Car marketplace Auto Trader and pork and poultry producer Cranswick pass 5 Strikes. Richard learns about animal welfare and finds a company is zigging when others are zagging.

Since my last update, five companies have passed my minimum quality filter, the first stage of the 5 Strikes process. Two of them have achieved less than three strikes, passing the second stage.

| Name | TIDM | Prev AR | Holdings (%) | Strikes | # Strikes |

|---|---|---|---|---|---|

| Shell | SHEL | 2/7/25 | 0.0 | – Holdings – Growth – ROCE | 3 |

| PayPoint | PAY | 1/7/25 | 0.4 | – Holdings – Debt – Growth | 3 |

| Castings | CGS | 30/6/25 | 0.1 | – CROCI – Growth – ROCE | 3 |

| Auto Trader | AUTO | 27/6/25 | 0.5 | 0 | |

| Cranswick | CWK | 27/6/25 | 1.0 | 0 | |

| Click here for our 5 Strikes explainer | 04/07/2025 | ||||

They are the car marketplace Auto Trader and pig and poultry producer Cranswick. These two companies achieve no strikes at all, a rare and precious accolade.

I will be reviewing Auto Trader [0 Strikes] shortly on Interactive Investor, so I will say no more about it here. Besides Cranswick, Mortgage Advice Bureau has caught my attention.

Cranswick [0 Strikes]

Cranswick is 50 years old this year, which is great news because the annual report celebrates the company’s history. You can read about it on the company’s website too.

The firm was founded by 23 disgruntled Yorkshire pig farmers. They started their own feed mill to end their dependency on big suppliers.

Over the years, the company has partnered with “Food Heroes”. These are gourmet sausage, cured meat, bacon and pastry makers. Together, the spiel goes, they have brought artisanal quality products to mass-market supermarket shelves in ranges like Sainsbury’s “Taste the Difference” sausages.

The company still mills animal feed, it farms, and it processes. The numbers suggest it is an efficient vertically integrated operation that has grown into a considerable business. The annual report suggests it is a wholesome business too.

Events in May make me wonder about that, though. Intensive farming has a patchy reputation for animal welfare.

Reportedly, in May, Cranswick suspended workers and production at one of its many farms and launched a review of its animal welfare practices after animal rights activists released footage of abuse at one of its farms.

Although the events took place after Cranswick’s year-end in March, I am a bit disappointed that the company says nothing about them in the annual report.

Maybe it could have been inserted in this paragraph, where it confirmed the review:

“We take seriously any instance, anywhere in our supply chain, where behaviour fails to meet those standards. We are therefore instigating a new, fully independent, expert veterinarian review of all our existing animal welfare policies, together with a comprehensive review of our livestock operations across the UK. We will provide a further update on this work in due course.”

The review is welcome. I hope it is fulsome in reporting its findings, not just because better animal welfare is more humane, but because the company says its approach to animal welfare differentiates the business.

The company cites several statistics to support this claim. It says 100% of Cranswick pig and poultry stock is certified to Red Tractor standards (Red Tractor has reportedly withdrawn accreditations for the farm implicated in the abuse of pigs, but Cranswick has stopped production), and 69% is certified to RSPCA standards. The percentages are lower for non-Cranswick farms supplying the company.

Red Tractor is an industry-funded farm assurance scheme (a Cranswick Director sits on the board). It has been criticised for lacking teeth and for going little further than offering the legal minimum protection for animals. Similar claims have been made of the RSPCA farm welfare standards, but it is better that a farm meets these standards than it doesn’t.

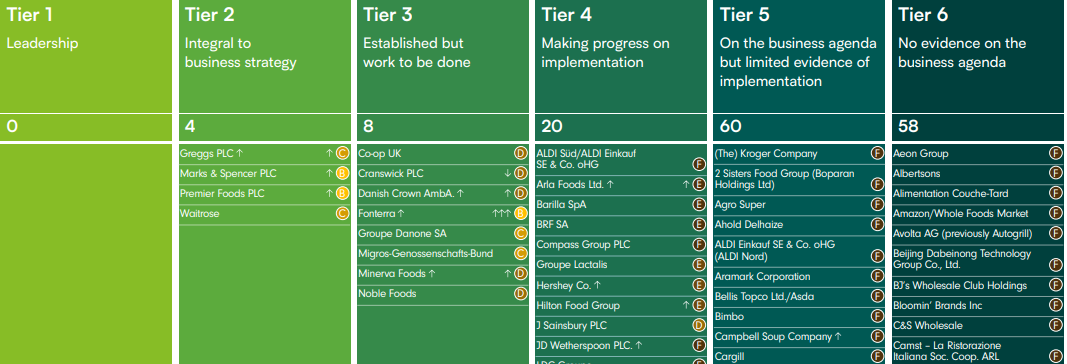

Some reassurance also comes from the Business Benchmark on Farm Animal Welfare (BBFAW), a survey designed, in part, to help institutional investors assess companies’ animal welfare policies and their implementation. Cranswick says it routinely appears in the higher tiers of the BBFAW, which suggests it is better than most.

Currently, it is in Tier 3 of 6, which puts it in the top 12 companies scored by the BBFAW, out of 150. The four businesses in Tier 2 are well known to investors (Greggs, M&S, Premier Foods and Waitrose), but they are not farmers. No companies make it into Tier 1.

Source: BBFAW report 2024 (website/pdf). NB Due to space restrictions, the lists in Tiers 4 to 6 have been truncated. The full table is in the report.

The BBFAW is supported financially and technically by two animal welfare organisations, so I think it is independent, although it relies on the disclosures of the companies it reports on.

These statistics may demonstrate that Cranswick is better at animal welfare than many of its peers, but that the whole industry is under pressure to do better.

If we take the view that the costs of animal welfare are likely to increase as standards improve, Cranswick may be in a good place commercially. It has more experience managing them than many of its peers, and so far it has managed them profitably.

Mortgage Advice Bureau [-Shares]

When a company achieves less than five strikes, I add it to my watchlist in ShareScope.

I check the news stories in SharePad’s news feed dailyish (i.e. often but not strictly every day). It’s a way of getting to know the shares better. Specifically, I am looking for news that tells us about the company’s business model or strategy. Ultimately, these drive profitability.

Mortgage Advice Bureau passed 5 strikes in April, with only one strike; its share count rose significantly in 2022. This was due to a placement in the same year to part fund an acquisition that doesn’t seem to have done it any harm and has probably done it good.

Mortgage Advice Bureau provides mortgage brokers with a mortgage and insurance platform. It receives a portion of the fee for each mortgage or insurance policy they sell through it, which has been a lucrative business. Judging by the growth in its market share, it is an attractive proposition for brokers.

An announcement from the company last month has encouraged me to take a closer look at the business. It has recruited a chief operating officer and a non-executive director with impressive-looking technology credentials.

The company says the employment of its tech-enabled COO is essential to delivering its ambitions communicated at a Capital Markets Day (meeting with analysts and investors) earlier in the year. My next action is to watch the video, which you can request from Mortgage Advice Bureau’s Investor Relations department.

But already I am intrigued. The annual report, which refers to the Capital Markets Day, has a section titled “Technology and AI” attributed to founder and chief executive Peter Brodnicki. It starts:

“While many industry players are shifting away from in-house solutions, proprietary technology remains central to our strategy. Our continued investment in ‘MIDAS Platform’, our proprietary technology platform, strengthens our ability to optimise operational efficiency and drive revenue growth from new lead flow, lead nurture, customer retention, adviser productivity and customer lifetime value.

We firmly believe that technological advancement and AI will revolutionise our industry. By retaining control of our technology, we can innovate freely, develop tailored solutions, and seamlessly integrate with our chosen partners, ensuring we stay ahead in a rapidly evolving market.”

I like it when companies articulate how they create value. And companies that zig when others zag intrigue me.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.