Although Richard prefers to invest in businesses that should grow steadily over the long term, one company is showing it can generate long-term shareholder returns while hardly growing at all.

Before I take a closer look at Colefax, a five-strikes update.

5 Strikes

Since my last update, nine companies have published annual reports and passed the minimum quality filter. After a cursory glance at their financial track records using a custom ShareScope table, five of them have scored less than three strikes, meriting further attention.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Begbies Traynor | BEG | 18/8/25 | ? Acquisitions ? CROCI – ROCE – Shares | 3 |

| Diageo | DGE | 14/8/25 | ? Holdings – Debt – Growth | 3 |

| Goodwin | GDWN | 14/8/25 | – CROCI – Growth | 2 |

| IG | IGG | 12/8/25 | – Holdings – Growth | 2 |

| Intercede | IGP | 12/8/25 | – CROCI – Growth – ROCE – Shares | 4 |

| NWF | NWF | 8/8/25 | – Holdings ? Acquisitions – Debt – Growth | 3 |

| Berkeley Group | BKG | 4/8/25 | ? CROCI – Growth | 2 |

| Colefax | CFX | 4/8/25 | ? CROCI ? Growth | 1 |

| Jet2 | JET2 | 4/8/25 | – Holdings ? CROCI ? Shares | 2 |

| Click here for our 5 Strikes explainer | 21/08/2025 | |||

I have taken a trip down memory lane by reading Colefax’s annual report (? CROCI ? Growth). I owned the shares and held them in Interactive Investor’s Share Sleuth model portfolio between 2011 and 2019.

Colefax: Generating returns from a tortoise

This chart shows the two buys and two sales I made in the model portfolio; my own trades were similar:

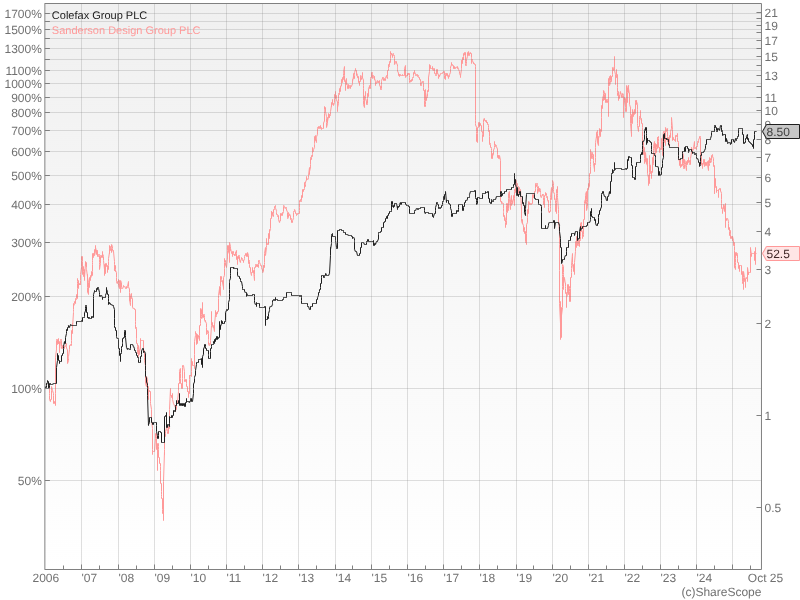

Over the last twenty years, Colefax’s share price has grown at a compound annual growth rate of just over 10%, yet the business has hardly grown at all. This was the deciding factor in my decision to sell the shares.

Colefax owns five famous high-end brands covering a wide range of styles and fashions. The company regularly refreshes designs and launches new collections. This has made it a reliable earner, but (with the exception of 2022) a slow and inconsistent grower.

Slow growth is the result of conservatism. It has been decades since Colefax acquired or launched a new brand. Conversations with the company’s veteran CEO and longstanding finance director at one of the company’s AGMs years ago indicated that these strategies were expensive and risky.

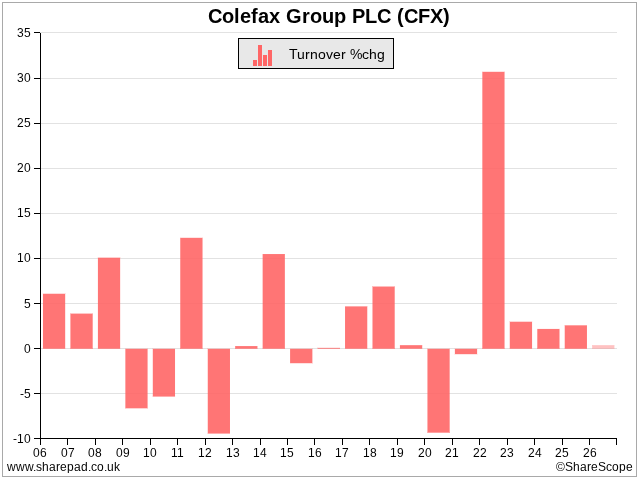

In the twenty years since 2006, Colefax’s turnover has grown from £68 million to £110 million, a compound annual growth rate (CAGR) of 2.4%. Growth has only exceeded 10% four times in those years, and it has been negative six times.

Using ShareScope’s inflation-adjusted figures, turnover has actually contracted slightly over the last twenty years.

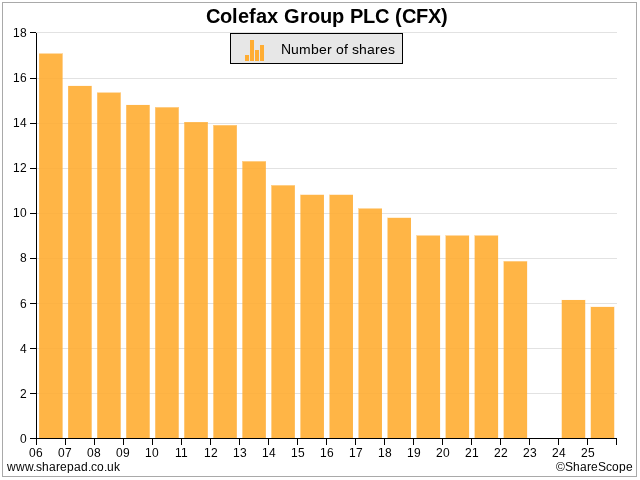

The increase in the share price is not because the company has grown. It is because Colefax has used its surplus cash flow to buy back the majority of its shares. Fewer shares means each shareholder owns a greater proportion of the business and is entitled to a greater proportion of the money that flows out of it.

The company pays a modest dividend yield (it scrapped the dividend during the pandemic and has reinstated it at a lower level, less than 1%), so the main driver of shareholder returns is buybacks.

This may be the best strategy; the company defended it years ago by saying its brands covered most price points and styles and many of its rivals are family owned businesses that will not sell cheaply.

Colefax’s somewhat more ambitious listed peer Sanderson Design (formerly Walker Greenbank) presents something of a test case. It is the weaker performer, currently:

The two companies are different in some respects; some of Sanderson’s brands are middle-brow, and, unlike Colefax, Sanderson manufactures. However, Sanderson’s shareholders have also endured much more volatility for less long-term capital gain.

It is 2025 now, nearly six years after I sold the shares, and reading the annual report, I could honestly be back in 2019, or 2011, or, I suspect 2006. Colefax grew turnover by 2.4% in 2025. Profit increased 23%, but the company believes much of the increase was due to US clients panic buying to avoid higher import tariffs. It reduced the company’s share count by 5% through a tender offer.

Colefax’s original business was decorating, and it still decorates mansions. This business accounts for about 10% of revenue. It is more volatile and is likely to be affected by fleeing non-doms. The company says deposits were down 32% at the year-end compared to the start of the year. That will hit profitability in 2026.

Colfax’s strikes are for minor infractions. Cash Return on Capital Invested has been negative only once in the last decade or so, and that was back in 2017. Growth contracted in 2020 and 2021, but they were pandemic years, so I am inclined to be forgiving.

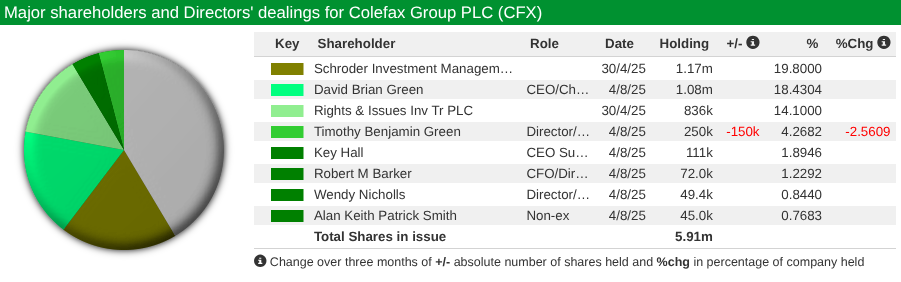

David Green is still running the company, as he has done since 1986. His son, Tim Green, having already been a chief executive elsewhere, joined in 2018 as commercial director and may well be 79-year-old David’s intended successor. Rob Barker is still finance director, as he has been since 1994 (though he joined as chief accountant in 1989). The company’s non-executive director is 84 and first took his seat in 1994. The director of the decorating division joined in 1975.

Chairman and chief executive of Colefax, David Green, is also a major shareholder.

Nothing much has changed, nor do I think it will, so I am unlikely to reverse my decision. As an investor who looks for predictable growth, I am not interested in tortoises or hares.

I can understand, though, why long-term investors would consider an investment in Colefax. It offers the prospect of reasonable returns at relatively low risk.

Four more shares to consider

If I were ever to get into homebuilders, Berkeley (? CROCI ? Growth) might be my gateway. The London-centric builder has a strong track record. It has failed to grow turnover three times in the last decade, but its only significant contraction was in 2020. It has generated positive cashflow in nine out of ten years.

Berkeley claims to be the only large homebuilder aligned with the Government’s brownfield regeneration agenda, and I must admit to a slight sense of awe when I see pictures of projects like this one, turning old gasworks into homes, shops and offices, while retaining the gasholder structures.

Turnover at trading platform IG (- Holdings – Growth) has contracted in recent years, which may explain the acquisition of FreeTrade just before the year-end in May. The purchase price was relatively modest compared to free cash flow, but it appears to have more than doubled the number of active accounts on the platform.

I own shares in Goodwin (- CROCI – Growth) and Jet2 (- Holdings ? CROCI ? Shares), and also hold them in Share Sleuth, the model portfolio I run for Interactive Investor, so I will be writing them up there, rather than here.

Both of these companies are doing very well in industries that are not known for being kind to long-term investors.

Goodwin makes heavy industrial products, components and materials for diverse niches, including boxes for nuclear waste disposal, air traffic control systems, and valves for oil pipelines. It also processes minerals used to manufacture jewellery and tyres.

It achieves a strike for CROCI and a strike for growth, which are scars in the company’s track record left by a strategic pivot after the oil price crashed in 2016. Revenue from oil companies fell, and the company spent money increasing the size of its foundry to win nuclear and naval contracts. It also used cash to establish a new business, which has just started making high-performance polymer resin for the aerospace and semiconductor industries.

Jet2 is the top UK package tour operator as determined by the number of passengers it is licensed to fly by the Air Traffic Organisers’ Licencing (ATOL) scheme. It is also the most integrated.

The airline haemorrhaged cash during the pandemic because it could not fly, and this required it to raise money. I have not fully penalised it for either the increase in its share count or the outflow of cash in these years, because I do not think another shock of this magnitude is likely.

The strike for director holdings is also questionable. Founder Philip Meeson retired in 2023, but he still owns nearly 15% of the shares.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.