Rightmove released a survey showing that the UK housing agreed sales picked up strongly to a record £37bn. A day later Persimmon reported half year results to end of June, adding that reported sales since the start of July were up 49% vs the same period last year. This would not have come as a surprise to investors who paid attention to UK banks outlook comments earlier in August, which also highlighted a bounce in UK mortgages.

Meanwhile the price of gold continues to rise to more than $2000 an ounce. The gold price seems to be being driven by inflows into gold-backed ETFs, which the World Gold Council reported accelerated in Q2, taking inflows for the first half of 2020 to a record-breaking 734t.

Possibly there is a trend of investors buying up perceived “inflation proof” tangible assets like houses and gold. If so, this trend has not been reflected in the platinum price, which has been left behind at $950 an ounce and trades at a 52% discount to gold. Historically platinum used to be more expensive than gold.

Mid-August can be a drought for companies reporting results. But one announcement that did catch my eye was Mithaq, the Saudi Arabian conglomerate, doubling their stake in Burford to 10.5%.

Yachts, bets and videotape

What do an oligarch’s £350m super yacht, a drunken £15m bet in The Horse and Groom and a billionaire’s sex tape have in common? * They’ve all been involved in litigation finance. Because litigation finance is inherently about disputes between wealthy people, it can generate stories that are rather more entertaining than lease accounting or life assurance. Fair value accounting means that short sellers have also targeted companies (Burford, Manolete) in the sector. So many investors understandably put litigation finance in the “too hard” pile, but given the high and uncorrelated returns, that may be a mistake. Below I take a look at the sector, with 3 of the companies reporting next month.

| Company Reporting |

Date |

| Manolete |

Reported FY (31 March y/e) Results early July |

| Litigation Capital Management (LCM) |

10th September (estimate) |

| Rosenblatt (RBG) |

16th September |

| Burford |

September |

Source: SharePad

History of Champerty

Though it sounds like an idyllic French alpine ski resort, champerty is in fact lending money to pursue court cases. Illegal through the medieval times until a few decades ago, a change in the law plus changes in attitudes have meant the practice has now become widely accepted.

Legal adversaries are often not evenly matched for resources, and therefore the side with the most money can make the process too costly and too risky even for a poorer litigant, even if that poorer side has a higher probability of success. An 80% chance of winning, but a 20% chance of paying millions in costs (yours and your opponents) is not an attractive risk/reward for many individuals or companies. Hence a deep pocketed third party litigation finance company steps in to fund the claim, taking on the costs and in some cases paying to insure against the risk of losing, in order to share in some of the upside of winning. In 2010, Lord Jackson in his review of civil litigation costs recognised the fact that third party funding enables greater access to justice for litigants and in doing so provides a “social good”.

High returns, poor cashflow

Because funders try to pick cases with a high probability of success, the sector is characterised by high reported ROIC (Burford reports ROIC rising from 60% in 2016 to 93% in 2019 and Manolete claims over 200% on average). Both Burford and Manolete have been criticised by short sellers for Fair Value accounting and poor cashflow, which has meant that despite high returns quoted, they have not been profitable enough to fund growth internally and instead seek external capital (equity and retail bonds in Burford’s case, IPO in Manolete’s case).

| Fair Value Accounting for litigation assets |

Historic Cost accounting |

| Burford

Manolete

Rosenblatt (RBG) |

Litigation Capital Management (LCM) |

Source: Company Reports

High returns are not merely a product of overly optimistic fair values though, LCM uses historic cost accounting and reports a 9-year ROIC of 134%.

That said, it’s important to understand that when litigation finance companies trumpet their high ROICs, it is not comparable to the 19.2% ROIC reported by Unilever in its Annual Report. Namely the litigation finance companies report the ROIC on a portfolio of completed cases and exclude i) cases where money has been invested, but have not yet settled and ii) allocating their group operating costs.

This explains the difference between LCM’s > 100% ROIC and Sharepad’s Group level RoCE, which is far lower 22% (though still ranking LCM profitability well above market average).

“Portfolio ROIC” seems to be an industry standard metric, almost as if lawyers had a tendency of making statements that are factually correct, but biased in favour of their own side of the case. I suspect that the high returns quoted have the opposite effect to what management intend, with many investors seeing a ROIC of around 100% or more as “too good to be true.”

Another opposite concern is that the high returns are real, but not sustainable. Increasing popularity of litigation finance means more capital is coming into the sector which should drive down returns available (either in terms of pricing or by encouraging funders to take on cases that they are less likely to win). The companies respond to this concern by pointing out that they are a relationship driven business, benefiting from referrals from their network of law firms, plus as they have been in business for decades they have a long dataset of successful (and unsuccessful) cases they’ve funded, which gives them a competitive “moat” versus new entrants and new capital.

Broadly the sector can be subdivided into 2 subsectors: insolvency cases (Manolete), general litigation finance (LCM, Burford). RBG is a listed law firm that dabbles in both of these subsectors.

Insolvency funding

The specialist in this area is Manolete which buys outright insolvency claims. Frequently questionable behaviour occurs around insolvency (for instance, transferring assets out of the troubled company at below market price, or a breach of contract or simply that creditors need help recovering assets). Yet because creditors have already lost money, they can be unwilling to “throw more good money after bad”, so Manolete steps in as a third party to buy and pursue the claim. Manolete give up at least 50% of proceeds (rising to 90% in some cases) after costs to the creditors. If the claim fails, Manolete bear 100% of their own and any adverse costs from the other side.

Although Manolete has in house lawyers that appraise and monitor cases, the insolvency professional who represents the creditors chooses the external law firm that will pursue the case. This suggests the model is inherently more scale-able than fighting the case in-house, as the number of cases increases Manolete should not have to juggle hiring more staff for fighting cases with investing in new claims.

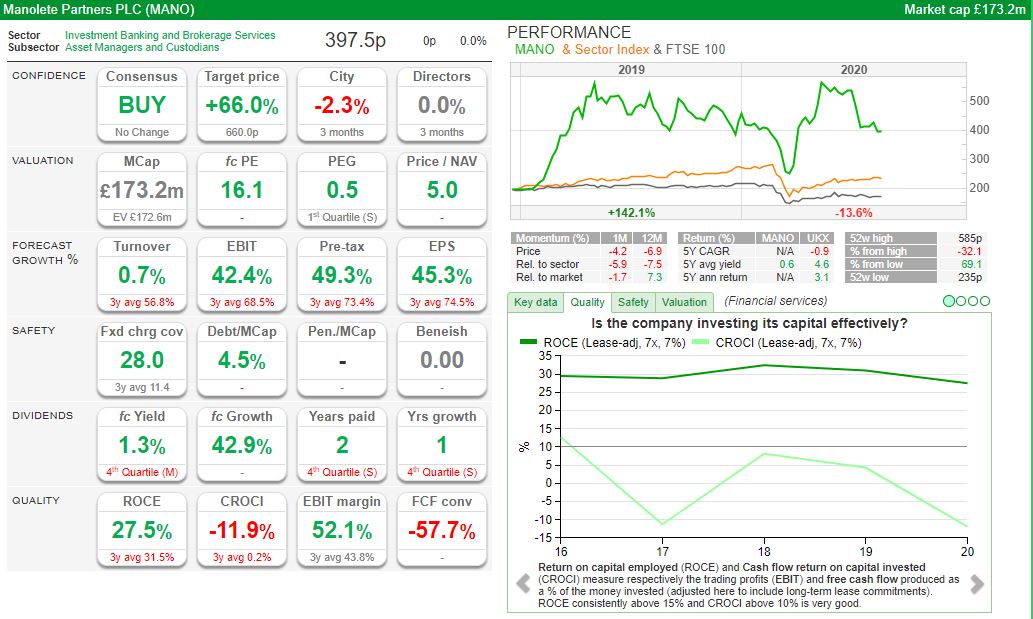

As noted by Jeremy in July, Rosenblatt Group (RBG Hldgs) has announced the launch of its new insolvency litigation financing solution. As if waving a red rag at a bull, the statement referred to a dominant provider in the space claiming this solution was both cheaper and more flexible. Rosenblatt named the division ISLERO, the name of the Spanish bull famed for killing the bullfighter Manolete in 1947. LCM has also suggested it will grow its insolvency financing business, though it is early days (9 claims in total, 7 in Australia, 2 in the UK). As we have seen in banking, new entrants (Monzo, Metro Bank) can reduce returns for incumbent operators with higher returns and marketshare (Lloyds), even if those new entrants have yet to prove their own business models generate significant returns. Hence it seems likely that Manolete’s 27.5% ROCE could fall, which might be a social good for creditors of insolvent companies, but disappointing for Manolete shareholders.

Worth noting too that as Manolete uses Fair Value accounting, the cash return (as measured by Sharepad’s CROCI) is negative at -12%. Manolete responds to criticisms of it’s accounting by pointing to the 257 realised cases over a period of 11 years of operation, which have not given rise to any material adverse losses in its financial statements.

Manolete’s institutional ownership includes Soros Fund Management as well as Amati and Miton. Not all institutions do their homework, but these 3 do in my experience, so retail investors can be confident management has been grilled about how accurately the accounting reflects reality. My mother also owns some shares in Manolete.

Litigation funding

Whereas insolvency cases tend to settle relatively quickly (Manolete has no open cases from 2016, and just one form 2017), litigation finance matters can last many years (at the start of 2020 Burford still had ongoing cases from 10 years ago). Also, Manolete owns the claim, and can decide when to settle. Burford and LCM fund the claim, which means it is the claimant’s decision when to settle. So for them timing of cashflows is particularly uncertain, though around 80% of matters settle before going to court, when a case does reach court the result takes longer and is binary (win/lose). To reflect this, returns on cases that win at court are substantially higher than those that settled early. The uncertain timing of cashflows means that broker forecasts should probably be ignored for both Burford and LCM.

To complicate things further, both Burford and LCM invest in disputes directly using capital from their own balance sheet and operate litigation finance funds, from which they charge a percentage of AUM and upside. They also invest in single cases or fund a portfolio of cases from the same corporate client. Occasionally they try to sell a share of claims into a secondary market to establish a “mark to market price” for the assets, though this market is nascent.

Interestingly Sharepad is able to calculate neither a ROCE nor a cash ROCI for Burford, probably because fair value adjustments have become so large relative to capital employed/invested. Up until 2012 Burford did publish a cash NAV figure, encouraging investors to use the figure for valuation purposes. It then stopped publishing cash NAV, claiming lack of interest from analyst and investors. I doubt this explanation would hold up well under cross examination.

Notoriously Burford has marked up the value of a single case (Petersen v Argentina) to $734m of unrealised gain, around half of shareholders equity of $1.5bn (market cap of £1.2bn). The matter relates to Argentina’s expropriation/nationalisation of an oil company YPF in 2012. FT’s John Dizard has written that even if successful, this claim will not pay out in US dollars, but devalued Argentinian Pesos.

Since Burford’s share’s peaked above £20 in August 2018, £3bn has been wiped off the market cap, partly due to Muddy Water’s short seller report questioning Burford’s accounting and business model. That £3bn of value is roughly 4x the amount that Burford have marked up the Petersen case to on their balance sheet, suggesting that investors are now extremely sceptical and the onus of proof lies on Burford’s management to win back investor confidence. Burford point out that both the CEO and CIO’s rewards are entirely based on cash metrics, not fair value accounting.

It is worth noting that Burford has funded successful claims against Latin American governments, including Argentina, and been able to collect before. In 2014, the group announced it had made an $11m net profit (and ROIC of 73%) funding Rurelec, a power generation company, against Boliva. Last year, Burford announced a successful conclusion to their Teinver case against Argentina, which made $107m of proceeds on a $13m investment, a 722% ROIC.

Conclusion

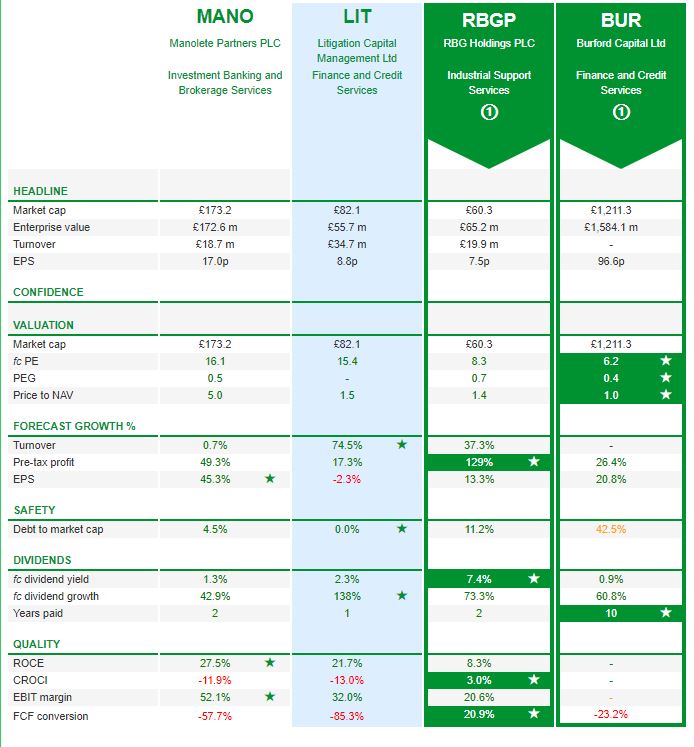

Manolete, with its shorter duration model and specialisation in insolvency, looks to be the highest quality company in the sector. The shares are up 8% since the end of February Covid sell off, now trading on 23x forecast P/E and reporting a top ranking 27.5% ROCE. Given insolvency claims are inherently shorter duration than other litigation finance matters, earnings should be more predictable. SharePad has forecast revenues and profits almost doubling in the next 2 years. The risk is competitors drive down returns, which might be a social good for insolvent estates, but less positive for investors.

Source: Sharescope, Manolete forecasts

Litigation Capital Management has been the pioneer in the field, and is up 19% since the Covid sell off, so investors have rewarded both the conservative historic cost accounting, long 21-year history and the likely increase in disputes following all the upheaval in 2020. The shares trade on 15x P/E.

RBG Holdings is not a major player in litigation finance with just £2.2m of litigation assets recorded on its balance sheet at the December year end. Its move into insolvency claims may lower Manolete’s returns, but it is unlikely that it will seriously threaten Manolete’s position as market leader. RBG has grown by acquisition, the balance sheet is top heavy with goodwill (£35m or 83% of net assets) as of Dec 2019. So far this seems to be working, but buying people businesses, when the assets walk out the door every evening, can go wrong. This is emphasised by an extra £1m payment Ian Rosenblatt disclosed in this year’s Annual Report in exchange for him signing an extension to a non-compete covenant put in place at the IPO. The shares are down 16% since end of February market sell off.

Burford is not without risk, but at 520p the shares are down 73% from their high 2 years ago. Despite this precipitous fall, the company is still the giant of the sector with a market cap of £1.2bn, roughly 4x the size of the three other companies mentioned combined. Management are currently seeking a secondary US listing, in part to assuage concerns that they have cherry picked AIM as the exchange with the lightest listing requirements. Mithaq Capital, is not an institution well known to most investors, but any existing investor doubling their stake to 10.5% should also be taken as a sign of confidence. I own the shares because I think that Burford has a viable business, but it’s not for everyone.

Bruce Packard

The author owns shares in Burford

* Farhad Akhmedov’s £350m superyatch “Luna” was seized by Buford, on behalf of his ex wife, as part of their attempt to recover assets following the couples divorce.

https://www.dailymail.co.uk/news/article-8628301/Divorcee-awarded-Russian-billionaire-ex-husbands-340m-superyacht-110m-art-collection.html

Jeffrey Blue funded his court case over a £15m share price “bet” against Mike Ashley with litigation finance from Therium. https://www.ft.com/content/e4968f14-1751-11ea-8d73-6303645ac406

Harry Sergeant III sued Burford after the law firm got hold of a sexually explicit recording of the billionaire. https://www.ft.com/content/bf126d7e-ce60-11e9-99a4-b5ded7a7fe3f

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 24/08/20 – Searching for uncorrelated returns

Rightmove released a survey showing that the UK housing agreed sales picked up strongly to a record £37bn. A day later Persimmon reported half year results to end of June, adding that reported sales since the start of July were up 49% vs the same period last year. This would not have come as a surprise to investors who paid attention to UK banks outlook comments earlier in August, which also highlighted a bounce in UK mortgages.

Meanwhile the price of gold continues to rise to more than $2000 an ounce. The gold price seems to be being driven by inflows into gold-backed ETFs, which the World Gold Council reported accelerated in Q2, taking inflows for the first half of 2020 to a record-breaking 734t.

Possibly there is a trend of investors buying up perceived “inflation proof” tangible assets like houses and gold. If so, this trend has not been reflected in the platinum price, which has been left behind at $950 an ounce and trades at a 52% discount to gold. Historically platinum used to be more expensive than gold.

Mid-August can be a drought for companies reporting results. But one announcement that did catch my eye was Mithaq, the Saudi Arabian conglomerate, doubling their stake in Burford to 10.5%.

Yachts, bets and videotape

What do an oligarch’s £350m super yacht, a drunken £15m bet in The Horse and Groom and a billionaire’s sex tape have in common? * They’ve all been involved in litigation finance. Because litigation finance is inherently about disputes between wealthy people, it can generate stories that are rather more entertaining than lease accounting or life assurance. Fair value accounting means that short sellers have also targeted companies (Burford, Manolete) in the sector. So many investors understandably put litigation finance in the “too hard” pile, but given the high and uncorrelated returns, that may be a mistake. Below I take a look at the sector, with 3 of the companies reporting next month.

Source: SharePad

History of Champerty

Though it sounds like an idyllic French alpine ski resort, champerty is in fact lending money to pursue court cases. Illegal through the medieval times until a few decades ago, a change in the law plus changes in attitudes have meant the practice has now become widely accepted.

Legal adversaries are often not evenly matched for resources, and therefore the side with the most money can make the process too costly and too risky even for a poorer litigant, even if that poorer side has a higher probability of success. An 80% chance of winning, but a 20% chance of paying millions in costs (yours and your opponents) is not an attractive risk/reward for many individuals or companies. Hence a deep pocketed third party litigation finance company steps in to fund the claim, taking on the costs and in some cases paying to insure against the risk of losing, in order to share in some of the upside of winning. In 2010, Lord Jackson in his review of civil litigation costs recognised the fact that third party funding enables greater access to justice for litigants and in doing so provides a “social good”.

High returns, poor cashflow

Because funders try to pick cases with a high probability of success, the sector is characterised by high reported ROIC (Burford reports ROIC rising from 60% in 2016 to 93% in 2019 and Manolete claims over 200% on average). Both Burford and Manolete have been criticised by short sellers for Fair Value accounting and poor cashflow, which has meant that despite high returns quoted, they have not been profitable enough to fund growth internally and instead seek external capital (equity and retail bonds in Burford’s case, IPO in Manolete’s case).

Manolete

Rosenblatt (RBG)

Source: Company Reports

High returns are not merely a product of overly optimistic fair values though, LCM uses historic cost accounting and reports a 9-year ROIC of 134%.

That said, it’s important to understand that when litigation finance companies trumpet their high ROICs, it is not comparable to the 19.2% ROIC reported by Unilever in its Annual Report. Namely the litigation finance companies report the ROIC on a portfolio of completed cases and exclude i) cases where money has been invested, but have not yet settled and ii) allocating their group operating costs.

This explains the difference between LCM’s > 100% ROIC and Sharepad’s Group level RoCE, which is far lower 22% (though still ranking LCM profitability well above market average).

“Portfolio ROIC” seems to be an industry standard metric, almost as if lawyers had a tendency of making statements that are factually correct, but biased in favour of their own side of the case. I suspect that the high returns quoted have the opposite effect to what management intend, with many investors seeing a ROIC of around 100% or more as “too good to be true.”

Another opposite concern is that the high returns are real, but not sustainable. Increasing popularity of litigation finance means more capital is coming into the sector which should drive down returns available (either in terms of pricing or by encouraging funders to take on cases that they are less likely to win). The companies respond to this concern by pointing out that they are a relationship driven business, benefiting from referrals from their network of law firms, plus as they have been in business for decades they have a long dataset of successful (and unsuccessful) cases they’ve funded, which gives them a competitive “moat” versus new entrants and new capital.

Broadly the sector can be subdivided into 2 subsectors: insolvency cases (Manolete), general litigation finance (LCM, Burford). RBG is a listed law firm that dabbles in both of these subsectors.

Insolvency funding

The specialist in this area is Manolete which buys outright insolvency claims. Frequently questionable behaviour occurs around insolvency (for instance, transferring assets out of the troubled company at below market price, or a breach of contract or simply that creditors need help recovering assets). Yet because creditors have already lost money, they can be unwilling to “throw more good money after bad”, so Manolete steps in as a third party to buy and pursue the claim. Manolete give up at least 50% of proceeds (rising to 90% in some cases) after costs to the creditors. If the claim fails, Manolete bear 100% of their own and any adverse costs from the other side.

Although Manolete has in house lawyers that appraise and monitor cases, the insolvency professional who represents the creditors chooses the external law firm that will pursue the case. This suggests the model is inherently more scale-able than fighting the case in-house, as the number of cases increases Manolete should not have to juggle hiring more staff for fighting cases with investing in new claims.

As noted by Jeremy in July, Rosenblatt Group (RBG Hldgs) has announced the launch of its new insolvency litigation financing solution. As if waving a red rag at a bull, the statement referred to a dominant provider in the space claiming this solution was both cheaper and more flexible. Rosenblatt named the division ISLERO, the name of the Spanish bull famed for killing the bullfighter Manolete in 1947. LCM has also suggested it will grow its insolvency financing business, though it is early days (9 claims in total, 7 in Australia, 2 in the UK). As we have seen in banking, new entrants (Monzo, Metro Bank) can reduce returns for incumbent operators with higher returns and marketshare (Lloyds), even if those new entrants have yet to prove their own business models generate significant returns. Hence it seems likely that Manolete’s 27.5% ROCE could fall, which might be a social good for creditors of insolvent companies, but disappointing for Manolete shareholders.

Worth noting too that as Manolete uses Fair Value accounting, the cash return (as measured by Sharepad’s CROCI) is negative at -12%. Manolete responds to criticisms of it’s accounting by pointing to the 257 realised cases over a period of 11 years of operation, which have not given rise to any material adverse losses in its financial statements.

Manolete’s institutional ownership includes Soros Fund Management as well as Amati and Miton. Not all institutions do their homework, but these 3 do in my experience, so retail investors can be confident management has been grilled about how accurately the accounting reflects reality. My mother also owns some shares in Manolete.

Litigation funding

Whereas insolvency cases tend to settle relatively quickly (Manolete has no open cases from 2016, and just one form 2017), litigation finance matters can last many years (at the start of 2020 Burford still had ongoing cases from 10 years ago). Also, Manolete owns the claim, and can decide when to settle. Burford and LCM fund the claim, which means it is the claimant’s decision when to settle. So for them timing of cashflows is particularly uncertain, though around 80% of matters settle before going to court, when a case does reach court the result takes longer and is binary (win/lose). To reflect this, returns on cases that win at court are substantially higher than those that settled early. The uncertain timing of cashflows means that broker forecasts should probably be ignored for both Burford and LCM.

To complicate things further, both Burford and LCM invest in disputes directly using capital from their own balance sheet and operate litigation finance funds, from which they charge a percentage of AUM and upside. They also invest in single cases or fund a portfolio of cases from the same corporate client. Occasionally they try to sell a share of claims into a secondary market to establish a “mark to market price” for the assets, though this market is nascent.

Interestingly Sharepad is able to calculate neither a ROCE nor a cash ROCI for Burford, probably because fair value adjustments have become so large relative to capital employed/invested. Up until 2012 Burford did publish a cash NAV figure, encouraging investors to use the figure for valuation purposes. It then stopped publishing cash NAV, claiming lack of interest from analyst and investors. I doubt this explanation would hold up well under cross examination.

Notoriously Burford has marked up the value of a single case (Petersen v Argentina) to $734m of unrealised gain, around half of shareholders equity of $1.5bn (market cap of £1.2bn). The matter relates to Argentina’s expropriation/nationalisation of an oil company YPF in 2012. FT’s John Dizard has written that even if successful, this claim will not pay out in US dollars, but devalued Argentinian Pesos.

Since Burford’s share’s peaked above £20 in August 2018, £3bn has been wiped off the market cap, partly due to Muddy Water’s short seller report questioning Burford’s accounting and business model. That £3bn of value is roughly 4x the amount that Burford have marked up the Petersen case to on their balance sheet, suggesting that investors are now extremely sceptical and the onus of proof lies on Burford’s management to win back investor confidence. Burford point out that both the CEO and CIO’s rewards are entirely based on cash metrics, not fair value accounting.

It is worth noting that Burford has funded successful claims against Latin American governments, including Argentina, and been able to collect before. In 2014, the group announced it had made an $11m net profit (and ROIC of 73%) funding Rurelec, a power generation company, against Boliva. Last year, Burford announced a successful conclusion to their Teinver case against Argentina, which made $107m of proceeds on a $13m investment, a 722% ROIC.

Conclusion

Manolete, with its shorter duration model and specialisation in insolvency, looks to be the highest quality company in the sector. The shares are up 8% since the end of February Covid sell off, now trading on 23x forecast P/E and reporting a top ranking 27.5% ROCE. Given insolvency claims are inherently shorter duration than other litigation finance matters, earnings should be more predictable. SharePad has forecast revenues and profits almost doubling in the next 2 years. The risk is competitors drive down returns, which might be a social good for insolvent estates, but less positive for investors.

Source: Sharescope, Manolete forecasts

Litigation Capital Management has been the pioneer in the field, and is up 19% since the Covid sell off, so investors have rewarded both the conservative historic cost accounting, long 21-year history and the likely increase in disputes following all the upheaval in 2020. The shares trade on 15x P/E.

RBG Holdings is not a major player in litigation finance with just £2.2m of litigation assets recorded on its balance sheet at the December year end. Its move into insolvency claims may lower Manolete’s returns, but it is unlikely that it will seriously threaten Manolete’s position as market leader. RBG has grown by acquisition, the balance sheet is top heavy with goodwill (£35m or 83% of net assets) as of Dec 2019. So far this seems to be working, but buying people businesses, when the assets walk out the door every evening, can go wrong. This is emphasised by an extra £1m payment Ian Rosenblatt disclosed in this year’s Annual Report in exchange for him signing an extension to a non-compete covenant put in place at the IPO. The shares are down 16% since end of February market sell off.

Burford is not without risk, but at 520p the shares are down 73% from their high 2 years ago. Despite this precipitous fall, the company is still the giant of the sector with a market cap of £1.2bn, roughly 4x the size of the three other companies mentioned combined. Management are currently seeking a secondary US listing, in part to assuage concerns that they have cherry picked AIM as the exchange with the lightest listing requirements. Mithaq Capital, is not an institution well known to most investors, but any existing investor doubling their stake to 10.5% should also be taken as a sign of confidence. I own the shares because I think that Burford has a viable business, but it’s not for everyone.

Bruce Packard

The author owns shares in Burford

* Farhad Akhmedov’s £350m superyatch “Luna” was seized by Buford, on behalf of his ex wife, as part of their attempt to recover assets following the couples divorce.

https://www.dailymail.co.uk/news/article-8628301/Divorcee-awarded-Russian-billionaire-ex-husbands-340m-superyacht-110m-art-collection.html

Jeffrey Blue funded his court case over a £15m share price “bet” against Mike Ashley with litigation finance from Therium. https://www.ft.com/content/e4968f14-1751-11ea-8d73-6303645ac406

Harry Sergeant III sued Burford after the law firm got hold of a sexually explicit recording of the billionaire. https://www.ft.com/content/bf126d7e-ce60-11e9-99a4-b5ded7a7fe3f

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.