager has record of swiftly deploying capital, given the new investments are typically large and timing difficult to predict. The shares are currently trading at $0.974 representing a c.3% discount to the last published NAV. BioPharma Credit has built a strong track record since launch, including a number of successful exits, and provides an attractive yield, 7.2%, or 8.5% including special dividends.”

Investec View

“BioPharma Credit is unique and we believe that the company has an important role to play in improving both portfolio and income diversification. A combination of an attractive and sustainable yield (7.2%), and access to a highly experienced management team with an impressive track record, represents a compelling investment case. BioPharma Credit is a constituent of our model portfolio and we strongly reiterate our Buy recommendation.”

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.