This week I have a very adventurous addition to my list of 35 Dynamic funds. I admit that it’s not without risk and its recent track record hasn’t been fab if I’m honest but I think the seeds for a rapid turnaround are being laid and if nothing else a future redemption opportunity might provide a boost. This redemption opportunity perfectly demonstrates why investment trusts with their active nonexecutives can add value by giving fund managers a good kicking when deserved.

Most importantly though this investment idea is a shorter term, trading opportunity focused on the next two to three years, which could turn into a longer-term story if the stars align for India. But before we explain the fund, lets be honest with the reader. India as an asset class has its challenges. It is constantly touted as the next great rival to China, a democratic,sort-of- capitalist, slightly anarchic place with a huge, young population, industrious and entrepreneurial. Take one small example. India has the world’s third-largest start-up ecosystem, which is expected to grow by 12-15% annually, according to the government said. In 2018, India had about 50,000 start-ups, of which around 9,000 were technology-focused, and many have attracted major global private equity investors like Sequoia Capital, Accel, Tiger Global Management and Blume Ventures. Analysts at Bloomberg Intelligence recently suggested that if India catches up with China’s digital market cap as a percentage of GDP, it could amount to a $375 billion opportunity.

A few years ago, I visited the country with the managers of this fund and like everyone else who’s ever been there I was hugely impressed. Impressed by that industriousness and obvious potential but also slightly horrified by poor infrastructure and bureaucracy. This ambivalence finds expression in the equity markets. Indian stocks frequently trade at a premium to most other national markets because of the obvious potential. But when EM stocks sell off, Indian stocks are frequently first in line for a pummelling. On top of all of this we have the paradox that is Prime Minister Modi. As a veteran of all things Turkish, I recognise a classic populist strongman promising rejuvenation via reform. As with Erdogan in Turkey, the first decade or so, is usually invigorating but after a while this reduces, and the populism and nationalism takes over – usually accompanied by the sound of global capital heading for the exit. Modi has promised a great deal and is yet to really deliver, yet over the last few years he has made many important changes, not least in the last few months. Unfortunately, the corona virus also exposes the weakness of a strong man approach. India has been greatly impacted by the pandemic, with infection rates sky high and deaths multiplying. The initial lock down was probably the right policy but was then damaged by a go home order to the tens of millions of rural inhabitants living and working in the big cities. Stuck in limbo, many were left with nothing and the policy almost certainly seeded the virus in the countryside.

Lalcap is a London based research company focused on India and its equity markets. Here’s its dour summary of the economic damage: “In its latest World Economic Outlook, the International Monetary Fund (IMF) further cut the GDP forecast of India. The economy is now expected to contract 10.3% in the fiscal year to 31 March 2021. In June the IMF forecast a drop of 4.5%. The additional downgrade of 5.8% is the biggest among the major global economies, and also the largest among major emerging markets. An index of coincident indicators, published by the RBI in its October Monetary Policy Report, shows that activity levels across India have rebounded close to mid-March levels but remain below what was recorded in February”.

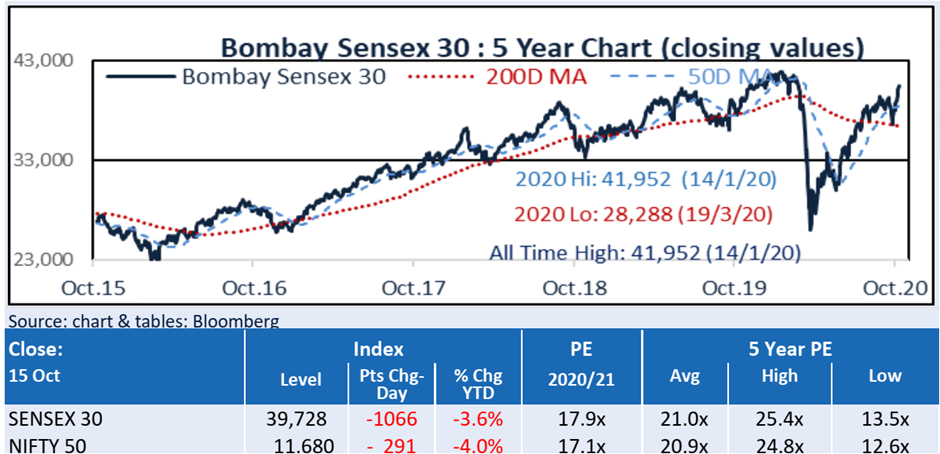

Given this dismal backdrop its not a surprise that corporate profits have cratered – at the national level corporate profits as a % of GDP are now down to under 1.8% versus a high of 7.3% in 2008. The local stockmarket by comparison has by contrast staged something of a hesitant recovery and according to Lalcap the two main indices – the Sensex 30 and Nifty 50 – are both down just 4% year to date which isn’t too horrific all things considered.

The problem though is that the corona virus isn’t going to go away any time soon. I suppose if one was charitable one could say that the Indian government is more engaged with managing difficult relations with China (in the Kashmir border region), its reform programme and difficult relations with the states, rather than thinking about locking down the country again. In effect, its mimicking the US Federal approach, and waiting for a recovery.

But Covid has certainly provided one obvious boost – China is fast becoming more unpopular with big investing nations. For a while I’ve heard talk of the ‘Switch from China’ strategy but in reality, places like Vietnam have been grabbing most of those switches. The rumour mill now suggests that India is actually winning some big deals and that 2021 could be the year in which we see even more major wins for India, especially as international corporates worry about their extended supply chains and reliance on the CCP.

My sense is that 2021 might see a proper V shaped recovery in India, especially by our spring. In that case the turn around in India could be dramatic, and especially if the Indian federal government pushes an expansionist reflationary agenda. In simple terms, my bet – and it is just that, an informed piece of speculation – is that when the turn comes in the global economy, the turn in India will be even more highly geared. In the language of investment, India will have a high beta to an economic recovery. In these circumstances, classic investment logic suggests you might want to be in the mid to small cap sector of the market which will turn most aggressively i.e mid caps have a high beta or responsiveness to a market move. Which brings me the fund under consideration this week – India Capital Growth, a London listed Indian equities fund that is aggressively focused on mdi cap Indian stocks (33 of them at the last count).

Why this fund?

In the table below, I’ve listed the four main investment trusts focused on Indian equities. If I’m honest and wanted to pick a fund which had had the best recent track record, I wouldn’t pick India Capital Growth. Instead I would pick Askhoka India Equity, which is relatively new to the London market. The Ashoka fund has had a great track record in stock picking and has been well positioned in more larger cap stocks. It deserves a (relative) premium rating and is currently trading at the lowest discount of this subgroup – a 7% discount. This is an excellent fund, with a great manager.

| Ticker | Fund | Premium/discount | Gross Assets | YTD returns | 1 year returns | 3 year returns | NAV returns YTD | NAV returns 3 year pa | NAV returns 5 years pa |

| ANII | Aberdeen New India | -15.6 | 339 | 0.3 | -3.3 | 55.9 | 1.9 | 0.3 | 0.4 |

| AIE | Ashoka India Equity | -7.0 | 78 | 9.1 | 7.5 | – | 10.7 | – | – |

| IGC | India Capital Growth | -17.8 | 96 | -3.0 | -5.3 | 18.2 | -2.2 | -4.1 | -5.2 |

| JII | JPMorgan Indian | -16.7 | 569 | -10.4 | -12.7 | 25.0 | -8.7 | -6.4 | -4.3 |

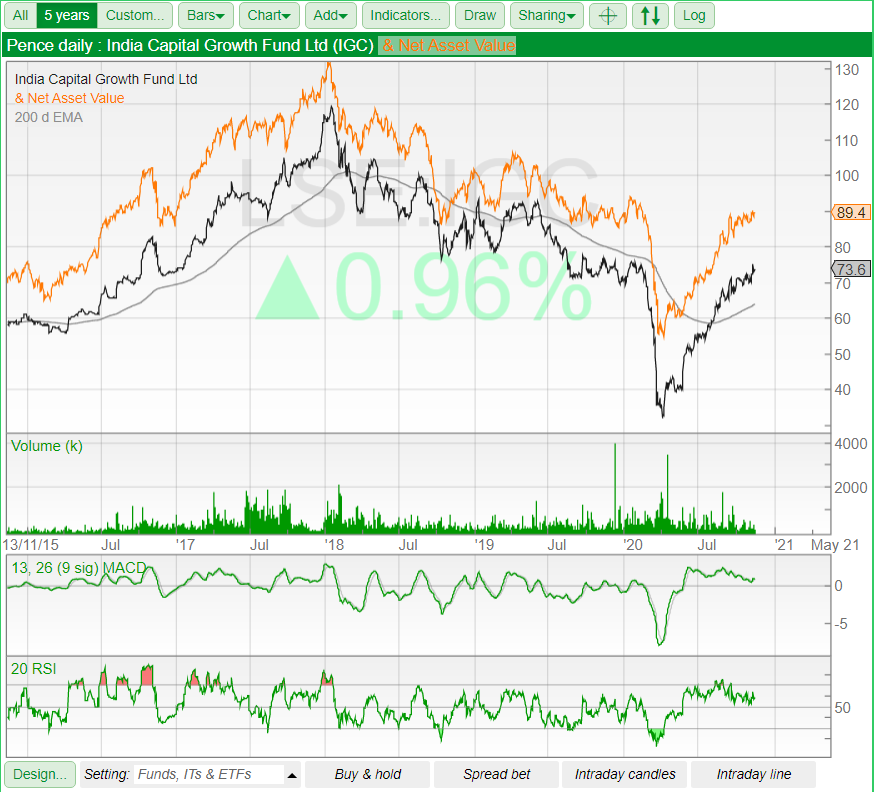

India Capital growth by contrast trades at the biggest discount although its recent net asset value performance has been more than half decent. Between 2014 and summer 2017 the fund did a great job of beating the Indian mid cap index but from then on, the fund has under performed Indian mid caps and their index which have had a rough few year. Policy mis steps such as demonetisation (India’s currency was replaced overnight) have badly hit domestic, mid cap stocks.

Which brings us to the board at ICG.

Investment trusts great strength is that they have non-executive directors whose job it is to look after investors money. This structure helps explain why I tend to prefer actively managed funds over passive – typically ETFs – in large bits of the emerging markets space. These are younger markets which tend to favour active stockpickers but investors need to keep an eye on performance of the fund managers. Put simply, managers can make mistakes and can drift away from their strategy. At that point good boards start to get a bit stroppy and insist on changes. The easiest way of seeing this in action is that anxious boards start pushing for more pro-active measures to close a yawning discount. But if a board wants to get really involved it can also insist on changes at the fund manager and in extreme circumstances even change the manager.

And change has most certainly come at ICG. The board thinks the fund should continue but it is introducing a redemption facility and a change to the Investment Manager’s fee. According to a research note back in May from Shore Capital about ICG, “Shareholders would have the right to request the redemption of part or all of their shareholding on 31 December 2021 (and then every two years) at an exit discount equal to a maximum of a 6% discount to NAV per redemption share”. The fund manager is called Ocean Dial and it has taken several steps to improve performance. Again, according to that Shore Capital report “ the research team has been materially strengthened (from four to seven) with the appointment of a co-Head of Equity (with 30 years’ experience) and two analysts, one senior and one junior. Gaurav Narain (26 years’ industry experience) and Tridib Pathak, who joined in 2019, (30 years’ industry experience) jointly head the team”. In addition, the investment process has changed incrementally largely by creating a focus list of around 140 companies. Businesses that the managers felt were “unscalable, capital inefficient, conglomerated, overcomplicated, driven by commodity prices, have governance concerns, are exposed mainly to overseas retail consumers, or where we don’t have enough knowledge to have an informed view on any of the above were excluded”.

A recent note from one of the managers involved at the fund nicely sums up the Ocean Dial approach – “If one was to summarise our investment philosophy in one statement it would be to find compounding machines (well managed companies that can sustain earnings growth of 15-20% over a long period of time) and add to them when they are out of favour. Across the next economic cycle, rural India coupled with the intermediation of financial services, are the best spaces to help our philosophy self-fulfil. In addition to a normalisation in earnings growth, allocating at this time has another powerful return component of an upward reversion towards the long term mean in the valuation of our companies.”

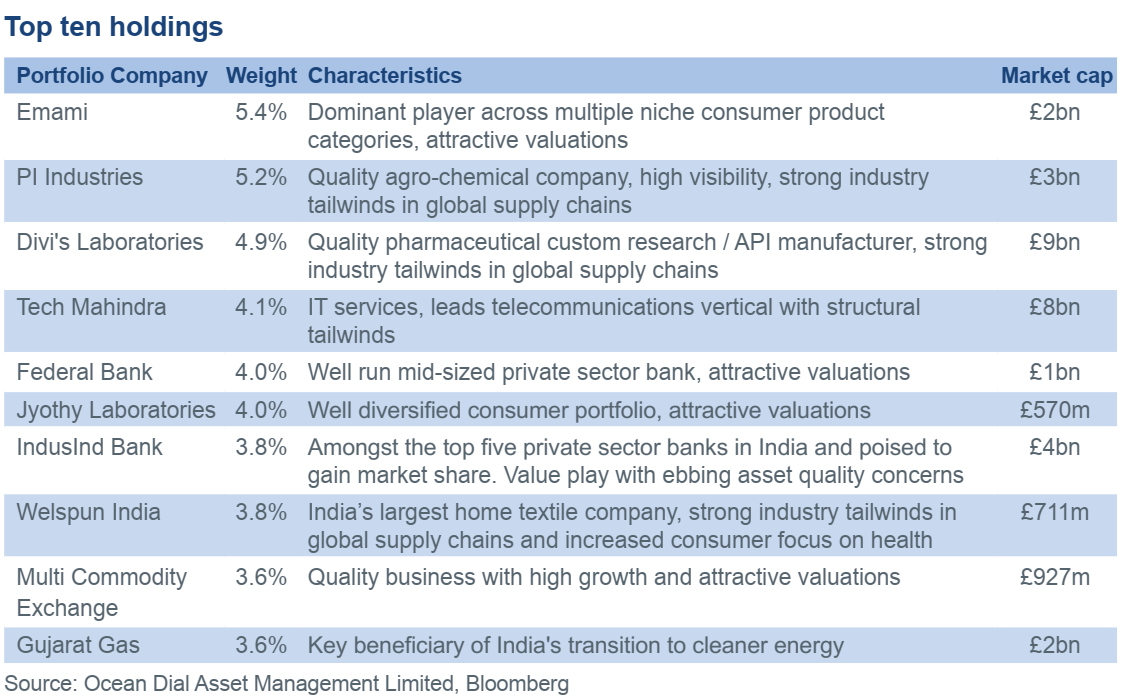

I would suggest that there is a new clarity to the process – instead of a more idiosyncratic stock picking approach, there’s a renewed focus on what one called quality stocks in the mid cap world. I think this probably makes a great deal of sense and if we look into the portfolio, we can see some subtle changes in holdings. Out go more volatile, possibly more cyclical stocks – perhaps with a bit more value bias – and in come more growth-oriented firms.

What’s in the Portfolio

The Ocean Dial managers now have a manageable universe of 140 companies out of which they choose between 25 and 35 o go into the ICG portfolio. In size terms the portfolio comprises 51.5% mid cap stocks and 32% small caps. Turnover in the portfolio has increased commensurately and is now expected to stabilise at 20%-25% from c.15% in the past.

New investments in the portfolio include Multi Commodity Exchange (MCX IN), CCL Products (CCLP IN), Aegis Logistics (AGIS IN), Gujarat Gas (GUJGA IN) and ICICI Lombard General Insurance (ICICIGI IN). According to Ocean Dial, “the underlying theme of new entrants is they are all market leaders which have created significant entry barriers and have strong underlying fundamentals”. Some of the recent stocks exited by IGC include Indian Bank (INBK IN), Yes Bank (YES IN), Motherson Sumi Systems (MSS IN) and Jammu & Kashmir Bank (JKBK IN). The table below outlines the top ten current holdings in the fund.

Risks

I don’t want to underestimate the risks with a fund like ICG. Indian stocks can be volatile as all EM (emerging markets) stocks can be, but India does present some unique challenges. Its leader is volatile and can jump nasty surprises on the market (demonetisation was one of them). I also think relations with China will get a great deal worse before they get any better. And I think – as I have already alluded to – that India is still in for even more nastiness connected with the Covid virus which could derail any sensible reforms happening in the background. And investors might take fright as Modi turns ever more nationalist.

More broadly if the US does suffer from political gridlock in the New Year and the economy takes a dive, we could see investors flee emerging market stocks en masse and seek safe haven assets. At which point I would expect to see expensive (based on relative valuations) and volatile Indian equities aggressively sold off.

Turning to the fund itself, I think it is fair to say that the turn around at the manager is still a work in progress and although recent performance has improved of late, we might still see continued under performance. As I said before, if you want a manager with a better track record and arguably a larger cap stock portfolio, I would choose the Ashoka fund although it has a smaller discount and is more large cap focused.

My bottom line

But I do not want readers to get carried away with my abundant caution. My hunch is that the Indian economy will start to come out of a dark tunnel at some point in 2021. If that happens, we could see a big bounceback in the domestic economy which will especially help mid cap equities which is where ICG is strongest. We might also see the reshaped fund management team start to score some big hits and that discount could tighten. And if all else fails, there is the chance that investors can get out at a 6% discount in 2021 via the redemption facility, which I think provides some underpinning to the bullish argument. And in the ideal case we could see a multiyear bull cycle as India starts to benefit from increased investment – especially by multinationals worried by China – and government reforms intensify. As India hopefully starts to close the gap with China, ideally investing in new infrastructure along the way, the local stockmarket might be a much better place and perhaps the new investment management approach being developed by Ocean Dial could start to produce real results.

Disclosure – As I have already mentioned I visited India a few years back whilst making a video for ICG and at the same time also interviewed key managers. I have no investment or commercial relationship with Ocean Dial or ICG.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.