Screening again for high margins and high ROEs pinpoints the super accounts of AJ Bell. Maynard Paton studies the investing platform’s impressive business that has attracted 681,000 customers – including himself.

Last month I revisited a ShareScope screen that applied two ratios favoured by ‘quality’ investors — operating margin and return on equity (ROE).

The filtering then returned 19 matches and I opted to study Hollywood Bowl.

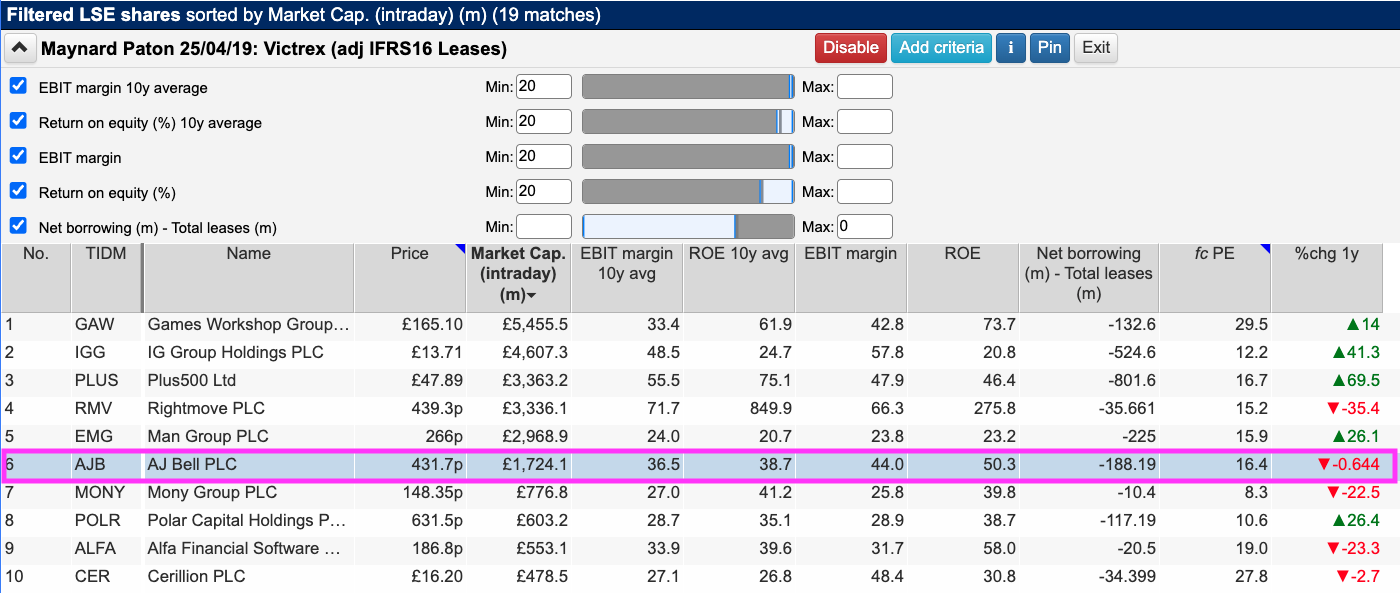

This month I have re-run the same ShareScope screen and once again received 19 matches. As a reminder, the primary criteria of this screen are:

- An operating margin (latest and 10-year average) of 20% or more, and;

- An ROE (latest and 10-year average) of 20% or more.

Any business with a margin and ROE of at least 20% is probably quite special.

To narrow the field down further, I also sought companies that carried net cash (i.e. net borrowings excluding IFRS 16 finance leases of less than zero):

(You can run this screen for yourself by selecting the “Maynard Paton 25/04/19: Victrex” filter within ShareScope’s amazing Filter Library. My instructions show you how.)

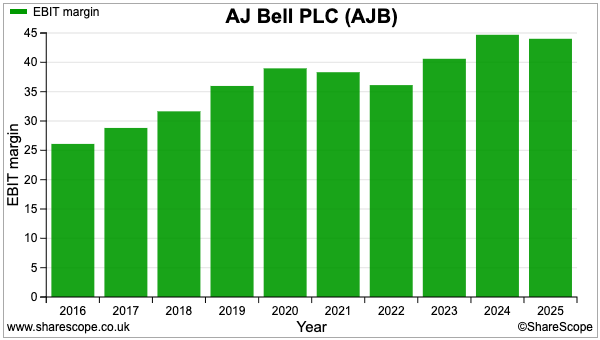

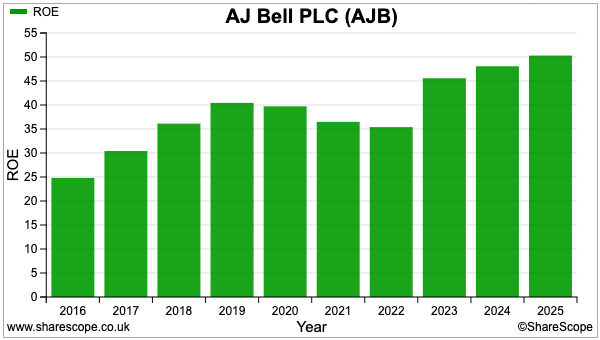

This time I selected AJ Bell, primarily because I have been a customer of the investing platform for 25 years. ShareScope also shows AJ Bell registering a wonderful 40%-plus margin and ROE since 2023:

Let’s take a closer look.

Introducing AJ Bell

“We set up AJ Bell with no real ambition to grow. We just felt we knew SSASs and SIPPs better than most, and it felt like a natural thing to do.”

So recounted Andy Bell during this Money Marketing interview about how he and Nicholas Littlefair identified a gap in the market for supplying administration services for small self-administered and self-invested pensions.

The pair established what would become AJ Bell during 1995 from a 149-square-foot Manchester office with two chairs, two computers and two phones.

“The first call I had was from my mum to see if anyone had phoned yet,” recalled Mr Bell to Money Marketing. “I said, ‘Get off the phone. There may be someone trying to get through.’ “

Customers did indeed get through, and apparently the venture registered a modest profit within its first month.

The next few years then witnessed Bell and Littlefair combine their pension and IT skills to launch Sippdeal – the UK’s first online SIPP provider — during October 2000.

A small article in the FT managed to prompt 35 transfer applications amounting to £2 million during Sippdeal’s first few days. Mr Bell would later admit to The Standard:

“We thought ‘we might have a business here’ [with Sippdeal]… The bigger competitors were too unwieldy, they could see what needed to be done but didn’t have the ability to do it, and the smaller ones didn’t have the IT strength in house… it wasn’t by design, it was more like luck.”

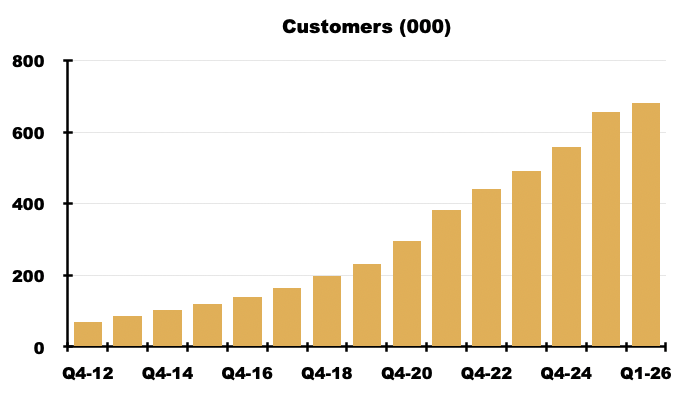

I converted my 1990s personal pension to a Sippdeal SIPP during March 2001 and today I am among 681,000 customers who employ AJ Bell to buy, hold and sell funds, shares and bonds within a SIPP, ISA and/or general investment account online.

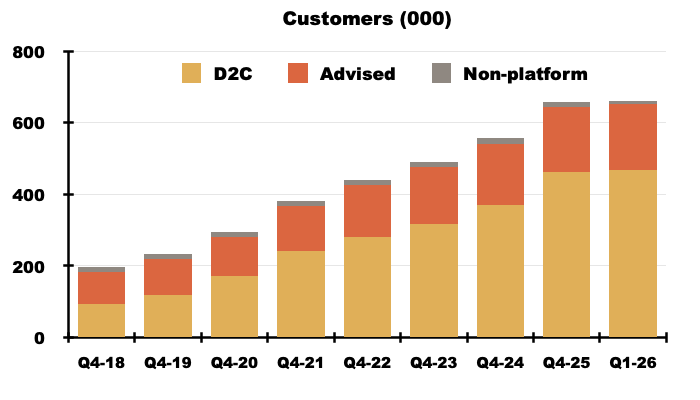

Note that AJ Bell’s client base is split between:

- ‘Direct-to-consumer’ (D2C): investors who make their own financial decisions, and;

- ‘Advised‘: investors who use the services of a financial adviser.

AJ Bell still serves 8,000 or so clients that do not hold their investments on either the D2C or Advised online platforms.

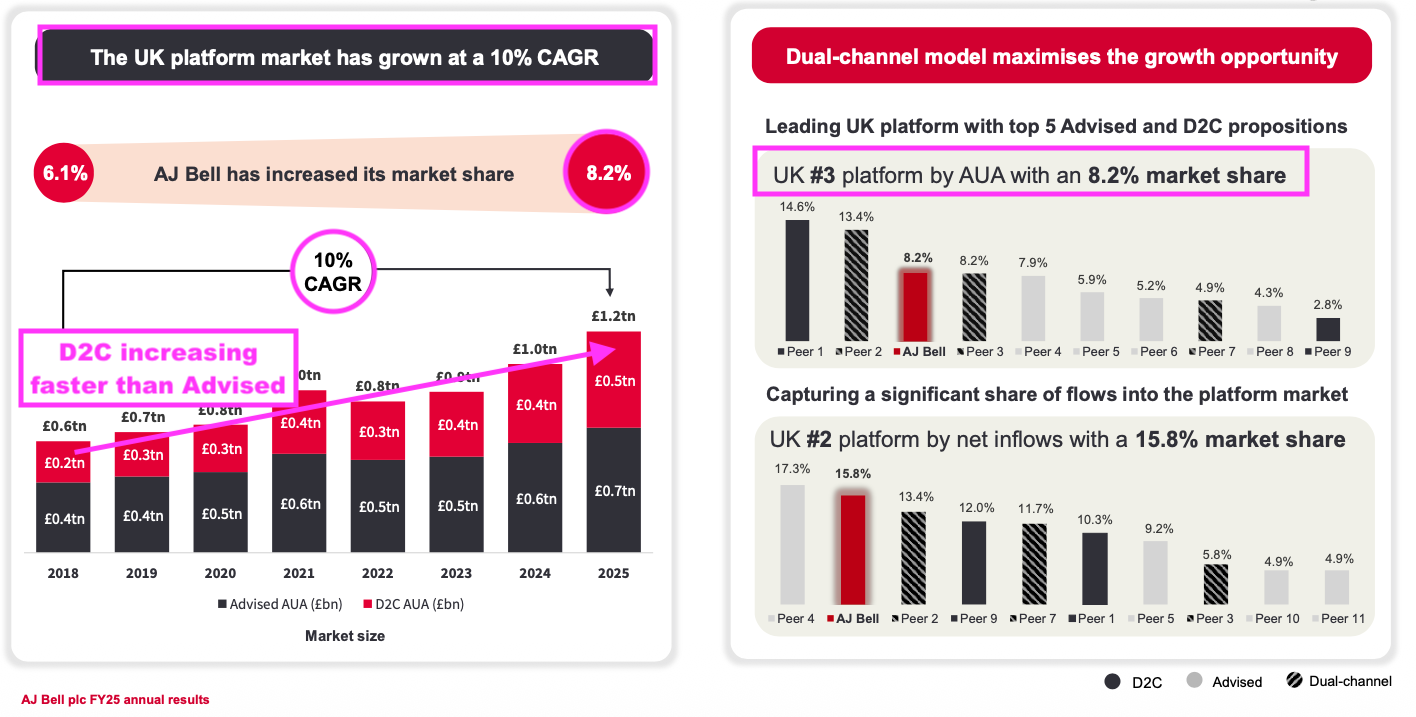

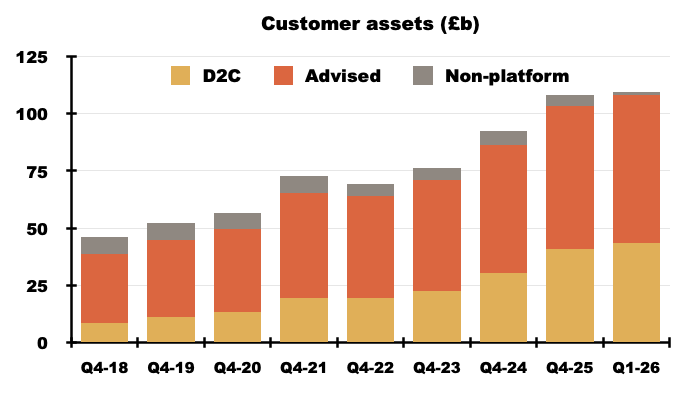

At the last count, those 681,000 customers held investments valued at £110 billion to place AJ Bell as the UK’s number three investing platform with an 8% market share:

Growth has been supported by the wider trend of investors moving from old-style wealth managers to online platforms. AJ Bell cites analysis showing the UK platform market expanding at a 10% CAGR since 2018, with the industry’s D2C proportion increasing faster than the Advised proportion.

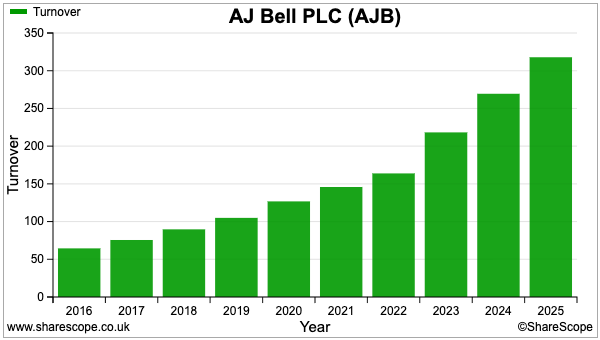

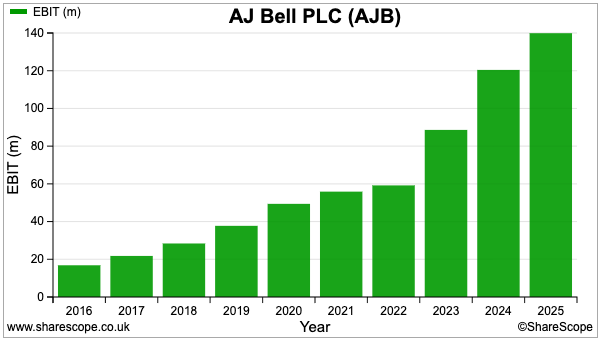

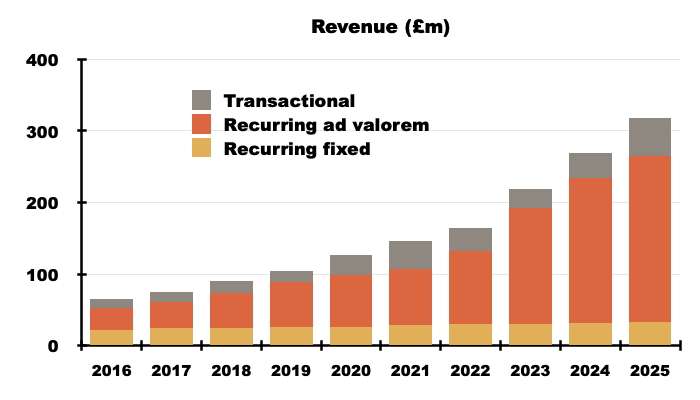

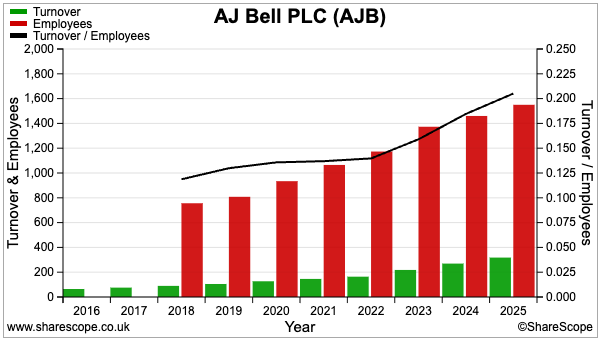

The ongoing recruitment of new clients has translated into an extremely appealing financial history. Since 2016, revenue has almost quadrupled to £318 million while operating profit has surged more than eight-fold to £140 million:

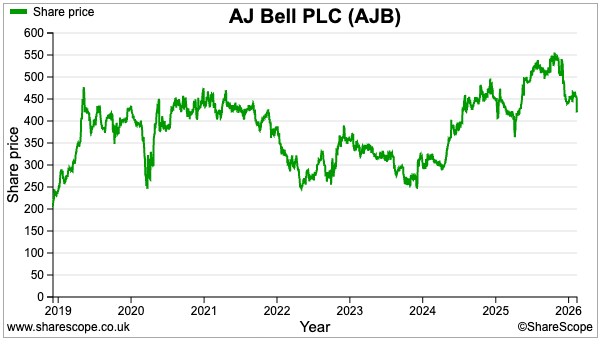

The shares floated during 2018 at 160p and the recent 432p share price supports a £1.7 billion market cap and a spot in the FTSE 250:

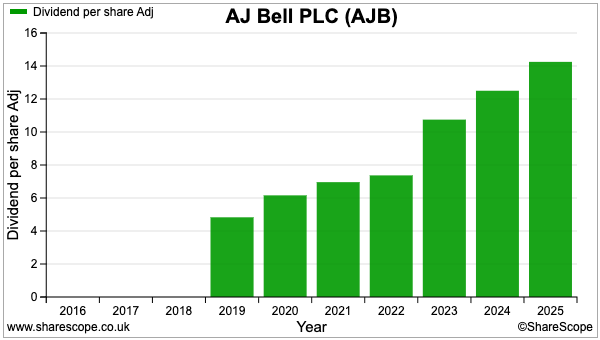

The capital gains have been accompanied by a rising ordinary dividend:

A 5p per share special payment was also declared during 2021.

Customers and assets

Reflecting the wider industry trend towards D2C investing, the number of D2C customers using AJ Bell has surged 290% to 468,000 since 2018:

The number of Advised customers using AJ Bell has meanwhile advanced 89% to 185,000.

Furthermore, the value of AJ Bell’s D2C customer assets has soared 291% to £43 billion since 2018:

The value of AJ Bell’s Advised customer assets has meanwhile climbed 91% to £65 billion.

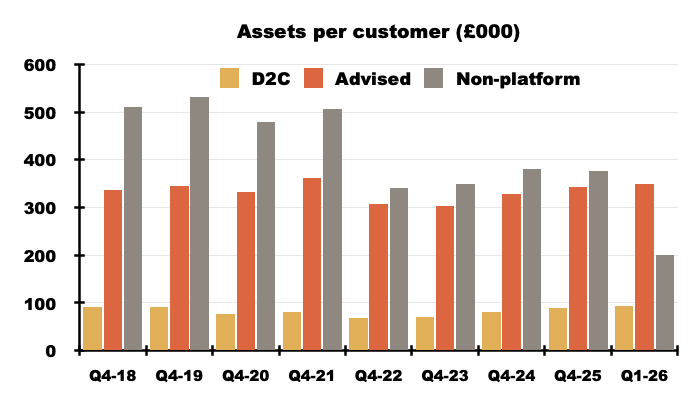

The additional customers and their incoming assets have not dramatically changed the size of the average portfolio on AJ Bell’s platform:

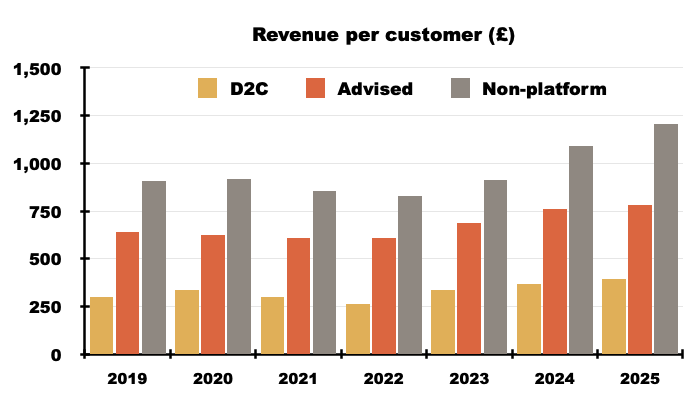

The average D2C customer at AJ Bell enjoys a £93k portfolio while the average Advised customer boasts a £349k portfolio (the diminishing number of non-platform customers now own an average £200k portfolio).

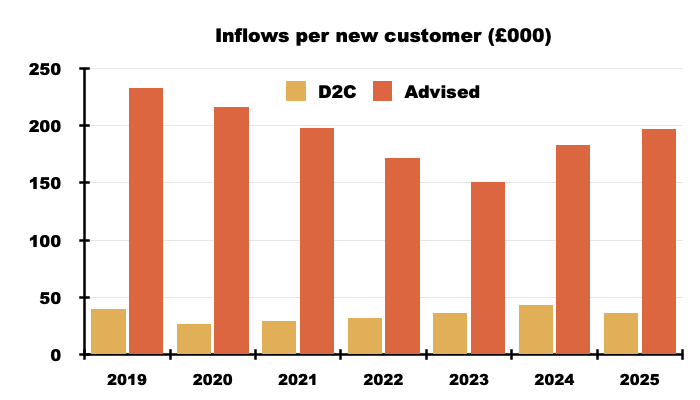

As you might expect, a new D2C customer brings in much less (c£35k) to AJ Bell than a new Advised customer (c£193k):

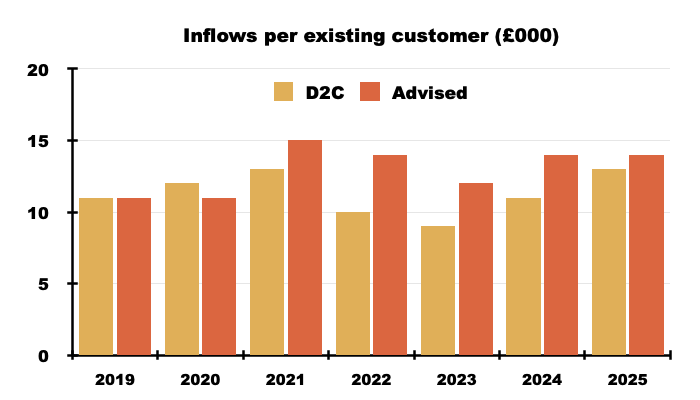

But interestingly enough, once on the AJ Bell platform, both D2C and Advised customers then add an average c£10-15k a year to their accounts:

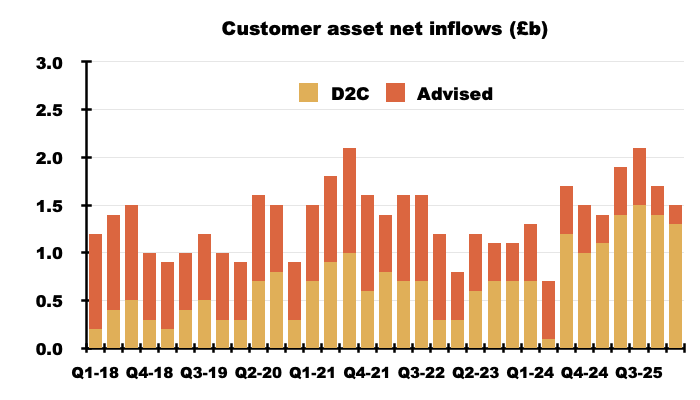

The most remarkable aspect of AJ Bell’s progress is the persistent inflows of additional customer money. New and existing D2C and Advised clients have on aggregate added funds to their accounts during each of the last 33 quarters:

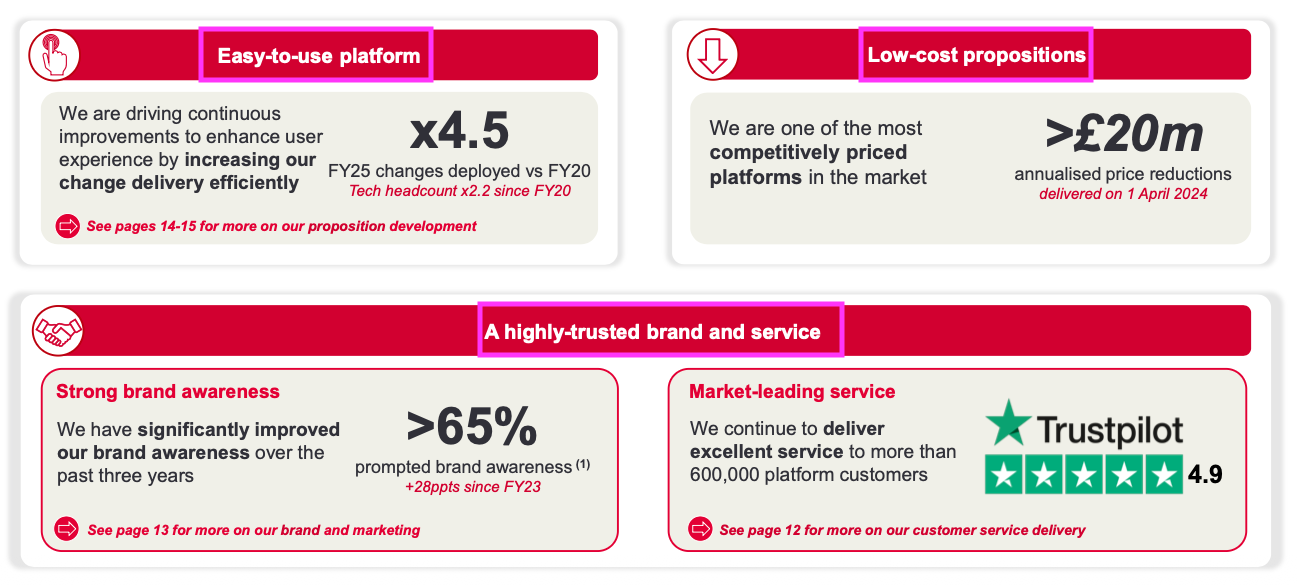

AJ Bell cites its “easy-to-use platform“, “low-cost propositions” and “highly trusted brand and service” for helping to attract new customers — and for helping to keep existing customers loyal:

The group regularly reports a retention rate of approximately 95% and claims customers will use its platform for an average 17 years.

I am certainly a loyal AJ Bell customer. As well as transferring my old private pension during 2001, I have transferred an old workplace pension plus my son’s pension to AJ Bell. I have also opened an ISA through AJ Bell.

Reasonable costs and decent service have prevented me from transferring these accounts to another provider.

My AJ Bell SIPP/ISA custody fees are £13.50 a month, dealing commissions are £5 a pop and my regular requests for AGM letters of representation are handled reasonably efficiently. Just so you know, back in 2001 my Sippdeal SIPP charged dealing commissions of £30 a trade but did not levy a monthly fee.

I also have accounts with Hargreaves Lansdown and interactive investor, and I would say AJ Bell’s website is the most user-friendly of the three.

Revenue sources and analysis

AJ Bell’s revenue is split into three segments:

- Recurring fixed: mostly fees based on tiered pricing (predominantly quarterly charges for Advised SIPPs);

- Recurring ad valorem: mostly custody fees based on a percentage of customer assets alongside retained interest on customers’ uninvested cash, and;

- Transactional: mostly fees earned from dealing activity and various pension-scheme actions.

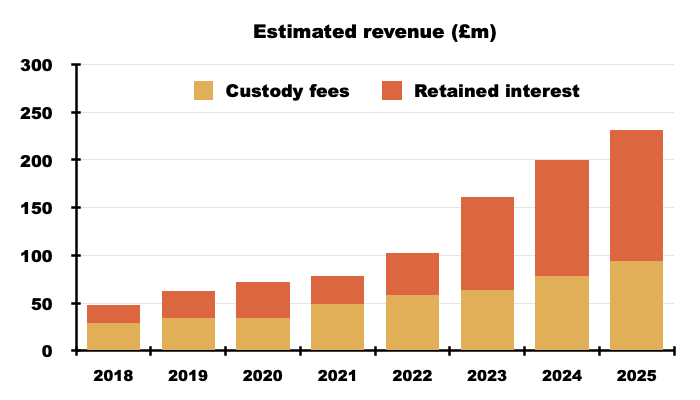

AJ Bell’s ‘recurring ad valorem’ revenue has rapidly become by far the greatest source of income. After all, custody fees based on a percentage of customer assets — even with fee caps in place — should steadily grow over time assuming financial markets generally climb higher:

The amount of interest retained by AJ Bell earned through uninvested customers’ cash has increased significantly during the last few years. I estimate such sums now exceed the amount of custody fees collected.

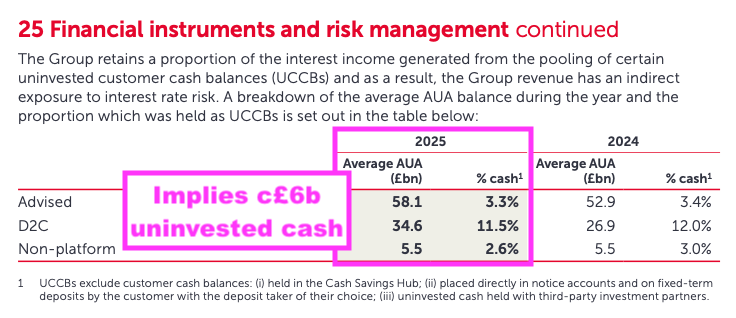

The small-print within the 2025 results contained the following footnote:

The footnote suggests customers collectively held approximately £6 billion as uninvested cash in their SIPPs, ISAs and dealing accounts last year. Additional small-print reveals that £6 billion earned 2.26% interest for AJ Bell:

“The weighted average rate calculated on the proportion of interest income retained on UCCBs [uninvested customer cash balances] held during the period was 2.26% (FY24: 2.33%).“

2.26% on £6 billion is £136 million — which I now realise is a lot of interest going to AJ Bell and not to customers such as me.

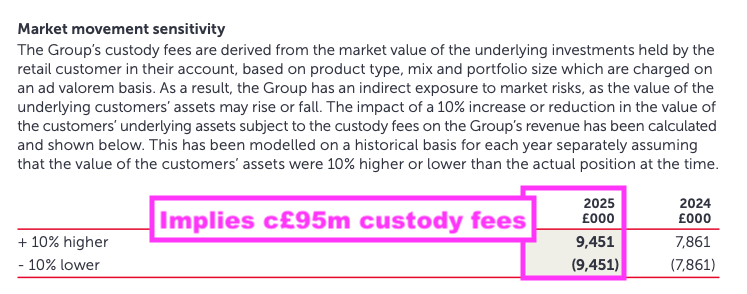

Another footnote reveals a 10% market advance or decline would have lifted or reduced 2025 custody fees by £9.5 million:

Custody fees last year therefore look to have been £95 million.

I have estimated custody fees and retained interest back to 2018. Higher interest rates from 2023 have clearly bolstered AJ Bell’s income:

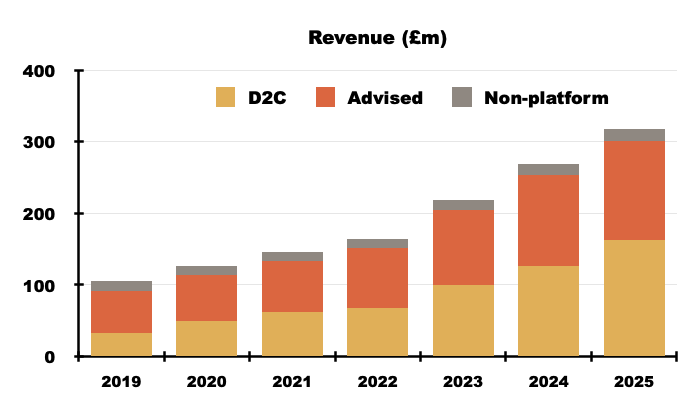

AJ Bell reveals D2C revenue matching Advised revenue during 2024 and then surpassing Advised revenue during 2025:

Last year the group earned £392 from the average D2C customer versus £780 from the average Advised customer (and a sizeable £1,207 from the average non-platform customer):

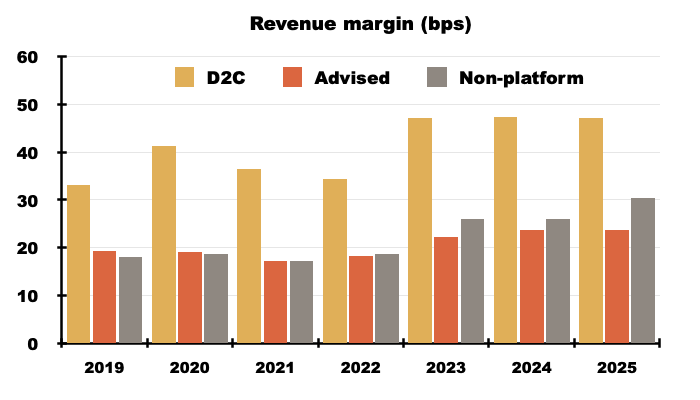

Note that AJ Bell earns almost twice as much from D2C customers than Advised customers when measured against the value of their respective investments.

For 2025 for example, the D2C revenue margin was 47 basis points (bps) — i.e. the group earned £47 for every £1,000 held by D2C customers:

In contrast, last year’s Advised revenue margin was 24 basis points.

The higher D2C revenue margin seems partly due to D2C customers preferring to keep higher levels of uninvested cash (c12%), from which AJ Bell earns that aforementioned 2.26% return. Advised clients meanwhile are seemingly told to keep most of their money invested (c97%).

Financials

I suspect the greater interest earned on uninvested cash balances has assisted AJ Bell’s revenue per employee:

The positive productivity trend does underline the ‘scalable’ qualities of AJ Bell’s platform. Last year total wages and salaries of £77 million (or £51k per person) absorbed 24% of total revenue versus 34% a decade ago. Managing staff costs may well explain why the group’s profit margin has topped 40% for the last three years.

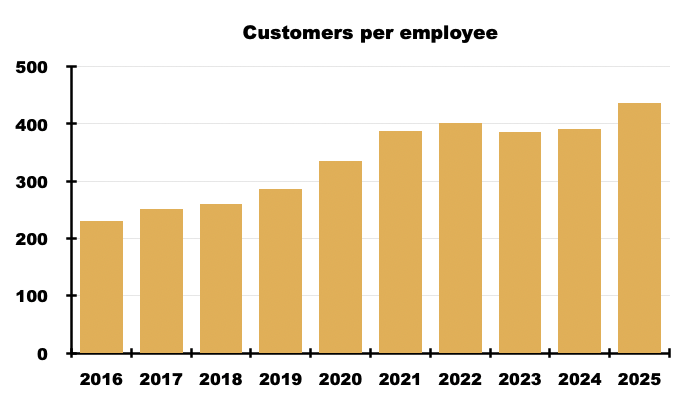

The number of customers per employee has also shown a worthwhile improvement over time:

AJ Bell’s accounts are among the simplest I have reviewed for ShareScope. In particular, the reported numbers are not complicated by adjustments and restatements, while acquisition activity has been minimal.

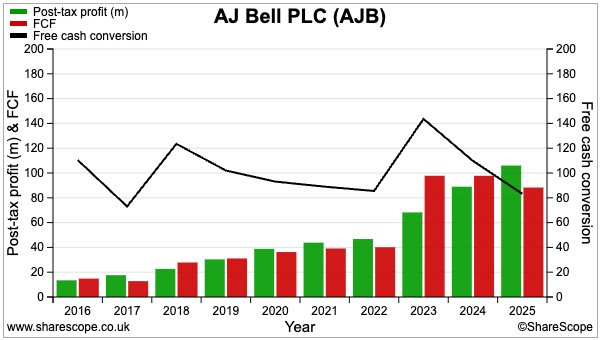

AJ Bell’s cash conversion emphasises the quality of the group’s profits. Although cash flow may fluctuate from year to year depending on the amount of interest owed to customers, reported earnings since 2016 have on average converted into free cash at a wonderful 101% average:

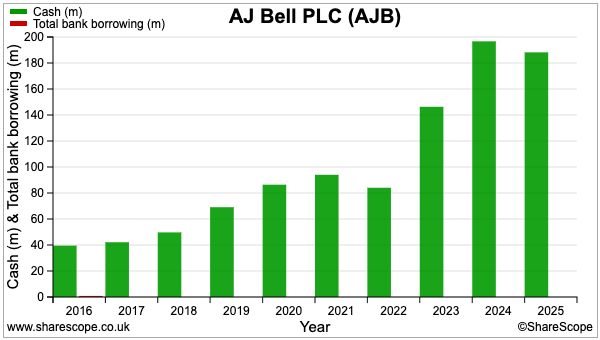

The cash conversion has allowed the group’s cash position to swell to £188 million:

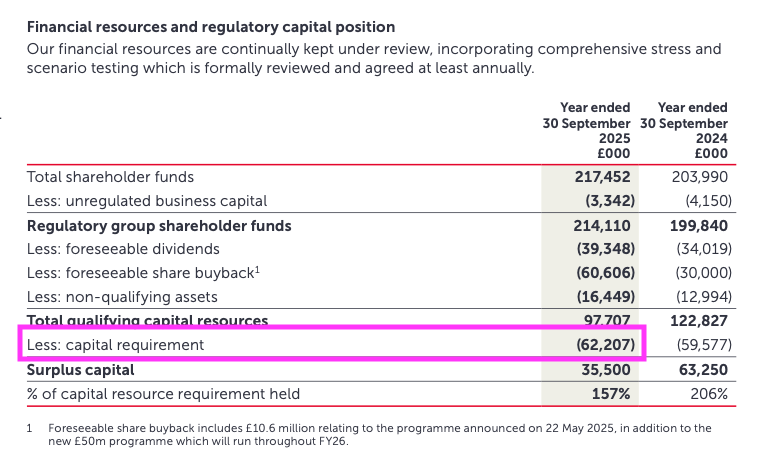

Note that AJ Bell needed to hold £62 million last year to meet regulatory capital requirements:

Alongside the aforementioned dividends, surplus cash has been used for buybacks. Some £45 million (approximately 11p per share) was spent reducing the share count by 3% last year at an average 455p. This year up to another £50 million (approximately 12p per share) has been earmarked for buybacks.

AJ Bell’s asset-light operation underpins the aforementioned 40%-plus ROE. Versus earnings of £105 million, the 2025 balance sheet showed net working capital at just £4 million, property, plant and equipment at another £4 million while various intangibles amounted to only £15 million.

Boardroom

Co-founders Andy Bell and Nicholas Littlefair are no longer involved with the day-to-day running of AJ Bell.

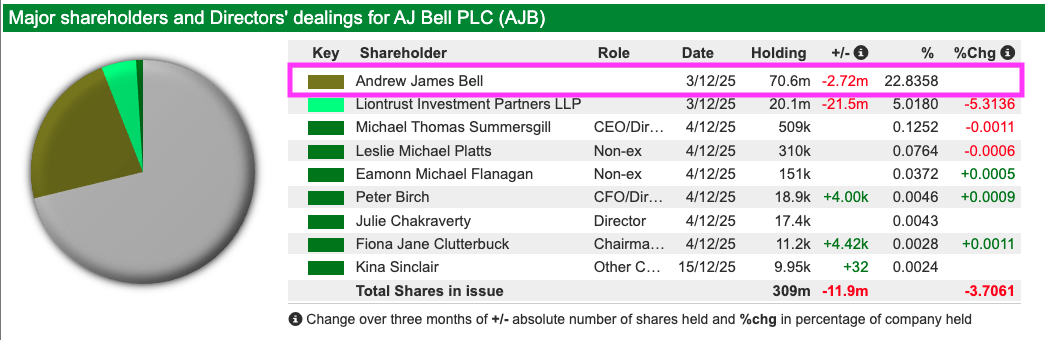

Mr Bell served as chief executive until September 2022, at which point he was going to become a non-executive — until the FCA suggested Mr Bell’s “significant shareholding” might create a “risk to effective board governance“.

Mr Bell instead became a £150,000-a-year consultant to the group and still retains a £305 million shareholding:

Mr Bell has reduced his stake by a third since the flotation, with his last top-slice occurring in November at approximately 500p. Mr Littlefair in contrast had sold his AJ Bell stake by 2007 and exited the board four years later.

Mr Bell was succeeded as chief executive by Michael Summersgill, who joined AJ Bell during 2007, became chief financial officer during 2011, “began to take on responsibility for the operational functions of the group” from 2014 and became deputy CEO during 2021.

Mr Summersgill’s loyalty to AJ Bell is complemented by his relatively young age for a FTSE 250 boss — 42. I imagine he could be leading the group for many years to come. But I am not sure he will follow Mr Bell into (very) amateur boxing.

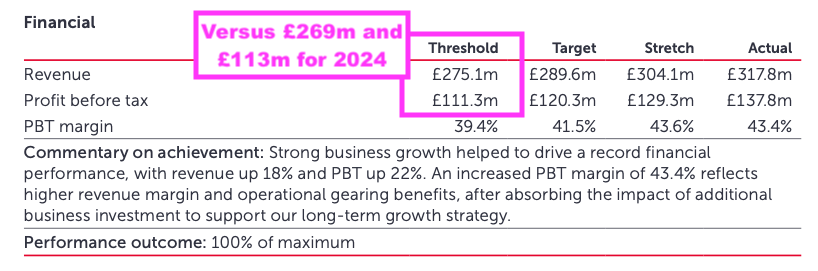

I cannot say Mr Summersgill is vastly underpaid given his total remuneration has topped £2 million during the last two years. And he looks set to enjoy 12% salary hikes during both 2026 and 2027. I am not entirely convinced about his option targets either; the board’s 2025 incentive scheme required a minimum 2025 performance broadly equalling that of 2024:

While I can’t fault AJ Bell’s progress with Mr Summersgill in charge, one strategic matter he may wish to ponder is the group’s foray into managed portfolios.

Go back to that Money Marketing article and Mr Bell stressed AJ Bell should not provide financial advice or manage money:

“We almost defined ourselves by what we were not rather than what we were. By saying from the start that we would not do financial advice or manage money, it meant that there was an affinity with financial advisers. They would be very happy to sell our services knowing well we would not be trying to cross-sell against them. So we were very supportive of the IFA sector.”

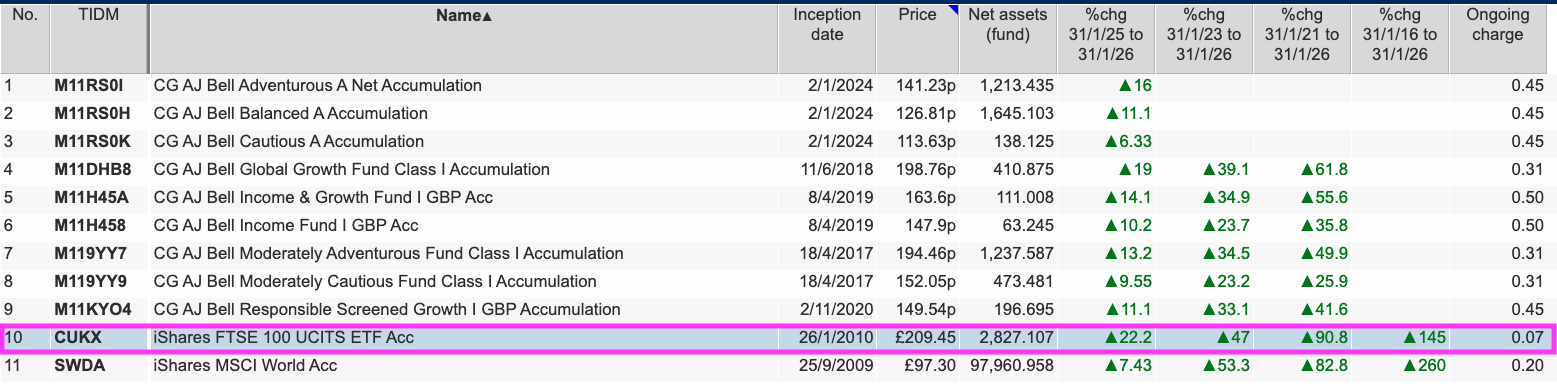

These days AJ Bell offers a small range of model portfolio services and in-house managed funds to its customers and their advisers. ShareScope shows all the managed funds costing at least 4x a basic FTSE 100 tracker and trailing the UK benchmark index over the last five years:

I would argue platforms should remain as platforms and just leave the (difficult!) job of (successful!) money management to the customers and advisers.

Valuation and verdict

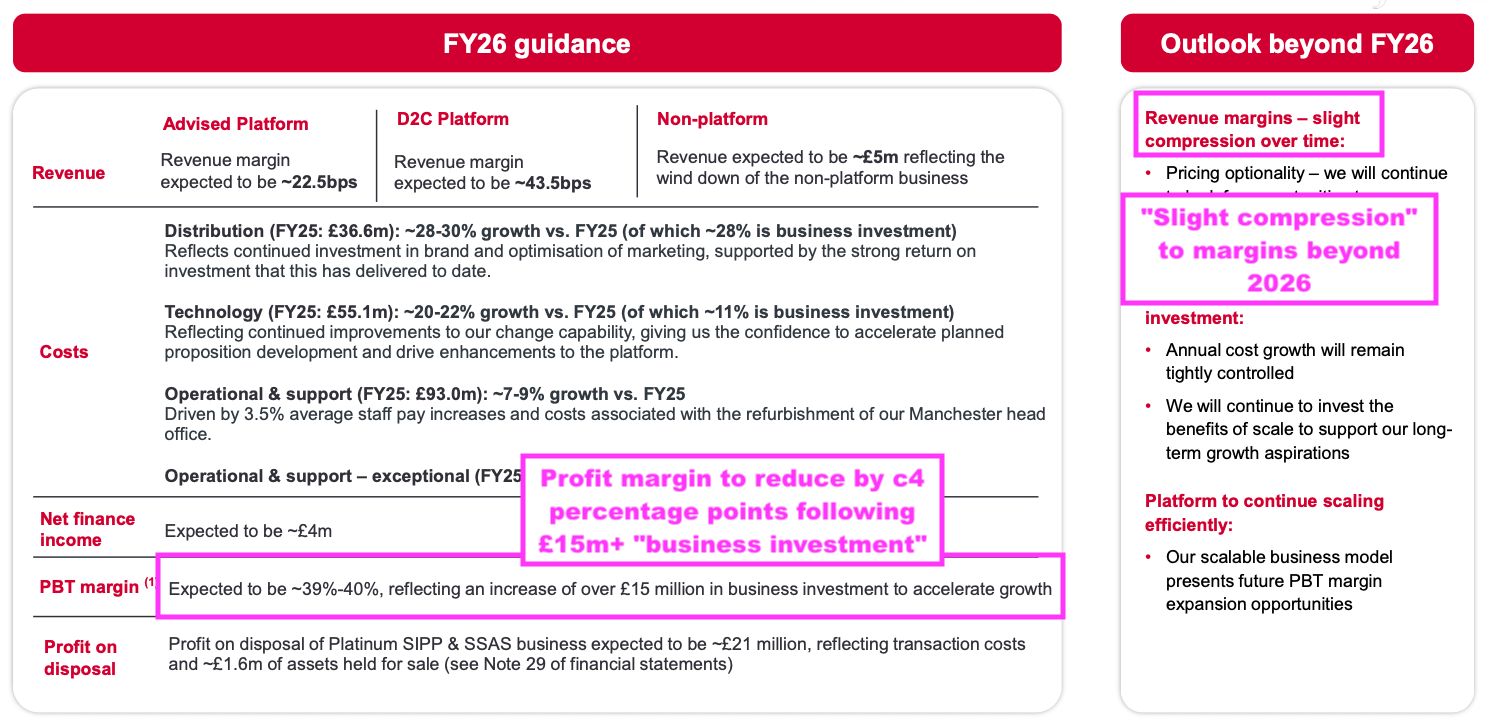

Last December’s annual results provided some very clear guidance for 2026:

Costs are expected to increase by nearly £30 million, of which approximately half was described as “business investment” to enhance the group’s marketing and IT.

The 2026 profit margin in turn is expected to reduce by four percentage points, which seems opposite to how a ‘scalable’ platform should behave and could mean the days of 40%-plus margins are over. I note margins beyond 2026 are set to experience a “slight compression“, too.

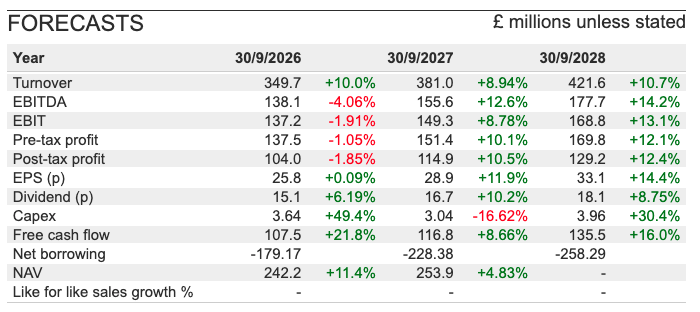

ShareScope carries the following forecasts:

Profit for 2026 is expected to be flat versus 2025 and perhaps then advance at a double-digit rate for 2027 and 2028. The 432p shares trade at 16-17x anticipated 2026 earnings and only 13x the projected 2028 earnings.

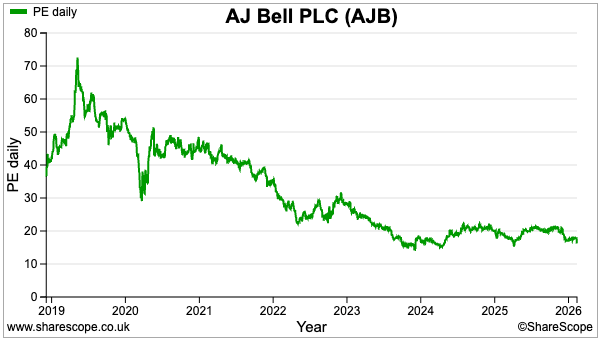

The immediate P/E rating appears close to the lowest since AJ Bell’s flotation:

Alongside greater “business investment” expenditure, other potential drawbacks to future progress include industry meddling by the government and industry disruption from AI.

The 2025 results referred to a “challenging policy environment” after the last Budget introduced additional “unnecessary complexity” to ISAs and pensions. I also wonder whether AJ Bell will always be able to earn such huge sums from customers’ uninvested cash.

I am less concerned about AI impacting the financial advisers who employ AJ Bell for their Advised clients. I suspect many people will always seek a human expert to advise on significant life savings and complicated pension rules. But recent market ructions due to AI fears could be a signal my view is far too complacent.

All told, I would say AJ Bell is a fundamentally attractive business that:

- Seems to provide good value and service to customers;

- Offers an appealing financial history and super accounts;

- Boasts long-term growth opportunities (the group cites a £3.7 trillion addressable market), and;

- Is not valued on an outrageous rating (assuming those broker forecasts prove accurate).

I have been a customer for 25 years and will probably remain a customer for the next 25 years. I really should consider becoming a shareholder as well.

Until next time, I wish you safe and healthy investing with ShareScope.

Maynard Paton

Disclosure: Maynard does not own shares in AJ Bell.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.