Richard invents a new filter that promises to weed out big acquirers in a drive for simplicity he hopes will make investigating his next company easier.

Complications tend to keep investors awake at night and wakeful nights are not conducive to long-term investment. You join me today on a quest for simplicity.

Keeping it simple

The starting point for this quest is a base filter, which rules out businesses in sectors and subsectors to steer clear of. One person’s base filter will be different from anothers’ of course, because the reasons for steering clear of particular businesses are personal. they are either businesses we do not approve of (tobacco and gambling companies are excluded by my base filter), or businesses we are not competent to analyse. My filter excludes most businesses that are likely to have little influence on the price of what they produce, miners, oil explorers, housebuilders and so on, because their fortunes and ours are likely to fluctuate dramatically. To my mind they are more suited to traders than long-term investors and so I have never developed the skills to trade them.

Today though, we are using an augmented version of the base filter, designed to rule out other complications, Loss making businesses do not respond to the usual tools of analysis: price earnings ratios, profit margins, and return on capital for example, for the obvious reason, they don’t make a profit (aka earnings and returns). Heavy debt also complicates investment, because we have to work out whether the company will be able to service it in dark times, and there is usually a limited amount of historical data available for recent flotations, which makes it tricky to look back in time and establish whether they have prospered through thick and thin.

My augmented base filter is called KISS after the well known acronym Keep it Simple, Stupid.

The additional settings are:

- Net profit > 0, excluding all companies that made an accounting loss over the previous twelve months

- Free cash flow > 0, excluding all companies that actually spent more than they earnt in cash terms over the previous twelve months

- Debt:capital < 50% on a lease adjusted basis, ruling out all companies that are mostly funded by debt

- Share price close four years ago > 1, which excludes companies that listed less than four years ago.

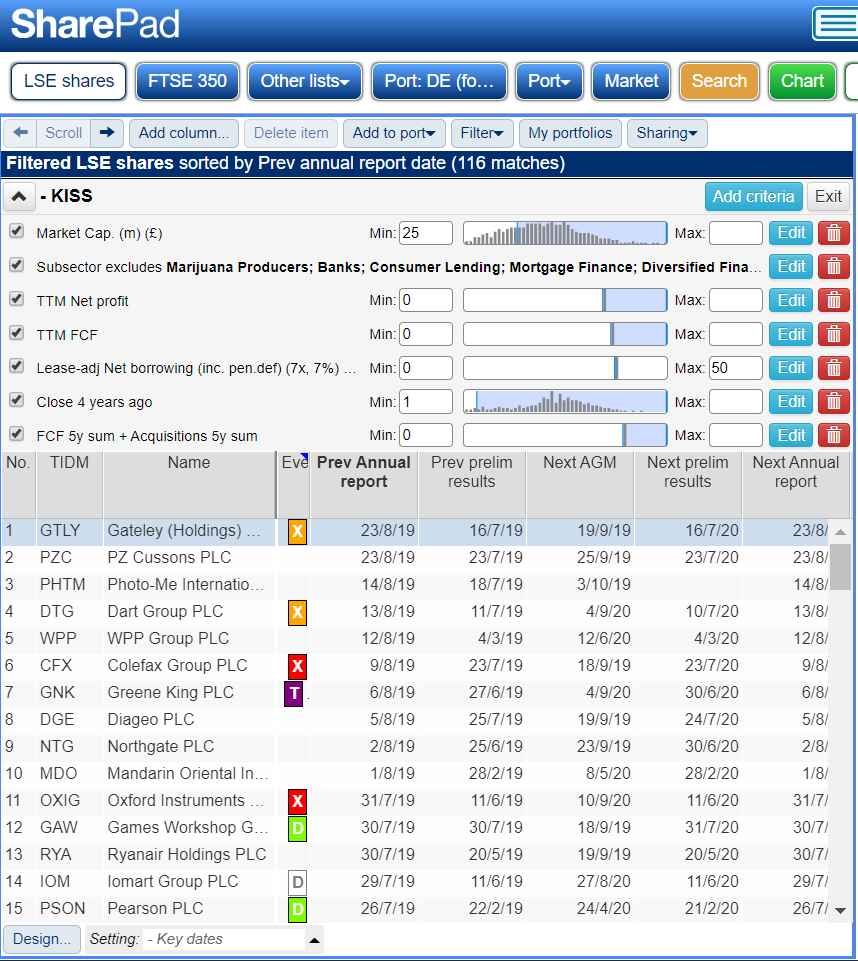

SharePad adds these as columns to the filter table so we can see the values for each company that passes the filter. At this stage it is tempting to dig down into the details. Before I do that though, I prefer to find out which companies have published annual reports recently by changing the table setting (beneath it) to one of my standard tables, Key dates, and sorting it by Previous annual report. I am trying to keep things simple, you see, and if the company has published its annual report recently it is unlikely that anything will have changed since.

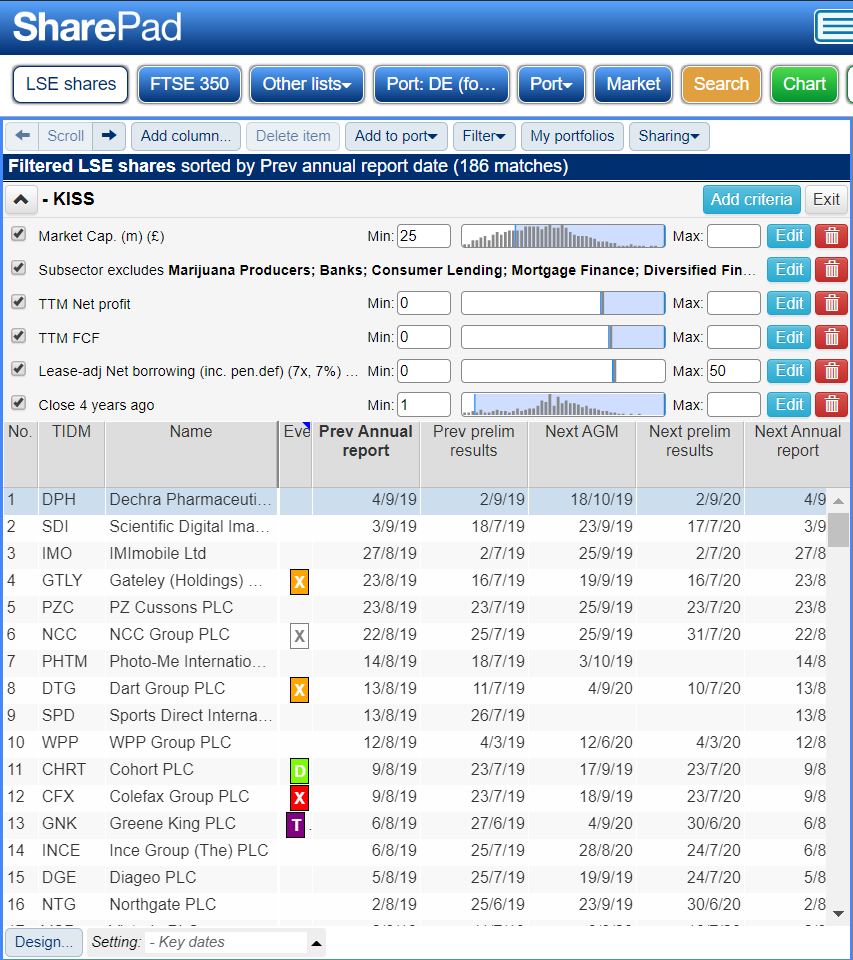

This is the result of the filter:

The next stage is to start with the first company, Dechra Pharmaceuticals, and go backwards and forwards between SharePad and the annual report, gaining an impression of the company and what it does. This time, by the time I got to number three, IMImobile, I realised my KISS filter was not bringing me joy.

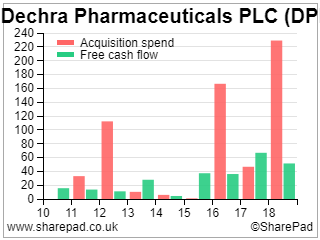

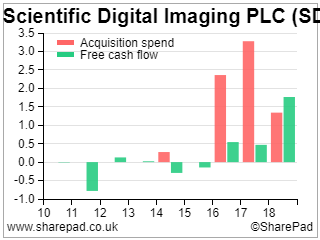

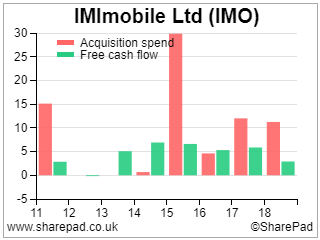

Before I explain why, let me explain that judging by their price charts, Dechra, SDI and IMImobile have all brought shareholders joy. Veterinary medicine supplier Dechra Pharmaceuticals has grown revenue handsomely and profitably over the years. I have written about SDI in reasonably favourable terms before, it manufactures scientific instruments. IMImobile distracted me for quite a while. Its cloud-based software connects the business systems of a wide range of companies to your mobile phone allowing companies to communicate with customers by text message and chat apps about deliveries, orders and enquiries, and it can blast us with marketing campaigns too. Software companies can be very difficult to work out if you cannot access the software yourself, but IMImobile’s website impressed me. It is replete with case studies you can download for the price of your email address. It reminds me of DotDigital, a very successful business, and my first encounter with a chatbot (which still makes me smile).

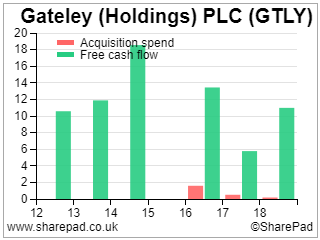

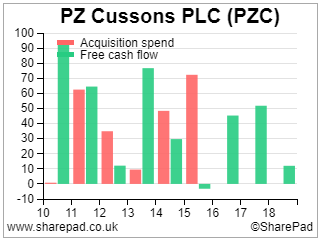

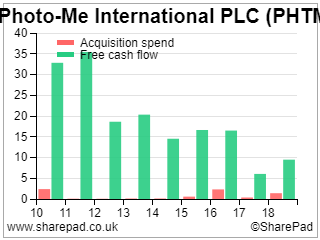

On another day, all three of these companies would have been suitable for investigation, but not this time. I want something easy, and Dechra, SDI, and IMImobile share the same complication, see if you can spot it by looking at these three financial charts from SharePad:

|

|

|

The red bars are taller than the green bars. These companies have spent more on acquisitions than they have earned in free cash flow.

Acquisitions add complexity. The bigger they are the more they complicate things. They complicate accounting, introducing spurious intangible assets onto the balance sheet that make calculating profitability more difficult. They may change the direction of the business itself, rendering the past an even more unreliable guide than usual to the future. They add risk, because sometimes acquisitions do not go well, for example when two cultures collide, or when the acquirer discovers problems in the business it has acquired. If acquisition spend exceeds free cash flow, the money the company has left after funding its operations and financial obligations (interest and dividends), the company may have to raise money, increasing debt, or watering down shareholders by selling more shares. Growth, often interpreted by investors as a sign of rude health, can be a company’s undoing if the cost of acquiring companies jeopardises its financial health. It can be an investor’s undoing, if it waters down our investment too much.

Acquisitions are not always a bad idea, but they are something to worry about, so instead of pushing on down the list, I augmented it again.

Filtering out highly acquisitive companies

Generally in SharePad, if you can chart a statistic, or put it in a table, you can also use it is a filter criterion and fortunately, that is true of Free cash flow and Acquisitions. We can marry the two to rule out companies that have spent more on acquisitions than they have earned in cash.

To combine the two, we start by adding the first criteria, Free cash flow, which I have chosen to sum up over five years (select cumulative and 5y in the Add criteria box) and then hit Combine items. We are combining these items by adding them, so we need to select add to in the drop down list. Then choose the second criterion, Acquisitions, also summed up over the last five years.

You may be wondering why we are adding them. Acquisition spend is a negative number in SharePad (a cost) and since adding a negative number to a positive number is the same as subtracting it we are actually taking away acquisition spend. For example, Dechra’s cumulative free cash flow over the last five years was £250.8m. Its cumulative acquisition spend was -£482.9m, so:

250.8 – 482.9 = -232.1

After acquisitions, in cash terms, Dechra has spent £232.1m more than it has earned.

All we need to do to augment the filter and rule out the big spenders, is set the minimum for this criterion to 0. Any company with negative free cash flow after acquisitions will fail.

There’s no need to create a new filter, KISS+ or Keep It Even Simpler, we can just use the check boxes to switch on or off any of the augmentations in a filter. Here it is, now including no more than modest acquirers:

(You can run this screen for yourself including the additional ‘Free Cash Flow + Acquisitions sums for last 5 years’ criteria and including Richard’s long list of excluded subsectors by selecting the “Richard Beddard 18/09/19: KISS+” filter within SharePad’s Filter Library. Simply go to: Filter -> Apply filter -> Library)

There is a bit more green and a bit less red in the charts of the first three compared to Dechra, SDI and IMImobile:

|

|

|

Choosing my next company

I will say two things now about my next article. The next company I investigate for SharePad will come from this list and there will be complications, there almost always are. But by filtering out some big obvious ones, I hope to have made life easier for myself.

Richard Beddard.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.