Highly profitable companies can make outstanding long-term investments. Arguably, the best way to measure a company’s profitability is to compare its profits with the amount of money invested to make them. This is known as the return on investment or return on capital employed (ROCE).

One person’s definition of a highly profitable business will differ from another’s. As far as I’m concerned, my threshold is for companies to have a consistent ROCE – over an economic cycle – of 15% or more.

It is very important for investors to understand the drivers of a company’s ROCE – how it is achieved. This boils down to two things:

- Profit margin – how much of the company’s revenues turn into profits. The most popular measure of profit margin is the operating margin which looks at operating profit as a percentage of revenue. Often EBIT (earnings before interest and tax) margins are used which adds the profits from joint ventures and associates to operating profits.

- Capital turnover (aka asset turnover) – how much it sells compared with the money it has invested in its business. This is calculated by taking a company’s annual revenues and dividing them by the amount of money invested in the business (the capital employed).

ROCE can be calculated by multiplying a company’s operating margin by its capital turnover.

ROCE = profit margin x capital turnover

![]()

A company can therefore improve its ROCE by three main routes:

- Increasing its profit margins

- Increasing its sales

- Reducing its capital employed

If you look at the vast majority of highly profitable – high ROCE – companies they tend to have high profit margins (15% or more). It’s quite rare for companies with low profit margins to have high returns on capital employed but it is not unknown.

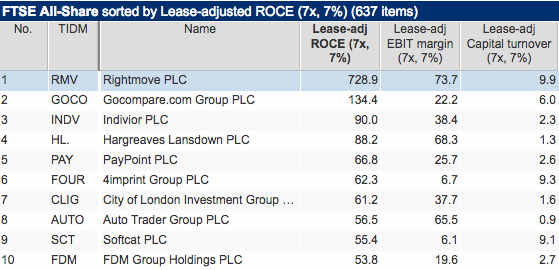

If we look at the ten highest ROCE companies – I’ve adjusted the ratios to take into account rented or leased assets – from the FTSE All Share Index below you can see that eight of them have very high profit margins. 4imprint (LSE:FOUR) and Softcat (LSE:SCT) have relatively low profit margins and make their high returns by having a very high level of revenue compared with their capital employed – a high capital turnover.

High ROCE underpinned by a high profit margin is often an extra seal of quality. This is because high margins are often – but not always – a sign that a company has pricing power and limited competition. Not only that, high profit margin businesses are also much better placed to cope with tough trading conditions or a weak economy.

The reason for this is down to some very simple maths. If a business with a 2% profit margin sees its operating costs increase by 3% of sales it quickly becomes loss making. A business with a 30% profit margin can cope with this very easily and will not suffer losses.

What makes high profit margin businesses safer is what makes low profit margin businesses riskier. A low profit margin business is effectively a marginal business – it has little room for error if business conditions deteriorate. Many low margin businesses get found out if something goes wrong such as a bad contract, weaker industry demand or increased competition.

According to SharePad, there are 194 companies listed on the London Stock Exchange that have experienced share price declines of 50% or more during the last year. Of these, only 25 of them had profit margins of 10% or more.

High profile stock market casualties and their profit margins

The table below shows some high profile stock market fallers over the last year. As you can see, high profit margins are no guarantee of safety if they attract competition which leads to lower prices. This is what is currently happening to funeral provider Dignity (LSE:DTY).

For years Dignity has increased the prices it has charged for funerals and cremations and has earned very high profit margins as a result. This has now attracted lots of competition which has forced Dignity to cut its prices and warn investors that its profits will be significantly lower in the future than they have been in the past. Its share price is experiencing the same effect.

If you are going to invest in a high margin business then you have to spend some time thinking about whether its margins are sustainable.

Dignity aside, many recent stock market disasters have been experienced by very low margin businesses such as Carillion, Carpetright, Connect Group and Conviviality Retail. In the case of Carillion and Conviviality, they were not able to withstand the shocks to their businesses and ended up in the hands of administrators. There are fears that Debenhams and Mothercare could follow suit.

Given the risks of owning the shares of low profit margin businesses it’s not unreasonable to ask whether investors should avoid low margin businesses entirely?

I think it you value a good night’s sleep then there are strong grounds for doing so. Good businesses with low margins are few and far between. However, as with many things in investing there usually tends to be a few exceptions to a rule.

Companies with low profit margins and high ROCE

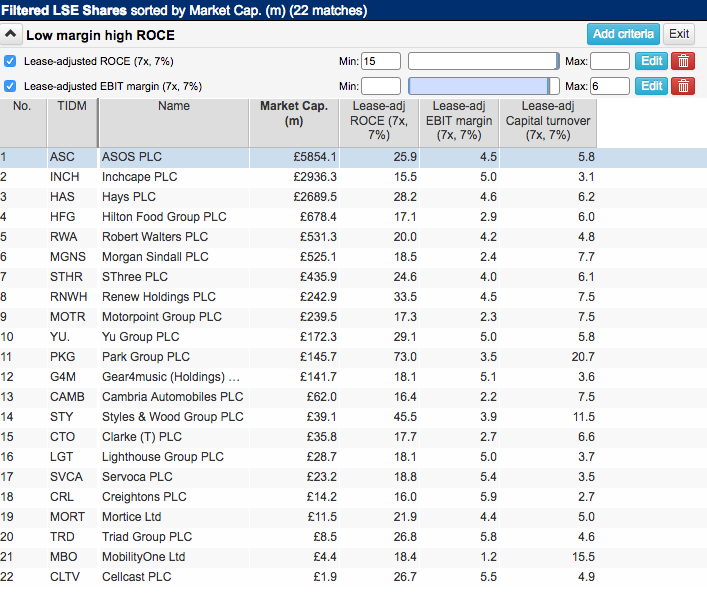

According to SharePad there are only 33 companies listed on the London market with a current ROCE of more than 15% and a current EBIT margin of less than 5%. If ROCE is adjusted for leases and the margin threshold is pushed up to 6% (because lease interest payments are added on to profits and therefore increase profit margins) there are only 22 companies that meet the criteria.

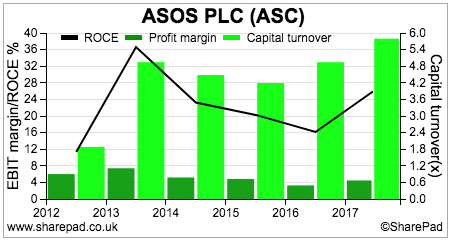

ASOS (LSE:ASC) is a great example of a company that has thrived despite having low profit margins. It has achieved its high ROCE by selling lots of clothes at competitive prices.

The lighter bars in the chart above show that its capital turnover has been increasing in recent years. In 2015, it was selling £4.20 of goods for every £1 of capital invested. In 2017, it was selling £5.80 of goods for every £1 invested.

ASOS’ business model is all about volume – selling more stuff. By not having the large costs associated with high street stores and selling over the internet it is able to charge lower prices. Backing this up with an efficient delivery and customer returns service is what has given it a very powerful business franchise that is difficult to compete with.

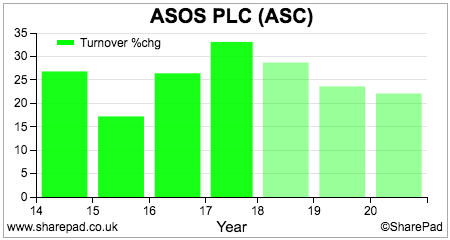

City analysts are still expecting the company to keep on growing its sales at an impressive rate.

ASOS is clearly a very good business. The problem that most investors will have with it is the hefty price tag on its shares which currently trade on a one year rolling forecast PE of just over 62 times.

Other things to consider

If you come across a business where a high ROCE is generated by a high capital turnover and low profit margin it is a good idea to check the reason for the high capital turnover ratio. The best reason is a rising level of sales as seen with ASOS above.

Companies can have high capital turnover ratios for other reasons. It might be shrinking the amount of capital invested in the business by selling off unproductive assets. This is a good thing to do but is not as attractive as a business with growing sales.

Capital employed can also fall – and cause capital turnover to rise – if a company does not invest in its asset base. This may be the case if capital expenditure (capex) has been less than depreciation for many years. If the company wants to stay in business for the foreseeable future worn out assets will eventually have to be replaced. When they are, there is a strong possibility that capital turnover and ROCE will fall.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.