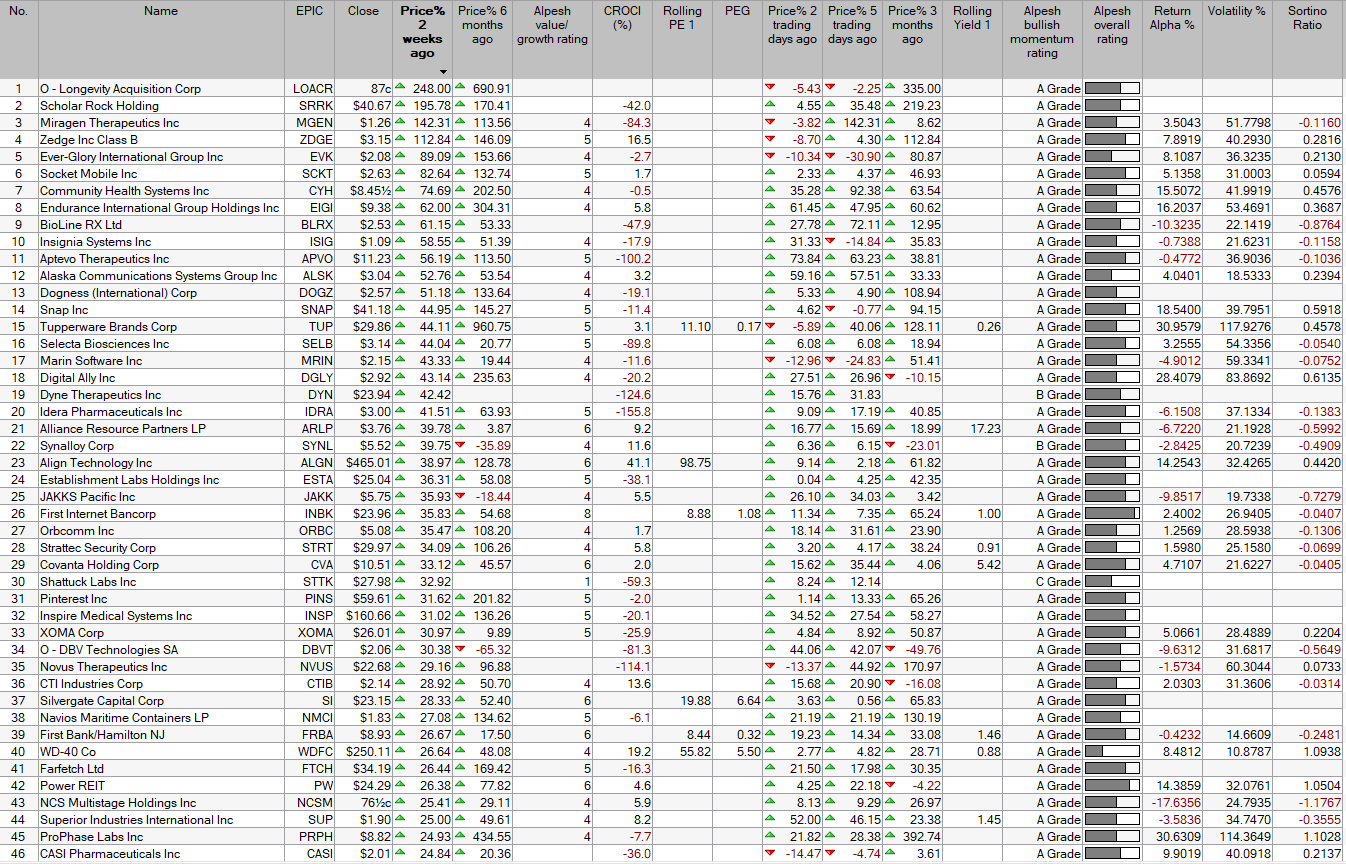

There is no shortage of stocks that are delivering triple digit returns.

Scholar Rock, Miragen, Zedge, Socket Mobile – even Tupperware is up nearly 1,000%.

Source: ShareScope – Alpesh Patel Special Edition (click on image to enlarge)

The problem is hindsight is great, but each of these and the other climbers have huge problems in the future.

- Take the valuation. Do you want to risk something with weak profits to their share price? Do you want to risk a stock with poor cash-flow (CROCI).

- Do you want to speculate on a loss-making company?

- Maybe you like news and to spray and pray in your stock selection?

- And what about companies which, despite recent gains, don’t have a history of outperforming the market (Alpha)? Surely they will revert to mean? Do you want to gamble on them suddenly changing their spots to be outperformers.

- And despite recent rises, perhaps you’d like the highly volatile one but does not deliver returns (Sortino)?

Surely not.

So, where does the leave us. I’m fed up. I wish I could gamble and speculate on the duffers, the poor performers or the shooting stars.

But there is not a strategy which allows you to do that and have consistent success.

You end up throwing the dice and too often getting nothing to show for it as the shooting star burns out and crash lands.

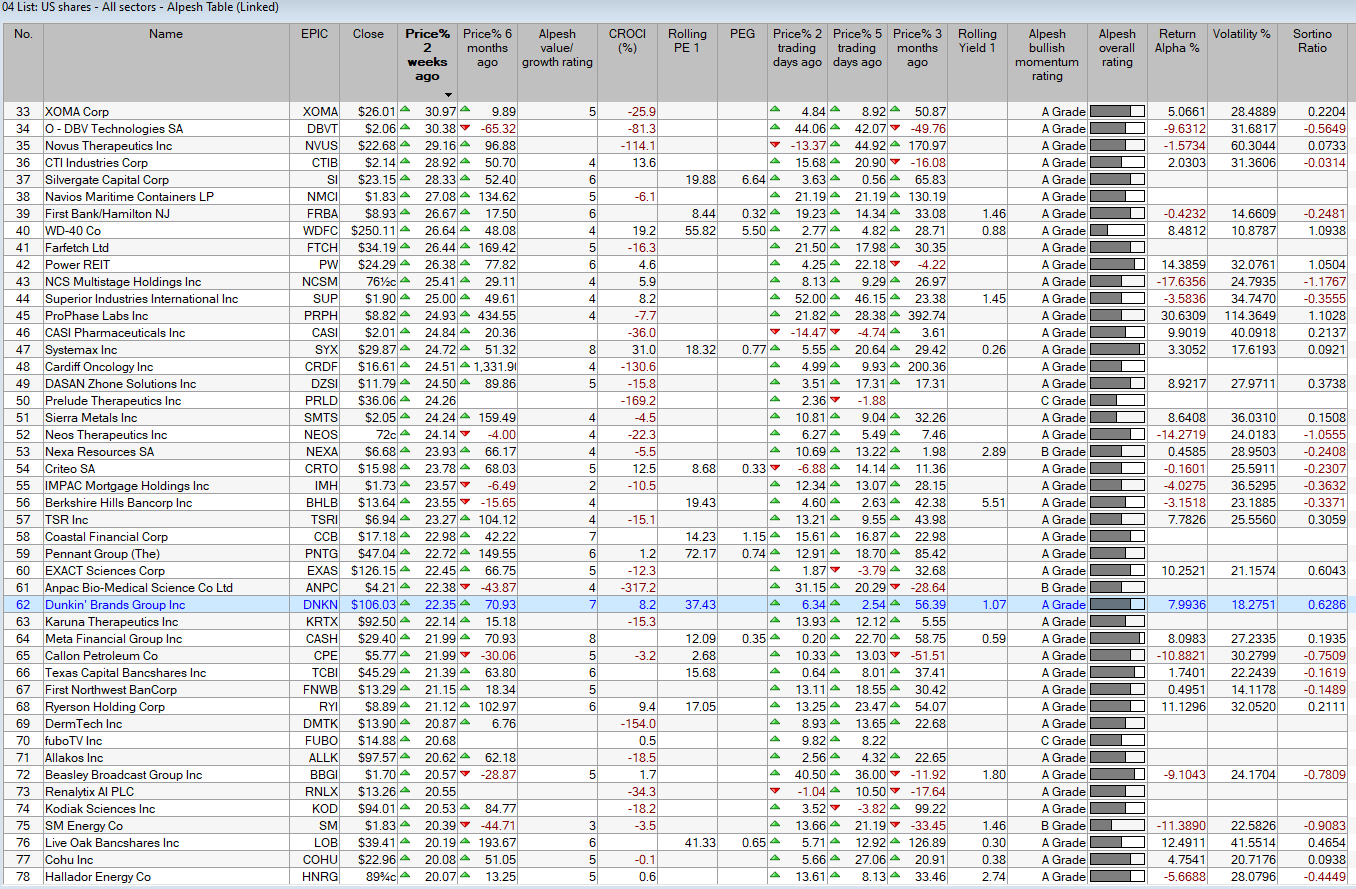

So, I kept drilling and drilling until I could find stocks with fair valuations, momentum, growth, returns, not too volatile—the Goldilocks stocks.

Source: ShareScope – Alpesh Patel Special Edition (click on image to enlarge)

Three potential Goldilocks Stocks

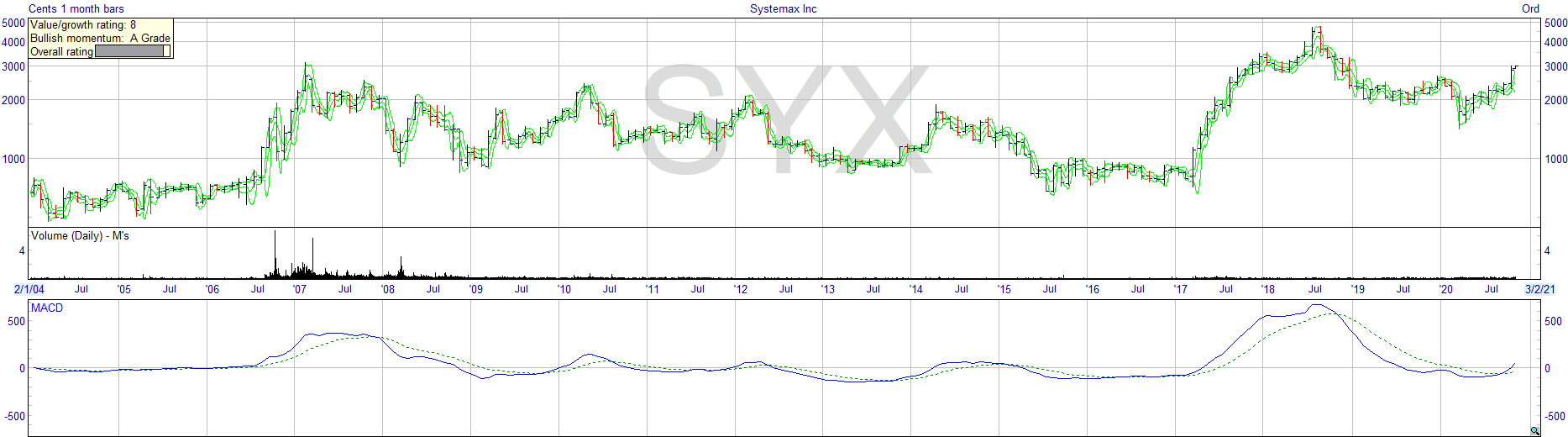

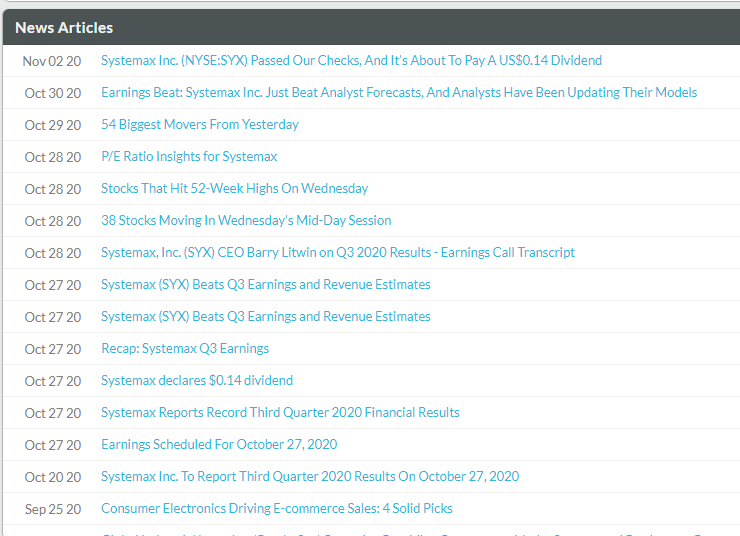

Systemax (SYX)

Source: ShareScope – Alpesh Patel Special Edition (click on image to enlarge)

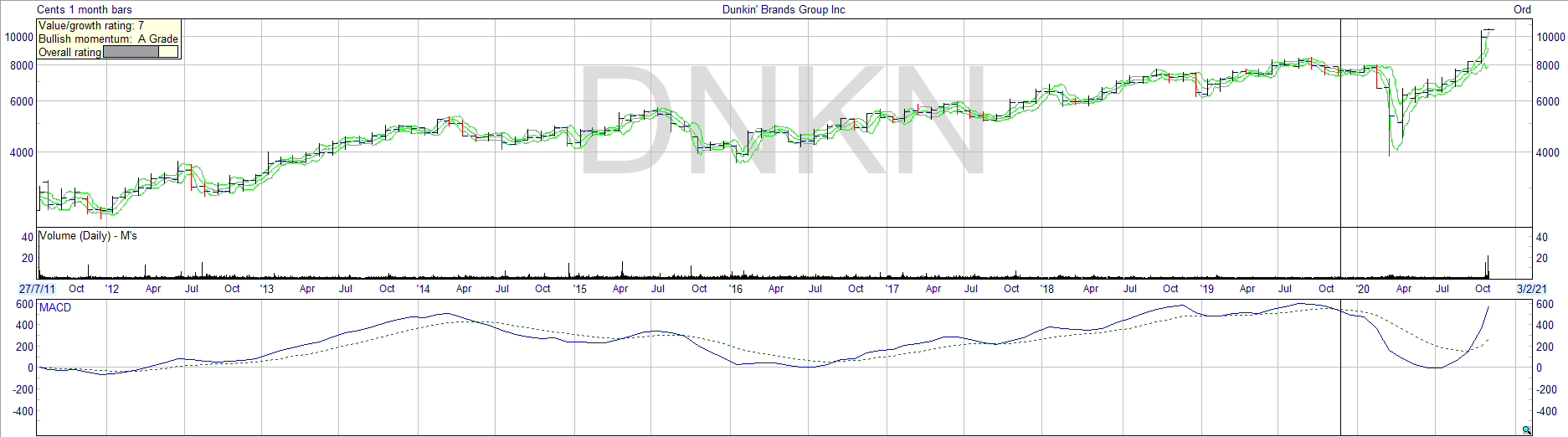

Dunkin Brands (DNKN)

Source: ShareScope – Alpesh Patel Special Edition (click on image to enlarge)

Insperity (NSP)

Source: ShareScope – Alpesh Patel Special Edition (click on image to enlarge)

Of course, I could have picked others. In future, I will. I added in news analysis too. No stock is perfect. Dunkin may have peaked, for instance.

So what’s the thinking? Remove all the bad data, filter it out. What you’re left with should be what has a decent chance of not letting you down.

After all in a bull market everyone is a genius. It’s when things go south that you need the insurance of growth, value, income, returns, cash-flow.

Getting Out

As every General knows, getting in is the easy bit; it’s the getting out that get’s you killed. My general rule is to hold for 12 months, or a drop from 25% from the high point since purchase, whichever happens first.

Read that again. It sounds simpler than it is.

Alpesh Patel OBE

Founder of Alpesh Patel Special Edition of ShareScope

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.