A new addition to the Dynamic 35 Aurora Investment trust

I wanted to start this article with an immediate declaration. I am a non-executive director at my new addition to the Dynamic 35, the Aurora investment trust. As a general rule I tend not to discuss any fund where I have some form of professional involvement for the obvious reasons. But every once in a while, even I feel I have to draw attention to what I think is a potential opportunity, and I think Aurora at the moment is one of those. That said bear in mind – to repeat – I am a non-executive director although I would add that being a NED doesn’t mean I am a cheer leader for the funds’ manager, Phoenix and Gary Channon. I clearly think they are capable and talented – otherwise I wouldn’t be involved – but even the best managers have bad years and bad funds.

So, with that declaration out of the way, I’ll try and explain why I think Aurora is an interesting fund. It could/might/should benefit from two tailwinds.

The first is that UK equities are, by comparison with their developed world peers, under owned. Part of that under exposure is because of dismal recent performance. The S&P 500 has recovered to levels higher than those pre-Covid, whereas the FTSE All Share is still more than 20% below its 2020 highs in January. Another useful indicator – the FTSE All-Share is trading at a 12 month forward P/E multiple of 14.8x, compared to 22.0x for the S&P 500 and 17.4x for the Stoxx 600. The FTSE All-Share is just 0.7x higher than the 5-year average, compared to the S&P and Stoxx, which are 4.7x and 2.7x above their long-term average.

There’s lots of good macro-economic reasons for not owning the UK. I think it is fair to say that we have not made a good job of fighting Covid, and Brexit – whatever your view – has certainly put off many international investors. I could list a great many more negatives to do with government policy, but I think those two observations possibly explain a great deal about most international investors attitudes.

There is also every reason to think that in the next few months matters will get worse. One doesn’t have to be a rabid opponent of the government to question whether the Three Tier system regional alert system is fit for purpose, or question whether we are testing enough and also wonder aloud what the heck happened to our much vaunted track and trace system. UK unemployment levels are also about to steadily rise as more firms lay off surplus employees. But its usually at the peak of dismal macroeconomic newsflow that investors need to see past the negatives to understand the potential opportunity.

One small example of how we can become too dismal. If, as I do, you accept that the next few months will be grim, one also has to accept that this tide can reverse at some point and that positive news flow could start to pick up again. Take the labour market which was the focus of a report a few weeks ago from Tosca funds’ chief economist Dr Savvas Savouri. His main point is that all the talk about a K shaped recovery might be very wide of the mark! According to Dr Savouri, “Yes, parts of the UK labour market’s private side will suffer job losses, not however its – admittedly smaller – public sector. Far from it in fact, with large parts of the latter set to see their headcount grow, and do so by popular demand as it were. Moreover, whilst elements of the private sector will indeed suffer permanent job losses, far from all of it will.” The first set of charts below spell out what I think is a perfectly defensible argument – that after the late Autumn spike, employment will recover sharply.

If that reversal does happen, then its not unreasonable to expect international investors to rediscover their previous enthusiasm for UK equities – especially as we will be in the next post Brexit stage. At which point investors might begin to realise how cheap, and under owned UK equities are.

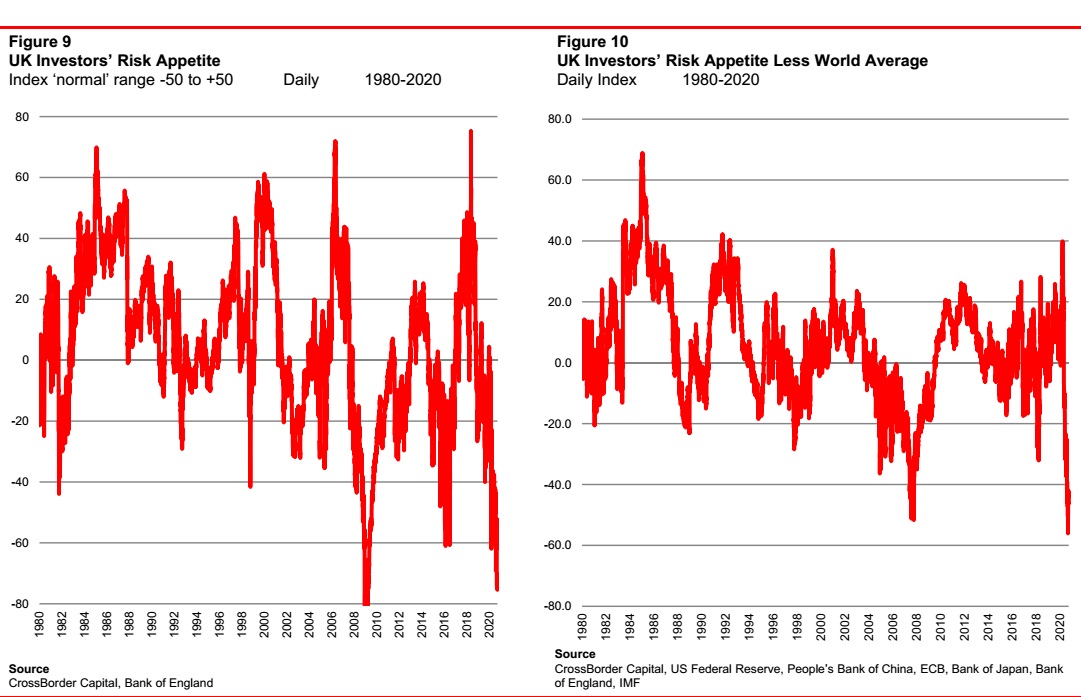

One piece of evidence for this comes from research house Cross Border Capital. They, rightly in my view, focus on how funds flow through the global financial system in order to spot key trends. They have even built indices which measure not only flows but also risk appetites. For the UK their current reading for their risk appetite index is a low of minus 74 ”which has only been once bested by the lows of the 2008/09 GFC. According to historical experience, UK equities deliver an average two-year ahead returns of 35.5% when risk appetite is at just minus two-standard deviations below normal – each additional standard deviation, in theory, adds another 12% to returns. Figure 10 puts this into context and compares the UK with the World investor average. The differential of minus 45 index points is virtually unprecedented. UK equities are both relatively and absolutely out-of-fashion. Where is Warren Buffett when you need him?”

The next leg of the argument is that the UK stock market also boasts a great many cheap stocks, otherwise known as value stocks. In a sense this is obvious – if the UK market is cheap and under owned, you would expect to have lots of cheap stocks. But there is a structural factor at work here – many sectors that are unloved have much higher prominence in the UK market whereas growth sectors such as Technology is relatively underrepresented in the UK.

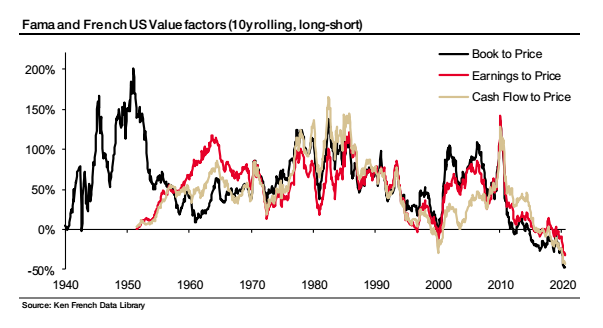

Globally, value stocks are unloved. According to the global quant strategist at French bank SocGen, Andrew Lapthorne, value stocks in aggregate are near peak depressed levels on virtually every historical timescale. In simple terms, sexy, popular growth stocks (tech, healthcare) have boomed but unloved sectors are spectacularly unloved.

In the chart below Lapthorne plots “the rolling 10y long-short performance for Book to Price, as well as Earnings and Cash Flow to Price. It is no wonder why many are questioning whether Value investing is dead. In almost 100 years of data, we have never seen such a prolonged period and magnitude of Value underperformance. The only period that resembles to some extent Value’s current struggles was the TMT bubble, but the current performance is still worse “.

One crucial last crucial point. Not all UK equities are unloved. Some indices such as the AIM index or the FTSE 250 index are near recent peak levels and have most definitely not under performed. What has under performed are mid to large cap stocks in unloved sectors.

So, to summarise.

The UK large to mid cap is under owned and has underperformed.

It is also full of unloved sectors and stocks. That might continue and I think there is a strong argument for hedging your bets by owning a fund which has a strong UK exposure but with a growth stock bias. I will be looking at these funds in a later article. But history suggests at some point the dislocations I have mentioned will unravel and one is suddenly thrown into a value rally as investors realise the opportunity. These reversals are usually quite quick in terms of timescales and my guess is that if it did happen, it could happen next year.

Which brings me to Aurora. Its manager is Gary Channon of Phoenix and as we will see shortly, he has an excellent track record. I am not sure he would really call himself a traditional value manager anymore, more one who is focused on buying quality businesses with a cheap share price. That said he has a more value biased approach compared with other managers in the UK listed equities space, which is crowded to say the least in terms of investment trusts.

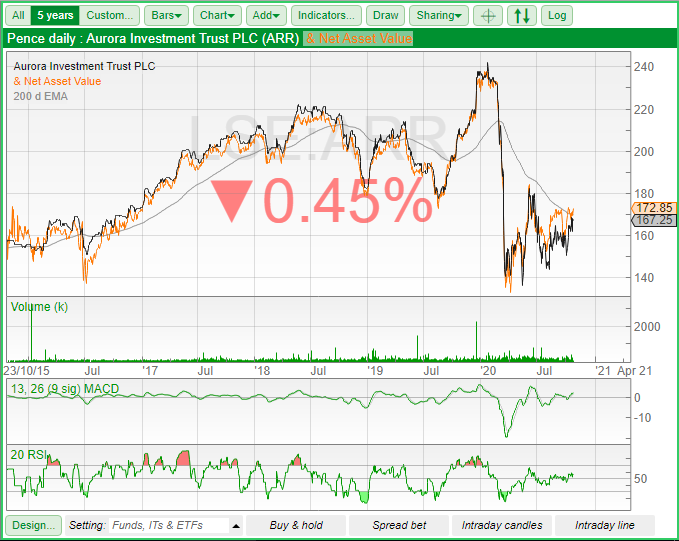

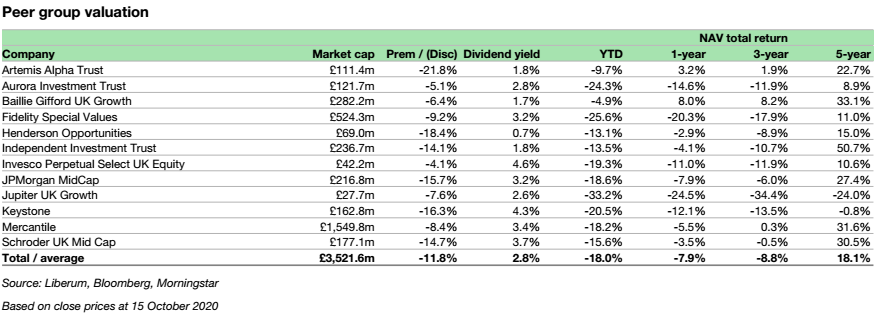

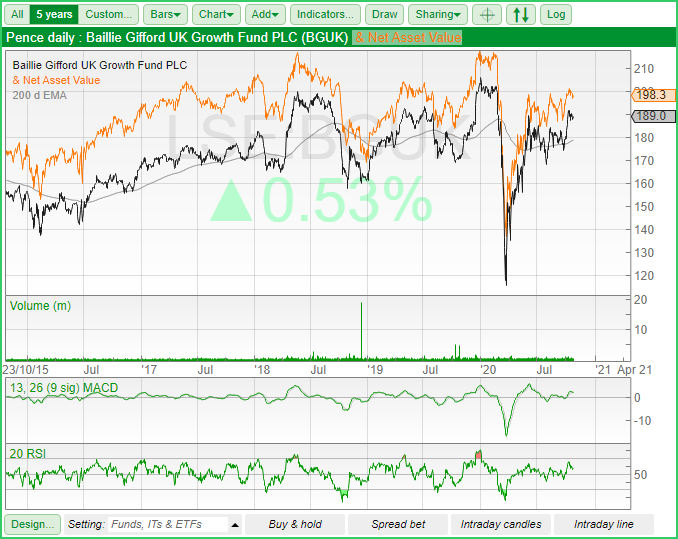

The Baillie Gifford fund for instance – see table below – has a strong growth bias, while the Schroders UK Mid Cap and Mercantile funds are also much more FTSE 250 focused, and thus have a different style of stock within their portfolios. Because Aurora has a large to mid-cap bias with a value tinge, it has had a rough 2020 and in September the fund NAV was down 6% for the month, versus the FTSE All Share which was down 1.7%. There is no getting away from the reality that Aurora hasn’t been ideally positioned in portfolio terms during Covid – counting against it has been its UK focus, its value oriented strategy and the fact that it holds stocks in sectors (airlines) that the market hates. That investment strategy is a deliberate choice, based on a well thought through, long term investment approach which involves deep research into the concentrated handful of stocks in the portfolio. Sometimes that approach can be painful for shareholders, but there is usually a reversal. The fund on which Aurora is based –the Phoenix UK fund which has been in existence for over 20 years – has had four negative years since 1998. It has outperformed the market by an average 24% in the years immediately following these periods according to a report by house brokers Liberum.

The Peers in the UK investment trust space

The Portfolio and performance numbers

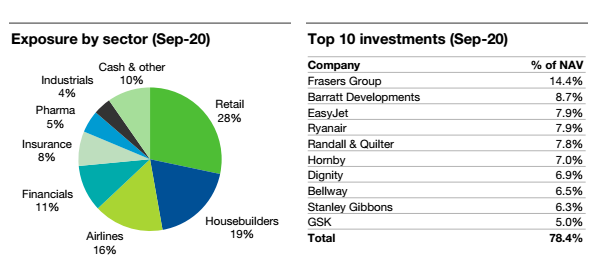

The two tables below, from a Liberum report, nicely sum up the concentrated Aurora portfolio. My guess is that amongst UK stock pickers who are readers, there will be very divergent views on these holdings. Everyone under the sun has a view about Mike Ashley and Frasers (which used to be Sports Direct) and equally the big holdings in Easyjet and Ryanair will draw immediate comment – given Covid they were clearly going to massively under perform.

The Phoenix team have traditionally been very enthusiastic about the UK housing sector; thus you’ll see Barratts and Bellway in the list. And there are also several special situation style holdings such as dominant funeral home provider Dignity plus Hornby and Stanley Gibbons. I would also draw attention to Randall and Quilter in the insurance space which has flown under most investors radar but strikes me as a quality business. In sum, there are plenty of reasons why this portfolio will have under performed in recent weeks and I am sure that many investors will hold strongly negative views about some of the individual holdings. But in a sense, this all rather besides the point. The core stocks are the result of a focused research process which looks at everything from cashflow to how the brand is performing in the wider marketplace. That means you are most definitely NOT getting a fund which looks and feels like the index, be that the FTSE 100 or FTSE 250. This is a stockpickers portfolio with a strong bias towards the UK domestic economy with lots of relatively unloved stocks.

Core to this active approach is the idea of Intrinsic Value. First popularised by Ben Graham and then taken up with gusto by Warren Buffett, this involves a deep dive into a business, working out its true long term value and then comparing it to the current share price. The manager aims to only invest in businesses where the discrepancy between the intrinsic value and the share price is very substantial.

According to a Liberum report on the fund “the manager has reduced its intrinsic value estimate by an average of 15% across the portfolio following the outbreak of the pandemic. The upside to the latest intrinsic value on 30 September 2020 was 143%. There has historically been a positive correlation between upside to intrinsic value and future performance of the Phoenix UK Fund. Since inception in 1998, there have been 28 quarter ends when the upside to intrinsic value was over 140%. The average net return of the Phoenix UK Fund over subsequent three-year periods is 60.8% (17.2% annualised) and none have been loss-making Aurora currently trades on a 5.1% discount to NAV. This compares to an average 1.1% premium since Phoenix took over as manager of the fund in January 2016.”

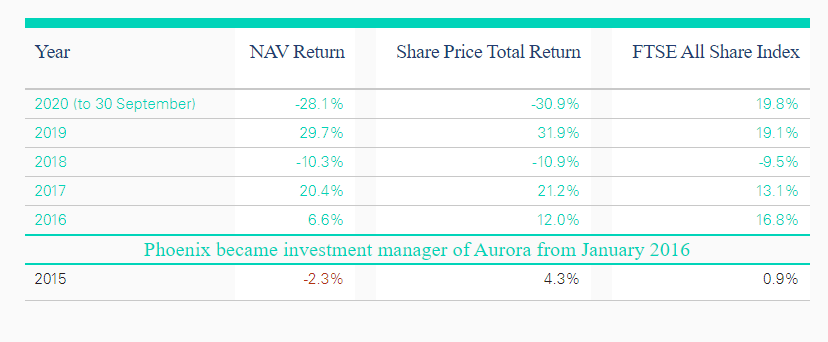

And how successful has this contrarian, intrinsic value-led strategy been overall in performance terms? The funds current managers Phoenix only took over in 2016, so for a longer track record we need to go back to the original unlisted fund called the Phoenix UK fund. Since May 1998 (to Sept 2020) the cumulative net return ahs been 403% compared to 149% for the FTSE ALL share index. Annualised since inception that equates to a 7.5% net return compared to 4.2% for the FTSE All Share index. The table below, from Aurora’s most recent fact sheet, shows more recent returns for the listed fund.

Risks

Quite apart from my initial caveat that I am a non-executive on this fund board, I think the risks are obvious. Active stock picking is a risky business and despite Gary Channon and Phoenix’s long term track record of out performance, that is no guarantee that it will succeed in the future: very successful active managers lose their touch all the time and that could happen with Aurora.

Precisely because you have a concentrated, active portfolio there are some very obvious risks that big holdings could backfire – and crush returns. If Covid lingers around all the way through 2021 then airlines will be in deeper trouble. Maybe Mike Ashley will land himself in another big scandal? And perhaps some of those special situations involving smaller businesses such as Dignity, Stanley gibbons and Hornby won’t turn the corner and continue to struggle. Overall, even if you were optimistic about the portfolio, I would suggest that you should reasonably expect considerable share price volatility in many of the underlying holdings.

More pertinently a value inspired strategy based around intrinsic value may once have worked but in the new normal it may not work in the future. Perhaps growth-oriented stocks will continue to shoot ahead and perhaps a UK value influenced approach will underperform? I think there is a very real risk there and I can easily see tech stocks for instance continuing to outperform for many more months or even years. If that is the case a UK equities manager with a more growth focused style such as the BG UK Growth fund might be a ‘safer’ bet.

Pulling further back to the macro backdrop, one might decide that my more upbeat assessment of the UK economy is faulty. Perhaps the UK will continue to under perform as growth stagnates. Again, I think there is decent chance that that might happen which could prompt investors to ignore the UK equities all together.

One last crucial observation, which is less of a risk more something to be aware of – at the moment in terms of fees charged, Aurora is a cheap play on UK equities. The ongoing charges ratio at 0.45% is lower than most of its peers but the fund does have an innovative performance fee structure which means that there could be a considerable increase in charges if the fund out performs the index over the next few years. Hopefully, the alpha out performance will justify those fees but not all the upside will be yours as an investor.

The Bottom Line

My core view is that UK equities are cheap, and that large to mid-cap UK equities in unfashionable sectors, are even cheaper. My sense is that the UK domestic economy could/might/should recover very strongly in 2021 and that many of the businesses in this portfolio – which are all well led in my view – will rebound aggressively. In that case this fund is well positioned to benefit. The manager has a long, impressive track record, although like all successful managers, has had their purple patches of underperformance. But these periods have usually been followed by big gains. My sense is that we could be at one of those points.

One last technical observation – Aurora currently trades on a 5.1% discount to NAV. This compares to an average 1.1% premium since Phoenix took over as manager of the fund in January 2016. Thus, if everything lines up as a I suggest in 2021, you could also benefit from a switch back into a premium share price rating, giving investors an extra return.

David Stevenson

Contact on Twitter: @advinvestor

Check out my blog at www.adventurousinvestor.com

Executive editor at www.altfi.com and www.etfstream.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.