Mind the Gap

It’s been a good few months. The FTSE small cap is up 14% since October, while the FTSE 100 is up around 7%. Suddenly the buy ideas start to disappear with prices adjusting upwards as the arrival of dawn reminds us the party is nearing a close. Which is often a useful time to re appraise our condition and see if a polite exit from the party may be appropriate before we do something we may regret.

The outlook for earnings is undoubtedly better in the UK with the likelihood of political stability enabling companies to plan and consequently invest for the future. This ultimately feeds through to wage inflation and consumer spending. But the market has been fuelled by hope and an expansion in the PE ratio so perhaps in small cap world the market is anticipating 15% more earnings than it was in September. According to Bloomberg the FTSE All Share index now trades at a PE of 19.5X which is anticipating earning growth. It may just be that the market has swiftly anticipated the next 12-18 months earnings increases so now it requires more distant vision to buy stocks. The election certainly hasn’t changed the global tensions we are seeing now, whether it be rioting, trade wars, or the rise of extremists. Nor has it reduced the amount of debt.

Social Friction

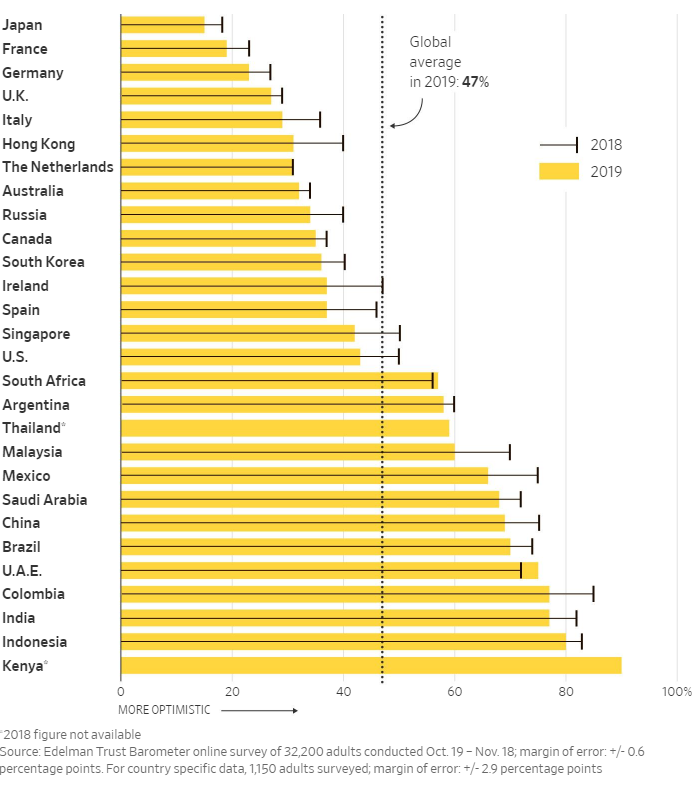

To understand what is going on the Edelman survey of 34,000 people over 27 counties may provide some insight. Released just over a week ago where 56% of respondents said that capitalism does more harm than good. In the UK it was 53% and higher in France at 69%. On average only a minority of people believed they and their families would be better off in 5 years’ time. Noticeably the more developed countries are the ones where optimism is lower with less than 30% of those surveyed in the UK believing they will be better off in 5 years’ time. This is troubling, as it disagrees with a stock market PE of 19.5X which is anticipating growth which translates to people being better off.

My daughter, who studies philosophy at university, has been telling me about the theories that witches were invented as a means of persecuting those that were of no use in the work force, nor useful for the purpose of perpetuating the human race. And hence a law was also passed making homosexuality illegal. But now we have too many people on the planet it has changed. I find myself wondering if the adherence to capitalism is a function of the need to escape poverty and in countries where poverty is less of a problem there is less belief in capitalism. Particularly as it has led us into debt.

The division between the developed countries and the less developed countries is striking. The population of China is 1.45bn, some 4.4 times greater than the US and the GDP growth in China has outstripped that of the US every year since 1977. In purchasing power parity terms China’s GDP exceeded that of the US in 2013 though it may take a while yet until it exceeds the US in absolute GDP terms. With China now accessing technology and mechanisation it would seem likely the growth will continue to accelerate.

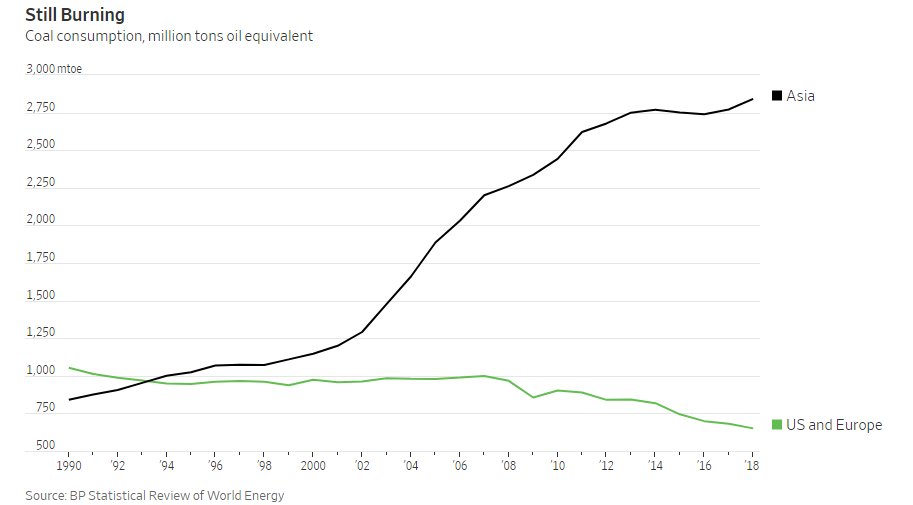

The scale of the demand from Asia can be seen in this chart of coal consumption. While many believe coal is not a growth market it would appear it is. As the US and Europe have managed to more than halve their coal consumption over 10 years this is dwarfed by the growth in Asia.

It seems that in the future we will be driven by the economies of Asia rather than the US and economic power will shift from west to east. The adage that when Wall Street sneezes London catches a cold could become redundant. Which Mr Trump won’t like and trade wars may continue. The transition from a western dominated capitalist system to an eastern dominated capitalist system is unlikely to be a smooth one.

Debt

The transition of capitalism from West to East may not be a smooth one for stock markets. But it is happening. The US have run down their gold reserves while China has been increasing them.

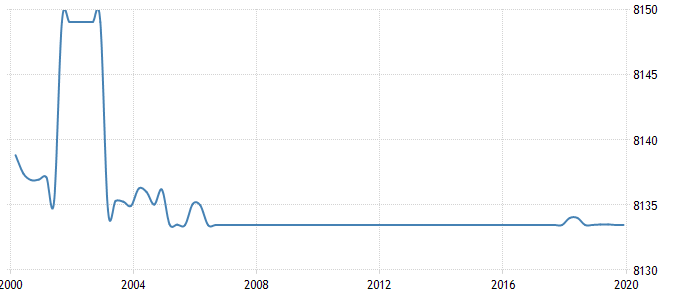

Chine Gold Reserves

US Gold Reserves

Source: Trading economics

Which suggests that when the final trade battle is fought it may well be around currencies. In the west we have been printing currency under a program known a “quantitative easing”, which has enabled governments to take on more debt which has leaked into stock markets causing Unicorn valuations.

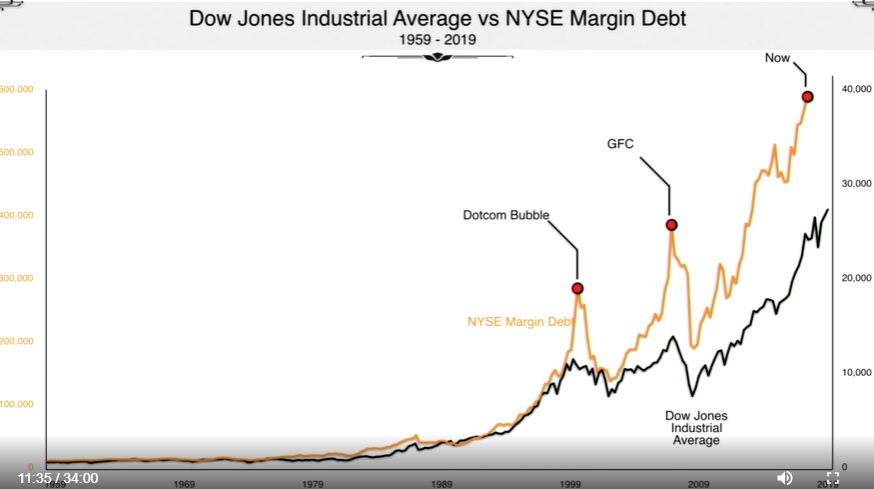

The use of debt to buy equities is known to inflate markets. The amount of NYSE margin debt is shown below on the brown line while the black line is the Dow Jones IA index.

Source: Grant Williams

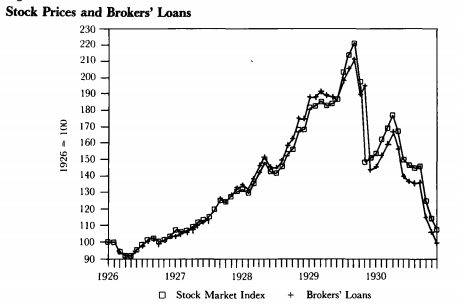

In the 1920’s this margin debt was known as “brokers loans”, which were largely blamed for the 1929 crash as this chart illustrates.

Source: Journal of Economic perspectives – Eugene N White

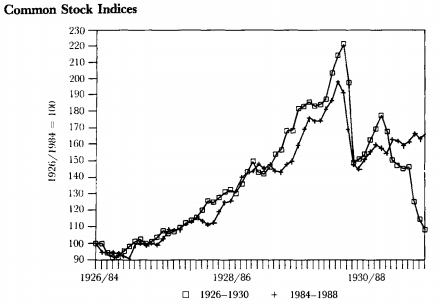

A similar pattern was seen in the 1980’s credit expansion

Source: Journal of Economic perspectives – Eugene N White

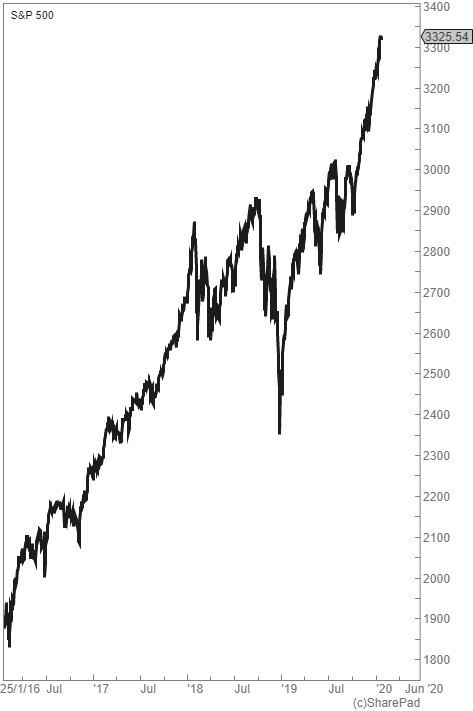

If we compare that to today’s chart of the S&P 500 index over a similar 4-year time horizon there are reasons for concern:

Source: SharePad

Perhaps if Wall Street sneezes London may still get a cold.

Investment approach

There looks to me like there are a lot of places over coming years where the stock market can fall down the gap as dominance of our financial system moves from west to east, notwithstanding that the outlook for earnings is strong in the short term. There are plenty of reasons for the market to worry which today it is ignoring on the back of a newfound enthusiasm. To be fair the UK market has not experienced the steep rise that the US market has, but it is unlikely to go up when the US market falls.

Against that backdrop I am inclined to stick to a method of “coffee can” investing. This was coined by Robert Kirby of Kirby Capital where a client of his never sold anything. He purchased stocks at $5,000 each and a decade later one of the holdings called Haloid (which later changed its name to Xerox) had ballooned to $800,000. This “buy and forget” approach Kirby termed “coffee can investing” since in the days of the wild west Americans kept their valuables in a coffee can under the mattress.

A study by Fidelity further backed up this style of investing by showing there were two categories of people who made the maximum amount of money – those who were dead and those who had forgotten about their investments.

Stocks

On a long term view, I want exposure to stocks that are selling into Asia as these are set to become the large markets of the future. I also want to see strong returns on capital as evidence of a competitive “moat” and a high-quality culture evidenced by healthy remuneration schemes and equity alignment.

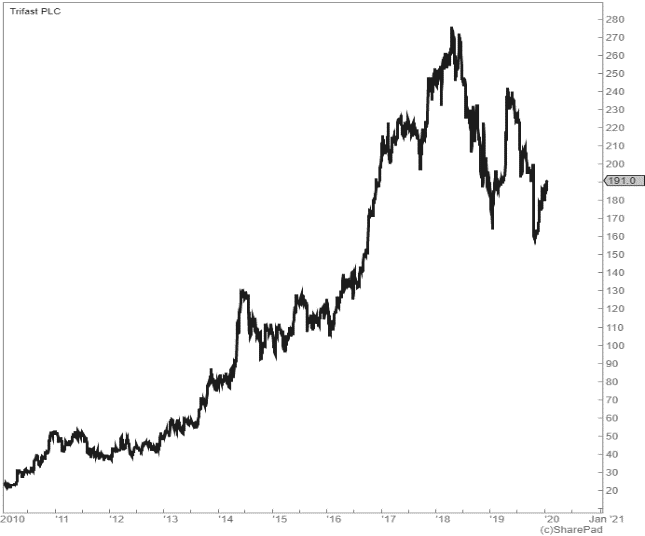

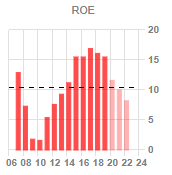

One example of such a stock may well be Trifast, who manufacture and distribute what they call “industrial fasteners” (I prefer to think of them as “nuts and bolts”). This is a very low-tech industry and yet they deliver a 15% ROE while having only modest debt and 23% of their revenue is from Asia.

Trifast Plc

Share Price 191p

Mkt Cap £234m

Source: SharePad

History

There are not many distributors of small industrial widgets that have such a reassuring 10-year share price chart. Malcolm Diamond joined TR fastenings in 1981 and for the past 12 years has served as non-executive chairman, before retiring this year. He still chairs discoverIE and Flowtech Fluidpower. Originally a distributor in Uckfield the company pioneered logistical supply solutions in the 1980’s and listed on the main market in 1994. It expanded to the US, Eastern Europe and the US later in that decade. Today it employs 1,300 staff across 30 global locations. Mark Belton remains CEO, a position he has held since 2015 having been with the company for 20 years.

Competitive Moat

Often, as investors, we can be transfixed by the low value add product, while the real moat the company has is in fact its distribution network. The same applies to Unilever who distribute household products at good returns, on account of their unique distribution network. In manufacturing, just in time delivery of components is crucial when any excess stock can be costly or any stock shortages can cause a production line to come to a standstill companies can be prepared to provide good margins for suppliers that can seamlessly and reliably integrate with their supply chain. And hence the competitive advantage may well be becoming increasingly technology based.

Returns

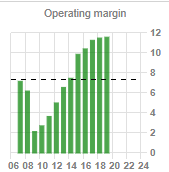

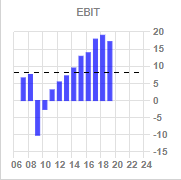

SharePad graphs can tell the story:

Source:Sharepad

Source: SharePad

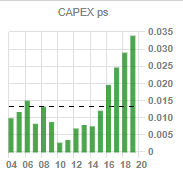

The share price has responded to the increasing ROE over the 8 years since the financial crisis, which in turn has been driven by the increasing operating margins. While over the last two years the share price has re-trenched as the recovery turned to growth and now it would appear a phase of capex has yet to bear fruit while the recent era of growth is slowing. This is a lifecycle many companies undergo and is healthy, although stock market analysts have a tendency to forecast in straight lines. Analysts were forced to revise down their forecasts at the end of last year when the company informed them that automotive markets were slower.

Estimates

Analysts now expect no growth in PBT between 2020 and 2022. The slower automotive market may be cyclical and pick up again, or it may be a secular long-term trend as vehicles move to electric. In both situations a company would normally go through a period of investment and enter new markets and/or gain market share to replace the decline making it well placed to recover. Note that the capex picked up very strongly on the chart above in 2018 and 2019 and the company is gaining market share in a slower market. The capex is largely around Project Atlas integrating the group’s IT infrastructure, and underlying rules, processes and practices alongside investment in the companies’ talent platform. If the company aims to continue to harness growth from Asia this will be important.

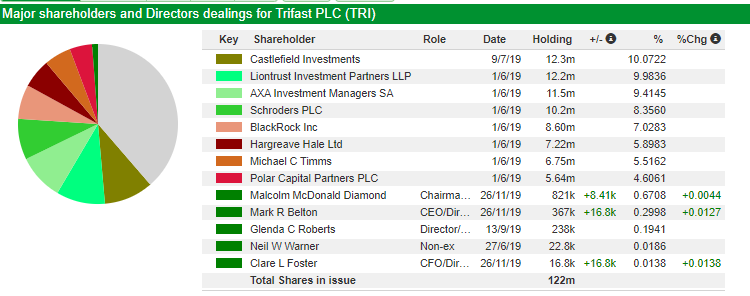

Valuation

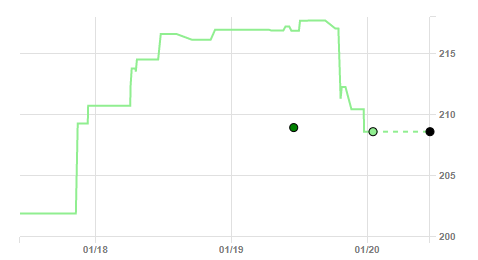

The company trades on a PE of 14.7X the forecast earnings which is at the lower end of its historical valuation range. This SharePad table of historic PE’s illustrates:

Source: SharePad

The yield however is a modest 2.3%.

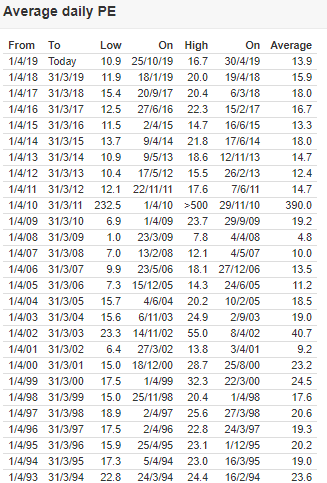

Alignment

There is a high-quality shareholder list. The largest shareholder, shown as Castlefield, is Keith Ashworth-Lord’s UK Buffetology fund where he applies Buffet-like principles to emerging companies. The second largest is Liontrust where the stock is held by the economic advantage team who invest in companies where management own at least 3% of the quoted equity and the company has a sustainable economic advantage. Note that Michael Timms who was an original founder of the Uckfield business still owns 5.5% of the company.

The CEO, Mark Belton, earned a total of £367k having been awarded no bonus last year which is far from egregious. Three-year LTIP targets are targeted on achieving 15% p.a. EPS growth and total shareholder return 8% ahead of the FTSE small cap index total return. While I would prefer to see ROE targets in the LTIP the bonus is predicated on a minimum ROCE of 15%.

Conclusion

This looks like it could be a typical coffee can stock set to harvest the benefits of capital moving from west to east with strong returns on capital, a high-quality culture and genuine competitive moat. Even if it just distributes nuts and bolts. If we can acquire this and forget about it during a period of investment, we may possibly find that one day distribution is deemed more important than technology and this distributor from Uckfield is the latest global hot stock.

Summary

The decisive election result in the UK has prompted a sharp re-rating of small companies. While the earnings outlook is improved this may now be discounted in share prices. The global outlook is unchanged with increasing social unrest, political tensions and high debt levels causing a crisis for capitalism. It may be that this is part of the rumblings to be expected as power moves from the west to the east, but stock markets don’t generally react well to these events. Because of this it could be a time to invest in coffee can stocks that will endure the passage of change with deep moats, a high-quality culture and an ability to access growth in Asia, all of which Trifast appears to possess.

Forthcoming Events

In line with good practise Trifast usually issues quarterly updates so we may expect a Q3 update in February as well as a pre close statement in April for the year to March.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 27/01/20 – Mind the gap

Mind the Gap

It’s been a good few months. The FTSE small cap is up 14% since October, while the FTSE 100 is up around 7%. Suddenly the buy ideas start to disappear with prices adjusting upwards as the arrival of dawn reminds us the party is nearing a close. Which is often a useful time to re appraise our condition and see if a polite exit from the party may be appropriate before we do something we may regret.

The outlook for earnings is undoubtedly better in the UK with the likelihood of political stability enabling companies to plan and consequently invest for the future. This ultimately feeds through to wage inflation and consumer spending. But the market has been fuelled by hope and an expansion in the PE ratio so perhaps in small cap world the market is anticipating 15% more earnings than it was in September. According to Bloomberg the FTSE All Share index now trades at a PE of 19.5X which is anticipating earning growth. It may just be that the market has swiftly anticipated the next 12-18 months earnings increases so now it requires more distant vision to buy stocks. The election certainly hasn’t changed the global tensions we are seeing now, whether it be rioting, trade wars, or the rise of extremists. Nor has it reduced the amount of debt.

Social Friction

To understand what is going on the Edelman survey of 34,000 people over 27 counties may provide some insight. Released just over a week ago where 56% of respondents said that capitalism does more harm than good. In the UK it was 53% and higher in France at 69%. On average only a minority of people believed they and their families would be better off in 5 years’ time. Noticeably the more developed countries are the ones where optimism is lower with less than 30% of those surveyed in the UK believing they will be better off in 5 years’ time. This is troubling, as it disagrees with a stock market PE of 19.5X which is anticipating growth which translates to people being better off.

My daughter, who studies philosophy at university, has been telling me about the theories that witches were invented as a means of persecuting those that were of no use in the work force, nor useful for the purpose of perpetuating the human race. And hence a law was also passed making homosexuality illegal. But now we have too many people on the planet it has changed. I find myself wondering if the adherence to capitalism is a function of the need to escape poverty and in countries where poverty is less of a problem there is less belief in capitalism. Particularly as it has led us into debt.

The division between the developed countries and the less developed countries is striking. The population of China is 1.45bn, some 4.4 times greater than the US and the GDP growth in China has outstripped that of the US every year since 1977. In purchasing power parity terms China’s GDP exceeded that of the US in 2013 though it may take a while yet until it exceeds the US in absolute GDP terms. With China now accessing technology and mechanisation it would seem likely the growth will continue to accelerate.

The scale of the demand from Asia can be seen in this chart of coal consumption. While many believe coal is not a growth market it would appear it is. As the US and Europe have managed to more than halve their coal consumption over 10 years this is dwarfed by the growth in Asia.

It seems that in the future we will be driven by the economies of Asia rather than the US and economic power will shift from west to east. The adage that when Wall Street sneezes London catches a cold could become redundant. Which Mr Trump won’t like and trade wars may continue. The transition from a western dominated capitalist system to an eastern dominated capitalist system is unlikely to be a smooth one.

Debt

The transition of capitalism from West to East may not be a smooth one for stock markets. But it is happening. The US have run down their gold reserves while China has been increasing them.

Chine Gold Reserves

US Gold Reserves

Source: Trading economics

Which suggests that when the final trade battle is fought it may well be around currencies. In the west we have been printing currency under a program known a “quantitative easing”, which has enabled governments to take on more debt which has leaked into stock markets causing Unicorn valuations.

The use of debt to buy equities is known to inflate markets. The amount of NYSE margin debt is shown below on the brown line while the black line is the Dow Jones IA index.

Source: Grant Williams

In the 1920’s this margin debt was known as “brokers loans”, which were largely blamed for the 1929 crash as this chart illustrates.

Source: Journal of Economic perspectives – Eugene N White

A similar pattern was seen in the 1980’s credit expansion

Source: Journal of Economic perspectives – Eugene N White

If we compare that to today’s chart of the S&P 500 index over a similar 4-year time horizon there are reasons for concern:

Source: SharePad

Perhaps if Wall Street sneezes London may still get a cold.

Investment approach

There looks to me like there are a lot of places over coming years where the stock market can fall down the gap as dominance of our financial system moves from west to east, notwithstanding that the outlook for earnings is strong in the short term. There are plenty of reasons for the market to worry which today it is ignoring on the back of a newfound enthusiasm. To be fair the UK market has not experienced the steep rise that the US market has, but it is unlikely to go up when the US market falls.

Against that backdrop I am inclined to stick to a method of “coffee can” investing. This was coined by Robert Kirby of Kirby Capital where a client of his never sold anything. He purchased stocks at $5,000 each and a decade later one of the holdings called Haloid (which later changed its name to Xerox) had ballooned to $800,000. This “buy and forget” approach Kirby termed “coffee can investing” since in the days of the wild west Americans kept their valuables in a coffee can under the mattress.

A study by Fidelity further backed up this style of investing by showing there were two categories of people who made the maximum amount of money – those who were dead and those who had forgotten about their investments.

Stocks

On a long term view, I want exposure to stocks that are selling into Asia as these are set to become the large markets of the future. I also want to see strong returns on capital as evidence of a competitive “moat” and a high-quality culture evidenced by healthy remuneration schemes and equity alignment.

One example of such a stock may well be Trifast, who manufacture and distribute what they call “industrial fasteners” (I prefer to think of them as “nuts and bolts”). This is a very low-tech industry and yet they deliver a 15% ROE while having only modest debt and 23% of their revenue is from Asia.

Trifast Plc

Share Price 191p

Mkt Cap £234m

Source: SharePad

History

There are not many distributors of small industrial widgets that have such a reassuring 10-year share price chart. Malcolm Diamond joined TR fastenings in 1981 and for the past 12 years has served as non-executive chairman, before retiring this year. He still chairs discoverIE and Flowtech Fluidpower. Originally a distributor in Uckfield the company pioneered logistical supply solutions in the 1980’s and listed on the main market in 1994. It expanded to the US, Eastern Europe and the US later in that decade. Today it employs 1,300 staff across 30 global locations. Mark Belton remains CEO, a position he has held since 2015 having been with the company for 20 years.

Competitive Moat

Often, as investors, we can be transfixed by the low value add product, while the real moat the company has is in fact its distribution network. The same applies to Unilever who distribute household products at good returns, on account of their unique distribution network. In manufacturing, just in time delivery of components is crucial when any excess stock can be costly or any stock shortages can cause a production line to come to a standstill companies can be prepared to provide good margins for suppliers that can seamlessly and reliably integrate with their supply chain. And hence the competitive advantage may well be becoming increasingly technology based.

Returns

SharePad graphs can tell the story:

Source:Sharepad

Source: SharePad

The share price has responded to the increasing ROE over the 8 years since the financial crisis, which in turn has been driven by the increasing operating margins. While over the last two years the share price has re-trenched as the recovery turned to growth and now it would appear a phase of capex has yet to bear fruit while the recent era of growth is slowing. This is a lifecycle many companies undergo and is healthy, although stock market analysts have a tendency to forecast in straight lines. Analysts were forced to revise down their forecasts at the end of last year when the company informed them that automotive markets were slower.

Estimates

Analysts now expect no growth in PBT between 2020 and 2022. The slower automotive market may be cyclical and pick up again, or it may be a secular long-term trend as vehicles move to electric. In both situations a company would normally go through a period of investment and enter new markets and/or gain market share to replace the decline making it well placed to recover. Note that the capex picked up very strongly on the chart above in 2018 and 2019 and the company is gaining market share in a slower market. The capex is largely around Project Atlas integrating the group’s IT infrastructure, and underlying rules, processes and practices alongside investment in the companies’ talent platform. If the company aims to continue to harness growth from Asia this will be important.

Valuation

The company trades on a PE of 14.7X the forecast earnings which is at the lower end of its historical valuation range. This SharePad table of historic PE’s illustrates:

Source: SharePad

The yield however is a modest 2.3%.

Alignment

There is a high-quality shareholder list. The largest shareholder, shown as Castlefield, is Keith Ashworth-Lord’s UK Buffetology fund where he applies Buffet-like principles to emerging companies. The second largest is Liontrust where the stock is held by the economic advantage team who invest in companies where management own at least 3% of the quoted equity and the company has a sustainable economic advantage. Note that Michael Timms who was an original founder of the Uckfield business still owns 5.5% of the company.

The CEO, Mark Belton, earned a total of £367k having been awarded no bonus last year which is far from egregious. Three-year LTIP targets are targeted on achieving 15% p.a. EPS growth and total shareholder return 8% ahead of the FTSE small cap index total return. While I would prefer to see ROE targets in the LTIP the bonus is predicated on a minimum ROCE of 15%.

Conclusion

This looks like it could be a typical coffee can stock set to harvest the benefits of capital moving from west to east with strong returns on capital, a high-quality culture and genuine competitive moat. Even if it just distributes nuts and bolts. If we can acquire this and forget about it during a period of investment, we may possibly find that one day distribution is deemed more important than technology and this distributor from Uckfield is the latest global hot stock.

Summary

The decisive election result in the UK has prompted a sharp re-rating of small companies. While the earnings outlook is improved this may now be discounted in share prices. The global outlook is unchanged with increasing social unrest, political tensions and high debt levels causing a crisis for capitalism. It may be that this is part of the rumblings to be expected as power moves from the west to the east, but stock markets don’t generally react well to these events. Because of this it could be a time to invest in coffee can stocks that will endure the passage of change with deep moats, a high-quality culture and an ability to access growth in Asia, all of which Trifast appears to possess.

Forthcoming Events

In line with good practise Trifast usually issues quarterly updates so we may expect a Q3 update in February as well as a pre close statement in April for the year to March.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.