THE SETTING

After nine years of impressive revivification under CEO Heejae Chae, the specialist tapes maker Scapa has just delivered three tingling episodes in three weeks. It could have stabilised now but it’s worth well under half its starting price.

Knock one came on the day of its annual results, 21 May. The results were OK but were accompanied by the unexpected announcement that Mr Chae was leaving. No reason was given and kind words both ways could not dispel an air of discomfort. Had he fallen out with his chairman? (Who arrived 18 months ago and looks like a bit of a tough nut.) Was some scandal about to emerge? No successor was in place. All the company could say was that a search and selection process was under way and Chae would stay long enough to ensure a smooth transition. The shares went straight down from 385p to 300p.

Worse was around the corner. On Monday 3 June Scapa revealed that a big customer had torn up a $30m a year supply agreement. This will be settled inside or outside the New Jersey District Court in the coming months or years. The shares fell to 160p.

Some relief arrived on June 10th. Chae had retracted his resignation and would be staying. However the knock-on from the Convatec dispute was costed at £28m of sales and £13m trading profit. The market weighed that up and considered it net positive – the shares improved to 180p.

WHAT HAPPENED?

Convatec, one of three big global suppliers of wound dressings and continence products, was floated on the London market in 2016 after ten years of private equity ownership. It’s had a disappointing couple of years, sacked its boss a few months ago and is implementing “a refreshed execution model”. One might assume that Convatec found itself needing to exit a contract that was no longer convenient. However, this does not seem to be the case, or at least not the whole case.

Convatec’s side of the story is in a 170 page complaint filed with the District Court in New Jersey on 31 May. This reveals that Scapa’s Tennessee subsidiary, Webtech, has since 2012 manufactured Convatec brand wound care products under a “Master Manufacturing Agreement” which set out a minimum level of business with corresponding undertakings on both sides. One of these was a standard non-compete clause bearing on Scapa, which according to the complaint was breached by Scapa’s October 2018 acquisition of Systagenix (see below). The complaint states that Convatec raised the issue with Scapa last November and commenced serious negotiations at “executive level” on 18 April, during which Scapa maintained it had not violated the agreement. The discussions broke off on May 21, which was the day Chae announced he was leaving. One might speculate that Chae was pushed into leaving when, after looming for months, the contract loss became a certainty. It would be interesting to know whether Chae had foreseen the fallout with Convatec at the time of the Systagenix acquisition and had decided it was a risk worth taking, for Systagenix does look like a very attractive business. Equally, whether Chae’s board colleagues were aware of the potential problem when the Systagenix deal was done. Probably, Scapa will keep its dirty washing private.

So far, Scapa has said Convatec has no grounds to terminate the agreement and it will contest the action strongly. At first sight, Convatech seems to have a point. The case will rest on whether Systagenix’ products are “directly competitive” with Convatec’s. The result of casting my inexpert eye over both companies’ product ranges suggests they are.

So that covers the current dramatics. What did the business look like before these events?

THE BUSINESS

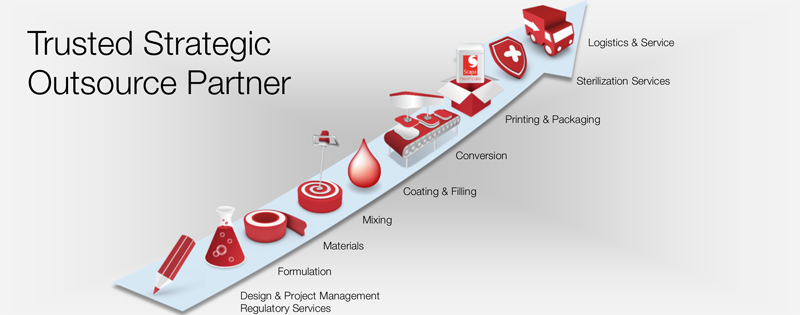

Scapa makes specialist sticky tapes for hundreds of applications in industry and healthcare from about ten manufacturing units across the USA, Europe and the Far East. The headline performer is healthcare which emphasises close R&D collaboration with global medtech customers, developing tailormade solutions to deliver their compounds to and through human skin.

Ten years ago, Scapa was a tired and declining producer of industrial tapes working from a dozen mainly old factories on three continents. Its shares had fallen from the mid-200s in the mid-1990s to a plateau around 30p between 2003 and 2010. Turnover fell from over £500m to under £200m when it shed its paper machine clothing business 1999. Half a dozen acquisitions intended to add some excitement to its tapes business had failed to deliver. A £23m tail end of asbestosis claims and a £50m pension deficit were the least of its problems.

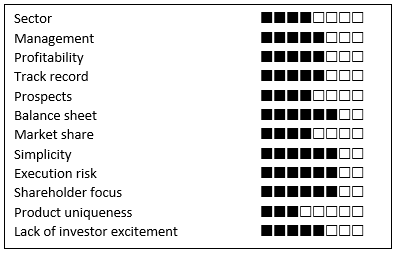

MY BUSINESS RATING – 59%

(Source: Alistair’s own rating system)

Chae was appointed chief executive of Scapa in 2009. This 39 year old Harvard MBA had spent ten years on Wall Street before moving into industry, initially in the USA. Somehow, in 2005, he had turned up in Warrington as chief executive of electrical cable manufacturer Volex where he had carried out a well-regarded restructuring.

One may deduce from Heejae Chae‘s early investor presentations (available at Scapa.com) that his colleagues didn’t know what had hit them. Harvard speak was accompanied by Harvard do (or as he called it, self help). Seven kinds of duct tape were reduced to two. 10 colours of gaffer tape became three. 618 SKUs of consumer tape became 342. That was in just one small Canadian factory. In Korea, cloth tapes were reduced to zero. Throughout the group, dozens of old machines were scrapped. What was left was moved around to create lean manufacturing cells. Shiny new gear was installed, its utilisation and changeover times recorded with precision. Next, NPD (New Product Development)! In a brace of new R&D laboratories. Three new appointments turned procurement upside down. Warehouses were consolidated. Working capital driven down. Dozens of suppliers got the push and the rest were told to sharpen up and cut prices. Et cetera.

Three themes set the framework for the next ten years. 1) Get rid of baggage and make the survivors perform properly. In 2010 Industrial turned in an underlying trading profit of £1.5m on sales of £150m. In the year just ended it made £21m on sales of £170m. But for limp sales growth, it could almost be exciting. 2) Beef up healthcare with acquisitions and make it an attractive outsourcing partner for pharma and medtech companies (in Scapa’s language, “transition from contract manufacturer to turnkey solution provider”). 3) Maintain a decent balance sheet.

Healthcare division

Scapa Healthcare began as a couple of opportunistic acquisitions—one in the UK, one in Los Angeles—way back when. They were managed as individual tape companies. When Mr Chae arrived, he discerned two areas of promise within the dozen or so tape businesses under his charge. These were electronics—mainly coming from Scapa’s small Korean business, and healthcare. The electronics potential was highlighted for a few years but never realised and eventually expunged. But healthcare came through.

Scapa has spent around £120m on five healthcare acquisitions in the last eight years as described below. None of these companies market final products. Instead they provide outsourced manufacturing to big medical and therapy device companies such as Johnson & Johnson, GSK and Roche. It’s important to understand how Scapa’s strategy is modelled around these much larger companies.

Manufacturing is a pretty incidental to a pharma or medtech giant. Their value creation lies in R&D, their brands, vast marketing and distribution capabilities and sheer financial heft. They have always been keen users of contract manufacturing, especially if the technology required is non-core to their main product mission. Yet they are significant manufacturers and even face a rising tide because they have made many acquisitions themselves often of other huge companies. Despite ongoing rationalisation they have accumulated scores of manufacturing sites – Pfizer and J&J each have over 80.

Processing plastic roll into a transdermal patch was only ever peripheral from a pharma point of view. As an example, Scapa’s latest acquisition—the Gargrave site in remotest Yorkshire—had been a small part of a Johnson & Johnson unit since 1935. The bigger unit was sold for $500m in 2013 to wound dressing specialist Acelity of Texas. Last year, in a sub-species of acquisition dubbed a technology transfer, Scapa bought Gargrave from Acelity. Six months later, Acelity itself was bought by 3M for $7bn.

This demonstrates two things. First, although the Gargave site would seem to be big, important and successful in wound therapy manufacture, it is but a crumb off the table of big medtech. And slotted into Scapa (with a five year supply contract to Acelity), it’s easy to see valuable synergies at Scapa’s scale that would have been meaningless roundings for Acelity. Second, that there is an active market in these crumbs off the table in the form of technology transfers. Clearly, they plug Scapa more closely into the company from which the technology is transferred, which should be a valuable springboard.

The table below describes Scapa’s Healthcare division as it currently stands and prior to the Convatec rupture:

| Location | Price + earnout | Sales | Profit | Activities, buzzwords | ||

| Pre Chae | ||||||

| 2000 | Acutek | Los Angeles (currently being moved to Tennessee) | £12m + £4.5m | c$22m | $2.6m | Tapes/pads for pulse oximetry, wound care, drug infusion therapy, diagnostic testing, medical device placement |

| 2001 | Meditech | Dunstable (currently being moved to Gargrave) | £5m + £5m (paid in full) | c£4m | c£0 | Wound management. “Solid European foundation for medical”. |

| Post Chae | ||||||

| 2011 | Webtech | Tennessee | $30m + $15m | $27m* | $3.6m | Dressings incorporating medical grade silicone, hydrogel, Negative Pressure Wound Therapy |

| *This 2010 figure excludes at least some of the $30m pa Convatech contract signed March 2011 | ||||||

| 2015 | First Water | Wiltshire | £11m + £4m | £5m | £0.9m | Wound dressings, skin adhesives, consumer wellness, NPWT |

| 2016 | Euromed | New York | $35m + $7m | $18m | $2.5m | Fragile skin technology based on silicone alternative – hydrocolloid, 40 patents, ISO Class 8 clean room, consumer wellness, acne patch |

| 2018 | BioMed | Dallas | $19m + $13m (the earnout was not earned) | $10m | $1.4m | Gels, creams, lotions, powders, hot filled wax for 1) advanced wound care and 2) consumer wellness |

| 2018 | Systagenix | Gargrave, N Yorks | £34m | £37m | £3m | 350 employees, advanced wound care dressings incorporating collagen and cellulose, non-adherent dressings, gamma sterilisation, freeze- drying, 22 R&D scientists, TECH TRANSFER |

At Tennessee, a 150,000 square foot factory was opened this year at a cost of $20m to accommodate the growth of what was originally Webtech. (This is the factory which will take the Convatec hit.) The acquisitions together with smaller technology transfers have lifted the division from £25m sales in 2010 to £140m. Although as can be seen from the table, a lot of this sales lift has been acquired, there has also been meaningful organic growth. Scapa recently quoted organic compound annual growth since 2014 as 10.3 per cent.

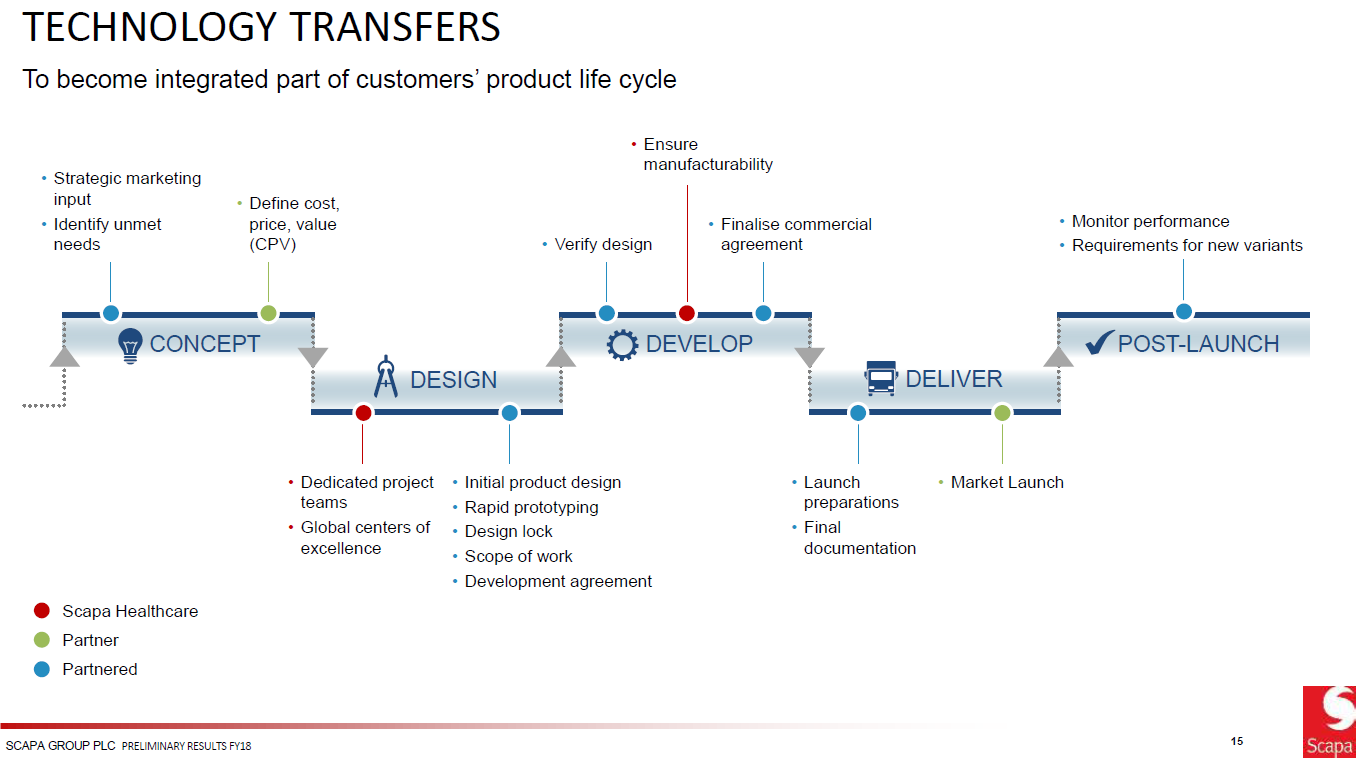

The following graphics illustrate the division’s strategy.

Industrial Division

Meanwhile, the ugly duckling industrial division got its act together even if it will never be a swan. Ten years ago industrial tapes occupied ten manufacturing sites located in Korea, France, Switzerland, Germany, Italy, Canada and the UK. Many sites were underutilised and their markets distinctly unexciting. The divisional trading margin was one percent. Today the markets remain unexciting but after ten years of self-help, the margin in the year to March 2019 was 13 per cent, based on £22m trading profit from £170m sales.

Self-help included a huge programme of process re-engineering and in particular the creation of “coating hubs” capable of extracting scale economies from high volumes, supplemented by “converting spokes” carrying out lower volume processes closer to customers and their more diverse requirements. This has enabled a massive consolidation of facilities. By the end of 2019, the ten sites will have become four including a new €6m greenfield site in France, opened in 2015. Alongside this consolidation a new build factory in Chennai, India opened last year. Capacity utilisation has risen by 24 per cent since 2013.

As the consolidation process moved towards a climax last year, there was a significant figure for reorganisation, closures and writedowns—£15m. One may deduce that there will be further exceptional costs this year although provisions of £11m (figure set pre-Convatec loss) are not insubstantial. There was the consolation of a bumper £13m inflow from the sale of the Swiss factory site in 2017.

The markets served by the industrial division are:

- Automotive: focusing on protection wraps for whole cars before shipping and wire harness covers, expected to see improved demand as electric vehicle production rises.

- Cable: especially water blocking tapes for fibre optic, power transmission and undersea projects.

- Construction: Scapa has two big brands—Barnier and Polyflex—offering huge ranges in this area covering hundreds of applications from simple masking tape for decorators to complex foil and foam formulations for duct sealing.

- Hockey: Ice hockey players are prolific users of tape for sticks and shinpads. Scapa bought the leading brand, Renfrew Pro in 1995. It’s the official supplier to most of the professional hockey teams in North America. Its results are not disclosed but it shows every appearance of being a tidy little cash cow.

- Markel: In 2017, Scapa paid $10m for this company which makes tacky/adhesive floor mats for healthcare and industry with a special focus on cleanroom protection. In the year before acquisition, Markel made $1.7m on sales of $5m. Its facilities in Maine and Connecticut were closed shortly after with production transferred to a nearby Scapa unit.

MANAGEMENT

The executive board was recently beefed up. Finance director Oskar Zahn, 54, arrived last October having been FD for 10 years of a sizeable and successful private equity owned corporate farming business operating in the UK and eastern Europe. The board has had only two executive directors for the last ten years but in January two new ones were appointed (with the prospective departure of Chae already in mind?). Joe Doherty was brought in as president of Healthcare. He spent 24 years with Johnson & Johnson followed by four years with a US medtech subsidiary of Olympus of Japan. Sevan Demirdogan joined Scapa a year ago after no less than 35 years with Illinois Tool including the last ten as boss of its industrial tapes division with $250m sales and 22 sites in 18 countries. The chairman is Larry Pentz, closely involved with two manufacturing companies—Victrex and Johnson Matthey—which have attractive records. This looks like a pretty solid crew.

Chae received total rewards of around £3m pa in recent years. This was rich but probably not out of the way. The (previous) FD made £500,00 and Larry Pentz’s fee is £125,000.

CURRENT TRADING

For the year just ended, top line figures in healthcare looked impressive but stripping away acquisitions, turnover grew 5.6 per cent and trading profit stood still. Scapa cited delayed product launches and operational issues at key customers. It said Systagenix had started well. Industrial turnover fell five per cent; trading profit by one per cent. Thus its margin improved to 13 per cent against a long term target of 15 per cent. The decline in sales was attributed to “strong end market headwinds in automotive and European cable”. Looking forward, “we are starting to see increased activity from all major accounts”.

Scapa should see valuable benefits from its two new factories in India and Knoxville as well as its Gargrave acquisition. Set against this is the loss of the Convatec business, worth $30m a year or about £25m. No doubt there will be some exceptional costs as well. In the P&L table we put in a nominal £5m to cover such costs.

BALANCE SHEET

The balance sheet was strong throughout Chae’s tenure until the combination last year of £27m of capex and £34m for Gargrave/Systagenix zoomed debt from £4m to £56m. Scapa claims underlying net debt stands at £44m if a temporary finance lease relating to the Knoxville site is taken out of the calculation. Presumably, this will convert to an operating lease. Regardless, the figure is well within bank facilities totalling £100m and interest cover is not strained. The pension deficit is £8m, down from £20m. By my calculation, shareholder equity of £139m and debt of £55m excluding the pension fund deficit gives year end gearing of 39% (although Sharescope quotes 27 per cent). The balance sheet remains solid.

THE ISSUES

The shares have been on a roller coaster in recent months. They got close to their all time high of 500p on the Systagenix announcement then plunged under 300p on flat interim results. A cheerful year end update in April took them back past 400p. And then followed the events related above. Putting Convatec to one side and assuming dealing with it does not push Scapa’s main businesses off track, there should be much to yield from the following immediate visibles:

- Efficiencies from the brand new Knoxville plant (although these will now be degraded by the Convatec loss)

- The Systagenix acquisition (which is promised to be meaningfully earnings accretive from April 2020)

- A burgeoning if small (£18m sales) business in India

- Major upcoming cable infrastructure projects in Europe

- 5G rollout in the USA

Perhaps more significant is the answer to the question, Has Chae created a serious new profit machine in the Healthcare division? There’s no denying the focus displayed by the list of acquisitions above. Their record to date is impressive and there should be several years’ worth of synergies yet to come. These don’t generate headlines as they emerge but if you put several solid companies with adjacent capabilities and customers together under one roof and apply an adequate guiding hand, good things should happen.

It’s more difficult to pin down the prospects of Healthcare’s vaunted aspiration to become a turnkey developer for pharma and medtech giants. Several projects have been referred to in each recent results announcement, but the customer, size and timing of each is not disclosed. Yet this aspiration has clearly been central to the vision underlying the creation of the Healthcare division from the beginning. So accepting that outside observers cannot see the detail, we should perhaps accept that this is indeed materialising.

Chae set a trading margin target for Healthcare of 20 per cent. It’s three quarters of the way there. I’m expecting it will travel further once the Convatec dispute is settled.

CONCLUSION

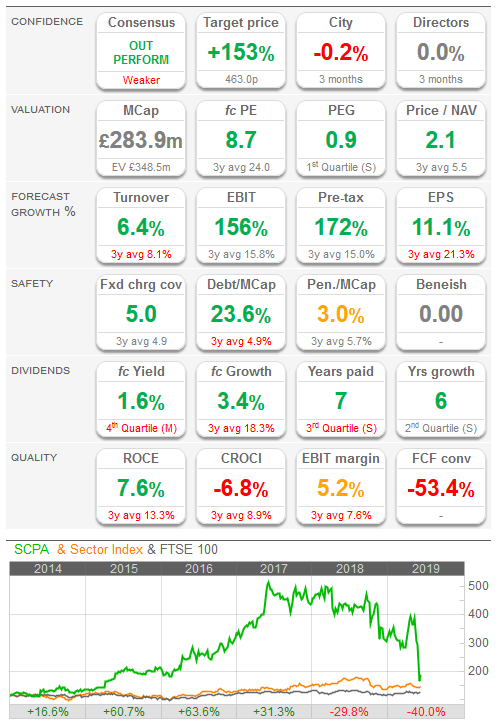

At the time of writing, the Sharepad dashboard shows 16 green signals out of 23. The two meaningful reds including minus 53% free cash flow conversion reflect the recent acquisition and capex.

Free cash flow conversion has been strong in all previous years back to 2010. However, all data should be treated with caution. Broker forecasts and ratings have not yet taken fully onboard the fast-paced recent events and the big institutional holders have shown contrasting buy/sell first reactions. The dust has yet to settle.

Alistair Blair

This article was initially completed on 11 June, after Chae had resigned but before the Convatec announcement, which came less than 12 hours later.