I am always looking for shares that can double, triple, quadruple or more during the years ahead.

And one good way of finding such great investments is to study shares that have, well, already doubled, tripled, quadrupled or more.

Take Fever-Tree (LSE: FEVR). This tonic-water specialist has rewarded savvy investors handsomely since the firm floated during 2014 at 134p.

The shares currently trade near £30 after briefly touching £40:

I don’t know about you, but I would love to capture just a fraction of such mega returns.

What has made Fever-Tree so successful?

As you might expect, Fever-Tree boasts some extremely impressive financials. The company’s SharePad summary tab is shown below:

Highlights include three-year average turnover and profit growth of 70%-plus, an EBIT (or operating) margin of 33%, and a return on equity of 42%.

Such magnificent stats alongside current-year predictions of 20%-plus growth explains Fever-Tree’s stratospheric P/E.

True, you can employ SharePad to trawl for other companies that exhibit similarly wonderful numbers.

However, you can also employ SharePad to delve a little deeper into the likes of Fever-Tree, and understand a little more about what makes such businesses so successful.

Perhaps the most beautiful chart I have ever produced

One of my favourite ways of assessing companies is by calculating their turnover per employee.

The theory is simple: companies that produce high sales from few people are often simpler to manage and grow than businesses that produce low sales from many people.

In fact, if you can find a business that can expand significantly without needing to take on huge numbers of extra staff, then perhaps you have found a business with a product that actually sells itself.

Suffice to say, companies blessed with products that sell themselves are generally good for us investors!

Here’s what I mean, using Fever-Tree as an example:

The green bars represent Fever-Tree’s sales, and the red bars represent Fever-Tree’s number of employees. The black line shows Fever-Tree’s sales per employee.

The chart above is actually one of the most beautiful I have ever produced within SharePad.

Fast-growing sales combined with just a few extra staff tell me Fever-Tree’s tonic waters have been selling themselves…

…and a vast army of new recruits — plus all the additional overheads such recruits come with — have just not been needed to get the firm’s mixers into many more drinks.

Instead, Fever-Tree has outsourced people-intensive activities such as manufacturing and logistics — and concentrated mostly on marketing — with the result being an average sales per employee at an astonishing £3m-plus.

(Source: Fever-Tree annual report)

Is selling cosmetics similar to selling tonic water?

Let’s now use SharePad to unearth an interesting business with high sales per employee.

For this trawl I have set a minimum sales level of £25m and a minimum employee number of 10. That way I remove a lot of niche property groups and obscure mining firms from my search.

My screening also looks for market caps of between £25m and £250m, with the hope I will find smaller companies that still have a long way to grow.

SharePad gives me 274 shares to consider:

Warpaint London (LSE: W7L) stood out among the first 15 names.

You see, I already knew this business sold cosmetics, had floated the other year… and issued a profit warning last month that saw its shares collapse by 45%:

So, sentiment towards the company should be low… and that may present us with a bargain.

Furthermore, selling cosmetics might be very similar to selling tonic water — the product could also enjoy super margins due to a perceived branding quality.

Has the 45% share-price crash left us with a high-quality bargain?

Warpaint started selling excess and clearance cosmetics to high street retailers back in the early 1990s. The firm introduced its own W7 cosmetic range during 2002 and today some 61% of revenue relates to this flagship brand.

Face make-up, eye shadow and lipsticks represent the bulk of sales, with more than half of all products now sold overseas.

A strategy of selling “high quality products at an affordable price” — alongside the help of celebrity endorsements and beauty bloggers — have delivered some useful accounts.

Let’s look at Warpaint’s sales and employee chart:

We can see sales per employee (the black line) improving steadily over time to £700k for 2017.

While not exactly in the Fever-Tree stratosphere, sales of £700k per employee are still very impressive. In fact, almost two-thirds of those 274 companies from my earlier search produce less than £200k per employee.

Warpaint’s SharePad summary tab reveals some further attractive numbers:

Certainly, the second row — with the prospect of sales growing by 51% and pre-tax profit by 29% — looks very enticing.

Then the bottom row — showcasing a 21% EBIT (or operating) margin and a 23% return on equity — is very encouraging, too.

Combine all of them with a reported 12.3 forecast P/E (top row) and a forecast 4.5% dividend yield (fourth row) and I am left wondering whether the aforementioned 45% share-price crash has left us with a high-quality bargain.

UK retailers have reduced stock levels and Christmas orders

So, what exactly caused that 45% share-price crash? SharePad shows us the profit warning:

The warning said:

“The UK market…has seen further softening recently, with retailers reducing stock levels and Christmas orders. This reduction in previously anticipated UK sales will have an impact on Group performance for the full year that will not be completely offset by better than anticipated performance in our major overseas sales territories.”

“Based on current expectations the Company’s board anticipates that revenue for the year ending 31 December 2018 will be in the range of £48 million to £52 million.”

“Consequently, the Company’s board currently expects profit before tax for the year ending 31 December 2018 (excluding amortisation in connection with acquisitions and exceptional items, which total approximately £2.5 million) will be in the range of £8.5 million to £10 million.”

But hold on… that earlier SharePad summary tab showed sales and pre-tax profit were still expected to grow significantly.

Let’s double check Warpaint’s recent sales and profit within SharePad:

Sales and pre-tax profit were £32.6m and £6.9m respectively last year, and the trading statement said sales and pre-tax profit could be at least £48m and £8.5m respectively for 2018.

Therefore, the business is still expected to grow.

I need to delve deeper. Why did the share price crash 45% when decent sales and profit advances are still anticipated?

A rule of thumb tells me to be careful

Warpaint’s cash flow reveals a clue. A sizeable acquisition was made during 2017:

This is not great news.

A rule of thumb I have with my own stock-picking is to always be wary of companies that spend all of their annual profit (or more) to buy other firms.

You see, my experience tells me shareholders often face trouble from large acquisitions.

For example, such deals may signal the core business has run out of steam and/or the directors have run out of ideas.

Large purchases also run the risk of hefty sums being wasted should the company acquired turn out to be poor.

Integration difficulties may arise, and the expected operational benefits may not appear, too.

Anyway, Warpaint spent £16.2m on an acquisition last year when the firm’s operating profit was £6.9m. The deal was therefore very significant. Time now to dig into the 2017 annual report to discover more.

No wonder the share price suffered a massive de-rating

The annual report reveals this vital footnote:

I now understand what has happened.

Had the purchase been made at the start of 2017, additional revenue of £18.9m would have been generated — and total sales would therefore have been £32.6m plus £18.9m, or £51.5m.

All of a sudden, expecting sales of approximately £50m this year has become not such a big deal.

In fact, ‘underlying’ revenue looks like stagnating at best for 2018. You could say the same for ‘underlying’ profit, too.

Before the profit warning, City brokers were expecting Warpaint to produce earnings of close to 14p per share:

Now those brokers are forecasting less than 10p per share.

No wonder the share price suffered a massive P/E de-rating.

Love Island contestant must now use the #ad hashtag

Six weeks before the profit warning, Warpaint’s interim results included this ominous paragraph:

“Trading conditions in the UK remain challenging because of the UK high street slow down and ongoing Brexit anxiety. Notwithstanding this, Group sales in the UK were up by 26% in H1 2018 compared to H1 2017. This figure includes the Retra sales for the first time in 2018. For W7 alone, sales in the UK were down 13% for the half year 2018 compared to H1 2017, most of which was due to container problems at Felixstowe port in June this year which delayed deliveries.”

The flagship W7 brand would appear to have lost UK sales even without the Felixstowe problems. I have to say, that is worrying.

I may be adding 2 and 2 together and getting 5 here, but a quick Google news search for ‘W7 Cosmetics Warpaint’ unearths this article: https://www.itv.com/news/2018-10-02/olivia-buckland-instagram-post- banned-by-advertising-watchdog/

The Advertising Standards Authority (ASA) has instructed Warpaint and Olivia Buckland to “ensure that, in future, their ads [are] obviously identifiable as marketing communications, for example, by including a clear and prominent identifier such as #ad”

I guess such hashtags may now take the shine off Ms Buckland’s social-media posts about Warpaint’s W7 range.

I should add that Warpaint’s interim results outlined the group’s six “key strategic priorities”. And the very first priority was:

“We continue to build our major brands, by utilising brand ambassadors, bloggers and vloggers to engage with our target audience. Much of this is done through social media campaigns to educate and interact with our loyal brand users.”

I don’t know whether the ASA and the floundering UK sales are connected. But I reckon the ASA’s intervention won’t have helped Warpaint’s “key strategic priority” for marketing.

The following extract from Warpaint’s annual report is interesting:

“In November 2017 the Group acquired Retra which owns three major brands: Technic, Body Collection and Man’stuff, allowing the Group access to an older age range and a growing male health and beauty market.”

I am not sure if the acquired customers that are of “an older age range” and/or are male are as likely to be as influenced by social media as Warpaint’s younger, female customers.

The pair started selling cosmetics as teenagers

Further SharePad checks show Warpaint may have the wherewithal to revitalise its struggling UK sales.

For a start, Warpaint’s two co-chief executives each own 25% of the business:

I would like to think their combined £45m shareholding will provide some incentive to get the business back on track. Indeed, both men started selling cosmetics as teenagers at street markets around 40 years ago. I bet the pair have recovered from many setbacks before.

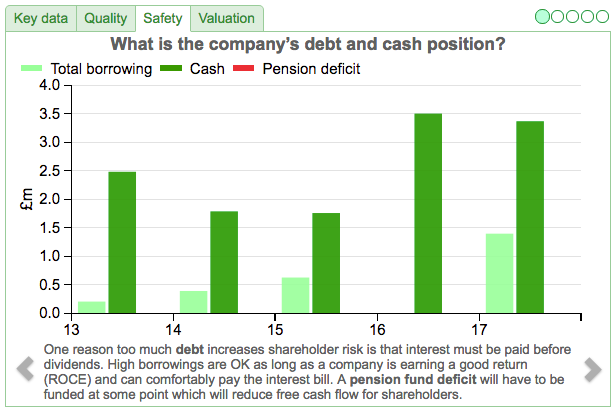

In addition, Warpaint’s balance sheet carries more cash than debt:

As such, the weaker UK trading should not lead to Warpaint needing emergency money from banks or shareholders.

Half of all the employees actually work in a warehouse

Oh dear. This article has not turned out quite as I had planned.

I had thought my screening would lead to discovering a higher-quality small-cap with products that sold themselves.

True, Warpaint exhibits some appealing financial ratios and management’s long experience is also a plus. However, I am really put off by the large acquisition combined with the flagging UK sales of the firm’s core brand.

Indeed, I do wonder whether the acquisition was a desperate move prompted by earlier signs of difficult UK trading.

Oh well, never mind. This sort of thing frequently happens with my stock-screening. I find an interesting share, only for SharePad to reveal all of the downsides. At least there are another 273 shares from my search to study!

Let me round off by showing you this table from Warpaint’s annual report:

Half of all Warpaint’s employees work in a warehouse, and only a small number work in sales.

In contrast, that snapshot I showed you earlier from Fever-Tree’s annual report revealed half of its staff working in sales.

Perhaps Warpaint should consider re-balancing its workforce to revive its UK revenue.

Until next time, I wish you happy and profitable investing with SharePad.

Maynard Paton

Disclosure: Maynard does not own shares in Warpaint London.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.