Just two shares out of six to publish annual reports in the last fortnight achieve less than three strikes. Richard introduces M Winkworth and Churchill China, before discovering that Spirax makes your toast (and his).

The two shares to publish annual reports, pass my minimum quality and achieve less than three strikes in the last fortnight are M Winkworth and Churchill China.

5 Strikes

|

Name |

TIDM |

Prev AR |

Holdings (%) |

Strikes |

# Strikes |

|---|---|---|---|---|---|

|

Churchill China |

CHH |

9/5/25 |

9.6 |

– CROCI – Growth |

2 |

|

Next 15 Group |

NFG |

6/5/25 |

5.5 |

– Debt – Growth ? ROCE – Shares |

3 |

|

M Winkworth |

WINK |

1/5/25 |

48.4 |

– Growth |

1 |

|

Epwin Group |

EPWN |

30/4/25 |

0.6 |

– Holdings – Debt – Growth |

3 |

|

London & Associated Properties |

LAS |

30/4/25 |

3.3 |

– Holdings – CROCI – Debt – Growth – ROCE |

5 |

|

Bisichi |

BISI |

29/4/25 |

7.9 |

– CROCI – Growth – ROCE |

3 |

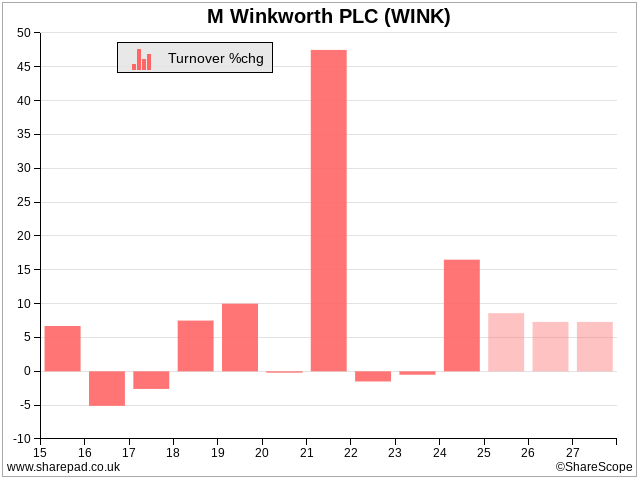

Estate agency franchise Winkworth [- Growth] scores a strike for its two-steps forward one-step backwards growth trajectory. In the year to December 2024, it took a stride forward. Unsurprisingly that was because as mortgage rates eased, people who had delayed moving house during the cost of living crisis finally got on with it.

Source: ShareScope

I too have prevaricated, but not over a house move. I have put off investigating Winkworth because I tend to avoid property-related shares.

Judging by the numbers, that’s been a mistake. While the property market is cyclical and so is Winkworth’s turnover, it is reliably profitable and debt free.

Two steps forward, one step back might be a good long-term trend to jump on.

Churchill China [- CROCI – Growth] makes tableware for the hospitality industry. It is a good business in a tough market.

The two strikes against Churchill tell a story. A slight contraction in revenue over the last two years follows a post-covid surge. Cash Return on Capital Invested (CROCI) was positive by a smidgen in the year to December 2024 and slightly negative in 2022, which is a marginal strike.

Even though it is one of my favourite businesses, I am not dwelling on Churchill today. It is the subject of my next article for Interactive Investor, which will be published here by the weekend. I will have a firmer opinion by then, and the world does not need it twice.

Local manufacturing in a protectionist world

Now tariffs are a defining feature of US policy, I don’t think we can ignore them just because of tariff reductions in recent days. The policy seeks to levy a tax on companies importing goods to encourage manufacturers to manufacture locally in the USA.

Exporting countries often don’t take kindly to tariffs and reciprocate tit-for-tat. This is why we have seen the ratcheting up, and subsequently down, of tariffs between the USA and China, its principal target.

Evidently, if a company already manufactures in a country, the impact of tariffs is lower (although they may still be subject to tariffs on imported components), hence this sentence in a trading update from Spirax caught my attention:

“Our local manufacturing mitigates the direct exposure of tariffs and we expect to manage the financial impacts through surcharges, pricing and limited reorganisation of manufacturing activity.”

This does not mean Spirax is immune to tariffs, price increases may reduce demand, reorganisation of manufacturing will come at a cost, but, as the company says, things are not as bad as they could have been. Even if the damage to Spirax is limited, its customers may be more susceptible.

Catching up with Spirax

The update reminded me that I had vowed in February to look again at Spirax Sarco, once it had published its annual report for the year to December 2024 in April.

The report tells me Spirax has a direct presence in 68 countries, although it does not state what it does in them. Many of them are probably sales offices. It mentions a number of US manufacturing sites, the closure of a site in Mexico and relocation of production to the USA. It is consolidating facilities in the USA as part of an efficiency drive.

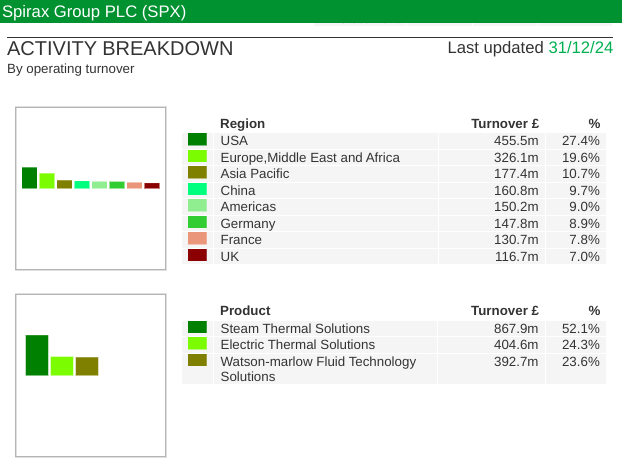

Source: ShareScope

This presence in the USA is reassuring as the USA is Spirax’s biggest geographical market. I’m pretty confident it manufactures in China and Europe too although the only specific reference I can find in the annual report is to a Watson-Marlow Bredel factory in the Netherlands.

Watson-Marlow Bredel makes pumps. The annual report highlights a new machine-learning enabled pump, which it is testing in portable water treatment equipment. Data from the pump enables the prediction of blockages before they happen.

What Spirax does

Industrial applications like pumps, and Spirax’s heat management systems, are quite abstract to me sitting behind a laptop in an office, so I am grateful to Spirax for doing something in the 2024 annual report that surprisingly few technical companies do.

It describes its products in terms a non-engineer can understand. It says “From the food on your table, the tyres on your car, your mobile phone, medicines and how you heat your home, the work of Spirax Group plays an essential role in daily life.”

To demonstrate this essential role, it tells us how it helps make our breakfast.

First, the coffee. To make instant coffee, producers combine hot water with ground coffee. Spirax systems remove condensate (cooled steam, aka water) from the steam system that heats the water and returns it to the boiler house.

Second, the toast. Bread is cooked in commercial convection heat ovens. Chromalox, a Spirax subsidiary, manufactures the heating elements.

Third, the orange juice. Orange juice concentrate is highly viscous (thick) so it doesn’t flow easily. It is transported and pumped into cartons using Watson-Marlow’s peristaltic pumping technology.

It’s always a good start if we understand the product, and, not coincidentally I am sure, Spirax has picked an example to showcase the product of each of its three divisions: Steam Thermal Solutions (STS), Electric Thermal Solutions (ETS) and Watson-Marlow Fluid Technology Solutions.

The strikes

Strike 1: The directors do not hold a big stake in the company, and they are not seasoned. Nimesh Patel joined Spirax in 2020 as chief financial officer and became chief executive in 2024. His replacement is Louisa Burdett, who joined from Croda. She moves around a bit. In the last decade, she has also headed up the finance function at Victrex and Meggitt.

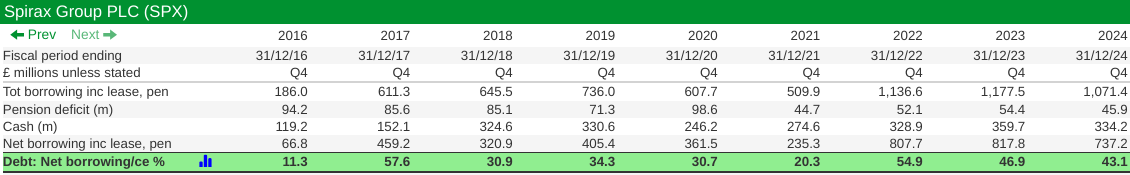

Strike 2: At 43%, the company’s financial obligations are above the arbitrary 25% of capital upper bound I prefer. This debt has accumulated since it acquired Chromalox in 2017. It was the first of a number of acquisitions that today comprise the ETS division.

The good news is the debt (including leases and pension deficit) is reducing:

Source: ShareScope

According to ShareScope, forecasters anticipate it will fall further. Perhaps they are right. I can find nothing to suggest an appetite for more acquisitions in the annual report and plenty to suggest the company has its hands full making the most of what it has acquired.

Spirax’s “Together for growth” strategy is to optimise the business for profitability and invest the loot in the generation of digital insights and services and use its combined steam electrical expertise to decarbonise thermal energy use.

I think the Watson-Marlow machine-learning-enabled pump is an example of the digital direction of travel. It is piloting systems to electrify fuel-fired steam boilers and other processes currently powered by fossil fuels in its markets.

Adoption depends on customers’ appetite to invest in greener fuels, and the availability of green electricity. At the moment it is at the breakfast stage, but lunch and dinner may follow.

~

Richard Beddard

Richard owns shares in Churchill China,

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.