Nine shares pass the minimum quality filter but five fail to make the grade. That leaves Polar Capital, XPS Pensions and MS International in the frame. Richard discovers how Mortgage Advice Bureau is setting out to disrupt its industry.

Of the nine companies to publish annual reports and pass the minimum quality filter since my last update, three have more than decent track records.

5 Strikes

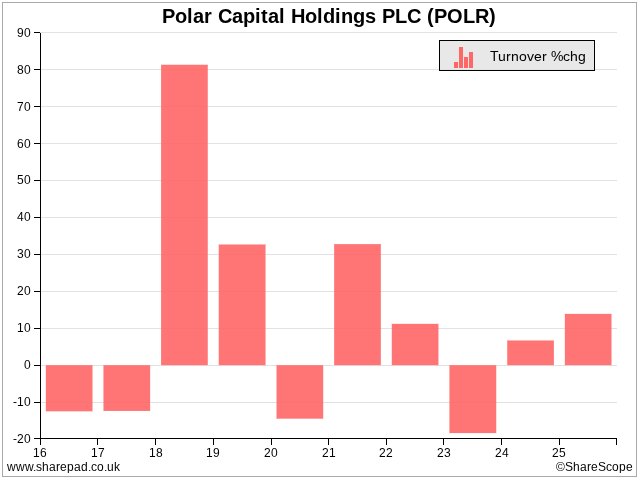

Polar Capital [- Growth] is a fund manager. It has only one strike for turnover growth because turnover has fallen by more than 10% in four of the last eleven years.

Volatility is an occupational hazard for fund managers, even ones like Polar Capital that claim to create their own path, because their fortunes are dependent on stock markets.

Because traders buy shares in fund managers in bull markets and sell them in bear markets their share prices are usually even more volatile than the performance of the markets they invest in.

Volatility and scepticism about how much value fund managers create are the reason I invest mostly in shares, not funds. I don’t find investing in management companies very appealing either.

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| Celebrus Technologies | CLBS | 15/7/25 | 0.9 | – Holdings – CROCI – Growth ? ROCE | 3 |

| MS International | MSI | 15/7/25 | 26.9 | – CROCI – ROCE | 2 |

| Pebble Beach Systems | PEB | 15/7/25 | 1.8 | -Holdings – CROCI – Debt – Growth – ROCE | X |

| XPS Pensions | XPS | 10/7/25 | 1.0 | – Holdings – Debt | 2 |

| System1 | SYS1 | 9/7/25 | 23.1 | – CROCI – Growth – ROCE | 3 |

| Polar Capital | POLR | 7/7/25 | 2.2 | – Growth | 1 |

| Liontrust | LIO | 4/7/25 | 3.4 | – Growth – ROCE – Shares | 3 |

| Telecom plus | TEP | 4/7/25 | 7.0 | – CROCI – Debt – Growth | 3 |

| Click here for our 5 Strikes explainer | 21/07/2025 | ||||

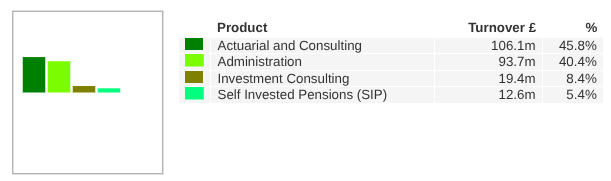

XPS Pensions [- Holdings – Debt] advises and helps administer pension schemes. Principally, it makes sure there is enough money in corporate and public sector schemes and provides them with investment advice.

Source: Sharescope > Financials > Company > Activity Breakdown

Generally, XPS has operated with a high net debt to capital ratio since it floated in 2017, but since it is a people business, this is probably because of the low amount of capital required to operate, not excessive financial obligations.

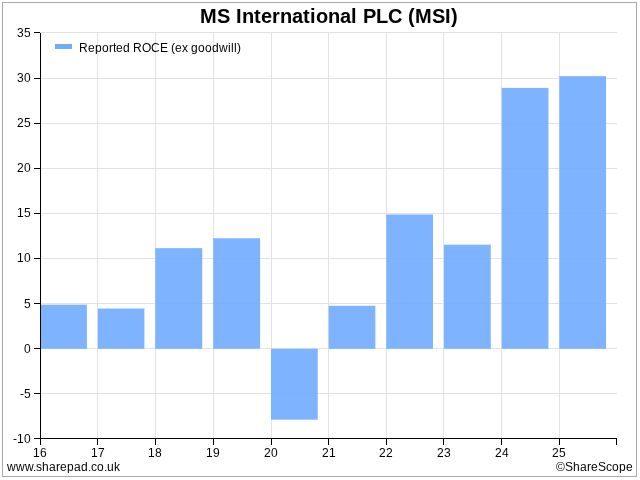

MS International [- CROCI – ROCE] is a mini manufacturing conglomerate. In recent years, new orders for the company’s defence division, which makes naval cannon and counter-drone land-based weapons systems, have transformed profitability and led the board to consider divesting other businesses, which make forks for forklift trucks, superstructures for petrol stations, and petrol station branding.

The defence orders are lumpy, though. In the annual report, MSI moderates expectations, saying government reviews and delayed decisions are likely to impact the year to April 2026.

Mortgage Advice Bureau – the zig

In my last article, I described Mortgage Advice Bureau as a company that zigs when others zag because it is investing in its own technology platform, unlike it claims, unlike its rivals.

Having watched back the company’s presentation (originally presented to analysts last February), I have learned more about the zig.

MAB operates a network of nearly 200 mortgage advisory firms (aka Appointed Representatives or AR firms). It generates custom for them through partnerships with estate agents, builders and price comparison sites, provides regulatory oversight, training, administrative support, and access to its brokerage platform.

MAB earns revenue from lenders who pay a fee each time the network procures a mortgage (40% of revenue) through its platform. It earns revenue from commissions from insurance companies (39% of revenue), and client fees from you and me when we mortgage (19% of revenue). It keeps about 30% of the revenue and distributes the remainder to the AR firms.

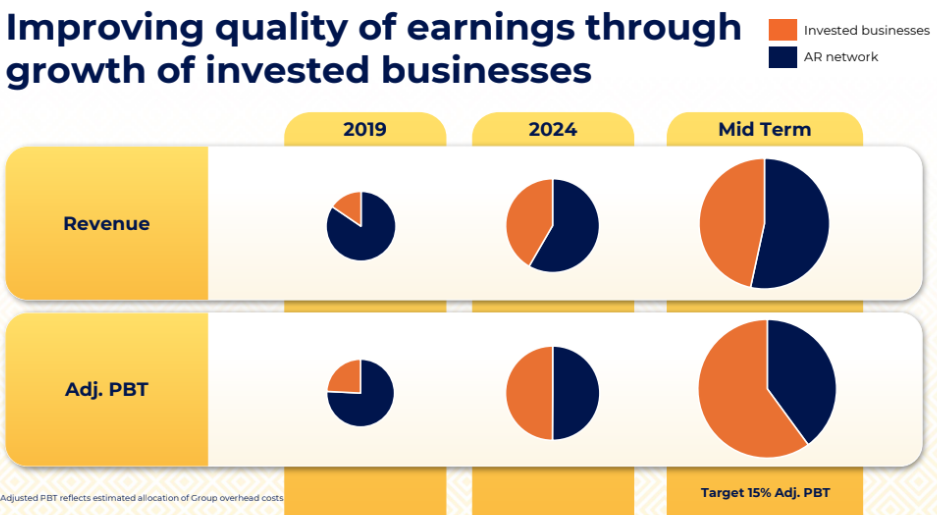

It also partially or wholly owns 12 firms. These, it says, are larger and more productive than the AR firms in the network. They are more profitable, contributing half of adjusted profit in 2024 from less than half of revenue:

Source: MAB capital markets day presentation, February 2025

One of the reasons given for the success of the invested business at the capital markets day was that they are more tech “savvy” than the AR firms.

MAB has long used technology to help advisers find mortgages for clients in an efficient and compliant way. MAB 2.0, the zig, extends the company’s capabilities from facilitating transactions to nurturing and retaining clients, while promising more efficiency gains.

The MAB platform allows advisers to engage with clients before they are ready to mortgage and stay with them until they are ready to remortgage. For example, MAB has introduced Mortgage Monitor, a service anyone can sign up for. It scans the market and sends monthly reports and alerts when a new mortgage deal might be beneficial.

MAB expects the new platform to halve the time it takes to arrange a mortgage from 10 hours to 5 hours through automation and customer self-service. It reckons a dash of coming AI enhancements will get that number down to 2 hours. It even demonstrated an AI advisor avatar conversing with a client.

Barring the avatar, the features did not overwhelm me with their originality. The Mortgage Monitor might have been modelled on the way the bank updates me on my credit score each month, or the way price comparison sites keep us informed of better energy tariffs.

But according to MAB, this level of sophistication does not exist in the fragmented world of Mortgage advice and, somewhat reassuringly, MAB says nearly 90% of residential mortgage transactions (excluding product transfers) are facilitated by intermediaries like MAB. Product transfers happen when we remortgage to another product from the same lender. About half of these are advised to.

MAB not only says it has a first mover advantage in an industry it believes is destined to be disrupted by technology, but it says none of its peers are in a hurry to follow. As for new entrants, they would need capabilities not just in technology but compliance and the sourcing of clients.

That’s the essence of MAB’s pitch last February. I thought it was a good one. However, rapid change in an industry can be unsettling even for early movers. Google wasn’t the first search engine.

Putting together the facts that invested businesses are both more productive and do more with the technology raises the question of how willingly advisers will adopt AI. The question was asked at the end of the presentation and the reply was, to paraphrase, people generally don’t like change, but advisers “get it” (“it” being AI is an enabling technology). Perhaps they are more likely to get it if you run the business, and that is driving MAB’s appetite for acquisitions.

Then there is the, to my mind, dystopian mortgage market. MAB expects the market to grow. Our mortgage had a term of 25 years, which we were very pleased to pay off early. But thirty-year and 35-year mortgages are growing in popularity because houses are so expensive. Remortgages later in life to pay off interest-only mortgages, and fund retirement and the “Bank of Mum and Dad”, are also more popular.

This vision of permanent debt may be attractive to mortgage advisers and their robot successors, but I don’t think it is good for the rest of us.

Nevertheless, people like to use advisers, and MAB passed the 5 Strikes process easily, so it has been a strong business. I like businesses that invest from a position of strength as much as I like businesses that zig when others zag!

MAB published a half-year trading update last week. Business appears to be brisk.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.