A year ago I started a trial of three model portfolios based on Joel Greenblatt’s magic formula approach (click here to read more about this). I wanted to see how this strategy would work in the real world and with all investing costs taken into account as many studies of investment strategies ignore costs.

The portfolios are also based on something that a private investor might be able to do in practice. A portfolio of 20 shares is just about manageable for most investors although the costs of buying and selling shares every year does mount up and reduces returns.

I like the magic formula because of its focus on two simple but crucial determinants of successful investing:

- Buying high-quality companies – ones with a high return on capital employed (ROCE)

- Buying cheap companies – ones with a high earnings yield

If you are just starting out on your investing journey then I recommend you buy a copy of Greenblatt’s book – The Little Book that Beats the Market. It is very easy to read and is not very long. If you are a more experienced investor you should read it too. It might convince you that investing really doesn’t have to be complicated.

Despite liking the magic formula approach, I had my concerns about it. Namely because it ignores the impact of:

- Intangible assets

- Significant liabilities such as pension fund deficits

- Hidden, off-balance sheet debts due to rented assets

- The ability of a company to turn its profits into cash

So I set up three test portfolios with the same amount of money invested in twenty shares from different sectors of the stock market to see which one would perform the best.

They were based on:

- A simple magic formula approach based on Greenblatt’s book

- A lease-adjusted version where the ROCE calculation and earnings yield were adjusted for pension fund deficits and hidden debts

- A lease-adjusted earnings yield – buying cheap shares regardless of quality

The results

Whilst one year is nowhere near long enough to reach any clear cut views on whether a strategy is any good or not, 2016 saw the lease-adjusted magic formula trounce the simple version. It delivered a very impressive total return after costs.

But just buying cheap shares was nearly as good.

| Portfolio | Starting value | Closing Value | Total return | Gainers | Losers |

|---|---|---|---|---|---|

| Simple Magic Formula | £100,000 | £121,749 | 21.75% | 14 | 6 |

| Lease-adjusted Magic Formula | £100,000 | £143,575 | 43.58% | 13 | 7 |

| Lease-adjusted EBIT yield | £100,000 | £140,193 | 40.19% | 12 | 8 |

All three strategies beat the FTSE All-Share index which delivered a total return of just under 17% in 2016.

The simple magic formula produced more winning shares and fewer losers than the other portfolios.

Simple Magic Formula portfolio

| Top 5 gainers | Total return % | Top 5 losers | Total return % |

|---|---|---|---|

| IQE | 86.2 | Hvivo* | -29.6 |

| Wireless Group | 75.9 | Independent News & Media | -22.1 |

| Indivior | 68 | RM | -16.8 |

| Rotork | 48.5 | Eurocell | -3.8 |

| McColl’s Retail | 39.4 | Wizz Air | -2.9 |

Lease-adjusted Magic Formula

This version captured Ferrexpo which produced a stunning gain in value. Its top 5 winners also trumped the simple magic formula thanks to contributions from the likes of Dialight and Central Asia Metals.

| Top 5 gainers | Total return % | Top 5 losers | Total return % |

|---|---|---|---|

| Ferrexpo | 513.1 | NAHL | -33.5 |

| IQE | 86.2 | Hvivo* | -29.6 |

| Dialight | 72.9 | STV | -27.5 |

| Indivior | 68 | Berkeley Group | -17.3 |

| Central Asia Metals | 61.8 | RM | -16.8 |

Lease-adjusted earnings yield

Buying shares solely on their cheapness beat the simple magic formula and almost performed as well as the lease-adjusted version. For 2016 at least, it begs the question does quality matter? Should we just focus on cheapness instead?

As an investor who puts a very strong emphasis on buying quality companies this is not something that sits easily with me. It will take a good few years of very good returns from a simple cheap portfolio for me to be convinced.

| Top 5 gainers | Total return % | Top 5 losers | Total return % |

|---|---|---|---|

| Ferrexpo | 513.1 | GAME Digital | -39.4 |

| IQE | 86.2 | NAHL | -33.5 |

| Drax | 71.7 | Hvivo* | -29.6 |

| Indivior | 68 | Independent News & Media | -22.1 |

| Central Asia Metals | 61.8 | RM | -16.9 |

This very simple portfolio picked up many of the same winners as the lease-adjusted version but added a different significant winner in the form of Drax.

Magic formula shares for 2017

I am going to carry on with these portfolios for 2017. Whilst I am not saying that investors should blindly follow a formula approach, screening for shares that meet the Magic Formula criteria may throw up some interesting individual ideas.

The other interesting aspect of testing investment strategies is that the results can help investors learn about what type of strategy might work in certain types of market conditions. I therefore think it is a useful thing to do.

The most important thing to remember with screening strategies is that you need to go all in. The success of screens like Greenblatt’s Magic Formula is based on the assumption of buying a basket of shares.

In most years, the basket will contain winners and losers. So if you just pick one or two shares from the basket – like STV for example – you could pick a big loser. You might also pick a big winner but as an investor you should be looking to reduce your risks.

There are two main ways you can reduce your risk when investing in shares. One is to buy lots of shares so that your portfolio is not dependent on the fortunes of one or two shares. This spreads your risks but also tends to dilute your potential returns. If you own too many shares because you are frightened by the risks involved then you might as well buy a cheap index tracking fund instead.

The second – and better – way is to concentrate your portfolio into a smaller number of shares (say 10-15). You then reduce your risk by focusing your investments on high quality companies and not overpaying for them. This requires a bit of time and research.

So if you want to use the screen as a way to find investment ideas, you should subject your list of stocks to a reasonable level of analysis before buying. Using the Carousel on SharePad’s Financial Summary view should be the absolute minimum.

A very important point to realise with Greenblatt’s Magic Formula is that its results are based on only the most recent values for a company’s ROCE and earnings yield. This can mean it qualifies by having a temporarily high ROCE or that its shares have a high earnings yield (they look cheap) because it has poor growth prospects.

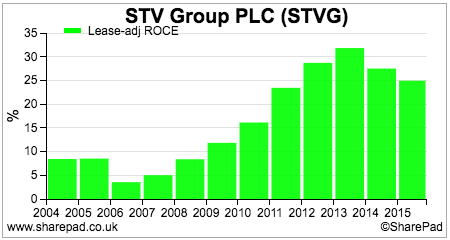

Let’s take STV for example, a look at its long-term ROCE chart would tell the investor that it is a cyclical business. Reading its annual report would also show you that the business was very reliant on advertising revenues which are very dependent on the fortunes of the economy.

Its 2014 and 2015 ROCE figures look to be at or close to a cyclical peak and have started to trend down. This would probably have been enough to put me off buying STV as an individual investment rather than part of a basket.

Now on to 2017’s list of shares.

The 2016 ending values of all three portfolios will be rebalanced into 20 equal-sized investments in the shares shown below. I will provide an update on their progress at the end of June.

Simple Magic Formula

| Name | Magic Formula rank | Market Cap. (current) | ROCE (ex intg) | EBIT yield | Subsector |

|---|---|---|---|---|---|

| DFS Furniture PLC | 1 | £472.20 | 314.6 | 12.2 | Home Improvement Retailers |

| Indivior PLC | 3 | £2,133.70 | 148.8 | 11.4 | Pharmaceuticals |

| Connect Group PLC | 4 | £386.20 | 168.9 | 10.9 | Business Support Services |

| Motorpoint Group PLC | 6 | £127.80 | 58.8 | 16.3 | Specialty Retailers |

| Next PLC | 10 | £7,053.60 | 62 | 10.6 | Apparel Retailers |

| SThree PLC | 14 | £400.10 | 68.1 | 10.1 | Business Training & Employment Agencies |

| KCOM Group PLC | 15 | £481.10 | 61.4 | 10.5 | Fixed Line Telecommunications |

| Wizz Air Holding PLC | 16 | £1,029.30 | 36.5 | 37.8 | Airlines |

| ITV PLC | 18 | £8,262.20 | 127.9 | 8.7 | Broadcasting & Entertainment |

| Rank Group (The) PLC | 21 | £758.70 | 56.2 | 10.5 | Gambling |

| McColl’s Retail Group Ltd | 25 | £212.60 | 58 | 9.6 | Food Retailers & Wholesalers |

| Tarsus PLC | 31 | £321.00 | 275.3 | 7.4 | Media Agencies |

| Howden Joinery Group PLC | 34 | £2,407.90 | 48.1 | 9.7 | Industrial Suppliers |

| PayPoint PLC | 47 | £701.00 | 59 | 8.4 | Financial Administration |

| NCC Group PLC | 48 | £516.30 | 152.4 | 6.8 | Computer Services |

| Restaurant Group (The) PLC | 53 | £666.50 | 30.5 | 13 | Restaurants & Bars |

| Berkeley Group Holdings (The) PLC | 54 | £3,935.10 | 28.6 | 14.2 | Home Construction |

| Keller Group PLC | 56 | £607.50 | 26.6 | 15.5 | Heavy Construction |

| Kainos Group Ltd | 59 | £240.20 | 61.7 | 6.9 | Software |

| XP Power Ltd | 64 | £336.30 | 50.1 | 7.5 | Electrical Components & Equipment |

Lease-adjusted Magic Formula

| Name | Lease-adj Magic Formula rank | Market Cap. (current) | Lease-adj ROCE (7x, 7%) | Lease-adj EBIT yield (7x, 7%) | Subsector |

|---|---|---|---|---|---|

| Motorpoint Group PLC | 2 | £127.80 | 39 | 14.8 | Specialty Retailers |

| Indivior PLC | 5 | £2,172.20 | 98.4 | 11.3 | Pharmaceuticals |

| Berkeley Group Holdings (The) PLC | 7 | £3,925.30 | 28.1 | 14.1 | Home Construction |

| Next PLC | 13 | £7,090.40 | 33.2 | 10.1 | Apparel Retailers |

| KCOM Group PLC | 16 | £485.60 | 26.3 | 10.3 | Fixed Line Telecommunications |

| SThree PLC | 18 | £404.30 | 31.2 | 9.6 | Business Training & Employment Agencies |

| STV Group PLC | 20 | £141.80 | 24.9 | 10.3 | Broadcasting & Entertainment |

| Softcat PLC | 23 | £587.60 | 48.5 | 8.8 | Computer Services |

| Howden Joinery Group PLC | 24 | £2,406.00 | 28.6 | 9.3 | Industrial Suppliers |

| Ashley (Laura) Holdings PLC | 26 | £144.60 | 20.7 | 10.5 | Home Improvement Retailers |

| PayPoint PLC | 29 | £688.40 | 49.6 | 8.4 | Financial Administration |

| Gocompare.com Group PLC | 36 | £286.30 | 77.3 | 7.8 | Media Agencies |

| QinetiQ Group PLC | 39 | £1,506.20 | 28.4 | 8.4 | Defense |

| Connect Group PLC | 41 | £381.60 | 19.1 | 9.8 | Business Support Services |

| Forterra PLC | 44 | £351.80 | 27.6 | 8.3 | Building Materials & Fixtures |

| Gulf Marine Services PLC | 50 | £184.20 | 14.5 | 17.1 | Oil Equipment & Services |

| Kainos Group Ltd | 56 | £240.90 | 49.6 | 6.9 | Software |

| Keller Group PLC | 58 | £609.50 | 14.6 | 12.6 | Heavy Construction |

| Britvic PLC | 59 | £1,503.50 | 17.3 | 9 | Soft Drinks |

| Gem Diamonds Ltd | 60 | £151.00 | 13.3 | 16.5 | Diamonds & Gemstones |

Lease-adjusted EBIT yield

| Name | Market Cap. (current) | Lease-adj EBIT yield (7x, 7%) | Subsector |

|---|---|---|---|

| Lonmin PLC | £418.70 | 28.1 | Platinum & Precious Metals |

| Lamprell PLC | £320.80 | 24.1 | Oil Equipment & Services |

| UNITE Group PLC | £1,321.50 | 22.5 | Real Estate Holding & Development |

| CMC Markets PLC | £322.80 | 21 | Investment Services |

| Pendragon PLC | £454.40 | 19.2 | Specialty Retailers |

| Sports Direct International PLC | £1,653.90 | 18.2 | Apparel Retailers |

| Barratt Developments PLC | £4,672.30 | 17.4 | Home Construction |

| International Personal Finance PLC | £387.30 | 16.5 | Consumer Finance |

| Gem Diamonds Ltd | £151.00 | 16.5 | Diamonds & Gemstones |

| LSL Property Services PLC | £240.90 | 16.3 | Real Estate Services |

| Thomas Cook Group PLC | £1,344.30 | 15 | Travel & Tourism |

| Trinity Mirror PLC | £298.90 | 14.8 | Publishing |

| Premier Oil PLC | £392.70 | 12 | Exploration & Production |

| easyJet PLC | £4,009.80 | 11.5 | Airlines |

| Indivior PLC | £2,171.90 | 11.3 | Pharmaceuticals |

| Carillion PLC | £1,010.00 | 11.2 | Business Support Services |

| Vedanta Resources PLC | £2,430.40 | 11.2 | General Mining |

| Drax Group PLC | £1,555.60 | 11 | Conventional Electricity |

| John Laing Group PLC | £995.50 | 10.6 | Specialty Finance |

| Ashley (Laura) Holdings PLC | £144.60 | 10.5 | Home Improvement Retailers |

* An error in the data for Hvivo meant that it was incorrectly included in each of the original portfolios. However, as each portfolio was equally weighted it had the same negative effect in each portfolio. As one of the largest fallers in each portfolio, the performance of them is most likely understated. All the stocks in the 2017 portfolios merit their inclusion.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.