Sticking to our guns

Investing can be lonely. Buying stocks in a downturn can be hard – we don’t know if we are catching a falling knife. Traders tell us we should operate with a stop loss policy so we sell when a stock has gone down, say 20%, but for a long-term investor this can result in selling in a downturn and buying momentum when stocks are higher. There is a plethora of suggestions as to what sell discipling we should adopt, and it is important to know our own personality, so we don’t make mistakes like selling at the bottom or holding on to failure.

The subtle dividing line between whether we are selling at the bottom or cutting a loss needs a lack of emotion to be clear about our rationale. If our original thesis for owning a stock has changed, we may be cutting a loss but if the reason we originally invested remains intact it may be better to hold on. This requires huge amounts of cold steely introspection to determine the difference between these two, particularly when the entire media community is dedicated to inflaming the stock at the calamitous fall in the share price of the unfortunate company. There is a desire to apportion blame and in the face of this media headwind and it is often easy to cut our losses thereby extinguishing the emotional anguish we are enduring as the share price continues to crumble. And thus, we are pulled away from being an investor to becoming a trader.

Trader or Investor?

Many investing books today are written about trading. We know that gambling releases a chemical called dopamine which is the exact same chemical that makes us feel good when we drink and smoke. Almost every alcoholic discovered alcohol when they were teenagers. When we had the summer work experience students in at my broking firm nearly all of them said they wanted to be traders. Dopamine can be very seductive.

There are no statistics on how many traders make money, as people talk about their profits more than their losses – but it is certainly very easy to lose money. There are, however, statistics about long term investing in stock markets. In real terms (above inflation) £1 invested in UK equities would have grown to £445 if invested in equities, £7 in bonds and £3.30 in treasury bills over the 115 years from 1900 (source: Dimson Marsh, Staunton). But this superior long-term return of equities comes at the price of higher volatility, and to withstand volatility we need to make sure we know our behavioural biases to avoid selling at the bottom and buying at the top.

There are many descriptions of investors: Contrarian, Value, GARP (growth at a reasonable price), Momentum,

Growth etc. Momentum and growth can be very dopamine inducing ways of investing, but I have experienced many times when growth turns out to be less growth at the next set of results or alternatively have found that I was the last marginal buyer of a momentum stock. The far less comfortable position of buying stocks when others don’t wish to seems to be the way I do better.

Contrarian/Value

A good example of this uncomfortable position is Warren Buffet’s acquisition of 5% of American Express in 1962. At the time the company had a small subsidiary with $12m in capital which certified that inventories really existed before owners could then borrow against the issued certificate. A fraudster named Tino De Angelis decided to take advantage of this process by filling tanks with water and then a thin layer of salad oil. American Express fell for it and were at one point authenticating more salad oil than the Department of Agriculture was saying existed in the United States. This tiny subsidiary was potentially on the hook for many millions of dollars. The potential liabilities were more than the value of the whole group and as a result stock came pouring out. And in the stampede towards the exit door investors forgot that the business of the company was largely credit cards and travellers’ cheques, not salad oil verification. And so, Buffet helped the Continental Bank out of its 5% stake at a valuation of the company of $150m.

Today I am sensing a huge rush for the exit door from the room marked “small cap”, which arouses the interest. But to invest successfully against the crowd I have found some rules useful:

- Define my reasons for investing – write them down

- Not shy away from risk – risk is interesting

- Never make decisions based on fear – go and make a cuppa

- Be patient – doing nothing is good

- Remain humble – be alive to the fact that my assumptions may be wrong

- Be patient – if the reason we invested is in-tact keep invested

I have seen many fund managers succumb to breaking these rules. Woodford may have broken rule 5 above, and many succumb to over analysing stocks without admitting they are breaking rule 3 above. It is useful to write down on a list the reasons that I hold a stock. External events change the outcome but if the reason I invested is intact this method helps me to stick through the volatility. If, however, the reason that I invested was flawed, such as the competitive advantage is less than I believed then it is important to admit a mistake and move on. Many large and small investors break these rules and one person’s loss is another person’s gain, especially against a backdrop of markets going up on average.

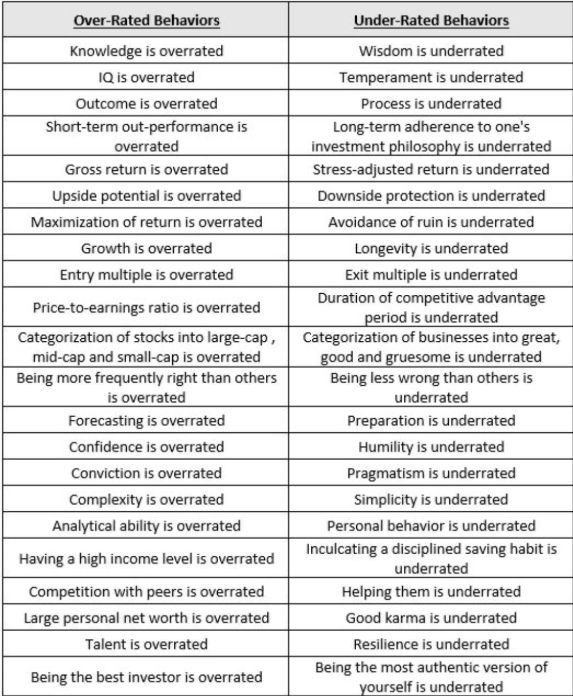

The book “the joy of compounding” by Gautam Baird appreciates the human frailty of emotion in investing and suggests that as a result markets tend to undervalue and overvalue certain behaviours.

Source: The Joy of Compounding

Where is the Fear today?

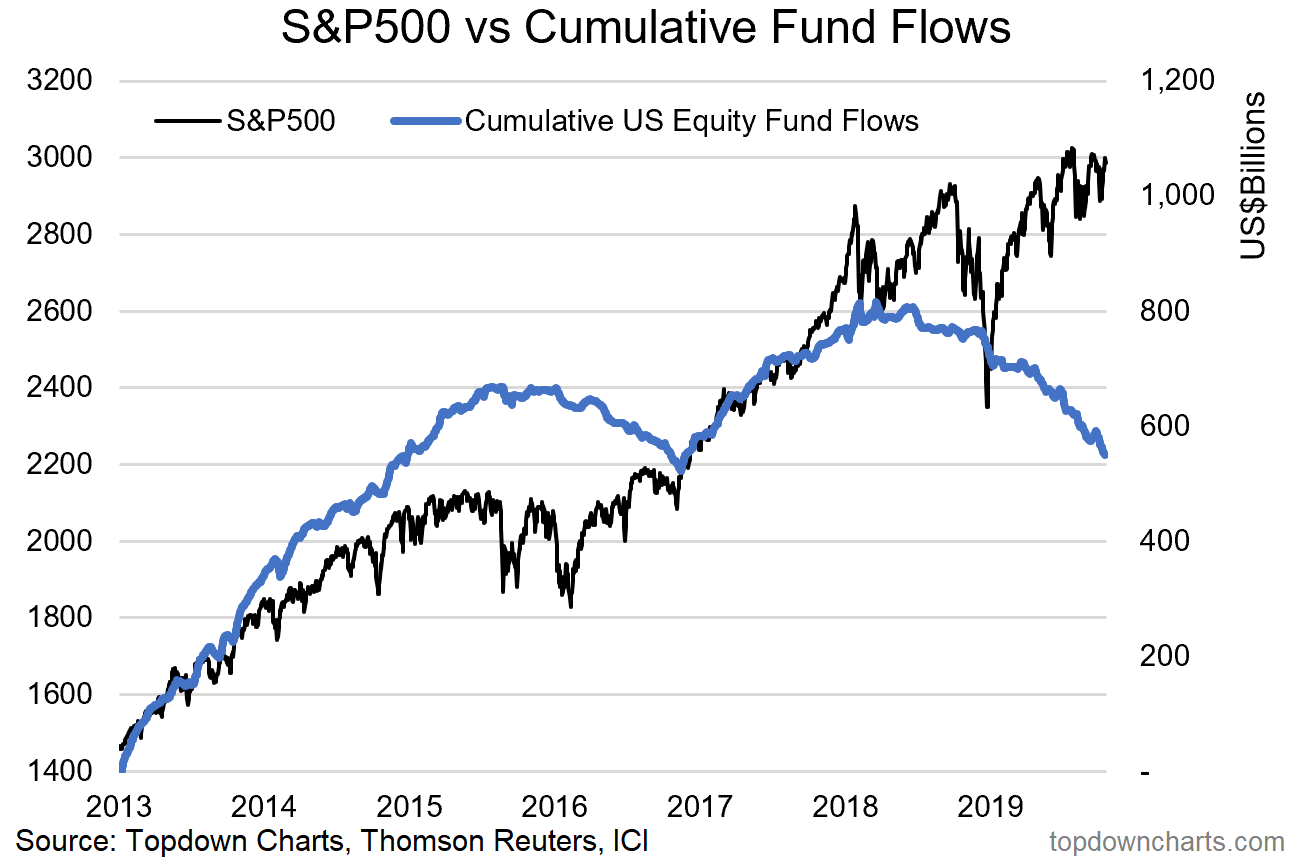

This chart of fund flows is for the US market, although UK fund flows have also been negative. Fund outflows mean that investors typically sell their liquid stocks while the appetite for illiquid stocks evaporates.

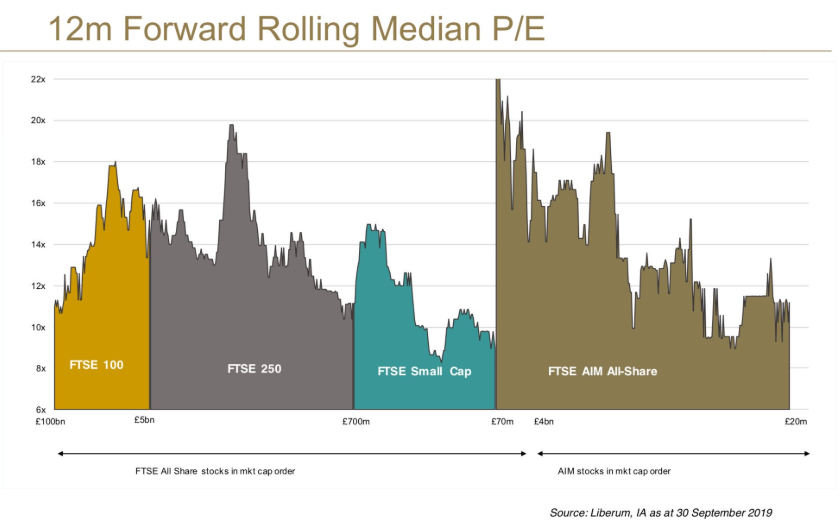

The result of this has been a significant differential between the valuation of large stocks and small stocks. The laws of supply and demand are evident in the chart below where more money chasing a finite amount of stocks ensures higher valuations. Small cap investors are certainly bunched towards the higher end of the market cap spectrum.

Source: Amati, Liberum, Investment association

Value has started to move

The sweet spot of valuation would certainly appear to be in the £200m-£400m market cap space where investors seem to be bunching higher. This looks like the liquidity aversion which may be partly due to Woodford but certainly enhanced by the net outflows from equity funds that fund managers have been experiencing. And naturally this perceived risk attracts my attention for the value opportunities that may arise. In a sure sign that this area is now overly neglected small cap stocks have outperformed large cap stocks in recent weeks. Just when nobody is left in a market is the time to be there. Naturally I am drawn to number of neglected stocks I have covered in previous notes and so it may be, at this apparent changing point in the cycle, to review those stocks.

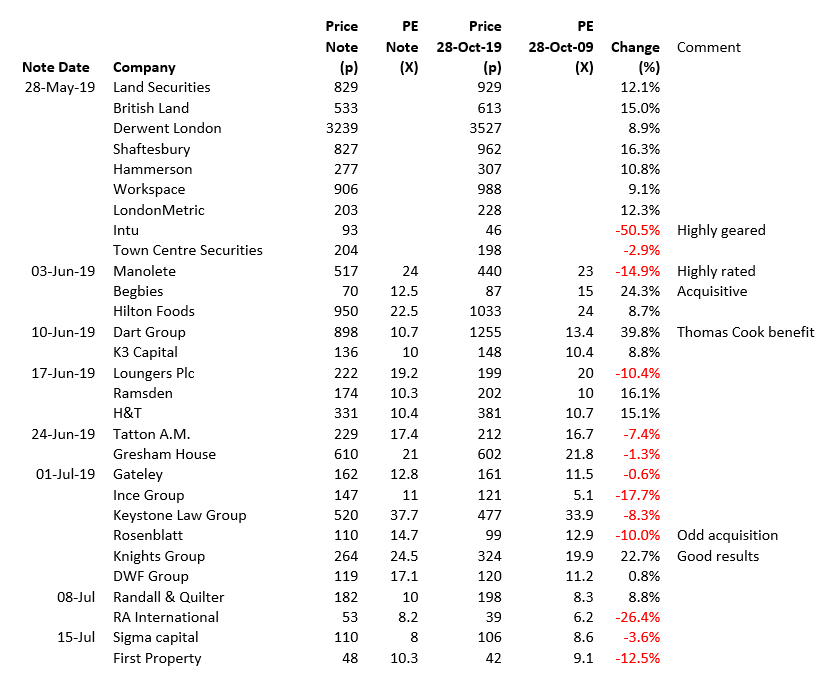

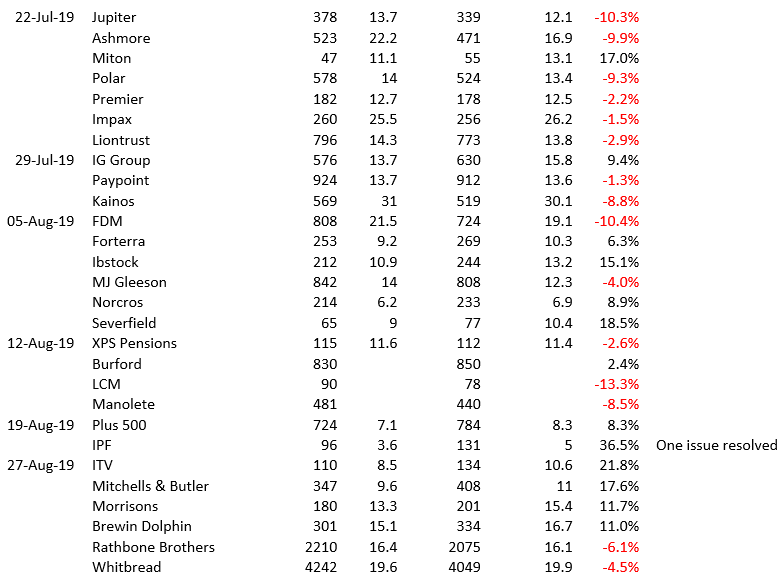

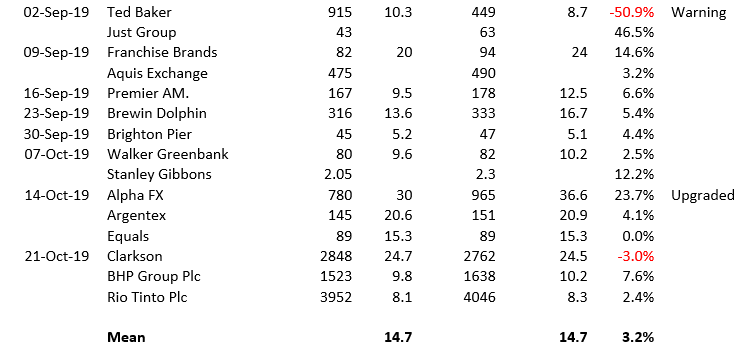

Of the 72 stocks mentioned in these weekly notes 42 now have higher share prices and 30 have lower share prices. (see table below). An equally weighted basket of the stocks would have improved by 3.2% but interesting the average PE is exactly the same today as it was when the various notes were written, implying the share price changes have been driven by changes in profits rather than changes in valuations.

The fact that the average PE of 14.7X is the same today as it was when the various notes were written tells us two things:

- Firstly that in the long run share prices follow earnings.

- Secondly that share prices over recent months have been driven by earnings upgrades rather than valuation changes. The world of small quoted companies may be at a point in the cycle where analysts have become gloomy and actually trading is in general better than analysts expect. Certainly, talking to a number of analysts last week I can confirm that they are very gloomy. Many are gloomy about their own job prospects even which I suspect can transfer to their forecasting.

Looking in more detail at the list of stocks there are some very wide deviations from the average performance. Ted Baker and Intu are both down 50% or more following a profit warning for Ted Baker and in Intu’s case the high gearing makes the share price very sensitive to changes in NAV.

The biggest riser is Just Group (+46%) which has simply revalued, while International Personal Finance (+36%) has received clarity over a tax judgement which has allowed for a re-rating because of better clarity, and Dart Group (+40%) has benefitted from the collapse of Thomas Cook.

Stocks

Reviewing the list, I can see 3 stocks that stand out. I shall use my list of reasons to hold them that I would use when buying a stock.

Tatton Asset Management

Share Price 212p

Market Cap £118m

Date Covered in previous note: 24 June 2019

Reasons to own:

- Market View The share price fall at the end of 2018 was when the market learned that the compliance business (50%) of revenue is not a growth business. Consequently, the market sees this as a disappointing and low growth situation

- Business The asset management business (50% of revenue) is a scalable platform which will benefit from operational gearing as the asset inflows continue. This remains intact and the new partnerships have enhanced the growth prospects

- Management are motivated and disciplined. They are dedicated, hard working and focussed. The opposite of a lifestyle business.

View

I wonder if this is a situation rather like Warren Buffet’s American Express when the market was fixated with the salad oil problem and overlooking the value of the credit card. It may be that the market is focussed on the consulting and forgetting the quality and scalability of the asset management.

Walker Greenbank

Share Price 82p

Mkt Cap £58m

Date Covered in previous note: 7 October 2019

Reasons to own:

- Market View A consumer stock that has suffered several profit warnings over recent years due to consumer demand. At £58m it is no longer on investor radars.

- Business The intellectual property of the style library of brands that go back to Victorian days is hugely valuable. Management have only recently started to exploit the brands through capital light licensing deals. This is only 6% of turnover today but is growing at 60%.

- Valuation The PE is 7.7X. This will expand as the licensing income becomes a greater part of the business.

View

This again looks a little like the American Express situation when investors focussed on the Salad Oil fraud. In this case the market is focussing on the fact that it is small and has proved to vulnerable to reduced consumer demand. The licensing business is small today but that is the reason to hold this stock.

RA International

Share Price 38p

Market Cap £67m

Date covered in previous note: 8 July 2019

Reasons to own:

- Market View This is a business involved in services war torn areas across the globe run by a husband and wife team that disappointed on earnings soon after IPO.

- Business This is truly scalable and ultimately when it reaches a certain scale is likely to be acquired by one of the large international outsourcers. The business can be unpredictable, but the company has never lost money on a contract.

- Valuation The 6.2X PE is allowing for the dim view the market takes of this stock.

View

The management team are dedicated to making this a larger business. There will be times when contracts don’t come through as hoped but equally, they are bidding on some large contracts that may come through. At this valuation with the potential to be a much larger company this could be a diamond in the war-torn rough terrain.

Summary

I think we have passed the nadir of gloom where any earnings surprises are rewarded by share price improvements. As clarity improves share prices are likely to improve which is evident at International Personal Finance and Just Group which have performed strongly recently. This applies to most of the UK economy which has been suffering an extended period of a lack of clarity. I can only think we could be heading towards a very enjoyable post Brexit rally. There are times when the best thing we can do is absolutely nothing. It is counter intuitive as there is a whole industry of people who are paid to generate commissions by creating noise. Independent platforms such as SharePad however, with no commission incentives, can provide much better guidance which today feels like to do very little other than stay invested and wait. It’s what Terry Smith has been doing rather successfully after all.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 28/10/19 – Sticking to our guns

Sticking to our guns

Investing can be lonely. Buying stocks in a downturn can be hard – we don’t know if we are catching a falling knife. Traders tell us we should operate with a stop loss policy so we sell when a stock has gone down, say 20%, but for a long-term investor this can result in selling in a downturn and buying momentum when stocks are higher. There is a plethora of suggestions as to what sell discipling we should adopt, and it is important to know our own personality, so we don’t make mistakes like selling at the bottom or holding on to failure.

The subtle dividing line between whether we are selling at the bottom or cutting a loss needs a lack of emotion to be clear about our rationale. If our original thesis for owning a stock has changed, we may be cutting a loss but if the reason we originally invested remains intact it may be better to hold on. This requires huge amounts of cold steely introspection to determine the difference between these two, particularly when the entire media community is dedicated to inflaming the stock at the calamitous fall in the share price of the unfortunate company. There is a desire to apportion blame and in the face of this media headwind and it is often easy to cut our losses thereby extinguishing the emotional anguish we are enduring as the share price continues to crumble. And thus, we are pulled away from being an investor to becoming a trader.

Trader or Investor?

Many investing books today are written about trading. We know that gambling releases a chemical called dopamine which is the exact same chemical that makes us feel good when we drink and smoke. Almost every alcoholic discovered alcohol when they were teenagers. When we had the summer work experience students in at my broking firm nearly all of them said they wanted to be traders. Dopamine can be very seductive.

There are no statistics on how many traders make money, as people talk about their profits more than their losses – but it is certainly very easy to lose money. There are, however, statistics about long term investing in stock markets. In real terms (above inflation) £1 invested in UK equities would have grown to £445 if invested in equities, £7 in bonds and £3.30 in treasury bills over the 115 years from 1900 (source: Dimson Marsh, Staunton). But this superior long-term return of equities comes at the price of higher volatility, and to withstand volatility we need to make sure we know our behavioural biases to avoid selling at the bottom and buying at the top.

There are many descriptions of investors: Contrarian, Value, GARP (growth at a reasonable price), Momentum,

Growth etc. Momentum and growth can be very dopamine inducing ways of investing, but I have experienced many times when growth turns out to be less growth at the next set of results or alternatively have found that I was the last marginal buyer of a momentum stock. The far less comfortable position of buying stocks when others don’t wish to seems to be the way I do better.

Contrarian/Value

A good example of this uncomfortable position is Warren Buffet’s acquisition of 5% of American Express in 1962. At the time the company had a small subsidiary with $12m in capital which certified that inventories really existed before owners could then borrow against the issued certificate. A fraudster named Tino De Angelis decided to take advantage of this process by filling tanks with water and then a thin layer of salad oil. American Express fell for it and were at one point authenticating more salad oil than the Department of Agriculture was saying existed in the United States. This tiny subsidiary was potentially on the hook for many millions of dollars. The potential liabilities were more than the value of the whole group and as a result stock came pouring out. And in the stampede towards the exit door investors forgot that the business of the company was largely credit cards and travellers’ cheques, not salad oil verification. And so, Buffet helped the Continental Bank out of its 5% stake at a valuation of the company of $150m.

Today I am sensing a huge rush for the exit door from the room marked “small cap”, which arouses the interest. But to invest successfully against the crowd I have found some rules useful:

I have seen many fund managers succumb to breaking these rules. Woodford may have broken rule 5 above, and many succumb to over analysing stocks without admitting they are breaking rule 3 above. It is useful to write down on a list the reasons that I hold a stock. External events change the outcome but if the reason I invested is intact this method helps me to stick through the volatility. If, however, the reason that I invested was flawed, such as the competitive advantage is less than I believed then it is important to admit a mistake and move on. Many large and small investors break these rules and one person’s loss is another person’s gain, especially against a backdrop of markets going up on average.

The book “the joy of compounding” by Gautam Baird appreciates the human frailty of emotion in investing and suggests that as a result markets tend to undervalue and overvalue certain behaviours.

Source: The Joy of Compounding

Where is the Fear today?

This chart of fund flows is for the US market, although UK fund flows have also been negative. Fund outflows mean that investors typically sell their liquid stocks while the appetite for illiquid stocks evaporates.

The result of this has been a significant differential between the valuation of large stocks and small stocks. The laws of supply and demand are evident in the chart below where more money chasing a finite amount of stocks ensures higher valuations. Small cap investors are certainly bunched towards the higher end of the market cap spectrum.

Source: Amati, Liberum, Investment association

Value has started to move

The sweet spot of valuation would certainly appear to be in the £200m-£400m market cap space where investors seem to be bunching higher. This looks like the liquidity aversion which may be partly due to Woodford but certainly enhanced by the net outflows from equity funds that fund managers have been experiencing. And naturally this perceived risk attracts my attention for the value opportunities that may arise. In a sure sign that this area is now overly neglected small cap stocks have outperformed large cap stocks in recent weeks. Just when nobody is left in a market is the time to be there. Naturally I am drawn to number of neglected stocks I have covered in previous notes and so it may be, at this apparent changing point in the cycle, to review those stocks.

Of the 72 stocks mentioned in these weekly notes 42 now have higher share prices and 30 have lower share prices. (see table below). An equally weighted basket of the stocks would have improved by 3.2% but interesting the average PE is exactly the same today as it was when the various notes were written, implying the share price changes have been driven by changes in profits rather than changes in valuations.

The fact that the average PE of 14.7X is the same today as it was when the various notes were written tells us two things:

Looking in more detail at the list of stocks there are some very wide deviations from the average performance. Ted Baker and Intu are both down 50% or more following a profit warning for Ted Baker and in Intu’s case the high gearing makes the share price very sensitive to changes in NAV.

The biggest riser is Just Group (+46%) which has simply revalued, while International Personal Finance (+36%) has received clarity over a tax judgement which has allowed for a re-rating because of better clarity, and Dart Group (+40%) has benefitted from the collapse of Thomas Cook.

Stocks

Reviewing the list, I can see 3 stocks that stand out. I shall use my list of reasons to hold them that I would use when buying a stock.

Tatton Asset Management

Share Price 212p

Market Cap £118m

Date Covered in previous note: 24 June 2019

Reasons to own:

View

I wonder if this is a situation rather like Warren Buffet’s American Express when the market was fixated with the salad oil problem and overlooking the value of the credit card. It may be that the market is focussed on the consulting and forgetting the quality and scalability of the asset management.

Walker Greenbank

Share Price 82p

Mkt Cap £58m

Date Covered in previous note: 7 October 2019

Reasons to own:

View

This again looks a little like the American Express situation when investors focussed on the Salad Oil fraud. In this case the market is focussing on the fact that it is small and has proved to vulnerable to reduced consumer demand. The licensing business is small today but that is the reason to hold this stock.

RA International

Share Price 38p

Market Cap £67m

Date covered in previous note: 8 July 2019

Reasons to own:

View

The management team are dedicated to making this a larger business. There will be times when contracts don’t come through as hoped but equally, they are bidding on some large contracts that may come through. At this valuation with the potential to be a much larger company this could be a diamond in the war-torn rough terrain.

Summary

I think we have passed the nadir of gloom where any earnings surprises are rewarded by share price improvements. As clarity improves share prices are likely to improve which is evident at International Personal Finance and Just Group which have performed strongly recently. This applies to most of the UK economy which has been suffering an extended period of a lack of clarity. I can only think we could be heading towards a very enjoyable post Brexit rally. There are times when the best thing we can do is absolutely nothing. It is counter intuitive as there is a whole industry of people who are paid to generate commissions by creating noise. Independent platforms such as SharePad however, with no commission incentives, can provide much better guidance which today feels like to do very little other than stay invested and wait. It’s what Terry Smith has been doing rather successfully after all.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.